Technical analysis of week 48 observes the quickly shifting markets including: Spot price, ELR, deleverage, asset managers, and hedge funds.

Market Deleverages, Spot and ELR Descending

The digital asset markets were shocked during early hours (EET) of Saturday (4.12) this week, as spot prices collapsed ranging from -10 percent to -30% and more. The leading cryptocurrency Bitcoin (BTC) weakened -16,22% from Friday (3.12) to Saturday. The leading decentralized finance platform Ethereum (ETH) took a smaller hit than Bitcoin, dropping -14% during the same timeframe. Younger DeFi-related altcoins with smaller market capitalizations seemed to suffer more: Aave (AAVE) weakened -22,06% and Chainlink (LINK) -23,35%. Famous technology stocks had a rough week as well, Tesla (TSLA) has dropped -7,77% within past five days.

Price Performance from 3.12 to 4.12

Bitcoin (BTC): -16,22%

Ethereum (ETH): -14%

Aave (AAVE): -22,06%

Chainlink (LINK): -23,35%

The Deleverage

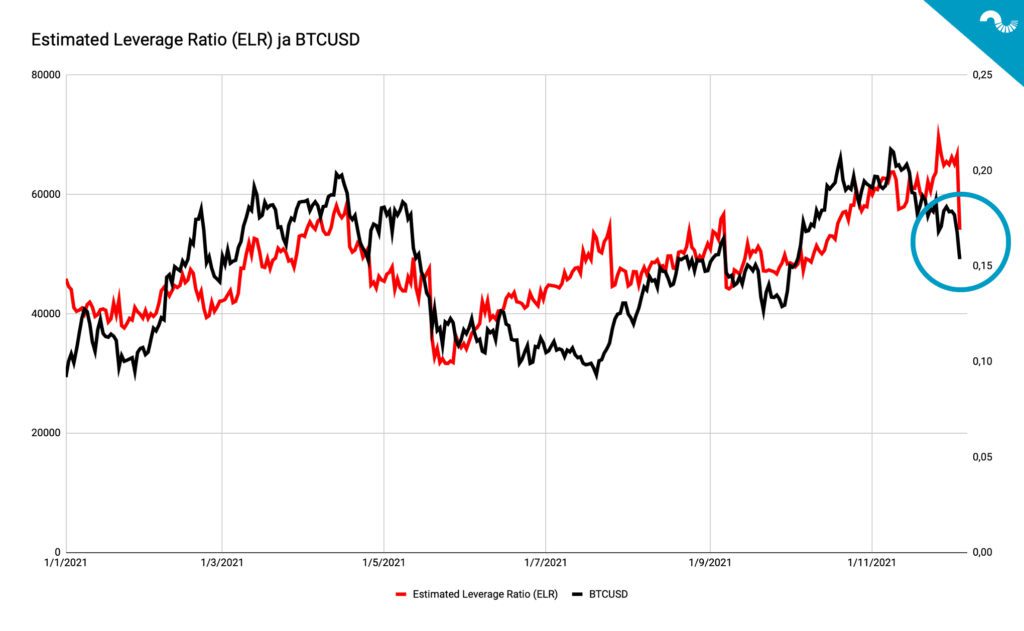

While the price drop certainly shocked many retail investors, the selling pressure also contains a silver lining. As estimated in previous technical analyses, especially in the TA of week 45, the estimated leverage ratio (ELR) has zoomed towards unsustainable highs during this quarter. In an overleveraged market, a deleveraging trend would be healthy. Well here’s the answer to our call: The embedded chart shows ELR dropping into 0,169, these levels haven’t been seen since October. The cryptocurrency market can be seen as a self-regulating system and the market needs to flush out overleverage in order to spot price to increase. Even though the deleveraging market might drive prices lower, Bitcoin’s long-term investment thesis and fundamentals still look excellent.

“Prices go up. Prices go down. Stick to your long term thesis and do not catch falling knives. This is a 10-20 year investment. Not a short term investment.” – Chris King

