The TA of week 33 explores the huge liquidation event of August 19th and recent price scenarios. Additionally, we assess the sentiment of hedge funds and asset managers towards Bitcoin.

The cryptocurrency markets were yet again stirred by Friday’s large sell-off, which pushed the leading cryptocurrency bitcoin to a -9 percent decline. Bitcoin fell from $23K level to below $21K, testing the $20K key support. During the early week of 34 bitcoin tried to regain $22K, however, the attempt was rejected for now. While the spot sell-off was relatively light per se, it causes a sequence of long liquidations worth $562 million. The amount of liquidations almost reached the level of June 13th mayhem, when liquidations climbed to $685 million. The June crash was caused by the meltdown of the hedge fund Three Arrows Capital (3AC).

One could argue that the market was yet again overleveraged, as the crypto market has a tendency to attract too much leverage. Also, the market needs to “purify” itself from excess leverage in order to support further price increases. Bitcoin’s Estimated Leverage Ratio (ELR) is still high at 0,32.

While bitcoin’s current sentiment looks gloomy, it could still form an inverse head and shoulders technical pattern later in 2022. In this scenario, the left shoulder (S) is at the $30K+ level and the head (H) is formed by summer’s spot price bottom. The right shoulder (S) is in close proximity to Deutsche Bank’s target price of $28K. DB argued back in June that Bitcoin would likely recover and return to higher valuations in correlation with the stock market. The rally of the stock market alongside cryptocurrencies in late July was fueled by lower-than-expected CPI data. Some analysts now expect inflation to be peaking.

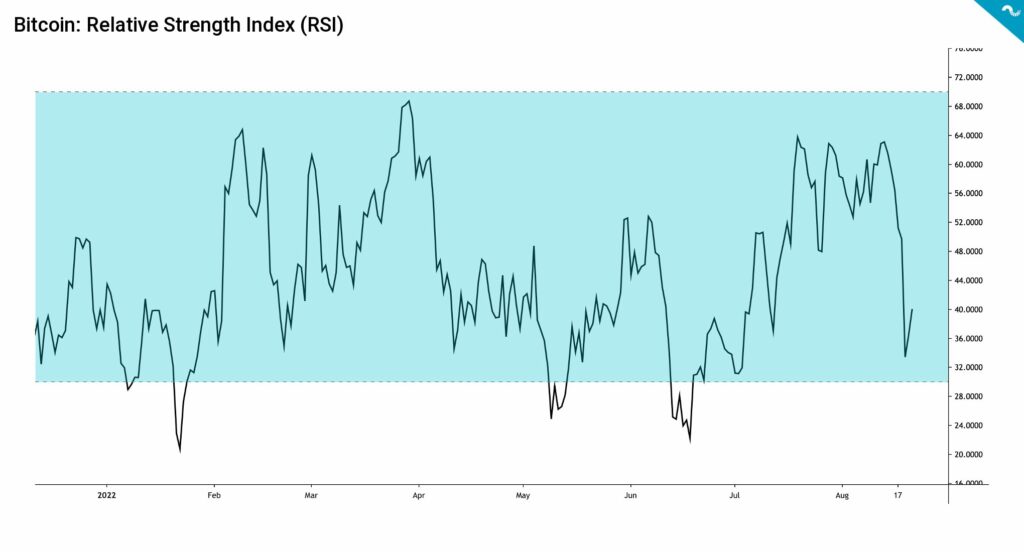

Bitcoin’s Relative Strength Index (RSI) approached oversold territory in Friday’s sell-off but inverted its trajectory. The last time RSI actually signaled oversold bitcoin was in mid-June, amid the 3AC capitulation. Back then RSI dropped to a significantly low value of 20. During the past seven days, other cryptoassets declined in bitcoins’ wake, which splashed Ethereum down -by 15,6%. DeFi-related assets like Chainlink weakened by almost -20%. The leading stock market index S&P 500 also weakened significantly and is down -3,7 percent in a week.

