This year’s last technical analysis examines the rise of the South Korean kimchi premium and the reasons behind this phenomenon. Additionally, we explore MicroStrategy’s escalating purchase program as the company aims to control a percentage of the entire bitcoin supply. We also briefly review the outlook and target prices for the approaching year 2024.

The recent crypto market price hike over the last seven days has been focused on altcoins, while the market-leading bitcoin has mostly moved sideways. The biggest news of the week was the continuation of MicroStrategy’s (MSTR) purchase program, with the company increasing its holdings by 14 620 bitcoins. The escalated purchases this year bring the balance of the company led by Michael Saylor to 189 150 units, representing 0,9 percent of the total bitcoin supply.

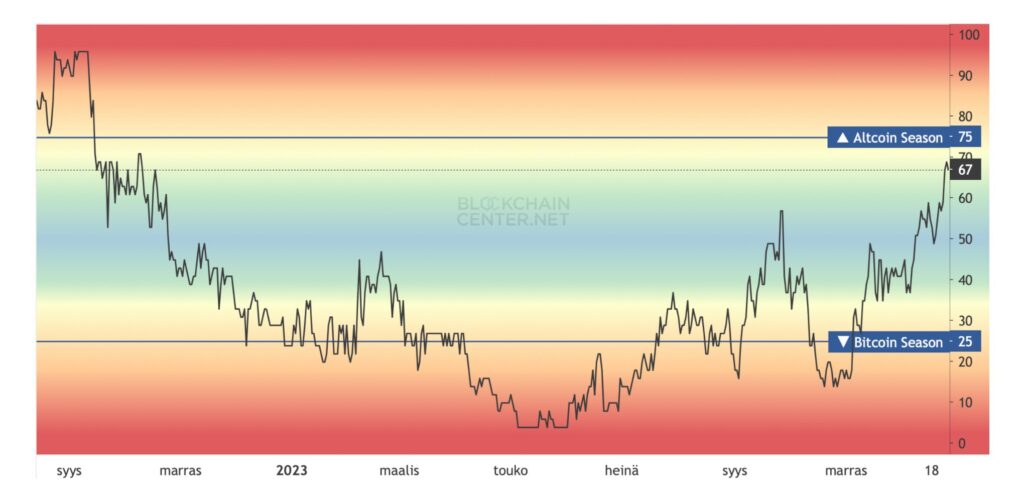

The emerging altseason is also indicated by Blockchaincenter’s chart, with a reading of 67, the highest in over a year. For example, Solana (SOL) has skyrocketed nearly 1000 percent since the beginning of the year, offering lucrative returns for investors seeking a higher risk-return profile. While Ethereum suffers from a lack of investment narrative, Solana’s growing popularity in developer communities may lead to a “flippening” situation.

Source: Blockchaincenter

From a purely technical standpoint, bitcoin is still in its price discovery cycle that began in the last quarter of the year. At the same time, the technical wedge (white) resembles the consolidation phase seen in 2020, after which the spot price rose parabolically.

The turquoise wave of bitcoin’s realized price has surged to nearly $22 000, representing the average price of all purchases. The growing divergence between the $43 000 spot price and the realized price indicates that the majority of investors are currently in profit.

