All the Way to the Moon?

After a short pause Bitcoin price continued its growth and surpassed the USD1800 borderline. At the time of writing the average weighted exchange rate stands at USD 1831 with market cap of less than USD30 billions.

Coinhills shows that Poloniex keeps holding the leader’s position in terms of the trading volume followed by Bitflyer and Okcoin.

BTC Dominance comparing to other cryptocurrencies is currently at 54,9%.

Majority of BTC is still traded in JPY and USD, which share the dominant shares (34,83% and 33,27% respectively).

Australia to drop double taxation on Bitcoin

While Litecoin’s official activation of the Bitcoin Core development team’s Segregated Witness is serving as one of the key factors driving the Bitcoin price up, the recent announcement of Australian government to officially recognize Bitcoin as a form of payment and dropping goods and service taxation is believed to make an impact as well.

The current national tax regulations treat transactions with cryptocurrencies as a barter arrangement, implying similar tax consequences. Thus, digital currency users are asked to pay GST twice – when purchasing digital currency and when sing it in exchange for other goods and services which are subject to GST.

However, the rules are to change as of July 1, 2017. The national budget for years 2017-2018 reads:

“The Government will make it easier for new innovative digital currency businesses to operate in Australia. From July 1, 2017, purchased of digital currency will no longer be subject to the GST, allowing digital currencies to be treated just like money for GST purposes.”

Germany’s Central Bank urges against investing in Bitcoin

Bitcoin’s continued growth in value obviously attracts investors, however, regulators keeps extending warnings for the citizens.

Germany’s Bundesbank Chair Carl Ludwig Thiele urged the people – Bitcoin can be anything but a secure investment. He shared with Welt newspaper:

“Bitcoin is a speculative object which value changes quite rapidly. From our point of view, Bitcoin is not a suitable medium for storing values, this is proven by the fluctuating course of its development.”

This is not the first time Thiele expressed his concerns of the use of Bitcoin. Back in early 2014, following the huge 2013 Bitcoin bubble, he explained that due to the architecture of cryptocurrency and its enormous volatility, it is poised to remain highly speculative object. Nevertheless, he doesn’t see any reason to ban Bitcoin, it doesn’t free anyone from compliance with Anti-money laundering laws and other regulations.

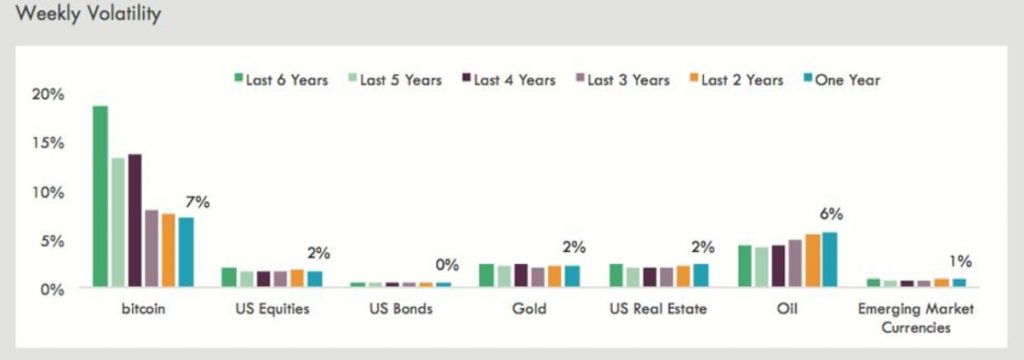

Also the Finnish regulators see Bitcoin still as a speculative object, but is it really so? The number of stores accepting Bitcoin is increasing at a high speed and for example in Japan the number of stores accepting the cryptocurrency is expected to reach 260,000 only in a few months. Additionally the volatility of Bitcoin has decreased during the last years and is now comparable to the volatility of oil.

Despite very sound claims against Bitcoin, Thiele is interested in the technology behind it, which allows for more secure, encrypted transfer of data, assets and shares. Thus, Bundesbank has collaborated with Deutsche Börse to develop a prototype for transfers based on the blockchain technology.

Blockchain’s Biggest Impact is Social: EU Report

It is true that governing bodies might not be very excited about digital money, however, the technology behind it often looks curious. European Parliamentary Research Service has published a report looking into how blockchain technology could impact social values. Report acknowledges the potential of technology to shake up a variety of aspects of our daily lives from the currency we use to our purchasing behavior.

The Report refers to a recent European Parliamentary Research Service study outlining the hundreds blockchain-based solutions for tracking all kinds of transactions spanning from casting votes in elections and improving supply chain management, to proving authenticity of documents and products, resolving of music and video piracy, and running all sorts of public services, including health and welfare payments.

The report touches on some of the material costs of running Bitcoin’s blockchain – namely the energy costs associated with mining. For instance, it reminds of the previous claims for Bitcoin blockchain being responsible for electricity consumption comparable to that of Ireland in 2014, which continues to grow and may become an increasing problem in the future.

Paper also touches the the impact of technology on ‘white-collar’ employment, looking into how some of the routine work currently done by human employees is being replaced by automated peer-to-peer transactions and smart contracts.

Authors of the report argue, however, that the biggest impact of the technology could be through its contribution to subtle changes in broad social values and structures. They emphasize that all technologies have values and politics, usually representing the interests of their creators, and each time we use those technologies we reaffirm the values and politics they represent. Each time using blockchain-based applications, we participate in a shift of power from central authorities to non-hierarchical and peer-to-peer structures. The report reads:

“To say that blockchain’s popularity is due to increasing social trends to prioritise transparency over anonymity, to diminishing trust in traditional financial and governance institutions, and to expect greater levels of accountability and responsibility in all aspects of our lives, is only part of the story. Nevertheless, using blockchains instead of traditional ledgers actually invokes these very shifts in society.”

Anticipating the often discussed blockchain revolution, authors of the report suggest governance institutions to mobilise four categories of action ranging from responding to the problems to which blockchain is a solution without blockchain, active encouraging of development of technology, to refusing to accept legitimacy of the tech.

The full report is available here.

0 Responses

This was a great article, thanks for sharing