7-Day Price Performance

Bitcoin (BTC): -11,7%

Ethereum (ETH): -15,6%

Litecoin (LTC): -8%

Aave (AAVE): -18,1%

Chainlink (LINK): -19,1%

Uniswap (UNI): -17,3%

Stellar (XLM): -11,7%

XRP: -9,3%

– – – – – – – – – –

S&P 500 Index: -3,7%

Gold: -2,41%

– – – – – – – – – –

Bitcoin’s 90-Day Pearson Correlation with S&P 500 Index: 0,45

Bitcoin RSI: 40

Bitcoin’s realized price (blue) has been a critical benchmark this summer and BTC/USD momentarily gained momentum to overtake it. The realized price was unfortunately breached during the recent crash, signaling potential trouble ahead. Bitcoin’s MVRV indicator (green) has declined to 0,95, diving deep into the buy zone. Although further spot price weakness might be ahead, these levels are good for cheap coin accumulation.

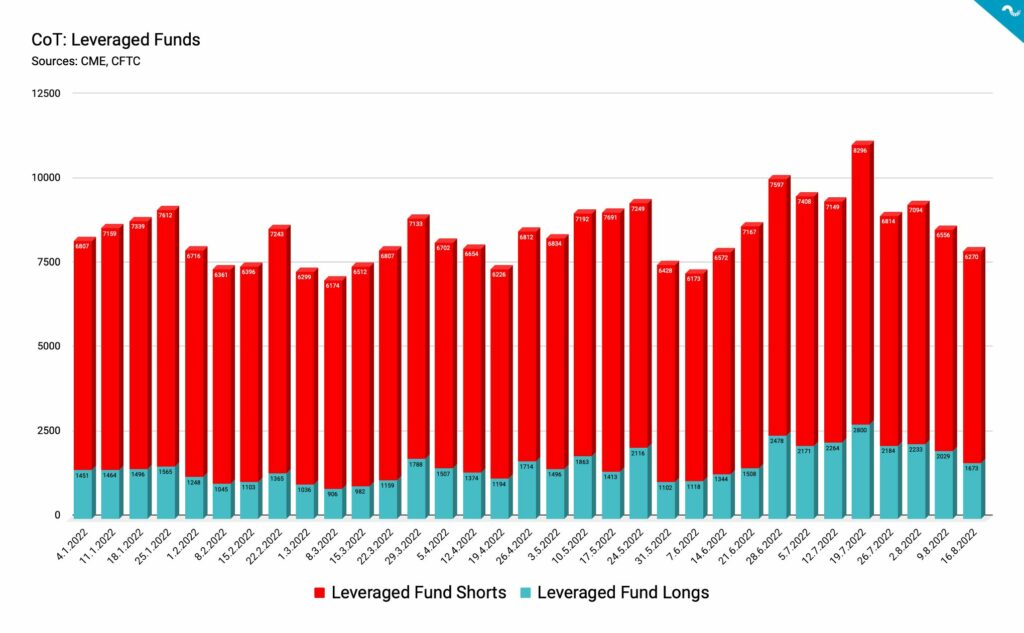

CoT: Asset Managers Bullish, Hedge Funds Hold a Significant Amount of Short Positions

The estimated size of cryptoasset derivatives market is over $3 trillion and the futures market of Bitcoin alone is worth $670 billion. When evaluating bitcoin futures, the CoT report (Commitments of Traders Report), is one of the most important publications in the futures market. The CoT report is published every Friday at 3.30 pm ET by CFTC (Commodity Futures Trading Commission) to provide market participants with a breakdown of open interest positions.

The CoT data shows asset managers being bullish on Bitcoin as the amount of long positions in this segment has risen to 7129 in mid-August. At the same time, the asset managers only held 983 short positions recently. The asset manager cohort has traditionally supported Bitcoin despite the macro uncertainty.

In contrast, the leveraged funds (i.e. hedge funds) have been massively shorting bitcoin during 2022. In mid-August, the hedge funds held 6270 short positions and only 1673 long positions. However, the amount of hedge fund shorts have been in decline since the 19th of July, when leveraged money had a total of 8296 short positions. Hedge funds currently hold -24 percent fewer short contracts than in July.

