MARKET INSIGHTS

Table of Contents

BITCOIN: SCARCITY WITHIN SCARCITY

As the majority of bitcoin investors already know, bitcoin is a distinctively scarce asset and limited by the maximum number of its native units: 21 million. Although the actual number of bitcoin units in circulation is significantly lower than 21M, due to lost coins. Nevertheless bitcoin’s scarcity impacts the market dynamics, usually based on supply and demand. Sharply peaking demand can cause a “supply shock”, experienced during spring 2021, stemming from retail and institutional buying pressure.

In addition to the already scarce amount of native bitcoin units in circulation, UTXO data below shows the amount of active units being significantly low. UTXO shows only 7 percent of bitcoin units being active in 30 days or more. This means that an enormous 93% of all bitcoin units can be considered as relatively inactive.

EXCHANGE RESERVES

Furthermore, bitcoin exchange reserves are at their lowest level in three years, possibly indicating another upcoming sell-side crisis. The descending exchange reserve levels are also a bullish indicator for bitcoin’s price (BTCUSD), as escaping reserves mean bitcoin units are moving towards long-term storage and/or OTC markets. Respectively huge exchange inflows usually indicate that bitcoin is being converted (or sold) to national currencies or other digital assets.

STOCK TO FLOW (S2F)

The famous stock to flow (S2F) model, developed by Plan B, has been extensively used to assess bitcoin’s long-term price performance. In essence, stock to flow is a way to interpret the scarcity of a particular resource. Bitcoin is a scarce asset with a maximum supply set to 21 million native units. Bitcoin’s supply issuance is also defined on protocol level, making it highly predictable.

Plan B’s BTCUSD price targets for Q3 and Q4 (based on on-chain data, not S2F):

- August: $47K (reached)

- September: $43K (reached)

- October: $63K

- November: $98K

- December: $135K

When assessing stock-to-flow and its effect on Bitcoin, precious metals are a good benchmark. Platinum currently has a 0,4 S2F, which is relatively low. Silver however has 22 S2F, which is closer to bitcoin’s current S2F of 58,9. Gold’s current stock-to-flow is 62. The estimated S2F for bitcoin after 2025 halving will be 121,4, making Bitcoin extremely scarce. Let’s remember, only a maximum of 21 million bitcoin units will ever exist.

INFLATION

We’re living in an era of rather experimental central bank policies, including quantitative easing and “helicopter money”. Central banks, and especially the Federal Reserve (FED) have become active market participants and contemporarily represent a large tranche of buying pressure. The embedded chart mirrors the significant growth of FED’s balance sheet during the last ten years. Nordea’s Andreas Steno Larsen has estimated that up to 20 percent of all U.S. dollars in circulation were issued during 2020.

These experimental monetary policies are leading to rising inflation, estimated to be over 4,2 percent in 2021. A growing number of global corporate leaders have expressed their concerns over the growing inflation: Aker’s Kjell Inge Røkke states inflation being one of the key reasons why Aker decided to hedge cash-related risk with bitcoin.

“Risk is not an obvious concept. What’s commonly considered risky is frequently not. And vice versa. We are used to thinking that cash is risk free. But it’s not. It’s implicitly taxed by inflation at a small rate every year”

– Kjell Inge Røkke, Aker ASA

INCOMING TAPERING?

As mentioned previously, FED has been extensively using quantitative easing (QE) as part of its recovery tools and the central bank has been injecting a record-breaking amount of U.S. dollars (USD) to the system. The stimulation phase can’t continue forever and we’re already seeing worryingly growing inflation figures, this is why FED plans to wind down asset purchases next.

As portrayed in the embedded chart, FED now has a concrete plan to reduce asset purchases, starting in Q1 2022. In an economy dominated by central bank policies, tapering not only means the end of expansionary policies, but also would translate into higher interest rates on mortgages, consumer loans, and corporate borrowing. While FED tapering seems “healthy” for the larger economy, the results might be unpredictable. FED’s “cheap dollars” have been flowing to all tranches of the economy, including cryptocurrencies. The lack of the biggest buyer in the economy will likely have an impact on all asset prices. The big question is has the market already priced the tapering in?

