The Recent Market Drop Increased Cryptocurrency Correlation

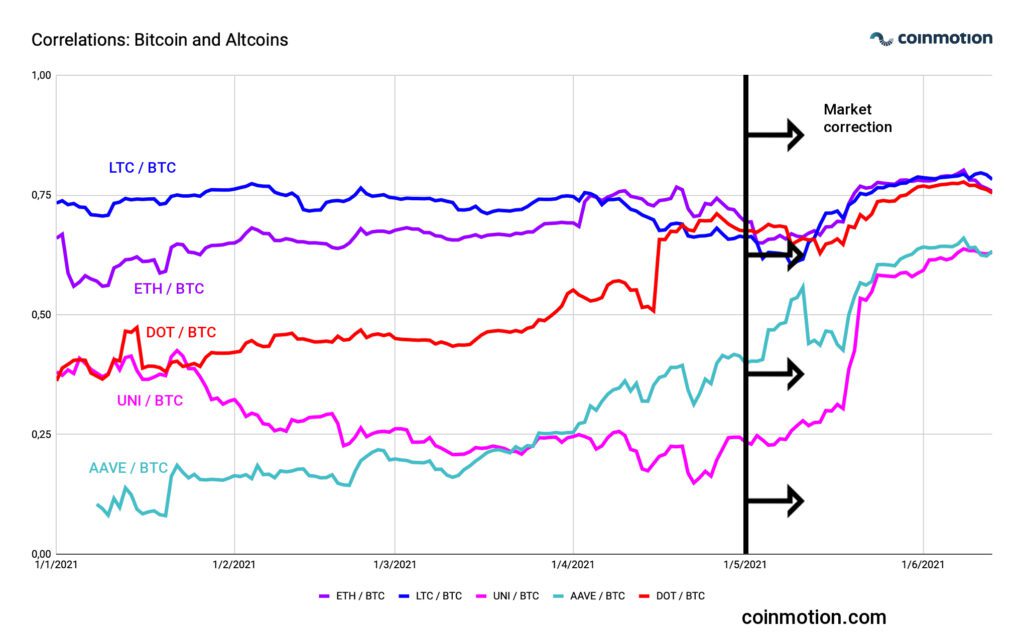

By historical data, cryptocurrencies have closely followed bitcoin’s price movement and consequently altcoins and bitcoin have been highly correlated. This fundamental rule has especially applied to older (legacy) cryptos, which have been especially highly correlated with BTC. On the other hand, newer decentralized finance (DeFi) tokens have usually been more weakly correlated with dominant bitcoin. We stacked correlation data of five relevant cryptocurrencies to the following chart. The average altcoin / bitcoin correlations in 2021 are listed followingly:

ETH / BTC: 0,68

LTC / BTC: 0,73

UNI / BTC: 0,32

AAVE / BTC: 0,31

DOT / BTC: 0,54

Does Diversification Apply to Cryptocurrencies?

A number of cryptocurrency investors have pondered whether diversification strategy applies to cryptocurrencies. There’s no simple answer as the efficiency of diversification heavily depends on which cryptocurrencies the investor allocates into. By the chart attached, Litecoin (LTC) and Ethereum (ETH) have been closely following bitcoin’s price performance, with Litcoin’s correlation of 0,73. Nevertheless, the newer DeFi tokens like Uniswap (UNI) and Aave (AAVE) have been weakly correlated with bitcoin, both showing only slightly above 0,3 correlation.

The chart also shows the radical effect of market correction on cryptocurrency correlation. E.g. Aave and Uniswap were highly correlated with bitcoin in early spring 2021, moving around 0,25 level. After the market-wide correction Aave and Uniswap started shifting towards 0,75 correlation. The price correction (down) makes correlations shift towards one (1). As a summary, the decentralized finance tokens are good for diversification in a bull cycle. Bear cycle has a tendency to drive correlations closer to one.

