The technical analysis of week 50 examines market prospects as cryptocurrencies seek a new direction. It is possible that bitcoin, which has strengthened by 153 percent since the beginning of the year, is now taking a “breather” as investors shift their attention to higher-beta altcoins.

The crypto market momentum has remained sideways since last week, with the market-leading bitcoin fluctuating between 41 000 and 43 000 US dollars. At the same time, price movement suggests the strengthening of certain altcoins, indicating that traders may be preparing for a rotation.

While the markets wait, several positive events can be predicted for the next year in the crypto market. These include the anticipated launch of the spot ETF and the spring halving event. Additionally, Raoul Pal and Arthur Hayes have predicted a turning point of monetary policy, where “cheap dollar” would make high-risk cryptocurrencies popular investment choices.

Coinbase Research recently published a report mapping out the year 2024. In the report, the company notes that the market capitalization of the industry has doubled this year.

“The total crypto market cap doubled in 2023, which suggests that the asset class has already exited its “winter” and is now in the midst of a transition. In spite of the hurdles directed towards the asset class, the developments we witnessed over the past year have defied expectations. They are evidence that crypto is here to stay.” – Coinbase Research

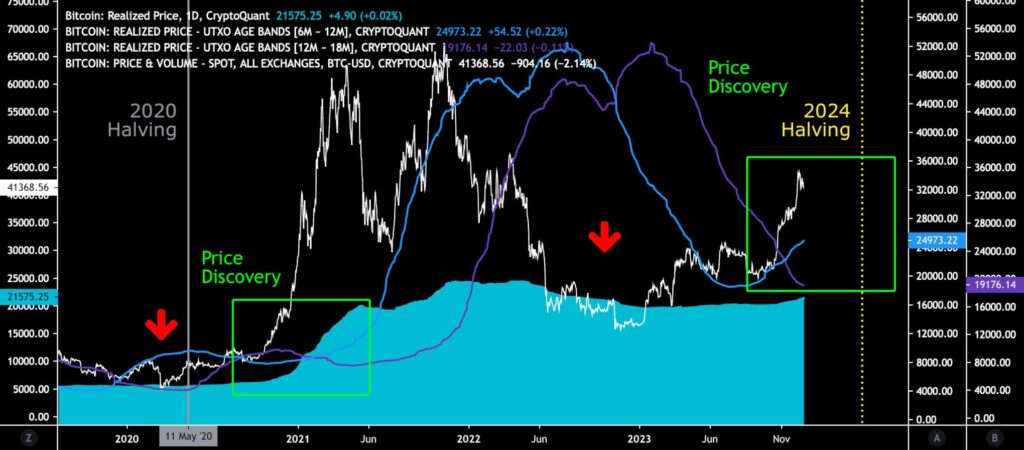

From a purely technical perspective, bitcoin is still in a price discovery cycle, with valuation levels approaching those of 2021. Bitcoin’s turquoise realized price wave is approaching $22 000, reflecting the average purchase price of all transactions. With the spot price trading above $42 000, the realized price indicates that the majority of bitcoin investors are clearly in profit.

The realized price 6M-12M (blue) and 12M-18M (purple) UTXO waves intersected in November, forming a setup reminiscent of spring 2021. In the broader picture, the market is looking towards the spring halving event, which is only 124 days away.