WEAK NATIONAL CURRENCIES, A GROWING PHENOMENON

Meanwhile big central banks like the FED have been radically expanding their balance sheet, many smaller ones are in deep trouble. Argentinian peso (ARS) has weakened 13,33 percent against USD this year and ARS has a troublesome track record: In 2019 it collapsed >30% against USD within a day, amid escalating political risk. Argentina has a history of failed governmental & monetary policies, suffering great depressions during 1974–1990 and 1998–2002. The peso-related troubles have a silver lining though: Argentina is experiencing a boom in cryptocurrency use and mining. The country is a prime example of growing bitcoin adoption in a low-trust environment.

Myanmar’s national currency kyat (MMK) is another relevant example: It has lost more than 60% of its value since the beginning of September in a collapse that has driven up food and fuel prices in an economy that has tanked since a military coup eight months ago. In a report published on Monday, the World Bank predicted that Myanmar’s economy would slump by 18 percent this year, partly due to the COVID-19 pandemic.

"Central banks were created to steal the wealth from the masses"

- Mark Yusko

GROWING DEFI INDUSTRY

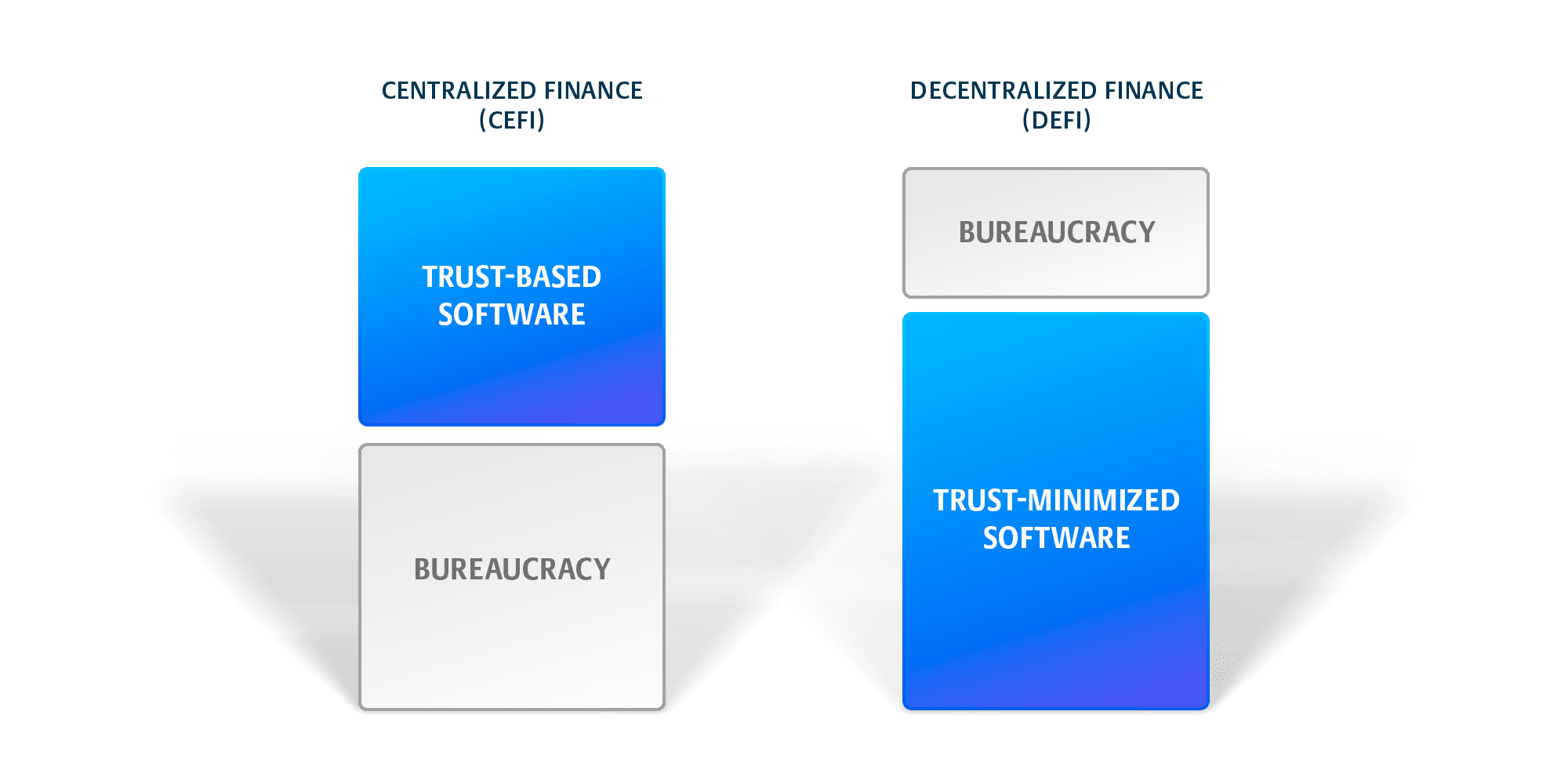

Decentralized finance’s value proposition is to solve the older financial industry’s inherent challenges. The fundamental idea is to learn from the casting flaws of the traditional centralized financial service sector. The most notable drawbacks of traditional centralized finance, or CeFi, are single points of failure, monopolizing power, and bureaucracy. Centralized finance utilizes trust-based software and heavy bureaucracy, while decentralized finance tries to minimize bureaucracy with trust-minimized software.

The decentralization of financial services relies on smart contracts. In smart contracts, rules are embedded in a computer code which enforces them automatically. A distributed ledger stores all the transaction-related data. This process ensures that no party has complete control over transactions, thus preventing censorship or intervention.

The decentralized finance industry has seen escalating growth in 2021, the DeFi user base grew from January’s 1,18 million users to September’s 3,29M. In quarter three (Q3) alone, the DeFi user base grew by 372 201 new users.

As the embedded chart shows, lending is the leading DeFi sector with $37,47 billion in total value locked (TVL). And interestingly, Aave (AAVE) is the leading DeFi platform by $13,87B in TVL. Aave was added to Coinmotion’s asset selection this year.

Aave is an Ethereum-based DeFi platform, which started its journey as ETHLend. The platform focuses on lending and recently launched undercollateralized lending based solely on social reputation. CEO Stani Kulechov, currently residing in London, manages Aave. Stani has a Finnish background and that’s how the project got its name: “Aave” means ghost in Finnish.