Ethereum Gas Price Hits a 2021 Low as EIP 1559 Approaches

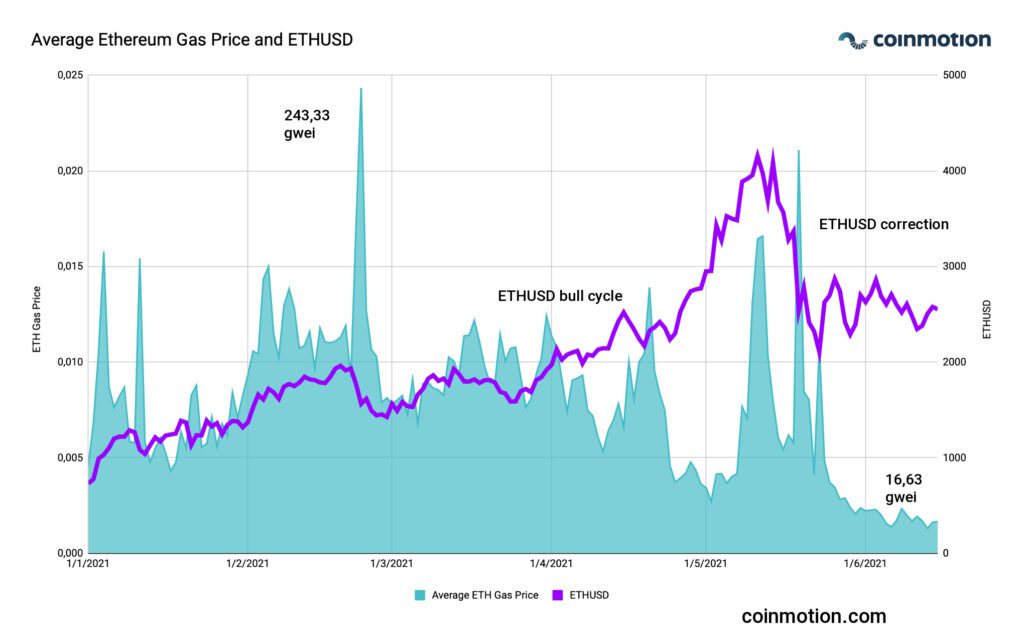

Ethereum (ETH) gas prices have dropped to the lowest level so far in 2021. In February 2021 the transaction fee, called gas (gwei), peaked at 243,33 gwei and later dropped to 16,63 gwei. The diminishing transaction fees of Ethereum mirror the market correction that has been leading to lower amounts of on-chain transactions.

Layer 2 scaling solutions are also affecting the transaction count of Ethereum network. E.g. Polygon network has been gaining traction despite the notable market correction, and Polygon directly absorbs part of Ethereum’s on-chain transactions. Ethereum is currently preparing for EIP 1559 update which promises to streamline fee structure and increase Ethereum’s scarcity.

Digital Assets Have Performed Exceptionally Well Year-over-Year (YoY)