Sources: Timo Oinonen, CryptoQuant

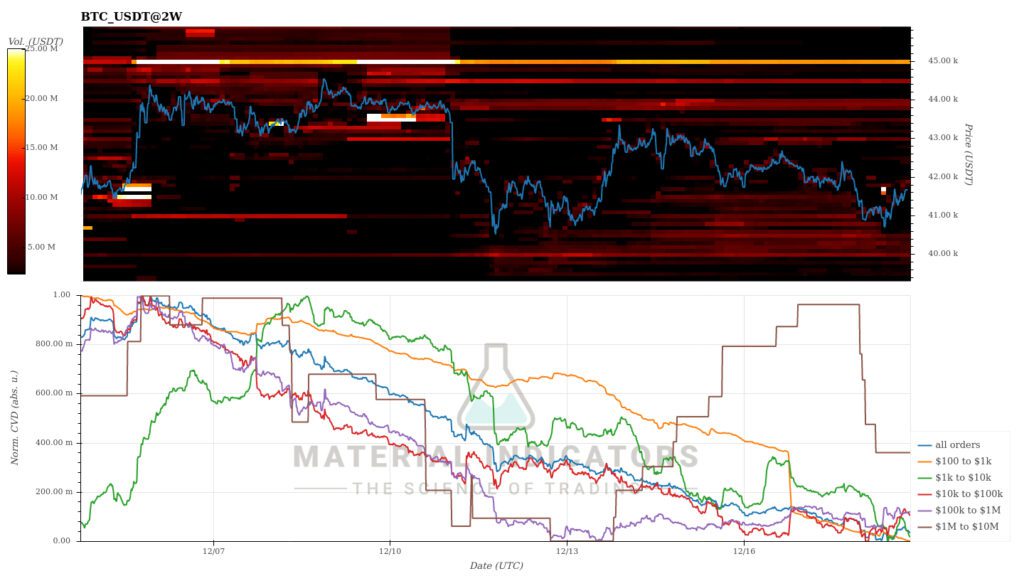

The Material Indicators’ heat map indicates the formation of weak support levels between $40 000 and $41 000. At the same time, the resistance level at $45 000 is gradually weakening, creating a favorable situation for a potential Christmas rally. The cumulative volume delta suggests whales feeding on ask liquidity at $42K.

Source: Material Indicators

7-Day Price Performance

The weekly momentum has mostly remained sideways, with the market sentiment being cautious. Nearly all cryptocurrencies Coinmotion-listed remained close to zero, with Aave being an exception, representing almost a ten percent increase. The S&P 500 stock index strengthened by 2,5 percent during the week, fueled by a positive market reaction to interest rate news.

Bitcoin (BTC): 1,5%

Ethereum (ETH): -1,5%

Litecoin (LTC): -2,2%

Aave (AAVE): 8,9%

Chainlink (LINK): -2,3%

Uniswap (UNI): -6,2%

Stellar (XLM): -2,9%

XRP: -2,6%

Cardano (ADA): 0,5%

Polygon (MATIC): -12,1%

Get started with Bitcoin Litecoin Ethereum AAVE USDC Stellar Ripple

Join Coinmotion and buy your first cryptocurrencies within minutes!

S&P 500 Index: 2,5%

Gold: -0,7%

YTD Price Performance

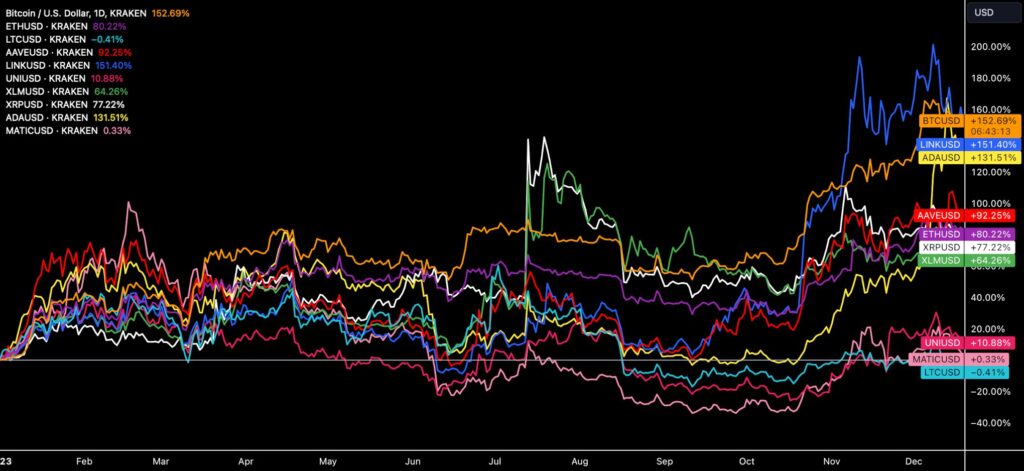

Chainlink (LINK), which held the top spot among Coinmotion listings for a month and a half, lost its pole position this week, weakening by 151 percent in the year to date metric. Meanwhile, the year to date figure for bitcoin, the market-leading cryptocurrency by market capitalization, rose to 153 percent. Concurrently bitcoin has regained the top position.

