Cryptocurrencies have entered the mainstream in a very real way in 2021. More people than ever own crypto–as of mid-September 2021, the total market cap of all cryptocurrencies was over $2 trillion. And innovators are following the money. Twelve years after the creation of the first-ever cryptocurrency, there were 6528 cryptocurrencies in existence–and counting, so should you invest in bitcoin or ethereum?

There’s also evidence that more people are using crypto than ever. In April, cryptocurrency exchange Gemini published findings that 14% of adults in the United States own cryptocurrency. And it’s true–throughout 2021, many crypto-savvy individuals reported phone calls from distant friends and relatives asking about which coins they should buy.

With more than 6500 on the market, it’s a good question. There are cryptocurrencies of every value, protocol, purpose, and level of risk. Choosing which ones make suitable investments can be challenging, particularly for new investors faced with the paradox of choice.

Therefore, many new investors may invest in some of the oldest and most popular cryptocurrencies: Bitcoin (BTC) or Ethereum (ETH).

Are Bitcoin and Ethereum “Safe” to Invest In?

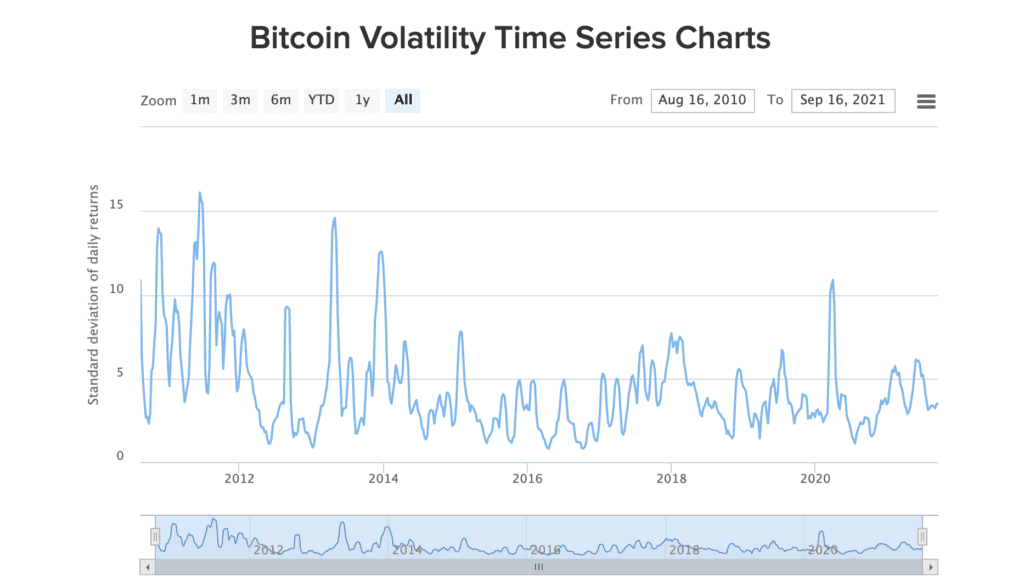

While these assets certainly aren’t without significant price volatility, some analysts described them as relatively more stable than other cryptocurrencies with smaller market capitalization.

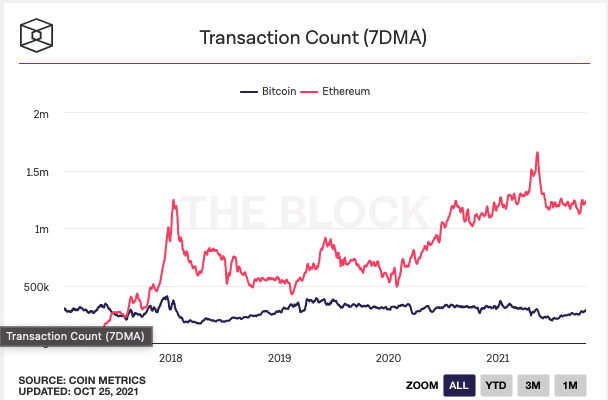

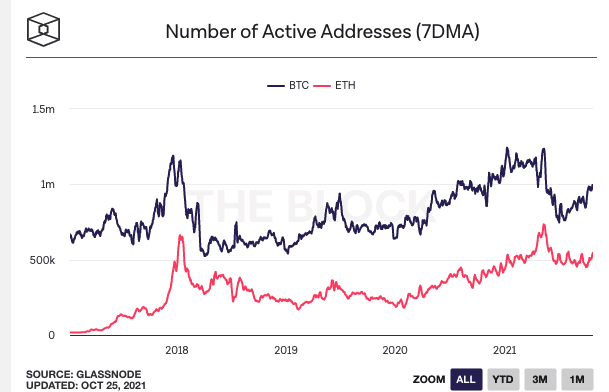

There is some truth to this as the coins with the two largest market capitalization, BTC and ETH, both have far larger bases of users than their smaller counterparts. As a result, one can argue that the economies of these crypto tokens are more decentralized than others. Because more users hold coins at any given time. “Whales”–crypto holders who control large amounts of coins may be less likely to sway the networks.