The second largest DeFi sector by TVL are decentralized exchanges, like Uniswap and dYdX. Decentralized exchanges currently account for $28,93B in TVL, rising parabolically since 2020. Although DEXs offer fast and effortless transactions without KYC, they have recently been under regulatory scrutiny. There has also been scepticism towards the true decentralization of these projects.

The decentralized finance industry has seen escalating growth in 2021, the DeFi user base grew from January’s 1,18 million users to September’s 3,29M. In quarter three (Q3) alone, the DeFi user base grew by 372 201 new users.

One of the most fascinating projects in the DeFi scene in Q3 has been the decentralized derivatives exchange dYdX. The DEX launched its governance token (DYDX) last month in parallel with a multi-billion level airdrop to its users. dYdX perpetual swaps crossed $2 billion in daily trade volume during late Q3. In summary dYdX facilitated >$4,3B worth of trading activity, even momentarily beating Coinbase’s volume.

The surge of dYdX volume is said to be stemming from Chinese traders switching from local exchanges (Huobi, OKEx) to decentralized alternatives. The People’s Bank of China recently said in a statement that cryptocurrencies are “not legal and should not and cannot be used as currency in the market”. Although older investors remember how China has already “banned” cryptocurrencies multiple times before, even creating a meme called “China FUD”.

BITCOIN DOMINANCE

Bitcoin’s dominance index stayed in the 42-50 percent range during the third quarter, after the notable drop in Q2. Bitcoin’s dominance reached up to 73% in early Q1, but then gradually dropped to 40s in early Q2. The low dominance index is likely a by-product of the escalating decentralized finance (DeFi) sector, which has seen a huge inflow of projects and tokens in 2021. However, Bitcoin’s dominance shouldn’t worry the investors too much, as the asset still holds its position as the de facto leading cryptocurrency.

“We believe that the Bitcoin network has a real first mover advantage. Social adaptation will determine the future of it on a wider scale. People who are a lot smarter than us believe that bitcoin can increase in value by 10, or even 50 times, in the coming years. Given the huge lead, we are not convinced that other cryptocurrencies can challenge bitcoin given the strong network effects; however, there is no such thing as certainty so we will remain painfully alert and passionately curious.”

– Kjell Inge Røkke, Aker ASA

When exploring the market cap data we should always remember that MCAP is only a relevant metric when it’s supported by volume relative to MCAP, and when volume comes from a broad group of participants that are representative of market demand. Many altcoins don’t fit the criteria above, so the real (organic) bitcoin dominance is well over the said percent.

