Central bank digital currencies (CBDC) have been an important point of interest for the cryptocurrency community for several years. In 2020 and 2021, as COVID accelerated the global movement away from cash, the concept of this new form of money became more popular than ever.

What are central bank digital currencies? How are they different from cryptocurrencies?

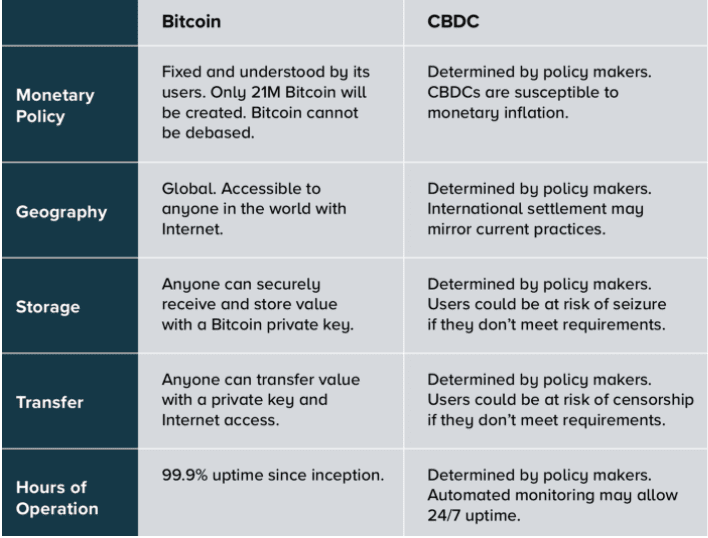

Central bank digital currencies are essentially what they sound like–they are digital versions of fiat currencies that central banks issue for the general public. Like other cryptocurrencies, CBDCs use blockchain technology. However, there are some essential differences between CBDCs and cryptocurrencies like bitcoin.

Unlike bitcoin, CBDCs are centralized. In other words, a single entity–a central bank–is in charge of issuing a digital currency for the public. The central bank also controls the supply of the CBDC and is responsible for regulating it as part of the financial system. CBDCs have a fixed value tied to the fiat currency they represent. 1 RMB would be equal to 1 digital RMB.

By contrast, cryptocurrencies like bitcoin are decentralized. There is no single entity that issues or controls cryptocurrencies. Instead, they are controlled by their users.

Virtual currencies are volatile in value. There are stablecoins like Tether Dollars (USDT) and Circle Coin (USDC) that private companies issue. Like CBDCs, stablecoins do not have volatile values. Since central banks do not issue them, though, stablecoins are not CBDCs.

Why are central bank digital currencies important for countries?

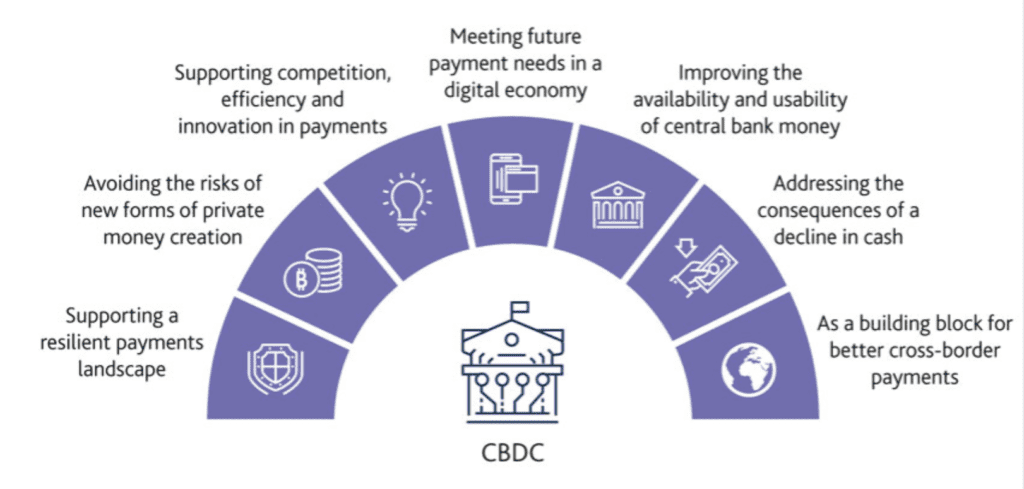

CBDC advocates argue that there are many benefits that CBDCs have for the countries that issue them. For example, global affairs think tank ODI says that “the most obvious and immediate benefit of a CBDC is faster, cheaper and more efficient payments, domestically and internationally.” CBDCs also “reduce costs of making, distributing and safeguarding physical money.”

