Bitcoin was the best-performing asset of the 2010s with 9 000 000 percent growth during the decade. Even the last year of the decade was gave huge returns to bitcoin investors, despite the bear market at the end of the year. More and more people are interested in how to invest in BTC and how to diversify portfolio with bitcoin — and for a good reason.

Should you invest in BTC?

At the same time, bitcoin is famous for its high volatility. During June 2019, bitcoin price was extremely volatile as you can see from the following price changes:

-> Fell -12% between June 1–10

-> Rose +81% between June 10–26

-> Fell -24% between June 26–27

Bitcoin is in its own class with the combination of excellent price performance and high volatility. In other words, these features make it an excellent asset for diversification with more traditional investments. In this article, we’ll take a look on how bitcoin performs as a part of traditional 60/40 porftolio — that is, 60% stocks, 40% bonds.

What strategy to choose?

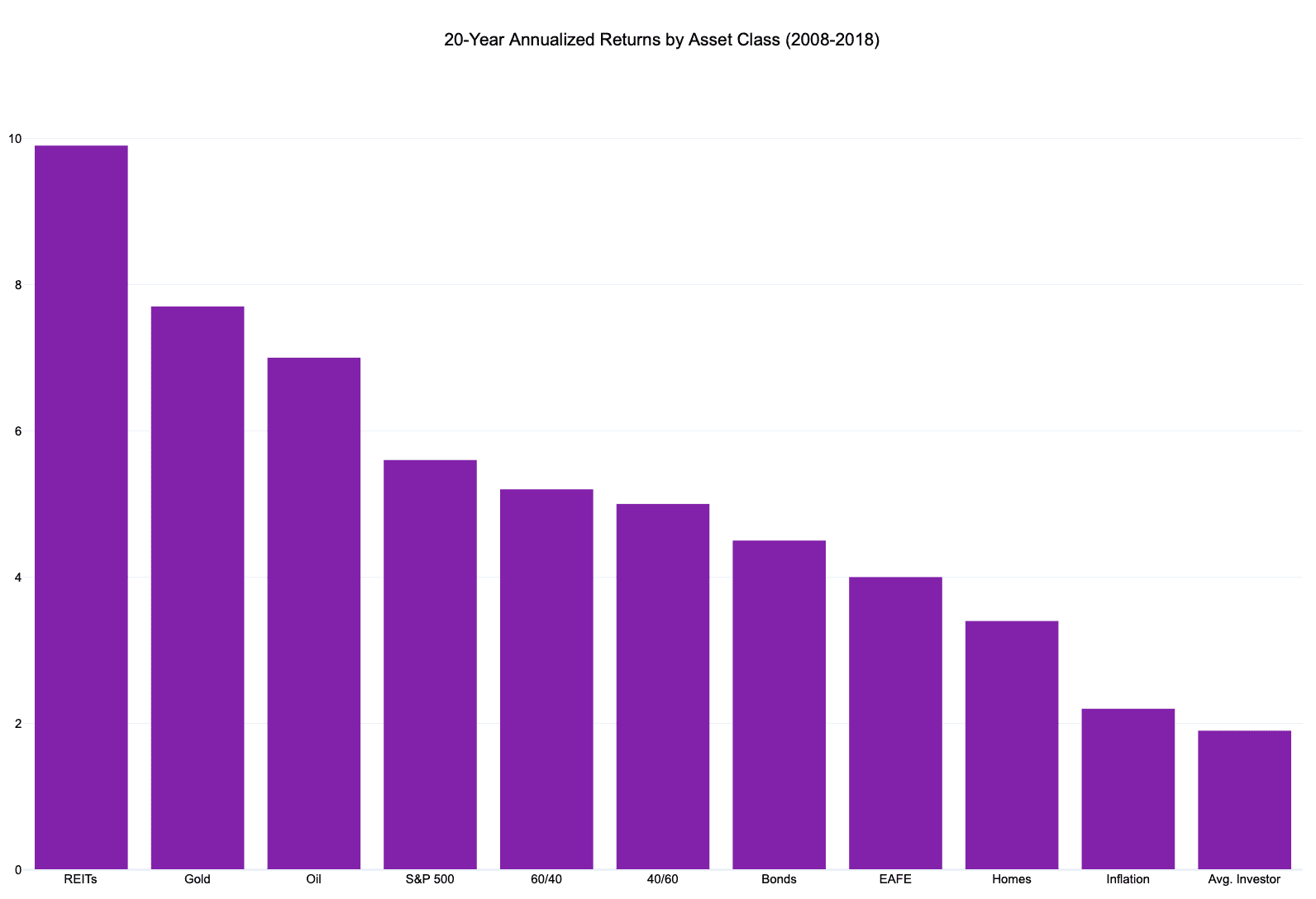

During the past 20 years, the 60/40 strategy has been a relatively stable option with a 5,2% annual return. Meanwhile, S&P 500 fared slightly better with 5,6% annually. These returns beat traditional investors’ 1,9% return with a wide margin. At the same time, the inflation-adjusted return for 60/40 is closer to 3,5% per annum. However, we have witnessed the longest bull market for stocks in history during the 20-year period. So the long-term perspective might be biased.

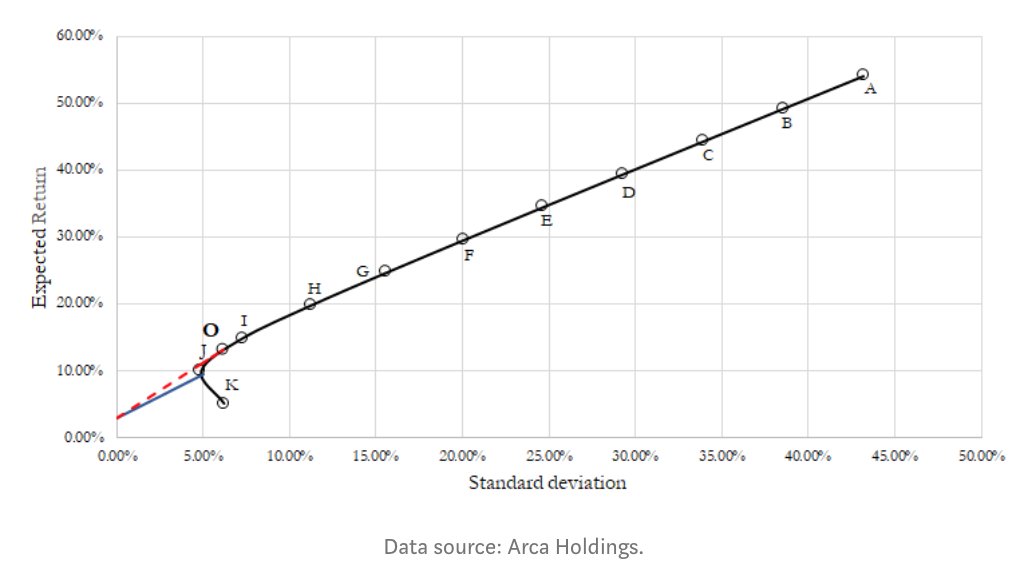

What would be the optimal allocation for bitcoin in traditional portfolio? Arca has done actual research on the question. According to their estimation, an optimal portfolio would call for an allocation of 14,21 percent bitcoin, 85,79% 60/40. These weights would indicate annual expected return of 13,23%, a standard deviation of 6,16%, and a Sharpe ratio of 1,66.