The mutual hierarchy of Coinmotion-listed tokens is undergoing a clear shift as Cardano (ADA) climbs to a 132 percent year to date angle. Cardano’s rocketing performance in the last quarter of the year can be considered exceptional, especially considering that as recently as October, ADA had a negative year to date value.

Source: TradingView

Bitcoin’s 153 percent annual growth represents its best performance since 2020 when the cryptocurrency strengthened by 303 percent. Prior to that, the most significant growth figure since 2016 occurred in 2017 when bitcoin gained 1369 percent. In light of these numbers, bitcoin has outperformed traditional asset classes almost every year, although the table does not account for technology indices such as the Nasdaq-100.

Source: Macrobond

Are We Approaching an Altcoin Rotation?

The year 2023 has unquestionably been a triumphal march for bitcoin, with its dominance growing by 27 percent from January to December. Simultaneously, bitcoin has deviated from the traditional correlation with the DeFi platform Ethereum, as the ETHBTC pair weakened by -29 percent. Additionally, the year 2023 has marked a massive bullish cycle for Bitcoin-related stocks, with MicroStrategy (MSTR) gaining 294 percent and Coinbase rising by 367 percent.

Despite these factors, the market focus may be shifting towards altcoins as bitcoin approaches critical support levels seen of 2021. As a general rule, bitcoin’s pause in the bull cycle has often meant strength for altcoins.

Is an altcoin rotation ahead and how will it affect your crypto investment? 📊

— Coinmotion (@Coinmotion) December 21, 2023

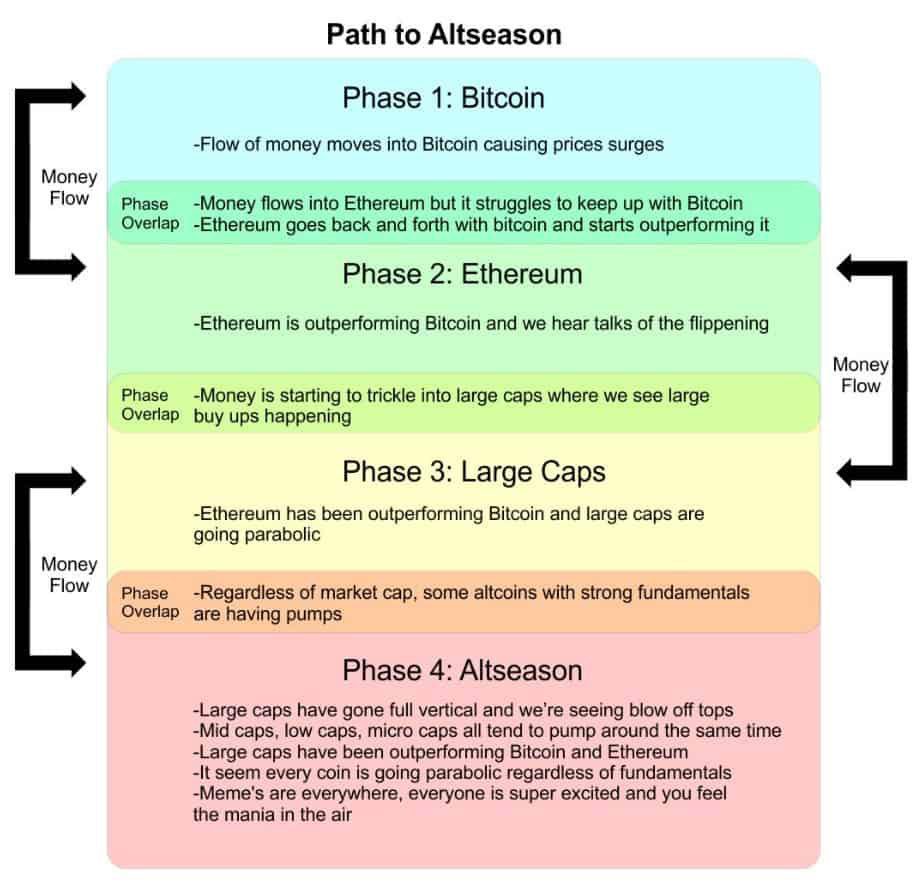

Altcoin rotation refers to a change in investor sentiment towards higher beta (and riskier) altcoins after the leading cryptocurrency has reached its legal point.