However, both BTC and ETH have their own issues that affect price volatility and other factors. Honestly, there is no such thing as a “safe bet” when it comes to cryptocurrency–never invest more than what you are sure you can afford to lose. However, if you do have some risk tolerance but may not wish to dive into the deep end of DeFi and small-cap coin investing, Bitcoin or Ethereum may be better options. But which one is suitable for your portfolio?

To help you answer this question, we’ve compiled some important information below.

Bitcoin: Pros and Cons. Is it better to invest in bitcoin or ethereum

History in brief

Created in 2010, bitcoin (BTC) is the oldest cryptocurrency in the world. It was invented by a mysterious figure who went by the name Satoshi Nakamoto. While there have been some theories and claims about who Satoshi may really be, their true identity has never been discovered.

What does Bitcoin do?

There has been some debate over what Bitcoin’s primary purpose is over the years. The BTC whitepaper describes the coin as “A Peer-to-Peer Electronic Cash System. In its earlier days, people considered bitcoin as a sort of “digital cash” that one can use quickly and easily in exchange for everyday goods and services.

However, the network’s limited scalability rendered it almost totally unsuitable for this purpose. When bitcoin became more popular, transactions became slow and costly. A lack of consensus about making bitcoin more scalable prevented any changes from being made. As a result, bitcoin evolved from a “digital cash” into a “digital gold”. Because there can only ever be 21 million BTC in circulation, many investors began to view it as a hedge against the rising tide of fiat inflation. Today, people rarely use bitcoin for exchanging value–instead, they use it a store value

Price volatility and risks

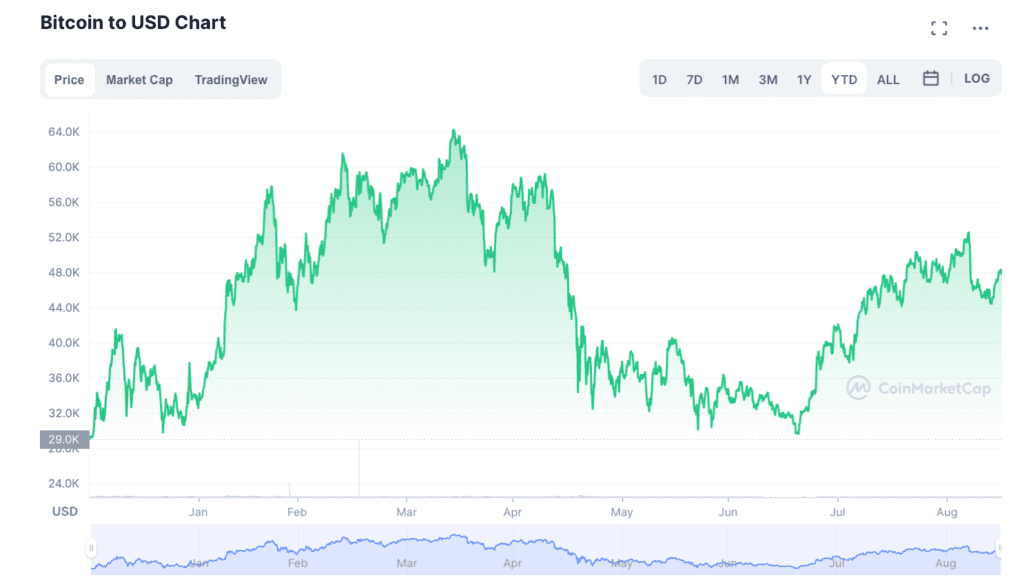

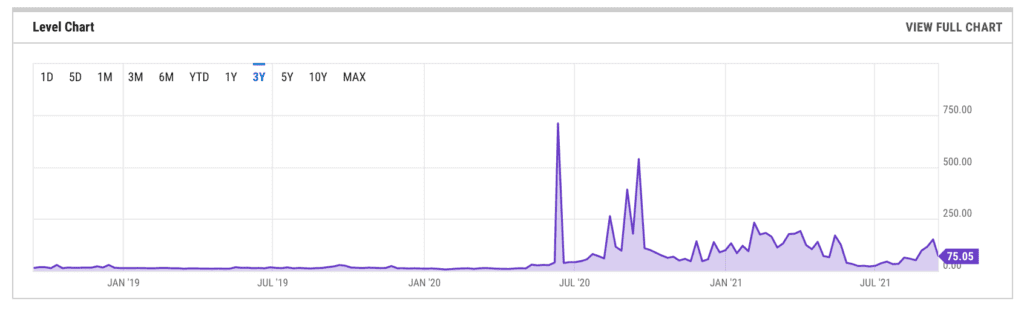

Since its creation, Bitcoin has remained the largest and most popular cryptocurrency on the market. September 2021, its all-time high was roughly $65,000, a height that had been achieved in April of the same year. However, no less than three months later, in July, the price sank down below $30K–shedding more than half of its value.