Sources: Timo Oinonen, CryptoQuant

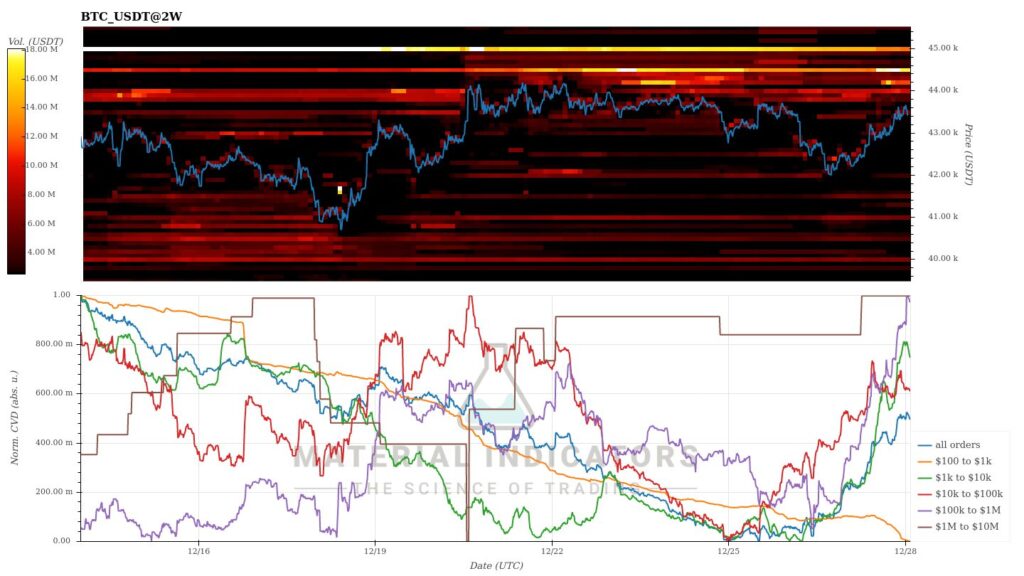

The Material Indicators’ heat map indicates increasing demand at the $44 000 and $45 000 levels. Whales, which bullied the retail segment about a week ago, are back in buying mode. The setup looks promising for the year 2024, although volatility is likely to increase.

Source: Material Indicators

Seven Day Price Performance

Bitcoin, having weakened by approximately -4 percent on a weekly basis, contrasts with the altcoin market, where Coinmotion-listed tokens have seen increases of over 20 percent. Generally, the cryptocurrency market signals a breather after the parabolic price surge in the fourth quarter.

The halving in 2024 and the introduction of spot ETFs will indicate a new direction for the market. The S&P 500 stock index has strengthened by about one percent in a week as investors respond to Goldman Sachs’ predicted turning point in central bank policy. GS previously estimated that the Fed would lower its interest rate by 25 basis points in March.

Bitcoin (BTC): -4,1%

Ethereum (ETH): 3,4%

Litecoin (LTC): 6,9%

Aave (AAVE): 10,9%

Chainlink (LINK): 2,1%

Uniswap (UNI): 21,1%

Stellar (XLM): 3,5%

XRP: 0,7%

Cardano (ADA): -6,1%

Polygon (MATIC): 17,3%

Get started with Bitcoin Litecoin Ethereum AAVE USDC Stellar Ripple

Join Coinmotion and buy your first cryptocurrencies within minutes!