Analysts have argued that the hedge funds are using a cash and carry strategy to short bitcoin. Cash and carry is a market-neutral strategy combining the purchase of a long position in an asset and the sale of a position in a futures contract on that same underlying asset. The cash and carry strategy seeks to exploit pricing inefficiencies for the asset in the cash or spot market and futures markets, in order to make riskless profits. Additionally, the futures contract must be expensive in relation to the underlying asset or the arbitrage will not be profitable.

Although Bitcoin has been one of the favorite short targets of hedge funds, the shorting is in no way limited to BTC. According to Bloomberg, hedge funds have built significant short positions in SOFR and eurodollar futures. Hedge funds seem to be betting that the Federal Reserve (Fed) will continue its hawkish policy as they rapidly position for higher interest rates in a key tranche of the derivatives market.

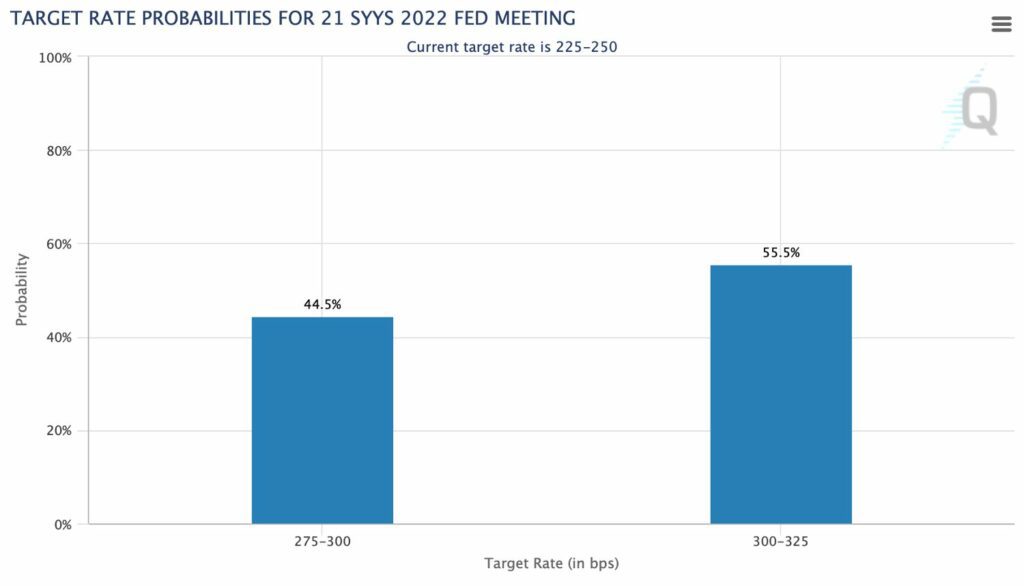

Fed Likely to Make a 75 Basis Point Hike in September

Investors are waiting for any signs of market movements and the Fed’s next FOMC meeting on September 21st is deeply anticipated. According to CME’s data, there’s a 55,5 percent probability for a 75 basis point increase. The probability for a 50 basis point increase is 44,5 percent. In this macro environment, Fed’s monetary policy decisions are critical and they can be seen as leading indicators for most assets.

Fed’s feared “tapering” program can now be seen in effect as the balance sheet of the central bank is effectively shrinking. After an epoch of zero interest policy and quantitative easing, central banks are now focusing on inflation by reducing the money supply. It’s clear that the flow of “cheap dollar” used to be beneficial to small-cap tokens and the decentralized finance protocols.

What Are We Following Right Now?

The US Office of Foreign Assets Control (OFAC) has sanctioned the cryptocurrency mixer Tornado Cash, which has allegedly been used to launder more than $7 billion worth of crypto since its creation in 2019. The Bankless team discusses Tornado Cash’s fallout and the current status of the Ethereum ecosystem.

Matt McCall and Bitwise’s CIO Matt Hougan talk about the future of crypto, Web 3.0, and how bitcoin can get to “half a million dollars.”

The views, thoughts, and opinions expressed in the text belong to the author and not necessarily to the author’s employer, organization, committee, or other group or individual.