The technical analysis of week 37 assesses the position of bitcoin at its multi-year confluence point. Additionally, we explore Bloomberg’s forecasts for the likelihood of a spot ETF approval for this year. We also investigate why bitcoin’s dominance and volume are rising compared to other cryptocurrencies.

The trend of the cryptocurrency market has continued as moderately positive since last week, with bitcoin gaining about four percent. Despite the autumn headwinds, the market is supported by the possibility of a spot ETF fund launch still within this year. Bloomberg’s senior ETF analyst, Eric Balchunas, estimates the probability of the ETF fund’s approval by the end of the year at 75 percent, which is a clear increase from the company’s previous 65 percent forecast.

“We had a 65 percent change for Bitcoin ETFs being launched this year, but we updated it to 75 percent. Now we have factored in the Grayscale’s win.” – Eric Balchunas, Bloomberg

In addition to ETF expectations, the growth of institutional appetite is also indicated by the bitcoin fund launched by the investment bank Nomura. The fund will belong to the Japanese subsidiary of Nomura, Laser Digital, and currently only allows long exposure for its clients.

From a purely technical perspective, the spot price of bitcoin is aiming to return to the vicinity of the 200-day moving average (turquoise) and towards $30 000. The 200-day moving average served as strong support for bitcoin throughout the summer, aligning with the 200-week moving average (orange) now. Together, these two moving averages form a multi-year confluence point.

Three descending channels (white, 1-3) have defined the spot market since the beginning of the year. Bitcoin managed to move from channel one to channel three in June but fell out of the third channel in August. Over the past week, bitcoin has once again been able to rise to the surface of the third channel.

Sources: Timo Oinonen, CryptoQuant

At the same time, bitcoin’s actual support level is represented by its realized price wave (violet), which is considered a market watershed. The realized price represents the average price of all bitcoin purchases and indicates that the average investor is in a profitable position. The Chop Zone indicator hints at bitcoin’s desire for an upward movement after a long cyclical weakening.

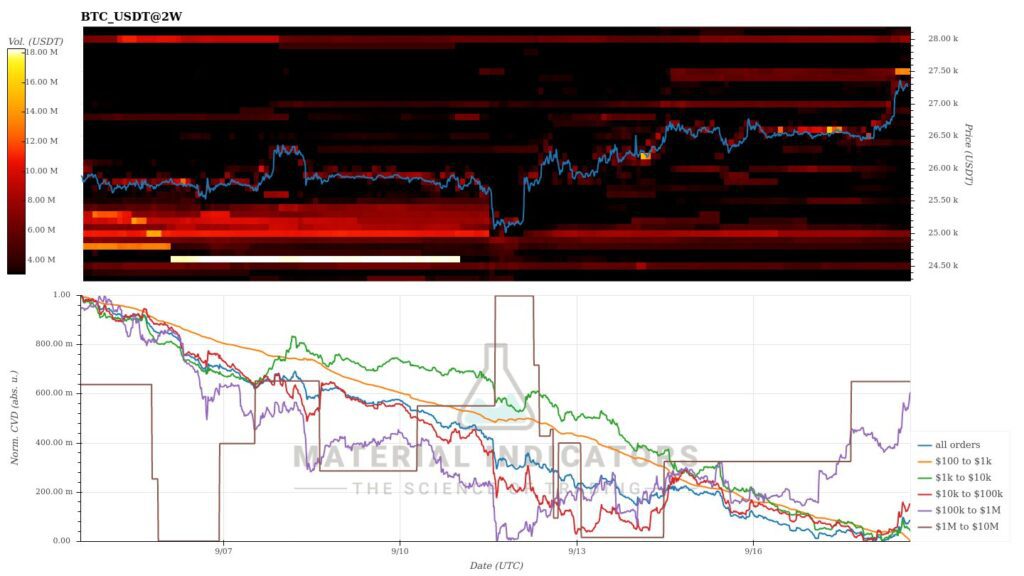

The Material Indicators’ heat map reflects the rapid strengthening of the spot price over a seven-day timeframe. According to the cumulative volume delta, demand continues to come from whales, while smaller investors are waking up to the rising trend. The market setup’s risk lies in the absence of clear support levels between the spot price and the realized price.

Source: Material Indicators

In the big picture, bitcoin is in a pre-halving accumulation cycle (blue). The distribution cycle that ended at the end of last year (violet) marked a decrease in selling pressure and a turning point in the market. As a reflexive asset class, bitcoin’s price development is supported by its diminishing supply due to halving, which, combined with a spike in demand, creates a favorable environment for the growth of the spot price.