S&P 500 Index: 0,8%

Gold: 0,6%

YTD Price Performance

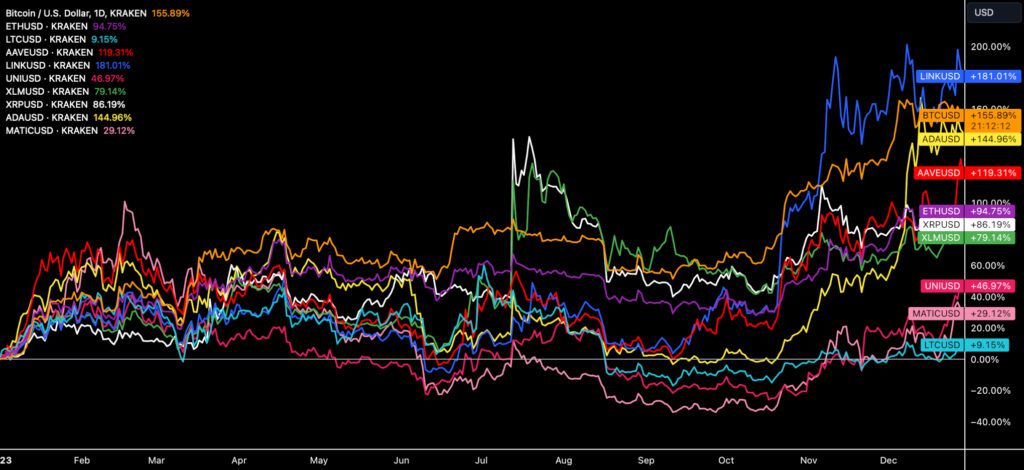

The final week of the year appears to solidify Chainlink’s (LINK) position at the top of Coinmotion’s listings, with the cryptocurrency strengthening by 181 percent year to date. At the same time, bitcoin, the market leader in terms of market capitalization, maintains its second position with a YTD figure of 156 percent. The surpriser of the last quarter, Cardano (ADA), rises to third place with a YTD performance of 145 percent.

Do you believe that the general price development of the crypto market will continue as strong in early 2024? 📈

— Coinmotion (@Coinmotion) December 29, 2023

The end-of-year rally has brought all listed cryptocurrencies into positive YTD territory, even though Litecoin, Polygon, and Uniswap dipped into negative territory for months. In the case of Uniswap, a turning point can be noted, as the long-negative UNI token is heading for a 47 percent increase since the beginning of the year.

In the light of the YTD metric, the year has been interesting as the hierarchy of cryptocurrencies continues to evolve. Following the capitulation at the beginning of the year and the spring price surge, notable events included the classification speculations of XRP and Stellar in July, which led XRP to surge by more than 140 percent. So far, the U.S. Securities and Exchange Commission (SEC) has classified only bitcoin, Ethereum, and XRP as commodities, while others may potentially fall into the securities category.

However, regulatory risk has not hindered a selective altseason, as Solana (SOL) has strengthened by almost 1000 percent this year. The rise of Solana is attributed to the attractiveness of its ecosystem from a developer community perspective, while Ethereum has had to defend its position. Ethereum is said to suffer from a lack of a proper investment narrative, and in 2024, the altcoin field might witness a significant “flippening.”

