The TA of week 29 focuses on the market sentiment after the FOMC meeting. Additionally we explore the Ethereum’s merge trade and how it has potential to disrupt markets.

Bitcoin’s Battle with Realized Price

Bitcoin experienced a moderate pullback early this week after the relief rally boosted the leading cryptocurrency into $24K level. While bitcoin’s spot price touched $21K in the middle, the FOMC news recovered it back towards $23K and above. The crypto market reacted positively on Fed’s 75 basis point increase, as many analysts expected the Fed to be hawkish and even 100 basis point rate hikes were on the table.

Somewhat suddenly Fed announced a relatively dovish approach and stated the economy to be already slowing down. As we estimated a week ago, most of the speculative money has already left the market and sub $20K ranges are holder territory. Bitcoin has once again managed to cross the realized price indicator (orange), that mirrors an area of increasing demand.

The FOMC news uplifted cryptocurrencies and particularly Ethereum, which has strengthened over 20 percent within 48 hours. In addition to digital assets, the legacy markets were also pulled up by FOMC news. The Nasdaq 100 index has climbed 4,3 percent within 24 hours, marking a biggest daily rally since November 2020.

Will Rhind, CEO of GraniteShares, previously estimated the 75 basis point increase to be the most obvious FOMC outcome. Rhind stated that markets will also see a wide rally after 75 bps. If Bitcoin can regain its upward momentum, we could see the leading cryptocurrency soaring towards Deutsche Bank’s target price of $28K (turquoise). The bank previously estimated Bitcoin to rise higher in the wake of recovering stock market.

Whalemap’s realized price data shows how bitcoin was rejected at $24K level, close to the < 1 bitcoin address average purchase price. Realized price by address indicates the average price at which current unspent bitcoins belonging to each category of addresses were purchased for.

S&P 500 index took a prominent leap, rising 3,55 percent in a week. The stock market strength also spreaded into digital assets. Gold has been grinding a bit higher, trying to regain its position after early July’s correction.

7-Day Price Performance

Bitcoin (BTC): -8,7%

Ethereum (ETH): -5,3%

Litecoin (LTC): -7,2%

Aave (AAVE): -14,2%

Chainlink (LINK): -13,2%

Uniswap (UNI): -9,1%

Stellar (XLM): -10,8%

XRP: -9,4%

– – – – – – – – – –

S&P 500 Index: +3,55%

Gold: 0,58%

– – – – – – – – – –

Bitcoin’s 90-Day Pearson Correlation with S&P 500 Index: 0,64

Bitcoin RSI: 48

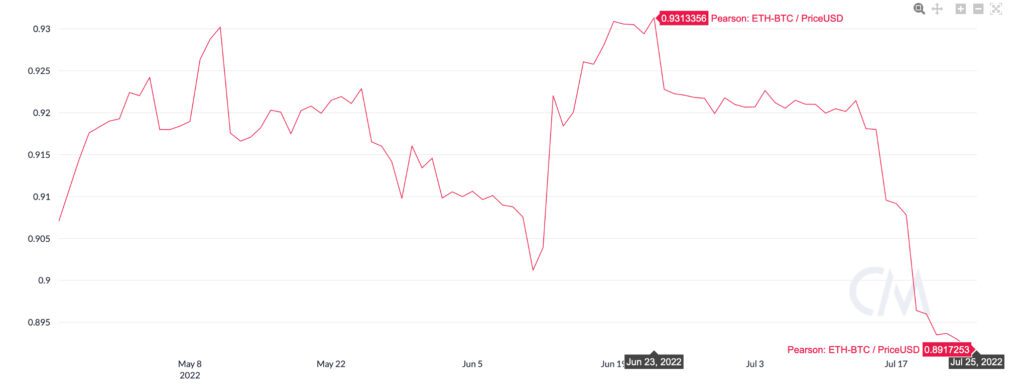

Ethereum’s correlation with Bitcoin has been weakening notably, dropping from June’s high of 0,93 to the current low of 0,89. The weakening correlation between the two leading cryptocurrencies mirrors the investor appetite for Ethereum’s upcoming protocol-level update. The upcoming merge is expected to act as a catalyst for appreciation.

How to Trade The Ethereum Merge?

Ethereum’s merge is surely one of the most anticipated events of 2022 and things were pulled forward as key developer Tim Beiko published a roadmap for it. On July 14th Beiko suggested September 19th as the official target date. The release consequently triggered a significant ETH/USD rally in which the Ether token zoomed up 60 percent between July 13th and 22nd. The stage seems to be set for a true merge rally.

