In last week’s cryptocurrency technical analysis, we examine the latest market trends. What does Bitcoin’s risk-adjusted return look like in relation to traditional assets, what are whales doing during the market correction, and how are the altcoin prices behaving under the selling pressure? Read more to find out.

Bitcoin’s Risk-Adjusted Return Superior to Traditional Assets

All asset classes include risk and profit expectations. The main fundamental of investment activity is that return should compensate for higher risk over a long investment horizon. The Sharpe ratio is an effective instrument for estimating risk and return. Sharpe can easily be calculated by deducting a risk-free rate from the expected return and dividing the result by standard deviation.

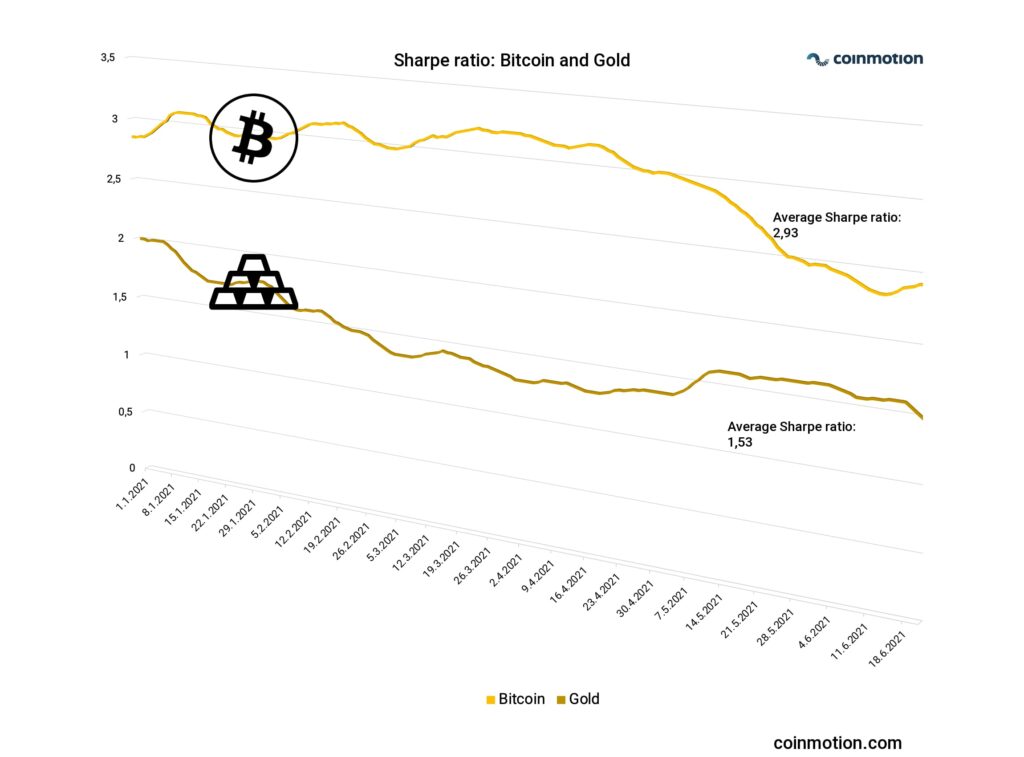

Bitcoin is frequently called ”digital gold,” and its scarcity-derived features make it an excellent benchmark to physical gold. Bitcoin’s 1y Sharpe ratio has been 2,93 on average since the beginning of 2021, i.e., roughly double the Sharpe of gold (1,53). Bitcoin’s Sharpe ratio can be classified as “good” (2 – 2,99), while gold’s Sharpe indicates “mediocre” risk-adjusted return (1 – 1,99).

Sharpe ratio interpretations:

- < 1: Weak

- 1 – 1,99: Mediocre

- 2 – 2,99: Good

- > 3: Excellent

Ethereum’s (ETH) Sharpe ratio has been in close proximity to Bitcoin’s, rising to above three in early 2021. Bitcoin and Ethereum both exceeded Sharpe of three in Q1 2021, indicating excellent performance (> 3). The Sharpe ratio of S&P500 has remained on a mediocre level so far in 2021, slightly below gold. In summary, Bitcoin’s weak correlation to the stock market and excellent Sharpe ratio make it a brilliant alternative investment.

Whales Continue to Accumulate Despite The Market Correction

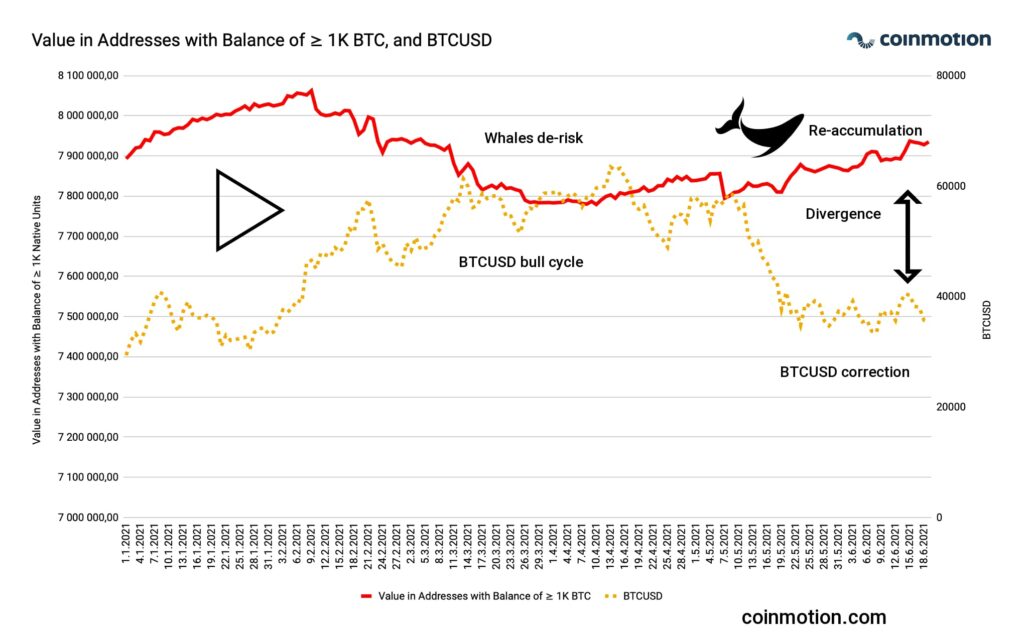

Albeit bitcoin (BTCUSD) has recently shown a – 47 percent correction since April 2021 highs, the wealthier and institutional investors clearly retain their trust in fundamentals. Whales, here interpreted as wallets with ≥ 1000 bitcoin units, have increased their longs despite bitcoin’s price drop.

The data reveals ≥ 1000 bitcoin unit wallets accumulating from the first day of 2021 until February when they started to de-risk towards April. The de-risking is related to anticipated price decent. After the bull cycle of the spring, whales have continued to accumulate BTC, forming a growing divergence to BTCUSD. The market behavior of whales is notable in contrast to retail sentiment as retail has been selling during early summer, occasionally fuelled by panic. The smart money has clearly been exploiting the opportunity to buy cheap bitcoin after correction, looking forward to future bull cycles.

Weakening Selling Pressure?

Altcoins have been especially vulnerable to selling pressure. However, the worst seems to be behind as new support levels are found. Uniswap (UNI), for example, is currently trading around 17 dollars (USD), previously dropping to 13 this week. The current price level of the UNI token mirrors the early 2021 valuation, likely forming a support level for future prospects.