The following technical analysis article focuses on the escalating competition between Bitcoin financial products: ProShares’ BITO and Grayscale’s GBTC.

The Launch of ProShares BITO

The first-ever U.S. Bitcoin ETF launch occurred around two weeks ago (19.10), as SEC showed the green light to ProShares Bitcoin Strategy ETF (ticker: BITO). Markets have anticipated the first Bitcoin ETF, and smart money has been trying to price it in for years. Will the ETF launch uplift the underlying asset (bitcoin), or should we consider this to sell the news event? Let’s find out!

Unlike traditional spot ETFs, the BITO does not purchase native bitcoin units directly. Instead, the ProShares financial product invests in futures contracts where bitcoin acts as an underlying asset. The BITO is actively managed and has a 0,95 percent fee, which is low compared with 2% annual management fee of Grayscale GBTC. As a further comparison, the Grayscale Ethereum Trust ETHE charges an even higher annual management fee: 2,5%.

Michael Sapir (CEO of ProShares) shared insightful comments on the new ETF, highlighting the ease of access for new investors. According to Sapir, BITO will open up exposure to bitcoin to a new segment of investors who have a brokerage account and are comfortable with traditional financial products but don’t want to learn how to invest in bitcoin personally.

Because the ETF deals in futures, it will not precisely track the price of bitcoin. Another consideration is that bitcoin trades 24 hours a day, seven days a week. The ETF trades during regular trading hours. Since bitcoin can be pretty volatile, this could increase the risks of the fund.

BITO, GBTC, and BTC

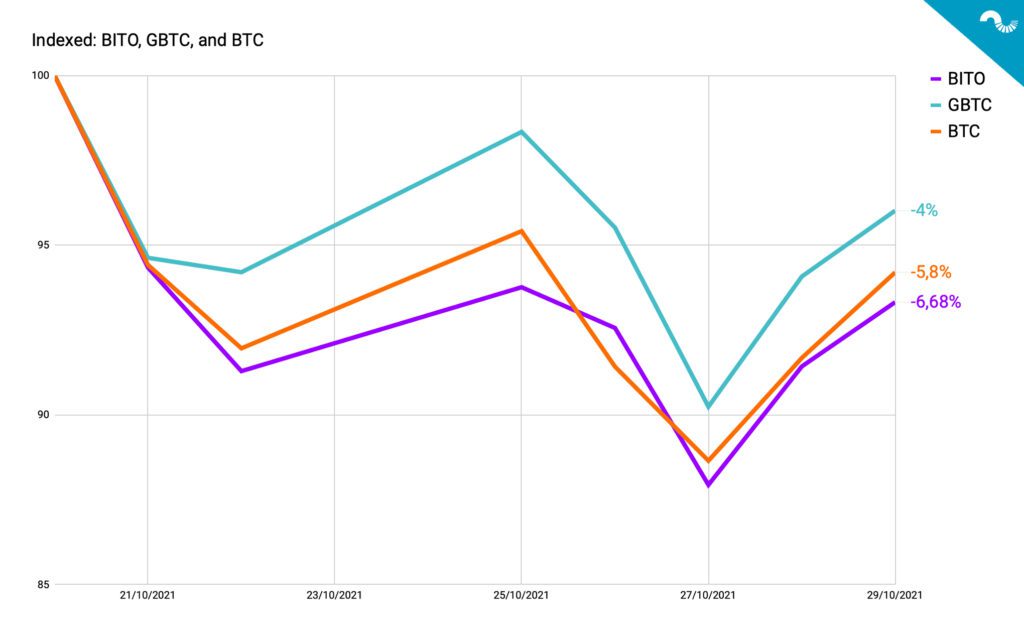

Let’s compare BITO, GBTC, and BTC after the new ETF launch. All three assets are seemingly correlated. However, BITO seems to be more volatile than its underlying asset and GBTC. BITO is currently down -6,68 percent since 19th October, Bitcoin -5,8%, and GBTC -4%. Grayscale seems to beat ProShares in volume as GBTC ascended to 374 million USD trading volume on 25th October, compared with BITO’s $286M.

As Grayscale’s GBTC uses native bitcoin units instead of futures, the GBTC should follow bitcoin’s price performance more closely. In other words, the GBTC should be more correlated to bitcoin than BITO.

GBTC upsides: Physically backed. Proven structure. High correlation with bitcoin.

GBTC downsides: Discount. High management fee.

BITO upsides: First-mover advantage as ETF. Lower management fee.

BITO downsides: Futures-based. Volatility. Unproven. Lower correlation with bitcoin.

Grayscale as a Competitor

Grayscale’s GBTC has a lot longer history than BITO, dating back to 2013. Grayscale’s assets under management (AUM) have grown to over 40 billion USD. In contrast to BITO, the GBTC purchases its bitcoin units directly instead of future contracts (sometimes called as paper bitcoins). Due to its structure, the GBTC is often considered a safe option for bitcoin exposure.