Some analysts have pointed out that these massive price drops used to be far more common than they are today–a 50% decline in the price of BTC, something that could happen multiple times a month, week, or even a day. But while these kinds of BTC price “death drops” may not be as common as they were several years ago, they are still a genuine part of what it means to invest in bitcoin: BTC whales may not have such a stronghold over the market as they used to, but high amounts of leverage and other factors can make investing in bitcoin very risky.

- Other points of consideration: Along with being slow and expensive, bitcoin is also extremely energy-intensive. Currently, the bitcoin network uses about the same amount of energy annually as the Netherlands did in 2019.

Ethereum: Pros and Cons. Is it better to invest in bitcoin or ethereum

History in brief

The Ethereum network was originally conceived by its creator, Vitalik Buterin, in 2013. In 2014, Buterin and several co-founders of Ethereum launched the world’s first initial coin offering, or ICO: a crowdsourcing campaign where they sold Ether (ETH) to investors, raising a total of $18 million. The first iteration of the Ethereum network, dubbed “Frontier,” was launched in 2015. Since then, the network has acted as the backbone of hundreds of DeFi applications, garnered the largest community of developers in the blockchain space, and much more. With a few short exceptions, Ether has retained its status as the second-largest cryptocurrency since its inception.

What does Ethereum do?

As the bitcoin network, Ethereum is a decentralized, open-source blockchain. However, Ethereum features smart contract capabilities, which enables the network to host independent financial services platforms known as decentralized apps. These include decentralized exchanges, lending platforms, insurance systems, and much more.

The Ethereum network is also home to thousands of different kinds of tokens. In addition to ETH, Ethereum also supports the creation of ERC-20 tokens, which act as tokens that belong to specific dApps on the network, and ERC-721 tokens, often known as non-fungible tokens, or NFTs. There isn’t necessarily a direct relationship between the number of tokens that exist on the Ethereum network and the price of Ether. However, one can use ETH to pay transaction costs (also known as “gas fees”) for any transaction that takes place on the Ethereum network, regardless of token type or standard.

Ethereum has also struggled with its share of scalability issues. While transactions on the network are not relatively as slow or expensive as they are on the bitcoin network. They are far more costly than most users are comfortable with. At their worst, Ethereum gas fees have exceeded hundreds of dollars.

Price volatility and risks

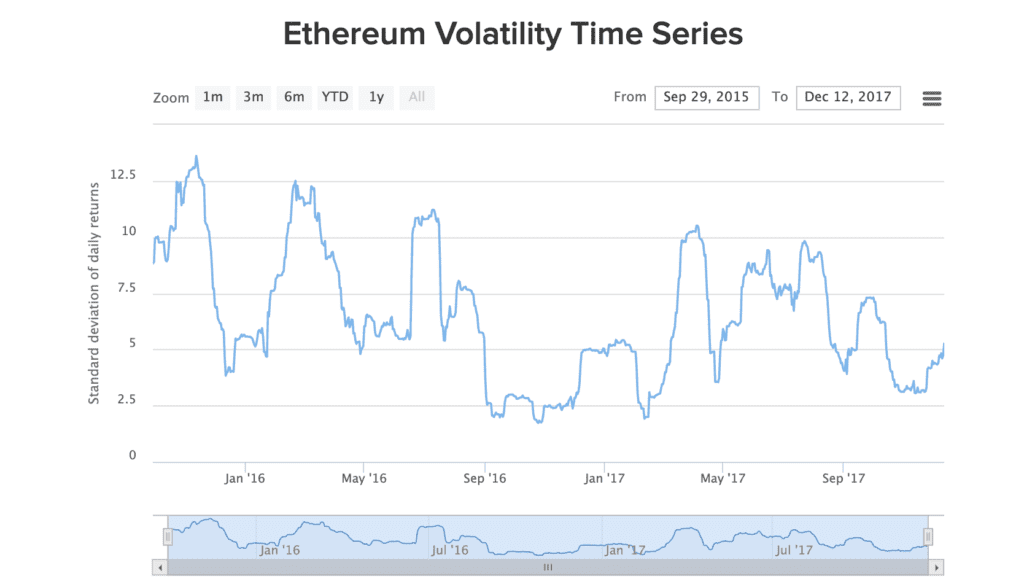

As of September 2021, Ethereum had a relatively high amount of volatility compared to bitcoin. Because Ethereum is still somewhat smaller than Bitcoin. It’s possible that ETH whales still hold a grip over Ether markets, contributing to price volatility. However, at the same time, leverage may not play as large of a role in the price of ETH as it does at the price of BTC. If this continues, ETH may not face some of the same growing pains later in its lifecycle that bitcoin is still currently experiencing.

Should I Invest in Bitcoin or Ethereum: What’ll It Be?

So, now for the big question–should you invest in bitcoin or Ethereum?

Unfortunately, we can’t answer that question for you. But we hope that you can be more informed to decide for yourself with this information at hand. If either of these cryptocurrencies seems like the right addition to your portfolio, check out our other blog posts to learn more. Visit Coinmotion to safely purchase and store cryptocurrency.

This content is for informational purposes only, and should not be construed with legal, tax, investment, financial, or other advice.