Source: TradingView

South Korean Kimchi Premium Peaks

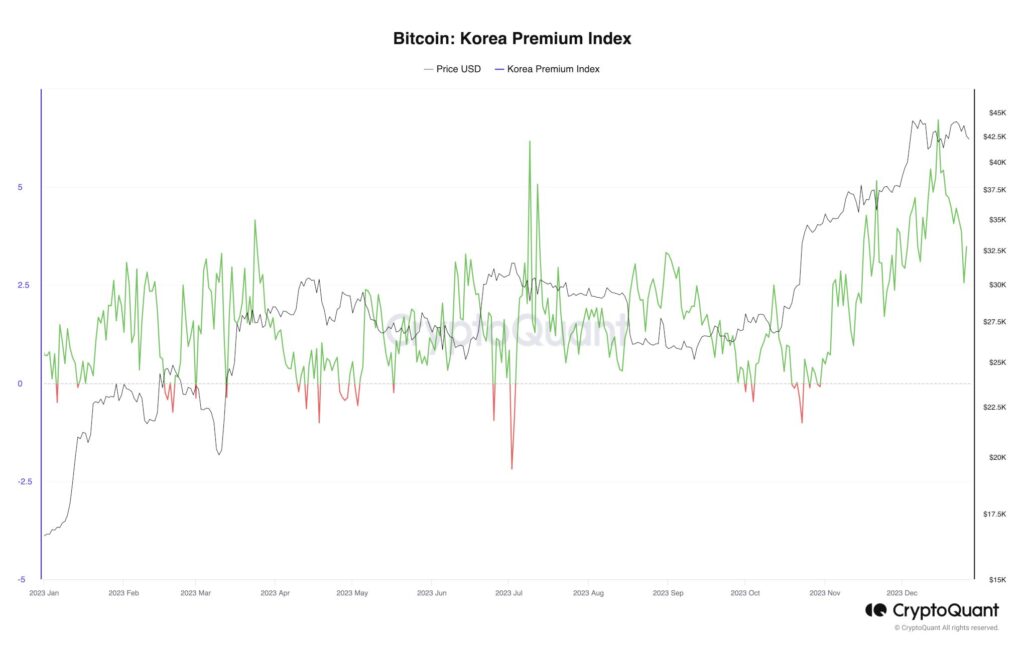

In mid-December’s report, we highlighted David Duong’s assessment of increasing demand for bitcoin from institutional sources, with CME futures prices rising 29 percent higher than spot prices on an annual basis. However, towards the end of the year, there is a clear awakening in the retail segment, as evidenced by the kimchi premium reflecting retail demand in South Korea.

South Korea is known for its strict capital controls, making the transfer of assets in and out of the country challenging. Additionally, Koreans are known as risk-taking and capable investors. The combined effect of these factors has at times significantly raised the price of bitcoin in South Korea compared to the general market price.

Arthur Hayes, the legendary founder of the BitMEX platform, is said to have exploited the kimchi premium as early as 2017 when the premium rose to over 50 percent. Hayes conducted over-the-counter (OTC) transactions in Korea, trading bitcoin units for the national currency at a massive price premium. He systematically repeated these trips, accumulating substantial capital in the process.

Source: CryptoQuant

Recently, on December 15th, the kimchi premium reached a figure of 6,71, representing the highest value in over a year. The kimchi premium simultaneously reflects the growing appetite of the Korean retail segment, and the premium can be seen as a leading indicator for bitcoin’s spot price itself.

Saylor in Full Accumulation Mode

Leading the way as a prominent institution of the Bitcoin space, MicroStrategy (MSTR) continued its massive purchase program this week, announcing on Tuesday that it had increased its holdings by 14 620 bitcoins. The latest acquisitions bring MSTR’s holdings to 189 150 units, meaning the company now controls 0,9 percent of the entire bitcoin supply.

MicroStrategy’s founder, Michael Saylor, is likely aiming to acquire at least a one percent share of the total supply. Additionally, the bitcoins managed by the company represent approximately 17 percent of Satoshi Nakamoto’s theoretically estimated holdings. In 2020, Saylor disclosed owning 17 732 bitcoins, which at the current market price are valued at around $758 million or €685 million.

MSTR employs a dollar-cost averaging strategy in its purchase program but also times its purchases cyclically. As spot prices sharply declined last year (2022), the company’s purchases amounted to a modest 8109 units, while this year’s acquisitions have risen to a total of 56 650 bitcoins. In summary, MicroStrategy’s purchase program has grown a staggering 599 percent from 2022 to 2023. At the same time, the latest acquisition represents 7,7 percent of the company’s total holdings.

Source: 21metrics

The escalation of the buying program may be related to the intensifying competition in the field of potential Bitcoin spot ETFs. In a recent Bloomberg interview, MicroStrategy was characterized as an “unofficial bitcoin ETF”. Additionally, Saylor argued that MSTR is a “leveraged ETF with no fees”.

The exotic arrangements behind MicroStrategy’s purchases have also sparked discussion: To finance this week’s acquisitions, MSTR sold a total of $610 million worth of new shares, diluting the position of existing shareholders. On the other hand, the bitcoin-per-share ratio is increasing, balancing the situation.

Previously, individuals such as Preston Pysh have seen MicroStrategy’s buying program as a speculative attack against the dollar. The loan arrangements ultimately rely on “unlimited” fiat money borrowed to fund the purchase program of a limited-supply asset class. Scaled up, this model implies a weakening dollar as bitcoin continues to strengthen consistently.

Pysh compares the current buying program to George Soros’s famous attack against the Bank of England, where he shorted the pound by almost a billion GBP. Some analysts estimate that the Bank of England was close to collapse at that time.

