Happy November, fellow crypto citizens! It’s getting darker and colder outside in the Northern Hemisphere, but Bitcoin shines as a glowing beacon all year round. The past week saw another landmark for Bitcoin, as its original white paper was published 11 years ago. Next we will celebrate the birthdays of the first Bitcoin block and transaction in January.

The young king of cryptocurrencies has again shown signs of a growth spurt after a longer correction. At the time of writing bitcoin’s price is above $9 000 dollars reaching toward the $10k barrier. While we won’t focus more on price development this time, we have published a wider market trend report for the third quarter of the year.

This week we will address new European cryptocurrency regulation, as Prasos running the Coinmotion service has been registered as an official cryptocurrency provider. In other news we have Italian bitcoin enthusiasm and German banks suggesting the creation of a digital euro. Additionally we have a city refusing to pay ransom in crypto to hackers holding it hostage.

Last week’s news can be read here.

Bitcoin’s white paper turns 11 years

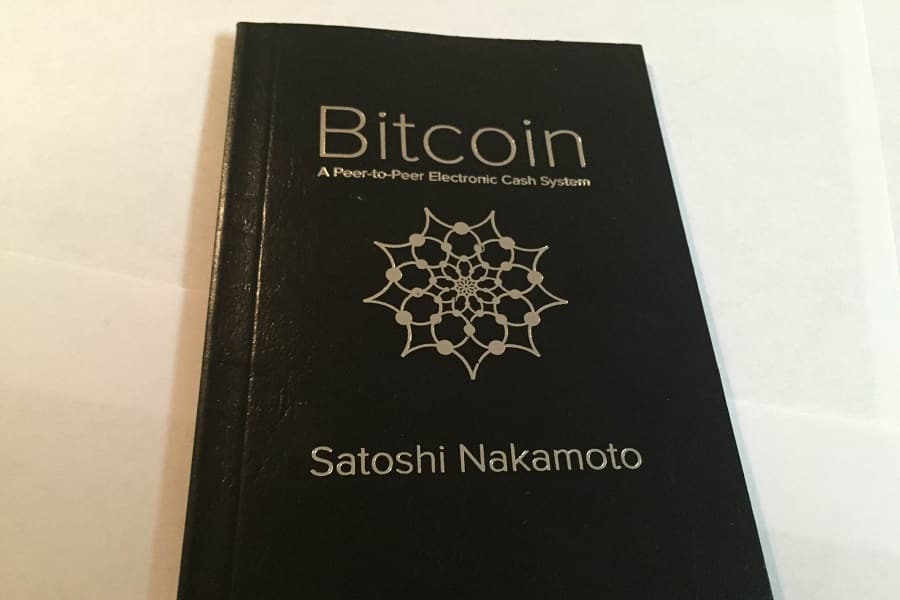

It has been 11 years since Bitcoin’s original white paper was published. An unknown inventor using the pseudonym Satoshi Nakamoto presented Bitcoin’s publication document on 31st October 2008. The Bitcoin network itself was subsequently launched on 3rd January 2009 with the first transaction following on 12th January, so Bitcoin can be seen as having three separate birthdays.

The document titled “Bitcoin: A Peer-to-Peer Electronic Cash System” outlines the basic principles of the cryptocurrency. Bitcoin was created as a decentralised consensus-based protocol between users with the capacity to trace and confirm transactions reliably.

Bitcoin’s creation was also influenced by the global financial crisis in 2008, which highlighted the problems of a centralized economy led by states and central banks. One of Bitcoin’s principles is indeed its decentralised nature, whereby no single party can manipulate the system.

Bitcoin has stayed true to its principles and grown more during a decade than many could anticipate. Due to its functioning technology also Bitcoin’s price has risen from few cents in the early days to five-digit numbers as the network continues to grow.

Prasos registered as a cryptocurrency provider

The Finnish Financial Supervisory Authority (FIN-FSA) has published a list of five registered cryptocurrency service providers to meet the European Union’s money laundering standards. Prasos, the leading cryptocurrency broker in the Nordics running the Coinmotion service, is the only operator which also has a payment institution license.

