The TA of week 21 scans JPMorgan’s views on Bitcoin as a preferred alternative investment. Additionally we explore Puell Multiple and other technical & fundamental indicators.

JPMorgan Prefers Bitcoin as an Alternative Asset

The multinational investment bank JPMorgan surprised the markets recently by giving new price estimates for the leading cryptocurrency Bitcoin. According to JPMorgan’s chief strategist Nikolaos Panigirtzoglou, bitcoin’s “Fair Price” would be in $38K range (purple), approximately 30 percent higher than the current level. Bitcoin found support on $29K level during last weeks, as it also represents the 2021 Cycle Bottom (red), between the Double Top structure. Bitcoin also approaches the Deep Value Zone (blue), marking a spot for DCA accumulation.

Nikolaos Panigirtzoglou estimated back in February that institutional appetite towards Bitcoin was fading, however he noted the trend was probably temporary. Currently JPMorgan thinks the Terra collapse momentarily crushed the sector sentiment, thus offering a good entry and accumulation point for investors. JPMorgan’s Fair Price is close to Bitcoin’s descending and ascending trendines (cyan), that form a cross next to JPMorgans’s projection.

Paningirtzoglou added that Terra crisis hasn’t generated much spillover to other stablecoins and consequently the industry seems resilient. JPMorgan estimates that the Bitcoin sell-off has been more significant compared with other asset classes and thus sees the cryptocurrency as the preferred alternative investment alongside hedge funds.

“While public markets already price in significant recession risks, and digital assets have repriced significantly following the collapse of terra USD (UST), some alternative assets such as private equity, private debt and real estate appear to have lagged somewhat. We thus replace real estate with digital assets as our preferred alternative asset class.”

Nikolaos Panigirtzoglou, JPMorgan

JPMorgan’s stance towards Bitcoin has greatly fluctuated over time and especially the remarks of CEO Jamie Dimon have been dramatic. Amid the great bull cycle of 2017, Jamie Dimon called Bitcoin a “fraud“, expecting the asset to collapse. Since then JPMorgan has pivoted its view on Bitcoin and the firm offers its client access to a selection of Bitcoin funds and trading.

Bitcoin Resilient, Small-Caps in Trouble

Bitcoin has been resilient amid the DeFi shake-up and the leading cryptocurrency has managed to bounce on its 2021 summer cycle $29K support. Bitcoin’s drawdown from ATH is at -54,26%, while many DeFi tokens like Aave are down over -80% from their 2021 peaks.

7-Day Price Performance

Bitcoin (BTC): -0,9%

Ethereum (ETH): -6,3%

Litecoin (LTC): -7,1%

Aave (AAVE): +16,2%

Chainlink (LINK): -1,7%

Uniswap (UNI): -1,2%

Stellar (XLM): +2,2%

XRP: -5,2%

– – – – – – – – – –

S&P 500 Index: +6,6%

Gold: +0,4%

– – – – – – – – – –

Bitcoin’s 90-Day Pearson Correlation with S&P 500 Index: 0,61

Bitcoin RSI: 42

Bitcoin’s correlation with the stock market index S&P 500 peaked at 0,67 noon May 13th and has consequently dropped to current 0,61. We expect Bitcoin to eventually decouple from the stock market as speculative money capitulates and exits the market. Bitcoin’s high correlation to stock market is a relatively new phenomenon, as the 90-day Pearson correlation fluctuated around zero (0) from 2015 to 2019. In the 2020’s “Saylor cycle” Bitcoin started to correlate more with the mainstream market as MicroStrategy accumulated a large amount of bitcoin units.