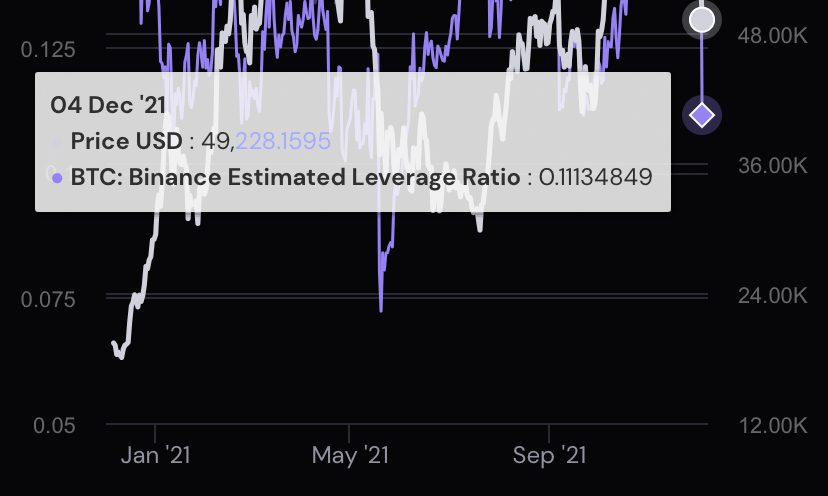

Binance’s Leverage Ratio Drops to Summer 2021 Levels

The effect of unwinding leverage was even more pronounced on exhanges like Binance where ELR dropped to 0,111, close to June’s brief bear market. Binance’s ELR previously peaked at 0,174 in late November. Binance is known for it’s huge selection of speculative and often controversial altcoins and the exchange also acts as one of the leading sources for leveraged products.