PRICE PERFORMANCE MACRO

Macro price performance YTD:

- BTC: +60,22%

- S&P500: +17,8%

- Gold: 10,35%

Let’s look at performance between rivaling macro asset classes. Bitcoin has clearly beaten both S&P 500 Index and gold in terms of price performance. 2021 year-to-date bitcoin has ascended 49,01 percent while the stock market (S&P) climbed 17,8%. Gold however has underperformed in a spectacular manner, dropping -10,35 since the start of the year.

– Alex Krüger

PRICE PERFORMANCE: DIGITAL ASSETS

Digital asset price performance YTD:

- Bitcoin 49,01%

- Ethereum: 286,61%

- Aave: 286,61%

Digital assets performed excellently during the first three quarters of 2021, with the leading cryptocurrency Bitcoin (BTC) rising 49,01 percent. The leading decentralized finance platform Ethereum (ETH) climbed 286,61% from Q1 to Q3. Most cryptocurrencies ascended by at least three figures, with some notable exceptions like ADA (1044%) and SOL (8800%).

CORRELATIONS

According to historical data, the cryptocurrencies have closely followed bitcoin’s price action and consequently altcoins and bitcoin have been highly correlated. This fundamental rule has particularly applied to older (legacy) cryptocurrencies, which have been especially highly correlated with BTC. On the other hand, newer decentralized finance (DeFi) tokens have usually been more weakly correlated with dominant bitcoin.

The embedded correlation chart shows an interesting pattern with weak correlation among cryptocurrencies in Q1, switching to high correlation in late Q3. The main factor behind this pattern is May’s correction that included bitcoin dropping >40 percent. The chart shows the radical effect of a market correction to cryptocurrency correlations: Corrections have a tendency to drive correlations closer to one (1).

ETHEREUM & OTHER DEFI PLATFORMS

Ethereum (ETH) has been considered as the de facto decentralized finance (DeFi) platform and Ethereum’s history dates back to the year 2015 when it was launched by Vitalik Buterin and Gavin Wood. The original value proposition of Ethereum was to be a “world computer” and Ethereum has been evolving its narrative slightly since then. In the 2017 bull cycle, Ethereum’s ecosystem was the main decentralized platform for a new kind of funding rounds: Initial coin offerings (ICOs). Ethereum has been extensively utilized as a platform for decentralized applications (dapps) and more recently for non-fungible token art (NFTs). Ethereum is the leading DeFi ecosystem with >$408 billion market capitalization.

Cardano (ADA) acts as the leading competitor to Ethereum and it was launched in 2017 by Charles Hoskinson, whose background also derives from Ethereum. Charles left Ethereum as he wanted to develop the platform using venture capital funding, while Vitalik wanted to keep ETH purely as a non-profit, decentralized organization. Cardano is the second largest of the three projects by market capitalization with $70 billion MCAP, around ¼ of Ethereum’s market cap. Solana (SOL) is the other plausible “Ethereum killer” with a market cap of $46 billion, the smallest MCAP of the three. Solana was launched in 2019 by Anatoly Yakovenko. Solana is capable of 50 000 transactions per second, however, this speed is achieved by reducing decentralization. SOL has definitely been one of the most hyped tokens of 2021.

BITCOIN LIGHTNING NETWORK

Bitcoin’s Lightning Network (LN) has seen incremental growth from Q1 to Q3 2021. As the embedded chart shows, the network capacity has more than doubled from the early first quarter, rising from 1070 into 2350 BTC.

The value proposition of Lightning Network is to solve Bitcoin’s scaling challenges, capable of handling millions of transactions per second. The recent wallet data also shows that LN-related spending has doubled in September 2021. September was also a significant month for LN as close to 10 million new users gained access to it, mainly via El Salvador’s Chivo and Paxful. Seems that LN is evolving from an online use platform into a more everyday use instrument.

The true revolutionary aspect of LN lies in its potential use case for unbanked people in third world countries. El Salvador is estimated to have 4,5 million Lightning Network users and 20 million transactions by 2026.

STATE-LEVEL BITCOIN

The year 2020 was characterized by institutional bitcoin adoption, mainly propelled by MicroStrategy (MTSR) and Michael Saylor, who subsequently became an industry thought leader. This year the bitcoin narrative has been shifting more towards state-level adoption, with probably the most remarkable example being El Salvador.

El Salvador accepted bitcoin as a legal tender on 9th of June this year and has been accelerating the adoption curve since. The country mandates every business to accept bitcoin payments and transactions are handled via the Chivo wallet. The country additionally started to mine bitcoin using native volcano energy, or like president Nayib Bukele calls it: Volcanode.