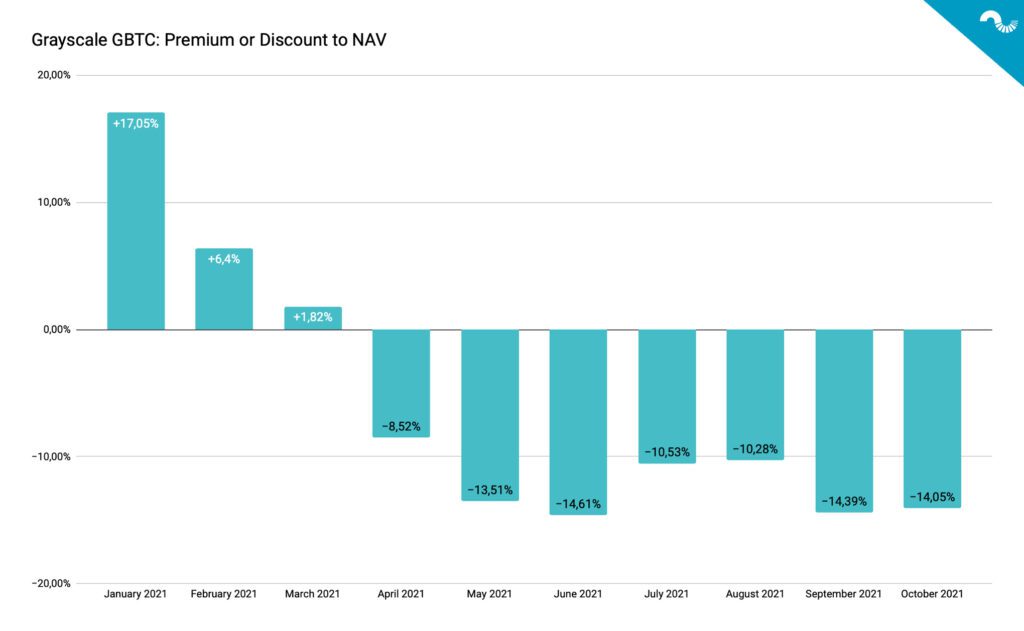

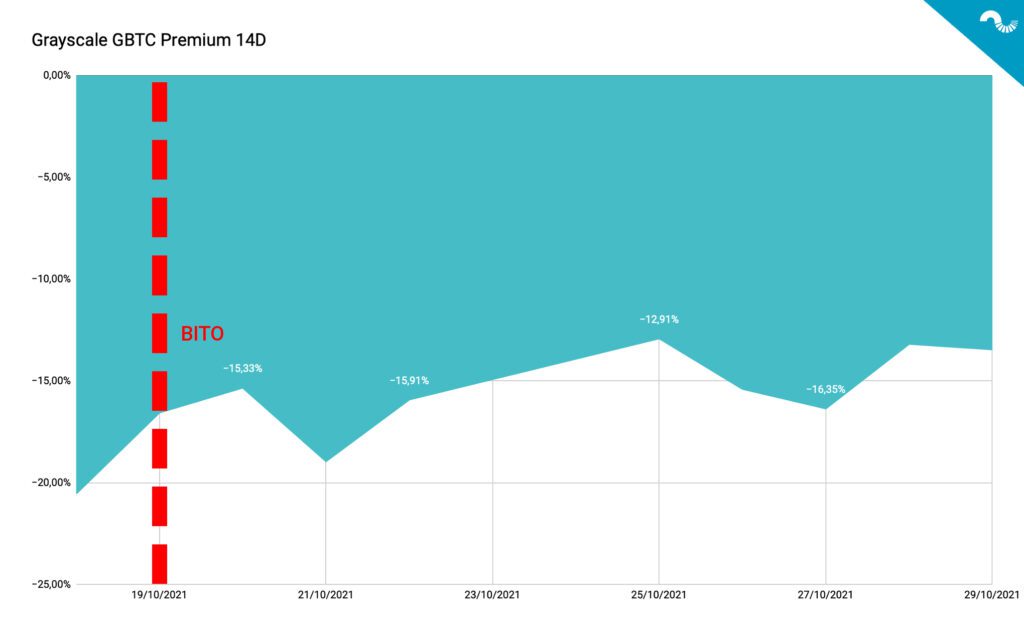

One of the most interesting features of GBTC has been its premium over bitcoin’s price, reaching its peak at +132,6 percent in late May 2017. Premium, or discount to net asset value (NAV), refers to the difference between the nominal value of the trust holdings versus the market price of the assets. Recently the premium has been downward, descending from January +17,05% to June -14,61%. The dropping premium (or discount) was a leading indicator of bitcoin’s price during previous years and recently in Q1 and Q2 2021. GBTC’s premium dropped to negative territory in April 2021, followed by a BTCUSD price drop later in May.

JPMorgan previously estimated that an ETF launch would deepen the GBTC discount. However, the effect seems to be inverse. The GBTC premium stayed below -20 percent the day before the BITO launch and climbed towards -10% towards the end of the month. Investors are currently trying to price in the possible GBTC ETF conversion, and the premium could bounce to positive numbers again.