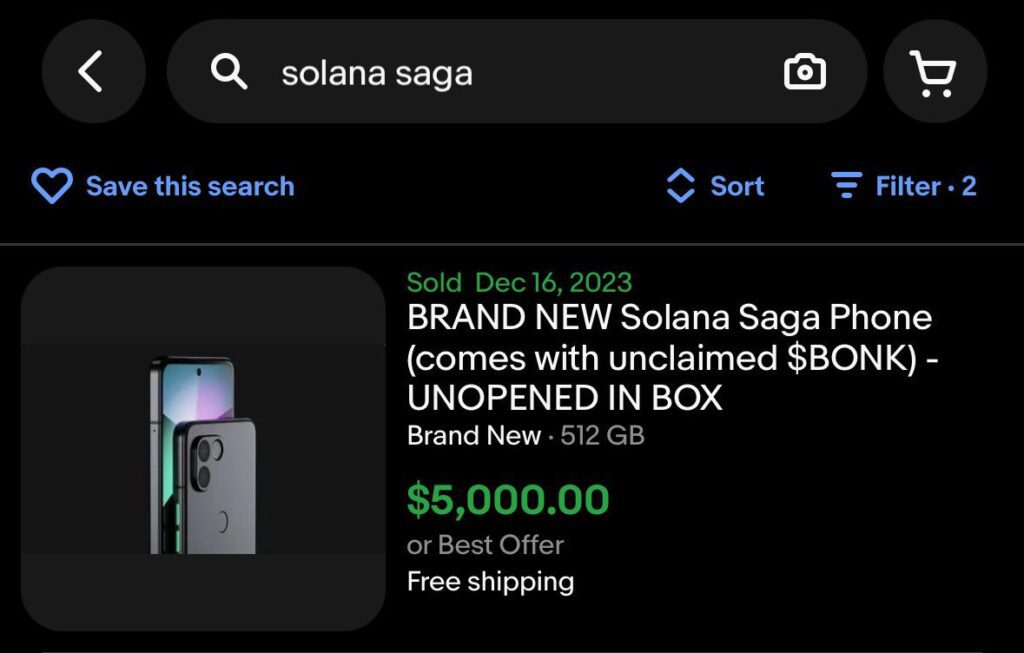

The emerging altcoin cycle is evident in the hype surrounding Solana (SOL), which has surged by 645 percent since the beginning of the year, leading to the sold-out status of Saga smartphones. Originally priced at $599, the post-market price of Saga has risen to as much as $5000, representing over a 700 percent price premium. The surge in Saga’s value is attributed to the popularity of the Solana ecosystem and the BONK token airdrop that comes with the smartphone.

Source: Ebay

According to the classic altseason chart, investments first flow into the market-leading bitcoin and then into smaller and higher-beta tokens. After bitcoin, cryptocurrencies have traditionally found their way to the decentralized finance platform Ethereum, although Solana is increasingly challenging Ethereum’s position.

Source: Secrets of Crypto

Altcoin rotation refers to a shift in investor sentiment towards higher-beta (and higher-risk) altcoins after the leading cryptocurrency has reached its peak. The Blockchaincenter’s seasonal chart is currently reading 49, representing peak levels for the year.

In addition to traditional rotation, the attractiveness of altcoins may be enhanced by an epoch of monetary policy transition: Investment bank Goldman Sachs anticipates the Federal Reserve lowering its benchmark interest rate by 25 basis points in the spring. Periods of low interest rates and a “cheap dollar” have traditionally supported smaller altcoins, as speculative funds seek greater risk-adjusted returns.