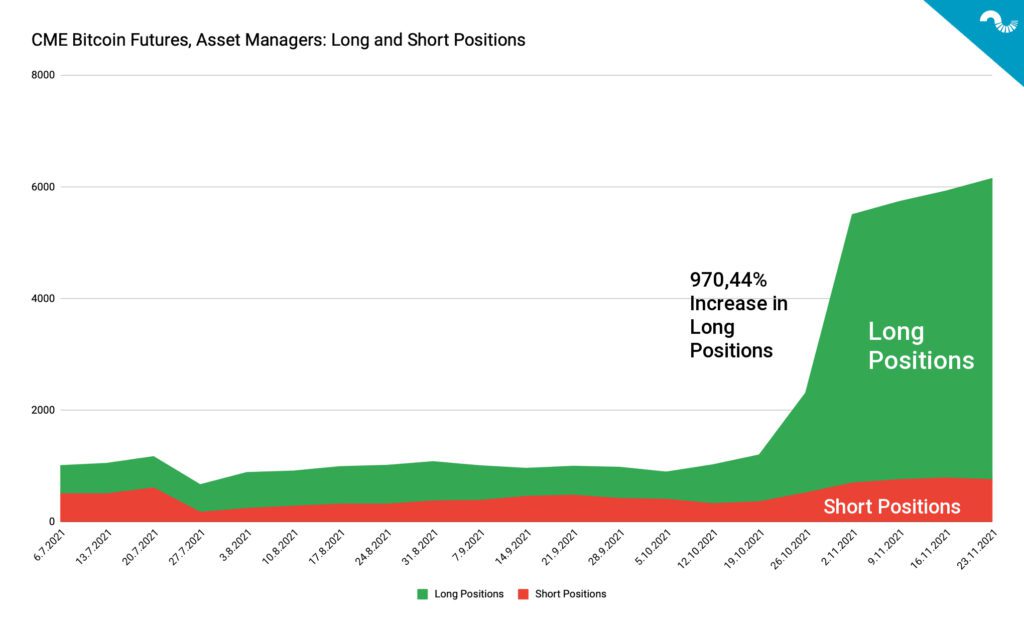

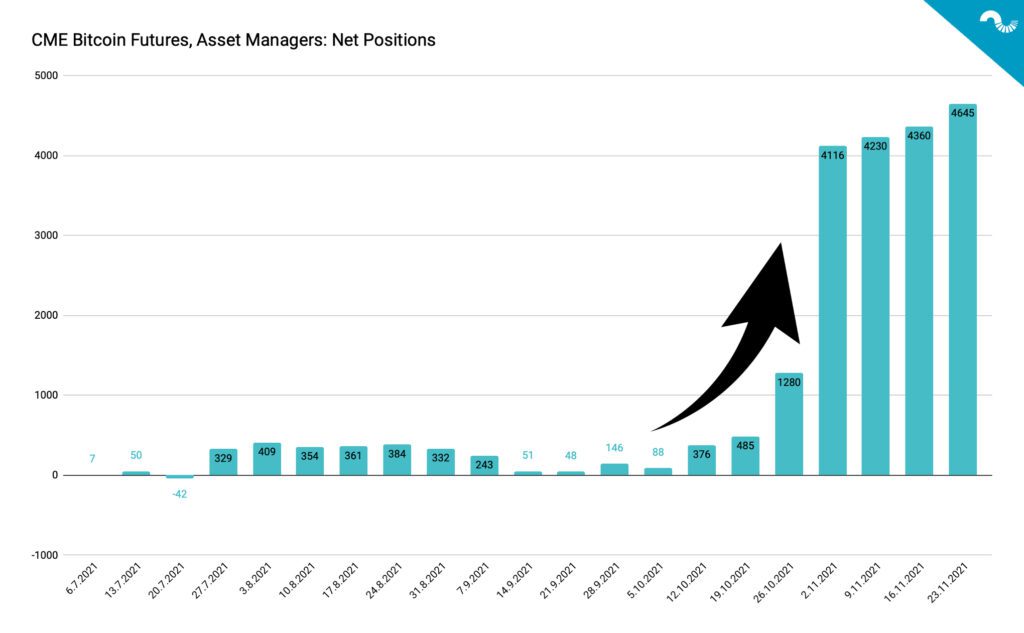

Asset Managers Bullish on Bitcoin

CME’s Commitment of Traders (COT) analysis shows a sharp increase in the Bitcoin futures long positions held by asset managers. The amount of asset manager longs has ascended over 970 percent from early July’s 504 long positions to late November’s 5395 longs. The Commitment of Traders report is a weekly publication that shows the combined holdings of different market participants, including hedge funds, financial institutions, and asset managers. The COT is published every week by CFTC.

Asset managers have been increasingly interested in Bitcoin and other digital assets and they currently own approximately 6% of bitcoin units in circulation. Grayscale Bitcoin Trust (GBTC) currently owns 3,47% of bitcoin’s supply or 654 600 bitcoin units as the industry leader. The escalating interest of asset managers towards Bitcoin asset class shows that smart money is increasingly considering BTC as a credible part of their portfolio.

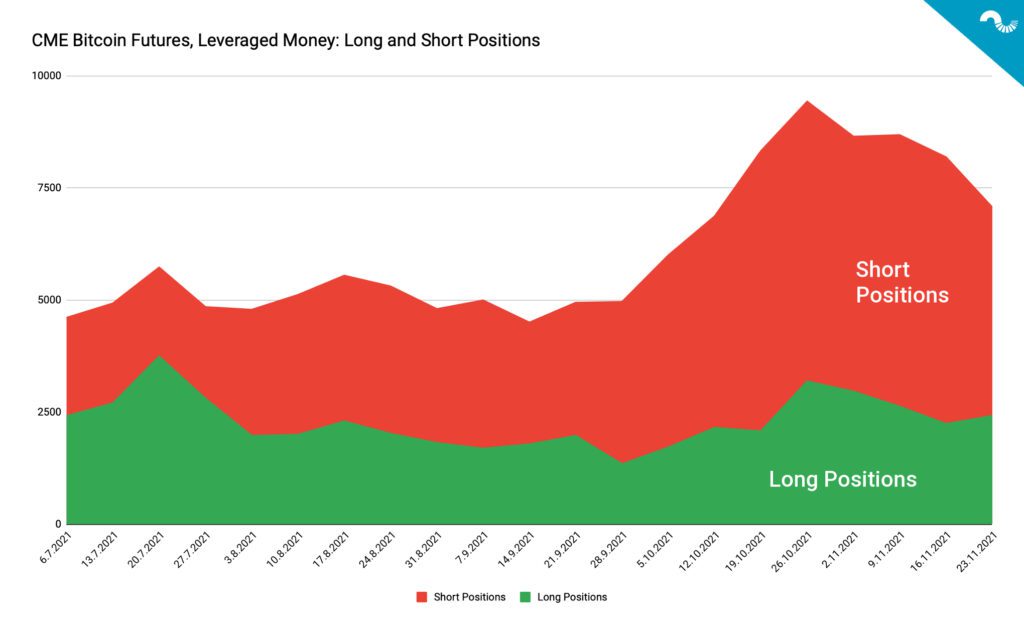

Leveraged Money Reducing Shorts

Diving further into recent COT data shows us how leveraged money (hedge funds) were increasingly short on Bitcoin in October, however hedge funds have been reducing their short exposure towards the end of quarter four (Q4). Hedge funds have historically been the most bearish segment towards bitcoin in CME futures, while retail and asset managers have been more positively aligned. The decreasing amount of hedge fund shorts might indicate that the smart money sees current price drop as transitory. If hedge funds would see an imminent price drop ahead, they’d likely maximize the amount of short positions.