Sources: Timo Oinonen, CryptoQuant

In the seven-day price development of cryptocurrencies, there is a clear recovery, with bitcoin rising by about four percent, while its closely correlated counterpart Ethereum increased by 1,7 percent. Aave and Chainlink, which performed poorly in August, have both strengthened by over ten percent, moving them into the middle range of year-to-date (YTD) prices. Uniswap’s downward trend continued with a weekly decline of -2,1 percent, and the UNI token has dropped by -16 percent since the beginning of the year. Delphi Digital recently assessed that Uniswap’s liquidity providers (LPs) are facing challenges.

7-Day Price Performance

Bitcoin (BTC): 3,5%

Ethereum (ETH): 1,7%

Litecoin (LTC): 6,7%

Aave (AAVE): 15,2%

Chainlink (LINK): 13,2%

Uniswap (UNI): -2,1%

Stellar (XLM): -3,6%

XRP: 7%

Cardano (ADA): 1,7%

Get started with Bitcoin Litecoin Ethereum AAVE USDC Stellar Ripple

Join Coinmotion and buy your first cryptocurrencies within minutes!

S&P 500 Index: -0,4%

Gold: 1,4%

Raoul Pal Confident about Bitcoin’s Market Outlook

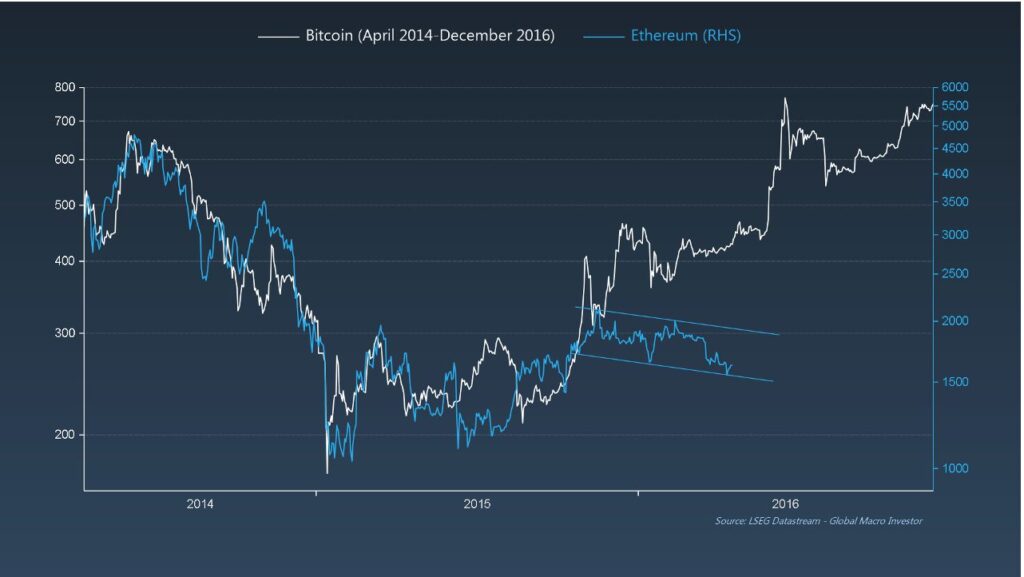

Raoul Pal, known as a Bitcoin bull, sees promising signs in the market. The chart below illustrates Ethereum, closely correlated with bitcoin, forming a bull flag pattern as Pal draws parallels to the 2014 market cycle. Raoul reminds us that bitcoin reached a parabolic price growth phase after a long sideways market in 2014.

Source: Raoul Pal

Raoul Pal has previously anticipated the end of the Quantitative Tightening (QT) period and the beginning of a new round of Quantitative Easing (QE). Historically, the spot price of bitcoin has correlated with the expansion and contraction of the circulating money supply. The U.S. central bank’s new QE cycle would bring much-needed liquidity to high-beta cryptocurrencies and tokens.