These benefits appear to be particularly important for developing countries. For example, digital money used in electronic payment could remove some limitations for cross-border payments, particularly for lower-income countries. That could lead to a higher level of financial inclusion in those countries.

How could CBDCs work in practice?

At the same time, Hong Kyung-sik, director of financial settlement at Korea’s central bank, once said that developed countries do not need CBDCs at all. Moreover, some economists are concerned that certain designs of CBDCs would not improve and might even worsen financial stability.

However, some believe that CBDCs will play an important role for countries that want to be financially competitive. For example, Ripple CEO Brad Garlinghouse took to Twitter in May 2020 that “U.S. regulators: now is the time to step up and lean into digital currencies. Remaining complacent is actually setting us back, while China’s grip on both crypto and fiat payments becomes stronger.”

U.S. regulators: now is the time to step up and lean into digital currencies. Remaining complacent is actually setting us back, while China’s grip on both crypto and fiat payments becomes stronger. https://t.co/NuGmFZmf7x (1/2)

— Brad Garlinghouse (@bgarlinghouse) May 26, 2020

More countries exploring the creation of a CBDC.

Over the last 20 months, the list of countries exploring the creation of a CBDC has grown considerably. Sweden, France, The Philippines, Japan, Turkey, and Switzerland, and many others are in various stages of exploring CBDC issuance. Even the United States is talking about possibly issuing a “digital dollar.”

Today, over 80 countries throughout the globe (representing 90 percent of global GDP) are researching or experimenting with central bank digital currencies (CBDCs). Only five nations had established CBDCs as of July 2021. They are all Caribbean island nations: the Bahamas, Nevis, and Saint Kitts, Barbuda and Antigua, Saint Lucia, and Grenada. The EU central bank has also begun the process of exploring a digital euro.

Additionally, countries that have been testing the creation of a CBDC have come closer than ever to launch. With its digital yuan, commonly known as the e-RMB or the Digital Currency, Electronic Payment, China has progressed the most towards a fully-fledged CBDC of any major economy (DCEP). The Central Bank of The Bahamas became one of the first to fully launch a currency in a digital form with its “Sand Dollar” (a digital version of the Bahamian dollar).

How do CBDCs affect cryptocurrencies like Bitcoin?

There is little evidence to suggest that CBDC issuance alone will significantly affect volatile cryptocurrency markets.

However, some analysts agree that the growing popularity of CBDCs could shed some extra light on the cryptocurrency industry as a whole. A parallel phenomenon took place in late 2019 when Chinese President Xi Jinping said that blockchain was an essential part of China’s future. This caused the price of Bitcoin to jump 50% even though Xi did not say anything about BTC (or cryptocurrencies at all, for that matter.)

China’s regulations on cryptocurrency are some of the tightest in the world. The Chinese government outlawed domestic cryptocurrency exchanges in late 2017. While Chinese residents have still managed to hold and trade cryptocurrencies, this has limited their opportunities to do so.

At the same time, China’s CBDC project is one of the most advanced in the world. As such, if the issuance of CBDC couples with regulations that would clamp down on the use of volatile cryptocurrencies, it could negatively affect crypto markets.

Another example of this is currently playing out in India. The Indian government is currently considering restrictive regulations on cryptocurrency as well as the issuance of a “digital rupee.” The future of these regulations is unclear. However, many analysts agree that restricting Indian citizens from cryptocurrency markets could negatively impact coin prices in the long run.

CBDCs are not currently available for purchase on cryptocurrency exchanges. If you’re interested in learning more about how to invest in other cryptocurrencies, visit us at Coinmotion.com.