This new 11-part series is designed for beginners who want to invest in cryptocurrencies but need more information before taking the plunge. Our goal is to provide clear and concise explanations of the fundamental concepts in the world of cryptocurrencies.

Over the following weeks, we’ll publish a weekly lesson covering one topic regarding investing in cryptocurrencies. Each lesson will take less than 5 minutes to read. At the end of the course, you will better understand how to invest in cryptocurrencies, what to invest in, and when is the right time to do it.

If you’re new to cryptocurrency investing, you may be wondering how to make informed decisions about when to buy and sell. Both traders and investors use technical analysis, which tries to understand the market sentiment behind price trends by looking for patterns, trends, and indicators to determine future price movements. In this lesson, we’ll explain technical analysis and how it works.

📈 What is technical analysis?

Technical analysis (TA) is a method used to predict future market behavior by analyzing previous price action and volume data. Although primarily used in traditional financial markets such as stocks and other assets, TA is also crucial in trading digital currencies in the cryptocurrency market.

Unlike fundamental analysis (FA), which considers multiple factors that affect the price of an asset, TA focuses solely on the historical price action. As a result, it is a helpful tool to examine an asset’s price fluctuations and volume data, which many traders use to identify trends and profitable trading opportunities.

💭 How does TA work?

Technical analysis works on the following assumptions:

- Human behavior in markets is somewhat predictable.

- Price fluctuations are not random and reflect market forces of supply and demand influenced by traders’ emotions like fear and greed.

- What has happened in the past can give us an idea of what will happen in the future (it allows us to calculate odds, not see the future, of course).

- The next wave of investors will tend to follow the trends of the last wave.

- Studying factors like past volume and price trends alongside the current volume and price can tell us about the likelihood of future volume and price trends.

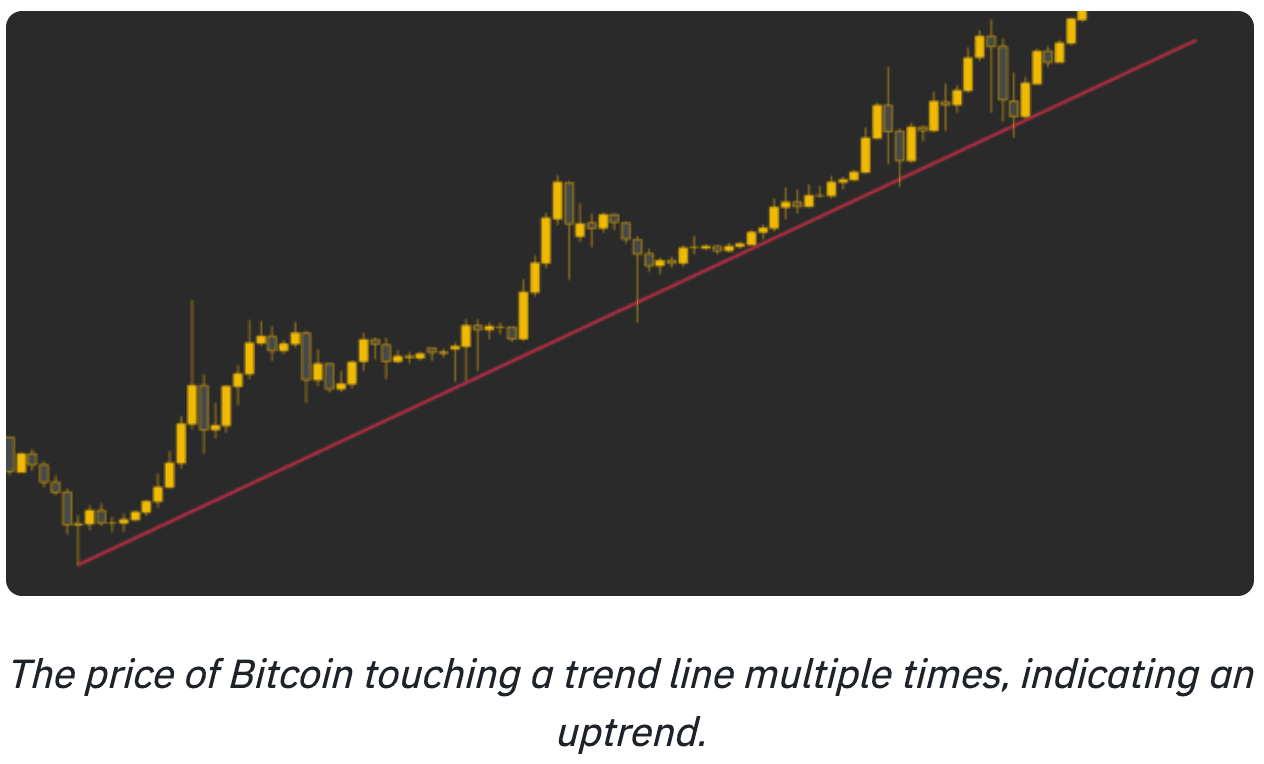

To examine prices and identify opportunities, traders use charting tools like candle patterns, trendlines, support and resistance levels, and technical indicators, which help to spot existing and emerging trends. To reduce risk, some traders use multiple indicators since they are fallible.

🤔 Issues with TA

Despite its widespread use across various markets, technical analysis (TA) remains a controversial and often disputed method, with some experts even labeling it a “self-fulfilling prophecy.” This term describes a situation where an event happens simply because many people believed it would occur.

If many traders and investors rely on the same indicators, such as support or resistance lines, the likelihood of these indicators becoming effective increases.

On the other hand, supporters of TA argue that each trader has a unique way of analyzing charts and utilizing indicators. This implies that it is highly improbable for a large group of traders to adopt the exact same strategy.

Lastly, TA works best on assets with high volume and liquidity, like Bitcoin or Ethereum. These are less susceptible to price manipulation and noise that could create false signals.

💡In short

Technical analysis can offer valuable information about short-term market conditions, making it useful for traders and investors seeking favorable entry and exit points.

At Coinmotion, we offer a range of tools and resources to help you make informed investment decisions, including weekly technical analysis on our blog. The content we publish also includes a variety of technical indicators that you can use to analyze market trends and identify potential buy and sell signals.

Our team of experts is available to provide guidance and answer any questions about using technical indicators in your investment strategy.

Get started with Bitcoin Litecoin Ethereum AAVE USDC Stellar Ripple

Join Coinmotion and buy your first cryptocurrencies within minutes!

The views, thoughts, and opinions expressed in the text belong to the author and not necessarily to the author’s employer, organization, committee, or other group or individual.