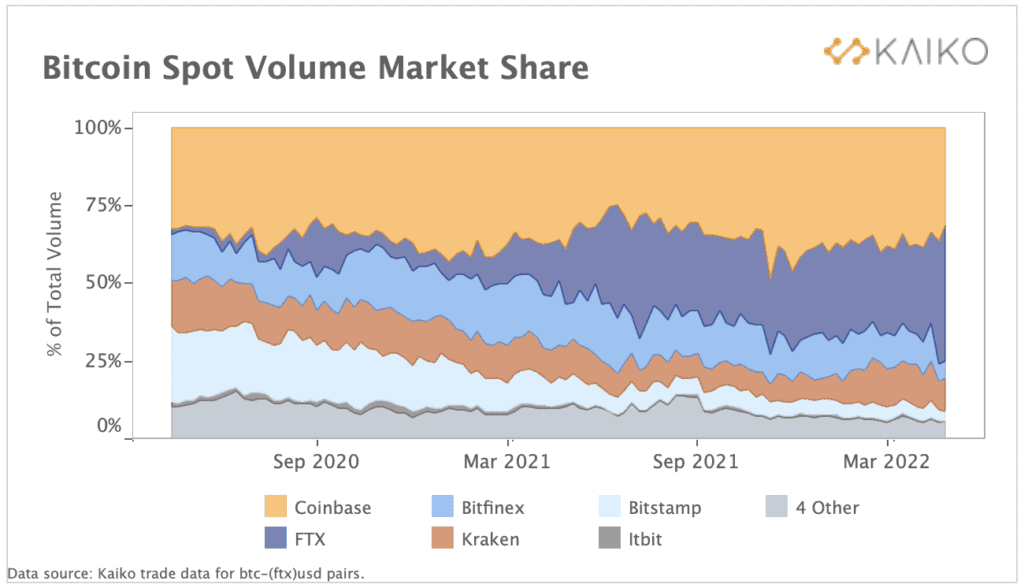

FTX Eclipses Coinbase in Spot Volume

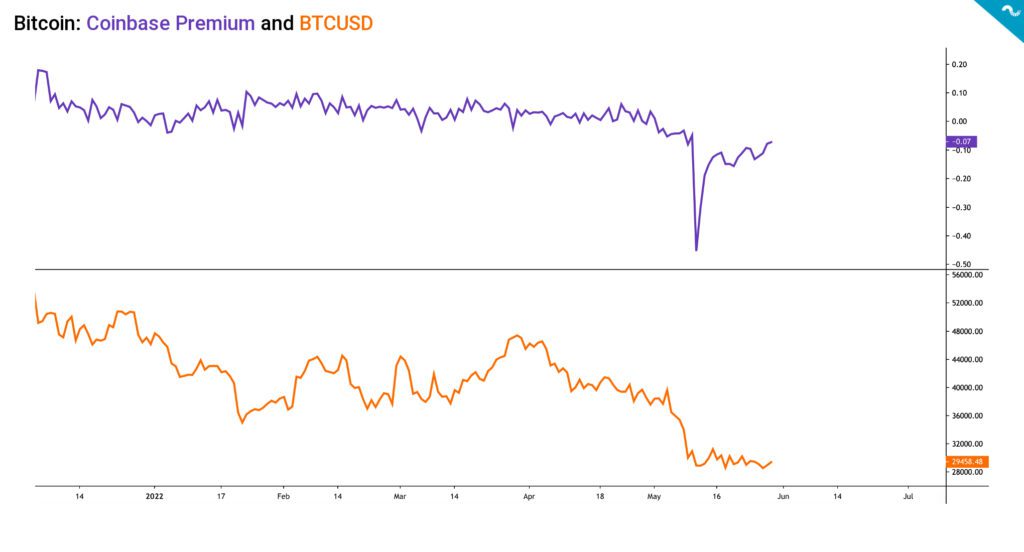

Coinbase processed a record number of Bitcoin transactions during Terra-induced sell-off. The radical de-risking resulted to Coinbase Premium dropping to -0,45, lowest value in 2022. Coinbase Premium since recovered to current -0,07.

Coinbase is still the largest U.S. exchange and its premium can be interpreted as a signal of institutional sentiment. Institutional volume accounts for 76 percent of overall Coinbase volume.

Coinbase is facing increasing competition in form of US-based exchange FTX that has recently surpassed Coinbase’s volume for the first time. FTX has built a significant growth trajectory as its market share increased from 5% to 44% in past 18 months.