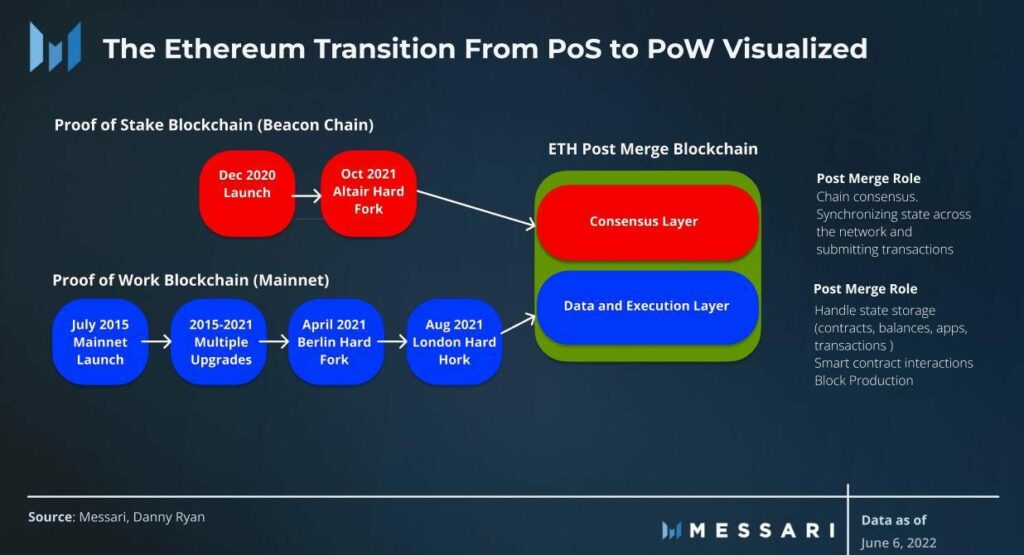

In the merge, the existing execution layer (Ethereum mainnet) will merge with the new PoS consensus layer (beacon chain). The network will be secured by staked ETH instead of mining, reducing energy consumption by ~99,95 percent and positioning the blockchain for future scaling upgrades like sharding.

The main selling point of the merge will be the classification of Ethereum as a “green” and “ESG friendly” blockchain. Wealth managers are increasingly aware of ESG-related topics and significantly lower energy consumption would make Ethereum easier to sell to investors. The green narrative would also allow Ethereum to differentiate itself from PoW-based Bitcoin. Many smaller “Ethereum killers”, like Avalanche, already use Proof of Stake.

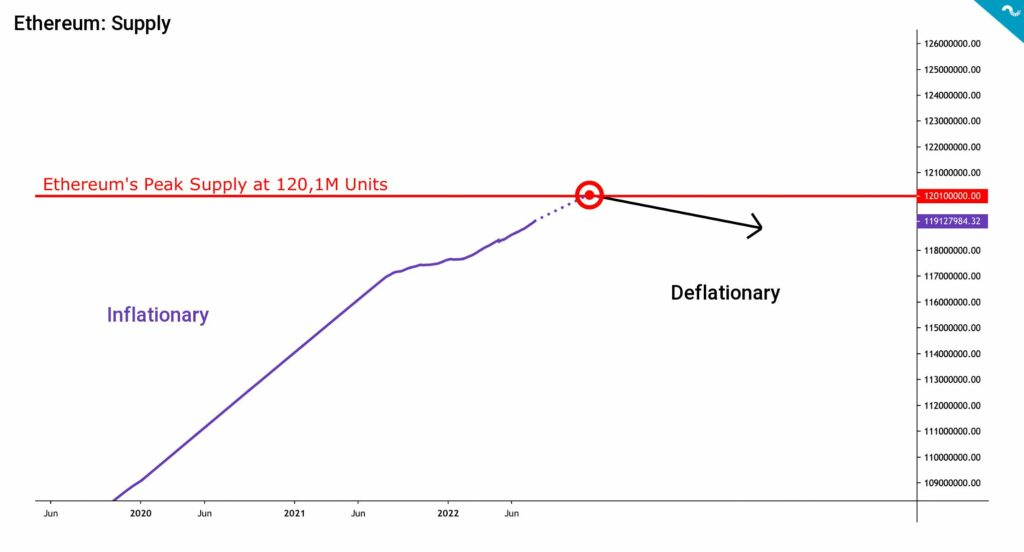

The merge promises the fees to remain the same, as the blockspace will not undergo any changes. However, the fees might rise alongside the demand. Ethereum’s supply has previously been inflationary (purple), as the embedded chart shows, and it’s expected to peak at 120,1 million Ether units. The EIP-1559 has been burning Ethereum’s fees since August 2021, effectively making the supply more scarce. Now Ethereum is expected to shift from inflationary to deflationary, as the supply curve (black) turns down. Some analysts even expect Ethereum to enter a virtuous deflationary cycle.

The merge data site ultrasound.money offers a wide set of tools for examining the upcoming protocol shift. While Ethereum’s supply is currently growing at 4,1 percent per year, the growth will drop to a mere 0,2% per annum after a simulated merge. Moreover the current rate of issuance is 5,5 million Ether units yearly and a simulated merge shows the issuance collapsing to 0,6 million per year.

In summary, the merge will be a dominant event in the cryptocurrency from here to September and traders should pay attention to it. Arthur Hayes even projected a $10K valuation for Ethereum after the merge, citing better price per developer, address, and total value locked (TVL). However, as always, everyone should do their due diligence.

What Are We Following Right Now?

China’s consumer sentiment hits record low, pessimistic outlook adds to calls for consumption stimulus policy.

What is going on in China? 🇨🇳😱 pic.twitter.com/oYWHvFhF1a

— AndreasStenoLarsen (@AndreasSteno) July 27, 2022

Recession is by default described as “two consequent negative quarters”. The central bank Fed will likely try to bend the definition.

The Feds own recession indicator is now flashing red 🔥

— AndreasStenoLarsen (@AndreasSteno) July 26, 2022

H/t @MacroAlf pic.twitter.com/WNM3AOagjt

According to Cory Klippsten, Bitcoin’s medium of exchange curve lags the store of value curve. By 2035 bitcoins will be used for everyday purchases alongside its store of value properties.

Most people don't spend #Bitcoin till they have nothing else to spend. That's why the Medium Of Exchange adoption curve lags the Store Of Value adoption curve.

— Cory Klippsten (@coryklippsten) November 17, 2021

By 2035 you'll be able to buy most goods and services in most places around the world denominated in sats. pic.twitter.com/pLThgheabe

Read more about the Ethereum Merge

Stay in the loop with our newsletter:

The views, thoughts, and opinions expressed in the text belong to the author and not necessarily to the author’s employer, organization, committee, or other group or individual.