The new directive improves customer safety in the industry as it demands companies to meet certain requirements for customer asset handling, anti-money laundering and reliable management. In the future all cryptocurrency operators that want to offer exchange services to European customers must get registered under the local financial authorities.

Companies in the sector have generally reacted positively to the new regulation. Chief Compliance Officer of Prasos Jukka Karhapää sees it as a welcome change:

“For the end users, the registration brings transparency in the usage of cryptocurrency exchange services. Above all, the requirements of conducting customer due diligence and anti-money laundering and anti-terrorist financing requirements benefit consumers and businesses in the industry. It will also help to improve the general public trust and reputation of the growing cryptocurrency sector,” Karhapää states.

Bitcoin transaction fees surpass a billion

Bitcoin has already produced miners over $1 billion dollars worth of revenue in transaction fees. Most of this billion was collected during the last three years, since the activity of the Bitcoin network was notably lower before the year 2017.

Sending bitcoins requires a small transaction fee, which at the moment is around one dollar. The fee is collected by miners, whose activity helps secure the Bitcoin network. Unlike many fiat payments charging a percentual fee, Bitcoin has a fixed fee regardless of whether one sends tens or a millions of dollars.

Reaching the milestone of a billion dollars indicates the Bitcoin network is very active and miners have a stable source of income as block rewards decrease. One new blocks are no longer born around the year 2140, miners will earn their rewards purely from Bitcoin’s transaction fees.

Italians favor Bitcoin in online shopping

According to fresh data Italians use Bitcoin more than Visa, Mastercard or American Express for Internet purchases. News site La Stampa reports that Bitcoin is the third most used method in online shopping after PayPal and the Italian payment card system PostePay.

According to La Stampa Bitcoin was used 215 800 times per month for online purchases in Italy, while American Express amounted to 189 000. Visa, Mastercard and other credit cards were in turn used only in 33 950 transactions per month.

However, Bitcoin was eclipsed by PayPal and PostePay leading with their respective 1.3 and 1.2 million monthly user amounts. The calculations did not include accounts of the services linked to credit cards.

In 2018 Italians used more than €40 billion euros for e-commerce between companies and customers. Bitcoin’s strong third place bodes potential for its growing use as a payment method also in the future.

German banks support a digital euro

The Association of German Banks, Bankenverbrand, has published a new report outlining the need for a programmable digital euro. The group consisting of 11 members and 200 commercial banks highlighted the importance of digital money in the modern age.

The report also noted that digital currencies like Libra have gained attention and stirred worry as potential reshapers of the world economy. German banks seem to want to create their own digital currency which could bypass the political challenges Libra has faced.

“To create public trust in programmable digital money, compliance with the highest regulatory standards is essential,” the report states.

Earlier Germany’s finance minister Olaf Scholz has voiced opinions supporting a digital euro. Also the central bank of China and Sweden have weighed the creation of their own digital currencies, so Germany is not alone with its plans.

Hijacked city refuses to pay crypto ransom

The city of Johannesburg in South Africa has refused to pay crypto ransom to hackers. The demanded ransom is worth 4 bitcoins, equaling a bit under $40 000 dollars at the time of writing.

Johannesburg was victimized by hackers on 24th October. The hackers have allegedly gained access to sensitive data and forced the city to shut down its webpages and other services. The deadline set by the hacker group expired at the beginning of last week.

While authorities have admitted the hack has caused significant damage to the city, they refuse to give in to the hackers’ demands.

“The City will not concede to their demands for Bitcoins and we are confident that we will be able to restore systems to full functionality,” states Johannesburg’s Twitter announcement.

Johannesburg is not the first city to have been targeted by hackers demanding crypto ransom. Earlier this year the U.S. city of Baltimore also refused to pay crypto ransom and was forced to use a much larger sum to fix the hijacked systems. In turn two cities in Florida submitted to paying over a million dollars worth of ransom in bitcoin to their hijackers.