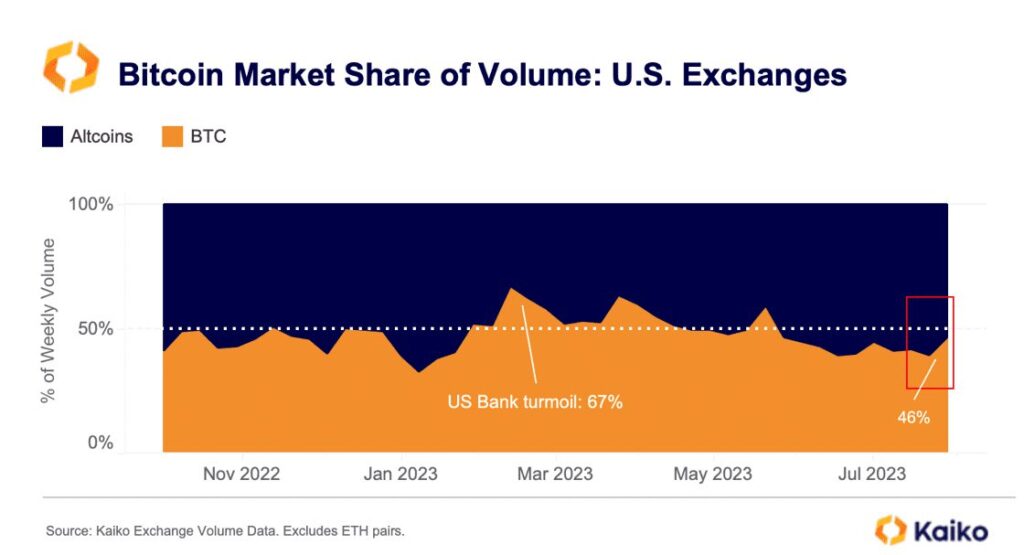

Bitcoin Dominance Uplifted by ETF Speculations

The bitcoin dominance, which is its market share relative to other cryptocurrencies, rose to 50 percent in September. The main reasons behind the increase in dominance include the anticipated spot ETF fund by investors and the upcoming halving of spring 2024. At the same time, bitcoin has firmly captured nearly half (46%) of the trading volume on U.S. exchanges.

Source: Kaiko

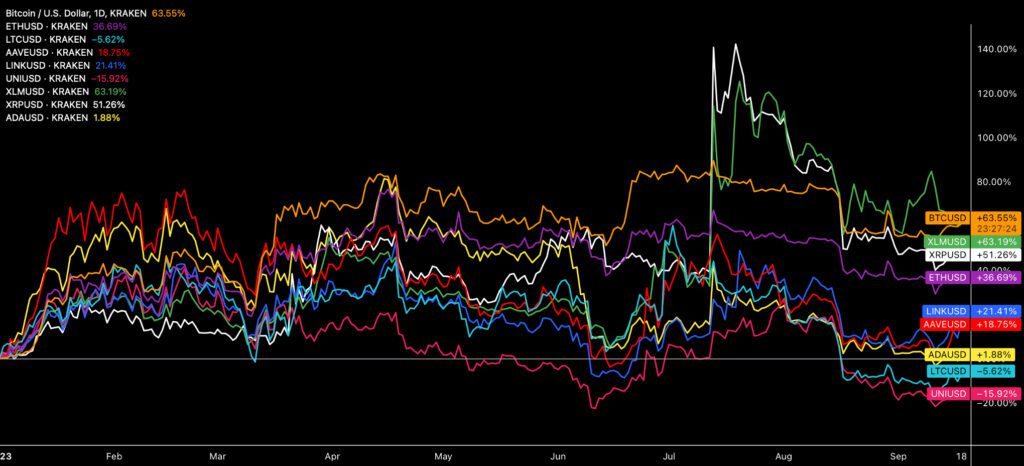

In addition to dominance and volume growth, bitcoin has led the price performance of cryptocurrencies listed on Coinmotion since the beginning of the year, with the cryptocurrency strengthening by 64 percent based on the YTD metric. The second best-performing is Stellar, rising by 63 percent since the beginning of the year. In July, both Stellar and XRP were subjects of U.S. Securities and Exchange Commission (SEC) classification speculations, experiencing increases of over 120 and 140 percent, respectively. After the rally, XRP has slightly cooled down but has still ascended by 51 percent since the beginning of the year.

Source: TradingView

A “wealth redistribution” occurs in the market as attention focuses on bitcoin’s macro events. The YTD performance of smaller tokens has often been lackluster, with Uniswap (-15,92%) and Litecoin (-5,62%) showing negative performance. Meanwhile, the SEC’s segmentation between “utility tokens” and “securities tokens” is creating clear divergence in the market. So far, the SEC has classified only bitcoin, Ethereum, and XRP as commodities, solidifying their status.

