The technical analysis of week 32 examines the market environment as bitcoin approaches the end of its multi-week sideways trend. Simultaneously, we delve into the weakness of national currencies as bitcoin has surged 140% against the ruble since the beginning of the year. Furthermore, we compare the perspectives of long-term and short-term investors and review experts’ price projections for the years 2023 and 2024.

The prospects of the cryptocurrency market remain cautiously positive, with investors awaiting a clear signal of the market’s direction. One significant signal is Michael Saylor’s MicroStrategy’s accelerating bitcoin accumulation, which was discussed in detail in last week’s TA.

Compared to 2022, when the company increased its holdings by 8109 BTC, the year-to-date growth by August 2023 has exceeded 150 percent. With MicroStrategy’s acquisitions picking up pace toward the end of the year, the growth compared to the previous year might climb to several hundred percentages. In his latest podcast appearance, Saylor characterized Bitcoin as follows:

“Bitcoin is the apex property; the conventional mediocre properties are either high-quality real estate or high-quality stocks.” – Michael Saylor

Sources: Timo Oinonen, CryptoQuant

From a purely technical standpoint, the price development of bitcoin resembles the structure of a descending trendline seen from April to June, which culminated in a nearly $10 000 surge in spot price by the end of June. Similar to the spring period, the descending trendline is currently acting as a resistance level for bitcoin, temporarily impeding upward attempts. After a short period of sideways movement, the time seems ripe for the price to strengthen.

Simultaneously, the traditional 200-week moving average (turquoise) and the realized price wave (purple) are providing support for bitcoin’s price development. The realized price around the $20 000 level has been seen as a market watershed, as it represents the average purchase price of all bitcoins. Additionally, when the spot price surpasses the realized price, it indicates that bitcoin investors are in a profitable position.

Sources: Timo Oinonen, CryptoQuant

The market’s transitional phase is also indicated by the Bollinger Bands, which are at their tightest since the beginning of January. The tightening of the Bollinger Bands anticipates a more significant movement in the spot price.

Sources: Timo Oinonen, CryptoQuant

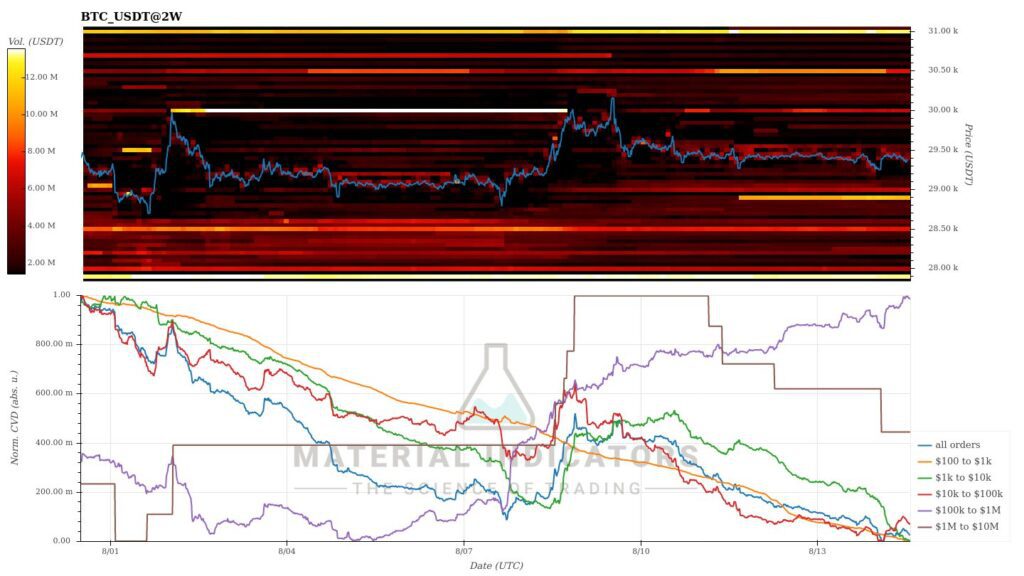

Material Indicators’ heat map reflects the formation of a strong support level below $29 000. The structure appears to support the spot price’s endeavor to move higher. The Cumulative Volume Delta (CVD) indicates an increase in demand at the price level of $1M – $10M.