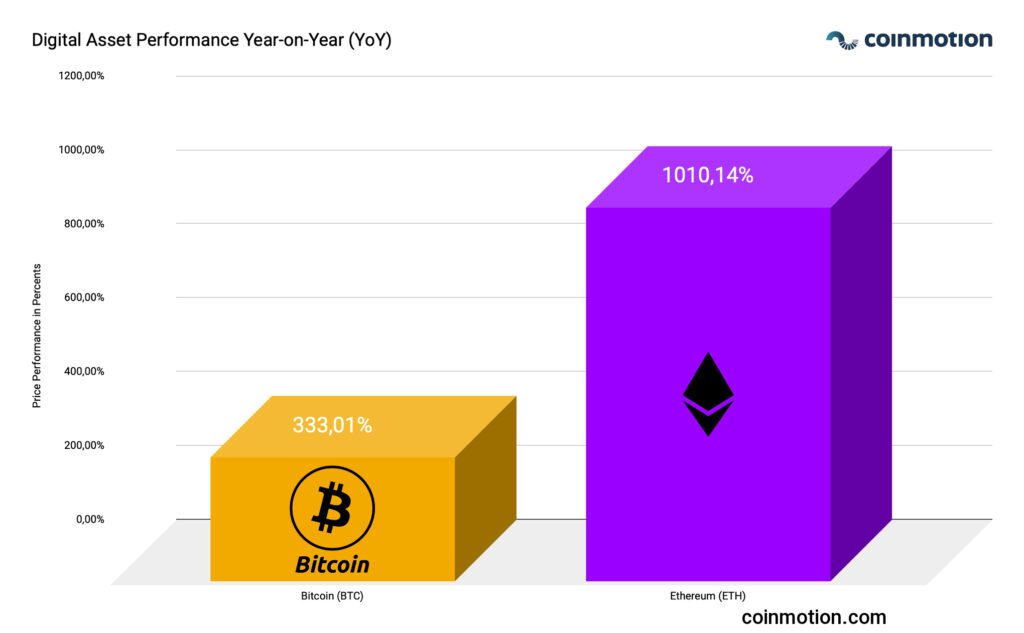

Even though the market correction scared many retail investors, the long-term outlook remains positive. When looking at a longer investment horizon, Bitcoin has ascended 333,01 percent within twelve months and Ethereum up to 1010,14%. Bitcoin is currently trading above €30K level, while a year ago one bitcoin unit cost around 8000 euros. Ethereum showcases astonishing growth figures: In June 2020 1 ETH cost ~ 200 euros, meanwhile today the value of one Ether is above 2000 EUR.

Bitcoin as an Inflation Hedge

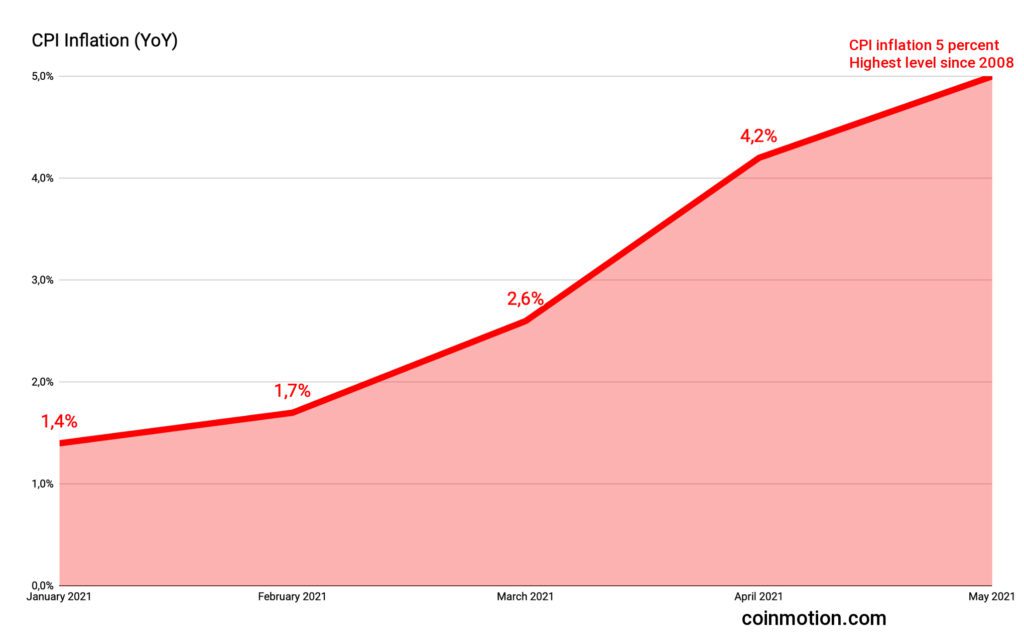

Consumer Price Index, or CPI, follows the weighted average of consumer good and service prices. In May 2021 the CPI ascended to 5 percent, the highest level recorded after the 2008 financial crisis. Numerous analysts have expressed concerns over possibly growing inflation since The Federal Reserve (FED) launched exceptionally large easing programs last year. Nordea’s Andreas Steno Larsen has estimated that over 20% of all U.S. dollars (USD) in circulation were created over 2020.

Bitcoin has a selection of built-in features that make it an optimal hedge for emerging inflation. Thus far 18,74 million bitcoin units have been mined and the largest possible amount (hard cap) is 21 million. The de facto amount of circulating bitcoins is notably lower than 21M as countless bitcoins have been lost forever. As a summary, bitcoin is a gold-like scarce asset that offers protection against inflation over longer time horizons.