S2F Model on Track Again

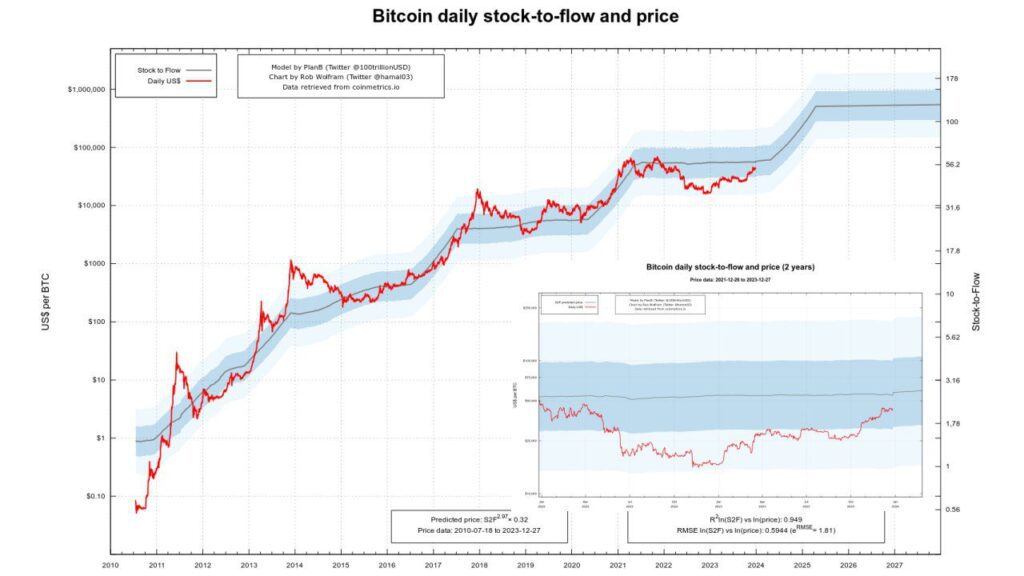

The previously declared dead stock-to-flow (S2F) model has once again proven its significance this year as the spot price of bitcoin approaches the model’s indicated value of $49 665. The ascent of the spot price from its current level to the S2F target would now require approximately a 17 percent upward movement.

The divergence between the 365-day ratio of the stock-to-flow model and bitcoin’s spot price reached a multi-year peak at the end of November 2022, when the spot dropped to a minimum of $15 829. The spot hike from that level to the S2F ratio of $49 665 would have required a 212 percent price movement.

Source: PlanB

In the previous report on Bitcoin’s Price Projections for 2024, we delved deeper into the stock-to-flow model and noted that the price projections for the coming year range between $50 237 and $186 040. The realistic target price is likely to fall within this range, with an emphasis on reaching six figures under favorable conditions.

What Are We Following Right Now?

Starting from 2025, individuals can allocate their funds to cryptocurrencies and crowdfunding through Estonia’s state investment account. The account is similar to the Finnish share savings account (OST), but it does not have a deposit cap, and there is no limit on the number of accounts one can have.

Why will the cryptocurrency market be exceptionally interesting in 2024?

Raoul Pal and Tim Draper share an interview. Draper’s target price for the year is $250 000.

Stay in the loop of the latest crypto events

- Are We Approaching an Altcoin Rotation?

- Dive into Cardano (ADA): A newcomer’s comprehensive guide

- Whales vs. Retail

- Bittrex Global shutdown — how to move funds from Bittrex to Coinmotion

- The Next Technical Resistance at 58 000 USD

- Polygon (MATIC) – Infrastructure for billion users

Get started with Bitcoin Litecoin Ethereum AAVE USDC Stellar Ripple

Join Coinmotion and buy your first cryptocurrencies within minutes!

The views, thoughts, and opinions expressed in the text belong to the author and not necessarily to the author’s employer, organization, committee, or other group or individual.