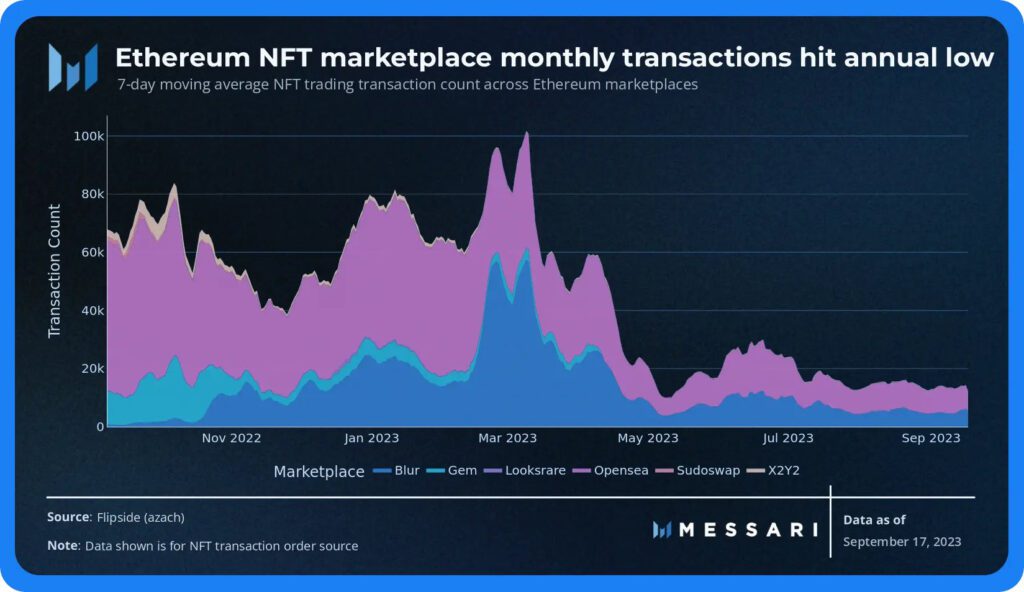

Source: Messari

In contrast to the interest in bitcoin, the NFT market appears to be in a state of stagnation. High-beta assets like NFT art and collectibles have been hit by quantitative tightening (QT) and the end of the zero-interest-rate cycle. Both cheap money and the availability of zero-interest-rate borrowing flowed into the NFT market in previous years.

The Amount of Small Bitcoin Addresses Reaching New Highs

According to Glassnode data, the number of small addresses containing less than 0.1 bitcoin has risen to nearly 4.5 million. In addition to the previously noted institutional growth, the quantitative increase in small bitcoin wallets is important because it reflects a broader societal adoption of Bitcoin.

Source: Glassnode

The intention of Bitcoin’s creator, Satoshi Nakamoto, was specifically to make bitcoin a replacement for inflationary national currencies at the retail level. Satoshi understood that organic growth was crucial for Bitcoin and stated it would become a “self-fulfilling prophecy” when enough people believed in it.

“If enough people think the same way, that becomes a self-fulfilling prophecy.” -Satoshi Nakamoto

What Are We Following Right Now?

Arthur Hayes, known as the founder of the BitMEX platform, predicts that capital outflows from China are accelerating. Meanwhile, the Chinese yuan (CNY) has depreciated by nearly 15 percent against the dollar since the beginning of the year and by -42 percent against bitcoin. Hayes commented that the capital outflows could potentially boost demand for assets like gold and bitcoin.

In China, there have long been strict currency controls and laws restricting the movement of capital, putting pressure on many Chinese companies and individuals who wish to transfer their funds abroad for various reasons. Such transfers are often related to investments, asset protection, or avoiding economic instability.

Follow the money, a lot of noise is being made about possible China capital flight.

— Arthur Hayes (@CryptoHayes) September 20, 2023

Something is going on because $CNY has depreciated almost 15% YTD. pic.twitter.com/oHxBsc1Sd5

Mark Yusko, known for his hedge fund, predicts that the liquidity situation of bitcoin is improving dramatically. Yusko argues that macroeconomic factors have less of an impact on bitcoin because the cryptocurrency exists within its own ecosystem.

Diving into blockchain data with Nik Bhatia and Willy Woo. Topics of discussion include volatility and the global adoption of Bitcoin.

Stay in the loop of the latest crypto events

- Dive into Cardano (ADA): A newcomer’s comprehensive guide

- How to send money home via crypto: Remittance made easy

- How technical analysis works in crypto: Lesson #6

- Continuing the Transformation: Coinmotion Welcomes New CEO Antti-Jussi Suominen

- The best strategy for passive investing: Lesson #5

- Pick your strategy: Trading vs. investing: Lesson #4

- Aave: The DeFi Powerhouse Changing the Crypto Landscape

- Technical Uncertainty Weighs on Bitcoin

- Price Projections for 2023 and 2024

Get started with Bitcoin Litecoin Ethereum AAVE USDC Stellar Ripple

Join Coinmotion and buy your first cryptocurrencies within minutes!

The views, thoughts, and opinions expressed in the text belong to the author and not necessarily to the author’s employer, organization, committee, or other group or individual.