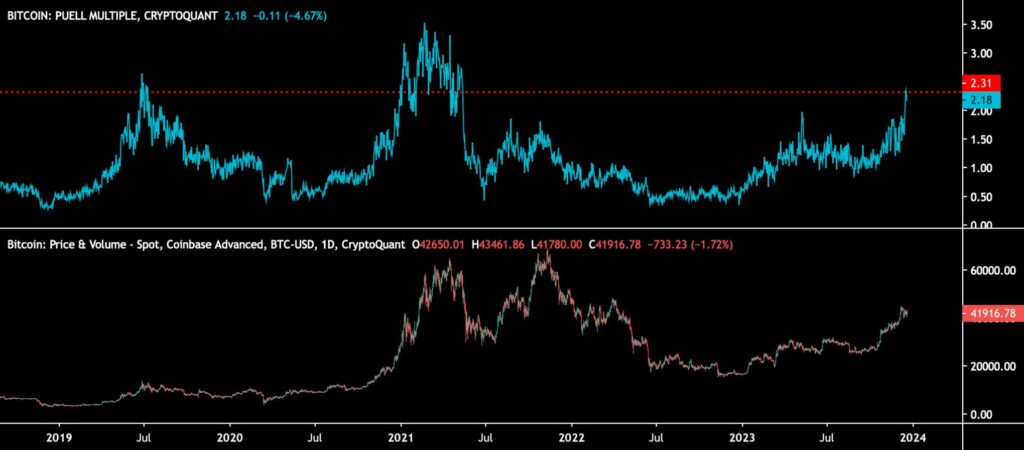

Puell Multiple Indicates a Short-Term Breather

Bitcoin, which has strengthened by 57 percent in the last quarter of the year, may be approaching a fundamental ‘breather,’ while the Puell Multiple indicator, measuring the ratio of bitcoin’s price level to mining rewards, has climbed to levels last seen in the spring of 2021.

The Puell Multiple is a crucial indicator for interpreting Bitcoin’s supply and Proof-of-Work (PoW) mining dynamics. As we know, miners sell native units obtained through mining to cover the costs of their operations. The Puell Multiple primarily reflects mining profitability.

Sources: Timo Oinonen, CryptoQuant

Puell Multiple is calculated by dividing the daily production of Bitcoin units by the 365-day moving average (MA) of the supply, and the resulting indicator is usually compared to the spot price of Bitcoin (BTCUSD).

In contrast to Puell Multiple, the market value realized in less than a month remains at a level of 13,59, reflecting the weakness of selling pressure. This chart, depicting the UTXO metric less than a month old, has previously served as an indicator of overheating retail segment. In mid-January 2021, the indicator reached a peak reading of 54.

Source: CryptoQuant

What Are We Following Right Now?

As the anticipated spot ETF approval approaches, MicroStrategy (MSTR), known as an “unofficial ETF”, finds itself defending its position. Michael Saylor argues that MSTR is a “leveraged spot ETF without fees”.

Positioning itself as a leading institutional player in the bitcoin space, MicroStrategy’s balance sheet has grown by 42 030 units this year, now owning a total of 174 530 bitcoins. Compared to 2022, MSTR’s purchases have risen by 418 percent on an annual basis.

The $BTC Spot ETF may be the biggest development on Wall Street in the last 30 years. My discussion of #Bitcoin in 2024, Spot ETFs vs. $MSTR, and the emergence of bitcoin as a treasury reserve asset with @KaileyLeinz on Bloomberg @Crypto. pic.twitter.com/QtPdBOhMDr

— Michael Saylor⚡️ (@saylor) December 19, 2023

Legendary trader and analyst Peter Brandt discusses his key investment theses for 2024. In addition to U.S. stocks and gold, Brandt sees significant potential in bitcoin.

The recent FOMC meeting by the Fed kept the interest rate unchanged. At the same time, Goldman Sachs predicts the central bank to lower its interest rate by 25 basis points in March. Mark Yusko, known for his hedge funds, anticipates the Fed making a radical shift in its monetary policy next year. The paradigm shift will likely boost the valuation levels of risk assets.

Stay in the loop of the latest crypto events

- Dive into Cardano (ADA): A newcomer’s comprehensive guide

- Whales vs. Retail

- Bittrex Global shutdown — how to move funds from Bittrex to Coinmotion

- The Next Technical Resistance at 58 000 USD

- Polygon (MATIC) – Infrastructure for billion users

Get started with Bitcoin Litecoin Ethereum AAVE USDC Stellar Ripple

Join Coinmotion and buy your first cryptocurrencies within minutes!

The views, thoughts, and opinions expressed in the text belong to the author and not necessarily to the author’s employer, organization, committee, or other group or individual.