Source: Material Indicators

The price development in the cryptocurrency market has remained relatively sideways for major currencies since last week, with Bitcoin declining by -2,2%. Tokens with a higher beta have experienced greater weakness, with Stellar, previously amidst speculation, declining by -9,7%. Both the S&P 500 stock index and gold weakened by over one percent over the week.

7-Day Price Performance

Bitcoin (BTC): -2,2%

Ethereum (ETH): -1,6%

Litecoin (LTC): -5,6%

Aave (AAVE): -4,7%

Chainlink (LINK): -5,6%

Uniswap (UNI): -1,6%

Stellar (XLM): -9,7%

XRP: -5,6%

Get started with Bitcoin Litecoin Ethereum AAVE USDC Stellar Ripple

Join Coinmotion and buy your first cryptocurrencies within minutes!

S&P 500 Index: -1,4%

Gold: -1,3%

The Ruble and Other Emerging Market National Currencies in a Downward Spiral

After the bear cycle of 2022, the leading cryptocurrency bitcoin has significantly strengthened, rising by 77% against the U.S. dollar (USD) and 74% against the euro (EUR) since the beginning of the year. Bitcoin’s ascent has been even more dramatic when compared to the currencies of emerging markets. It has surged by 140% against the Russian ruble (RUB), and a notable 280% against the Argentine peso (ARS).

So, what is causing the relative weakness of moderate-sized national currencies compared to bitcoin? The depreciation of the Russian ruble is attributed to Western sanctions, which retroactively begin to impact the country’s economy. In Argentina’s case, it is due to the country’s long-standing economic problems and corruption. Both the ruble and the peso suffer from significant distrust in their national currencies, leading to their conversion into dollars and bitcoin, among other assets. The countries with fragile national currencies thus provide fertile ground for the escalation of bitcoin’s popularity.

Source: Kaiko

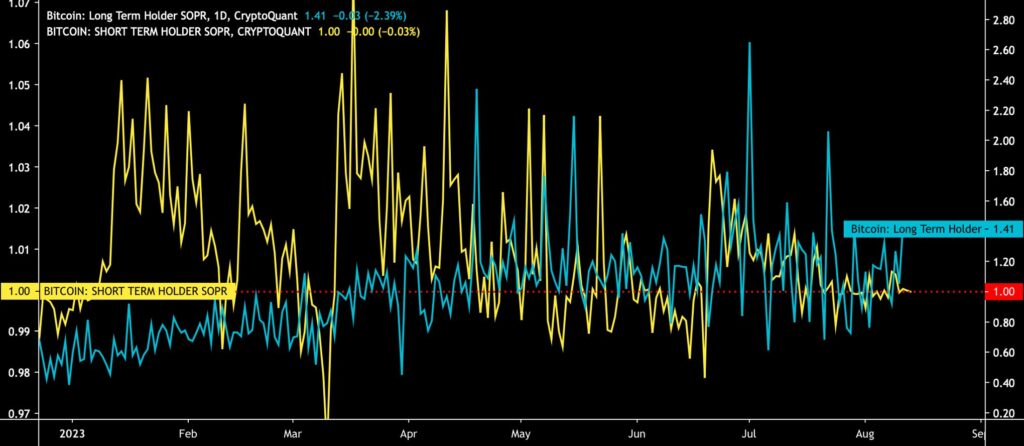

The SOPR Metric Reflects the Strength of Long-Term Investors

The short-term investor profitability indicator, represented by the STH-SOPR (yellow), and the long-term investor profitability indicator, represented by the LTH-SOPR (turquoise), approached each other during the summer. However, as of early August, the LTH indicator is starting to diverge from the STH indicator.

While the STH-SOPR showed strong readings during the spring’s parabolic price surge, the sideways market phase led it to drop into the negative range. On the other hand, with short-term investors approaching their profitability threshold (1), the selling pressure generated by this group diminishes, as immediate sales would result in losses.

