Did you know this month commenced a new era of crypto regulation in Europe? If not, now you do. European Union’s 5th AML Directive has come into force in first member state, Finland. By January 2020 the Directive needs to be implemented in all member states, which means that eventually all the cryptocurrency operators that want to offer services in Europe need to get registered under the local FSA’s.

This week we will address this directive and what it means for cryptocurrency service providers and customers in the sector.

It also seems certain the EU will continue to further develop its crypto regulation over time. According to a leaked draft the EU may also have plans to create its own digital euro to combat Facebook’s Libra. Whether this comes to fruition or not remains to be seen.

In other news we have the possible future of altcoins and China’s ever-shifting stance on crypto mining among other matters.

For those interested in Bitcoin’s course development we also have a fresh technical analysis by Toni Kosonen.

Last week’s news can be found here.

EU’s crypto laws come into effect

The beginning of November marked the introduction of the European Union’s new 5AML Directive concerning cryptocurrency service providers. The first country that implemented the new legislation was Finland. The new law requires all cryptocurrency service providers to register under FIN FSA in order to offer cryptocurrency related services to Finnish customers. From 1st of November only the five companies that have got the approval can offer cryptocurrency exchange services in Finland.

The new legislation is based on the European Union’s directive and will eventually affect all cryptocurrency service providers that want to offer services in Europe. The directive requires that all crypto companies operating in member states register under local financial authorities to offer their services.

While the legislation sets stricter requirements to the companies, the creation of a legal framework around cryptocurrencies also brings many benefits. The creation of certain standards in the sector brings security to the end users as the companies need to fulfill high requirements to be able to offer services. Additionally the new legal situation will potentially ease the collaboration between cryptocurrency service providers and banks. In the past many cryptocurrency service providers have had problems in opening and maintaining bank accounts, since banks have referred to the unregulated nature of the sector and cryptocurrency-related misconceptions. As a result it was nearly impossible for many companies to even operate in the Fiat-crypto interface.

The regulatory framework will allow bureaucratic institutes to trust crypto companies in the same way as any other legal businesses and it will open the door to further collaboration between the different financial operators. And hopefully that will be the case!

Taneli Tikka joins Prasos’ board of directors

Startup and growth company veteran Taneli Tikka has been chosen to the board of Prasos Ltd. Tikka has operated in the leadership of many Finnish public companies as well as board and advisory positions.

Tikka’s impressive career spans over 50 companies. The media has even given him the nickname “Finland’s Uncle Scrooge” due to his encompassing experience in financial ventures.

“Taneli will further strengthen the board of directors with his broad expertise and network supporting the company’s growth strategy. Taneli has a strong natural understanding of developing businesses in different stages and a long history in the cryptocurrency sector. The cryptocurrency industry is changing significantly due to regulatory development, which provides a regulated operator like Prasos opportunities for expansion and cooperation. We want to strengthen our position in this changing environment and continue to produce safe, innovative and scalable services for customers also in the future”, states Henry Brade, Chairman of the Board of Prasos.

Prasos is one of the biggest Nordic cryptocurrency and blockchain companies. Its main international services are the Coinmotion exchange platform and Denarium coins. Prasos also operates the Finnish site Bittiraha.fi as well as the Bittimaatti bitcoin ATM network.

EU considers its own digital currency to combat Libra

The European Union is planning to develop its own digital currency as a response to Facebook’s Libra, reports news agency Reuters. In a draft cited by Reuters the EU encourages member states to take action against the development of risky cryptocurrencies or even ban such currencies altogether.

“The ECB and other EU central banks could usefully explore the opportunities as well as challenges of issuing central bank digital currencies including by considering concrete steps to this effect,” the draft states.

However, the draft does not mean the EU would automatically issue its own digital euro. According to CoinDesk’s sources EU only intends to develop stricter regulation concerning so called stablecoins such as Libra.

Facebook’s upcoming Libra currency has alarmed many European decision-makers. Facebook already now has a position comparable to many states. The social media giant has also made repeated mistakes regarding user privacy among other things. Decision-makers are therefore suspicious if an operator like Facebook could responsibly carry such an immense economic power.

China will not ban Bitcoin mining

China has abandoned its plans to get rid of the country’s Bitcoin and cryptocurrency mining industry. Earlier this year China’s National Development and Reform Commission listed crypto mining among industries which should be eliminated from the country.

The commission has now published a fresh plan set to come into effect on 1st January 2020. The new plan will replace the earlier one composed in 2011.

The agency has removed all references to Bitcoin and crypto mining from the new version of its plan. The plan also no longer defines the mining of Bitcoin or virtual currencies in any way.

China has in recent years been one of the most significant centers for Bitcoin mining in the world. Even if China would have proceeded with its plan to ban mining within its borders, miners would likely only have moved to other countries. The new plan seems to indicate that China at least for now intends to keep the industry within the country.

Few alternative cryptocurrencies have a future

According to Ripple’s CEO Brad Garlinghouse only 1% of current cryptocurrencies will survive in the long run. In an interview with Bloomberg Garlinghouse stated his opinion that the world simply has too many cryptocurrencies.

According to Garlinghouse many new cryptocurrency and blockchain projects are born merely from the hype around the industry. Garlinghouse believes that a very small amount of cryptocurrencies have something real and useful to offer.

”Most of them will likely go to zero,” Garlinghouse summarized.

Henry Brade, chairman of the board of Prasos, shares Garlinghouse’s view. Brade believes only a few cryptocurrencies have a real future ahead.

”I personally believe mainly in Bitcoin, Litecoin and Monero. Bitcoin is already so big that it can survive even stately attacks. Litecoin maintains its value as a kind of test platform for Bitcoin and other crypto. Monero in turn gains value by providing the chance for anonymous transactions,” Brade commented.

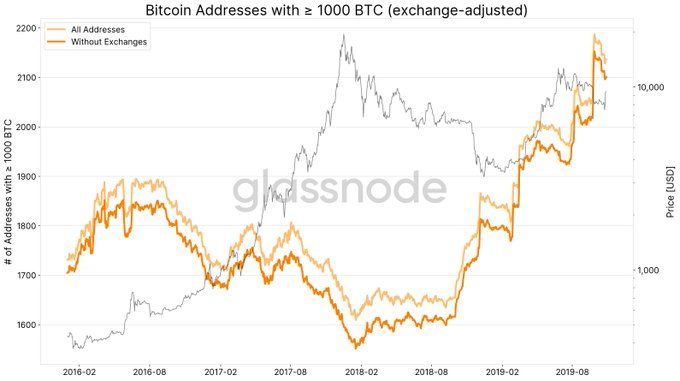

The amount of rich bitcoiners has grown

The amount of bitcoin addresses containing over 1 000 bitcoins has grown by 30% during the past 12 months. The amount seems to be accurate even if statistics account for addresses belonging to exchanges and broker services.

At the time of writing a total of 2 035 bitcoin addresses contain between 1 000 and 10 000 bitcoins. 108 addresses contain 10 000 – 100 000 bitcoins, while only two addresses have 100 000 – 1 000 000 bitcoins.

“The two options are we have high-net-worth investors coming in or it could be cold storage practice at the exchanges and custody solutions. The latter explanation cannot be ruled out, but it does not coincide with other data we have on the timing of when supply increased at these entities. For now, I’m going with the first explanation.” states investment analyst Willy Woo.