El Salvador is expected to be followed by countries like Paraguay, Panama, Brazil, and Ukraine. Countries are now competing for bitcoin adoption and the winner is likely to receive an inflow of wealthy bitcoin immigrants.

“Como toda innovación, el proceso del Bitcoin en El Salvador tiene una curva de aprendizaje. Todo camino hacia el futuro es así y no se logrará todo en un día, ni en un mes.

Pero debemos romper los paradigmas del pasado. El Salvador tiene derecho a avanzar hacia el primer mundo.”

“Like all innovation, the Bitcoin process of El Salvador has a learning curve. Every road to the future looks like this and we can’t expect everything to happen in a day or month.

But we must break the paradigm of the past. El Salvador has the right to advance towards the first world.”

– Nayib Bukele

The institutional Bitcoin thesis has been one of the prevalent topics during the current market cycle. While numerous institutions have signaled interest in Bitcoin, it was Michael Saylor and his company MicroStrategy (MSTR) who brought institutional Bitcoin to wider audiences. Back in July 2020, Saylor announced MicroStrategy to explore purchasing bitcoin, gold, and other alternative assets instead of holding cash reserves (USD).

Saylor’s public statements mark a turning point in the way institutions perceive Bitcoin and digital assets, leading to wider acceptance towards the asset class. MicroStrategy’s move was relatively soon followed by an even bigger announcement as Elon Musk of Tesla (TSLA) bought $1,5 billion worth of bitcoin in February. MicroStrategy currently holds 114 042 bitcoins in its treasury and Tesla 42 902 BTC.

– Michael Saylor

The institutional Bitcoin thesis revolves around following rationales:

Bitcoin as inflation hedge

An escalating amount of corporate leaders have expressed their concerns over growing inflation. The world seems to be shifting towards more unsustainable monetary policies and Nordea’s Andreas Steno Larsen has estimated that up to 20 percent of all U.S. dollars in circulation were issued during 2020.

Two percent annual inflation will consume a third of a liquid portfolio every twenty years. If central banks would target 3% inflation, almost 50% of portfolio’s assets would be consumed in the same time horizon.

The U.S. has expanded the money supply by 7% p.a. on average since 1971. 7% is the rate money collapses in value. Those who don’t generate (at least) a 7% return per year, are probably not keeping up with the money supply expansion.

Scarcity

Only 21 million native bitcoin units will ever exist and the amount of circulating supply is notably lower. After 2024, bitcoin will be even scarcer than gold by Stock to Flow model and holding it has historically enhanced portfolio performance. Bitcoin represents ultimate scarcity in a world full of infinite money and derivatives.

Asymmetric return profile

Bitcoin is an unique asset by its asymmetric return profile: There’s much more upside than downside in holding bitcoin. Long-term investors gain the full benefit of bitcoin’s price performance combined with an excellent risk-reward ratio. Bitcoin’s current Sharpe Ratio is 2,23, compared with gold’s 1,22.

– Hunter Horsley, Bitwise

INDICATORS

Bitcoin’s market capitalization / realized capitalization (MVRV) indicator has been aligned to BTCUSD during the current bull cycle. During quarter one (Q1) MVRV indicated overvaluation as it crossed into the sell zone (red) during three occasions: January, February, and March. In retrospect these were good moments to decrease exposure before May’s correction. Later during July, MVRV inched closer to buy zone (green), indicating increasing buying opportunity. 2021’s data shows the usability of MVRV as bitcoin’s leading indicator.

A negative MVRV ratio indicates market participants being not in profit, or minimally in profit. Positive MRVR indicates asset holders likely being in profit, respectively. As a rule of thumb, bitcoin is generally considered as overvalued when MVRV exceeds 3,7 and undervalued when it’s below 1.

NVT, or Network Value to Transactions Ratio, was first introduced by Willy Woo in February 2017. The NVT indicator can be described as bitcoin’s P/E ratio. Bitcoin NVT is calculated by dividing the Network Value (MCAP) by the daily USD volume transmitted through the blockchain.

Bitcoin is currently fluctuating between NVT values of 50 and 100, indicating a “fair price” for bitcoin. Like MVRV, NVT indicates whether bitcoin’s price is overvalued or undervalued. Bitcoin saw especially high NVT values during the early years and NVT is a sound indicator for revealing high speculative value.