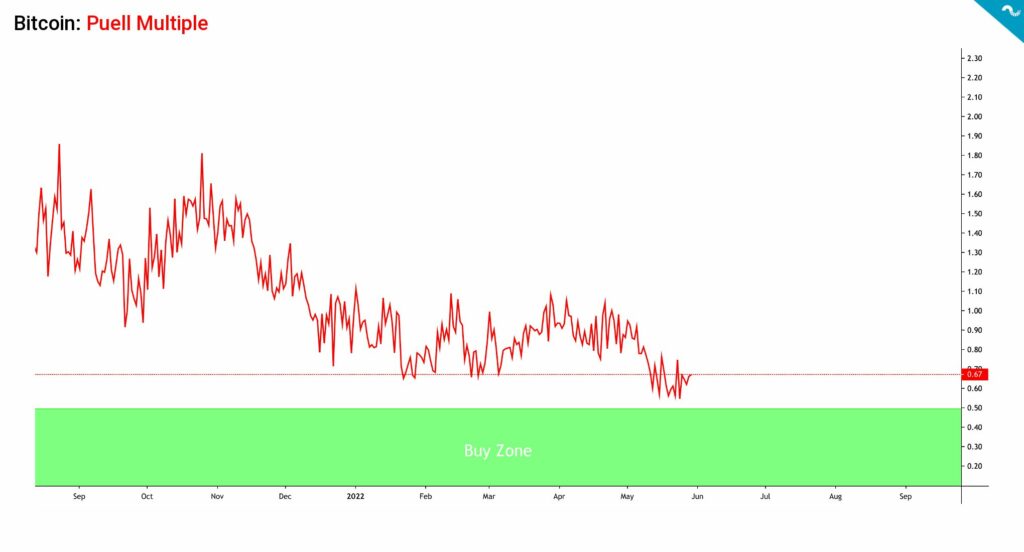

Puell Multiple Close to Buy Zone

Puell Multiple is an essential indicator that focuses on Bitcoin’s supply and mirrors the profitability of PoW mining. As we know, miners need to sell native bitcoin units in order to keep their operation running, Puell Multiple revolves around the mining revenue generation.

The Puell Multiple (PM) is calculated by dividing the daily issued bitcoins (in USD) by the 365D daily unit issuance moving average (MA). This gives us an indicator we’re usually benchmarking against bitcoin spot price BTCUSD. As a summary, the Puell Multiple pulls mining data and compares mining profitability now (per day) against over the whole year (365 MA).

The Puell Multiple can be used to form buy and sell zones in the following manner:

Buy Zone: Puell Multiple Between 0 and 0,5

Sell Zone: Puell Multiple Between 4 and 10

The recent spot price weakness has dropped the Puell Multiple indicator to 0,67, close to Buy Zone of < 0,5. Investors who bought Bitcoin in the green zone have enjoyed outsized returns.

What Are We Following Right Now?

Analyst Andreas Steno Larsen estimates that inflation has already peaked in the U.S. However eurozone inflation might still be growing.

QE and “cheap dollar” have definitely benefited the DeFi industry and analysts follow whether Fed plans to continue the tightening (QT). Eventually the environment will likely require more quantitative easing.

Inflation re-accelerated to 8.5% in Spain in May 😱

— AndreasStenoLarsen (@AndreasSteno) May 30, 2022

While inflation has likely peaked in the US, it is still debatable in the Euro area pic.twitter.com/yFQKhoO02y

Andreessen Horowitz (a16z) recently announced a new Crypto Fund 4, including $4,5 billion invested in Web3. a16z has raised a total of $7,6B to its crypto-related funds.

Today we are announcing a16z crypto Fund 4. We’ve raised $4.5B to invest in promising web3 founders and startups, bringing our total crypto funds raised to more than $7.6B. 💪 https://t.co/w5fr6QN0Xb

— AriannaSimpson.eth (@AriannaSimpson) May 25, 2022

StarkWare has raised $100 million, rising its valuation to $8 billion.

StarkWare quadruples valuation to $8B in 6 months, closing round in choppy market https://t.co/kXVLzAzQL1 by @jacqmelinek

— TechCrunch (@TechCrunch) May 25, 2022

The Terra meltdown has been a wake-up for many investors who were aligned with the DeFi Yield Farming field. As part of the due diligence process, investors should figure where the yield is actually coming from.

"Where is the money coming from?"

— shivsak (@shivsakhuja) May 29, 2022

The MOST important question in DeFi that most investors don't ask.. 👇 🧵

[1/x] pic.twitter.com/vqm1ui1tRI

A throughout on-chain analysis of the TerraUSD de-peg.

Turkey has inflation of 70%, Sri Lanka is at 30%, Nigeria is at 16%, and Romania is at 14%. At the other end of the spectrum, there are countries with still-low inflation. Japan has inflation of 1%, China is at 2% and, surprisingly, Bolivia is at 1%. In the developed world, the US and Germany have inflation of 8%, Sweden is at 6% and France is at 5%.