Sources: Timo Oinonen, CryptoQuant

Developed by Renato Shirakashi, the SOPR indicator is calculated by dividing the realized price of bitcoin (USD) by the value of the original bitcoin transaction. Or, in simplified terms, the selling price divided by the purchase price. SOPR indicates whether the average bitcoin investor is in profit or at a loss. The SOPR indicator is usually divided into two parts: Short-term holders (STH-SOPR) and long-term holders (LTH-SOPR). The SOPR indicator can be interpreted with the following logic:

SOPR > 1 = Seller in profit

SOPR < 1 = Seller at a loss

Price Projections for 2023 and 2024

Price forecasts and projections always capture investors’ interest. Earlier in the spring, technical analysis presented its own assessments, and at that time, we showcased a target price of $46 092 for bitcoin. The forecast used the reference points of the 2018-2019 price cycle, during which the spot price increased from $3808 to $10 570 between January 1st and July 1st, marking a 178% gain.

As bitcoin approaches its halving event of 2024 in 255 days, Standard Chartered released its event-driven price forecast. The company estimates the spot price to rise to $50 000 this year before the halving and then to $120 000 after the halving. Mark Yusko, well-known for his hedge fund, recently predicted the “fair value” of bitcoin to reach $100 000 within a year.

A more bullish price projection comes from Fundstrat’s Sean Farrell, who foresees bitcoin surging to as high as $180 000 next year. Farrell justifies his estimate with daily demand, which would rise to $125 million with the introduction of an ETF. Currently, the daily demand is at $25 million, which means Farrell’s projection would quintuple bitcoin’s demand.

Sources: Timo Oinonen, CryptoQuant

While price projections are always indicative and should be approached with caution, bitcoin’s current price below $30 000 appears to be quite favorable considering the ETF plans and the upcoming halving event. As demonstrated by MicroStrategy’s accumulation, it seems that a smart money-buying season is underway.

What Are We Following Right Now?

London-based Jacobi Asset Management is set to list the first European Bitcoin spot ETF with the ticker “BCOIN.” Jacobi initially received permission to launch the fund in 2021, with operations intended to commence in 2022. However, the negative cycle in the cryptocurrency market prompted the company to postpone the launch date. The custody of the fund’s assets will be managed by U.S.-based Fidelity Digital Assets, and market-making will be handled by Flow Traders.

Jacobi Asset Management listed Europe’s first bitcoin spot ETF and some analysts are predicting an imminent verdict in Grayscale’s lawsuit against the SEC. @LedesmaLyllah reports in First Mover Americashttps://t.co/XRpOpJBDOf

— CoinDesk (@CoinDesk) August 15, 2023

In a surprising turn of events, the libertarian and pro-Bitcoin candidate Javier Milei has emerged as the leading contender in Argentina’s presidential elections. Milei has previously expressed highly positive views about Bitcoin and Ethereum while also advocating against the role of central banks. Additionally, Milei aims to reduce the dominant role of the state in society.

🇦🇷 Javier Milei explains why Argentina should make #Bitcoin legal tender. “Bitcoin is the natural reaction against the central bank scammers and to make money private again.” pic.twitter.com/JrYlk9SCev

— Bitcoin News (@BitcoinNewsCom) August 14, 2023

How will the potential listing of a spot Bitcoin ETF by BlackRock impact the entire ecosystem? Will the institutional breakthrough simultaneously alter the mainstream perception of the asset class? Parker Lewis provides insights.

Stay in the loop of the latest crypto events

- Stellar Lumens — Unveiling a global digital payment protocol

- Ripple Labs score a major victory against SEC over XRP

- Fenergo FinTalks with Coinmotion Interim CEO Pasi Matilainen | Navigating Crypto Regulation

- Saylor Enters the Accumulation Mode, Again

- Coinmotion Adds Two New Strategic Board Members to Strengthen its Position in the Digital Currency Market

- Ripple (XRP): Empowering the future of digital currency

Get started with Bitcoin Litecoin Ethereum AAVE USDC Stellar Ripple

Join Coinmotion and buy your first cryptocurrencies within minutes!

The views, thoughts, and opinions expressed in the text belong to the author and not necessarily to the author’s employer, organization, committee, or other group or individual.