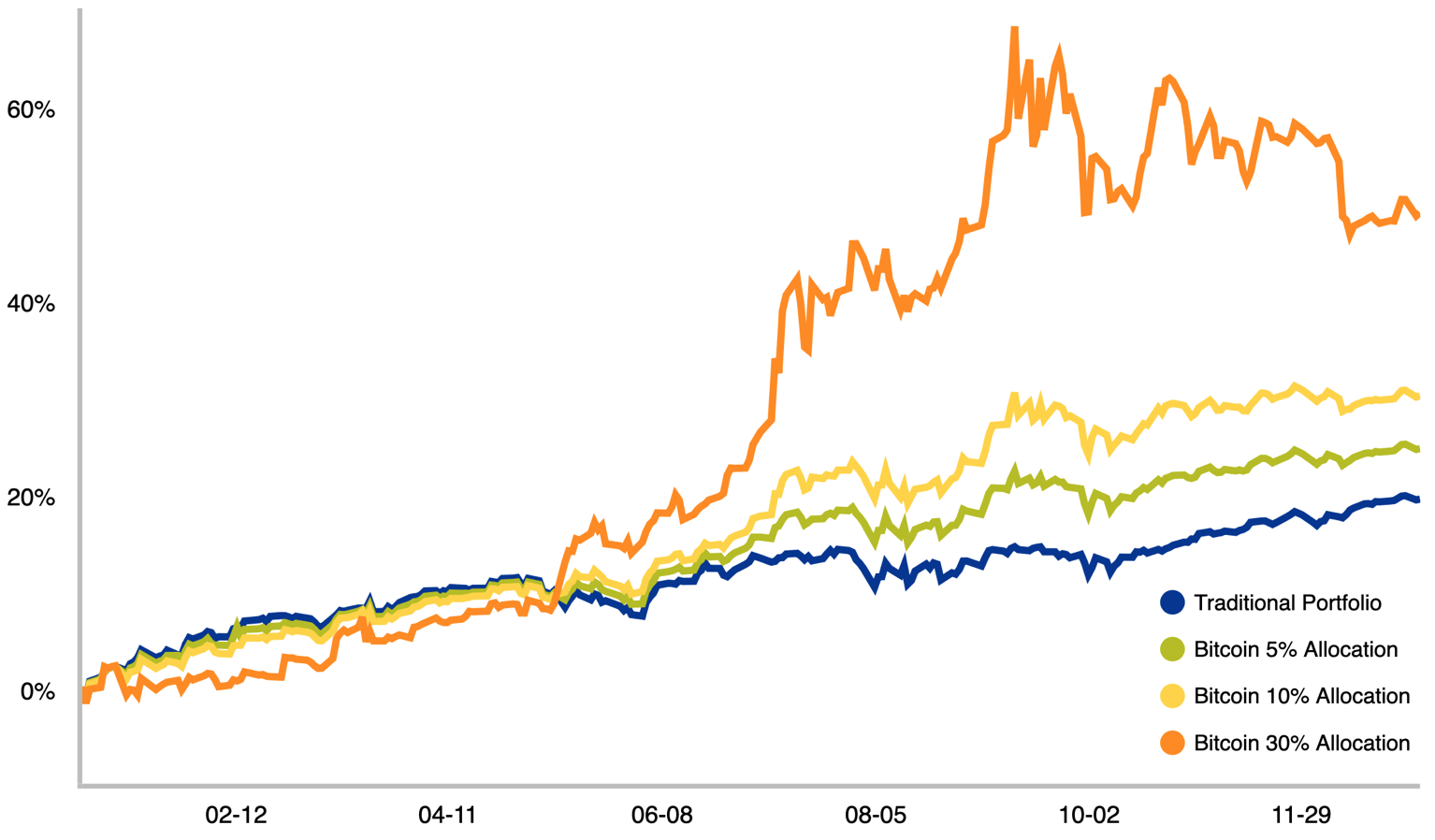

This portfolio would obviously outperform the average annual returns of 60/40 portfolio. The expected return of the model portfolio would also outperform the average annual returns of the S&P (9,8%). Now let’s look at 60/40 portfolio models with 5, 10, and 30 percent bitcoin allocations.

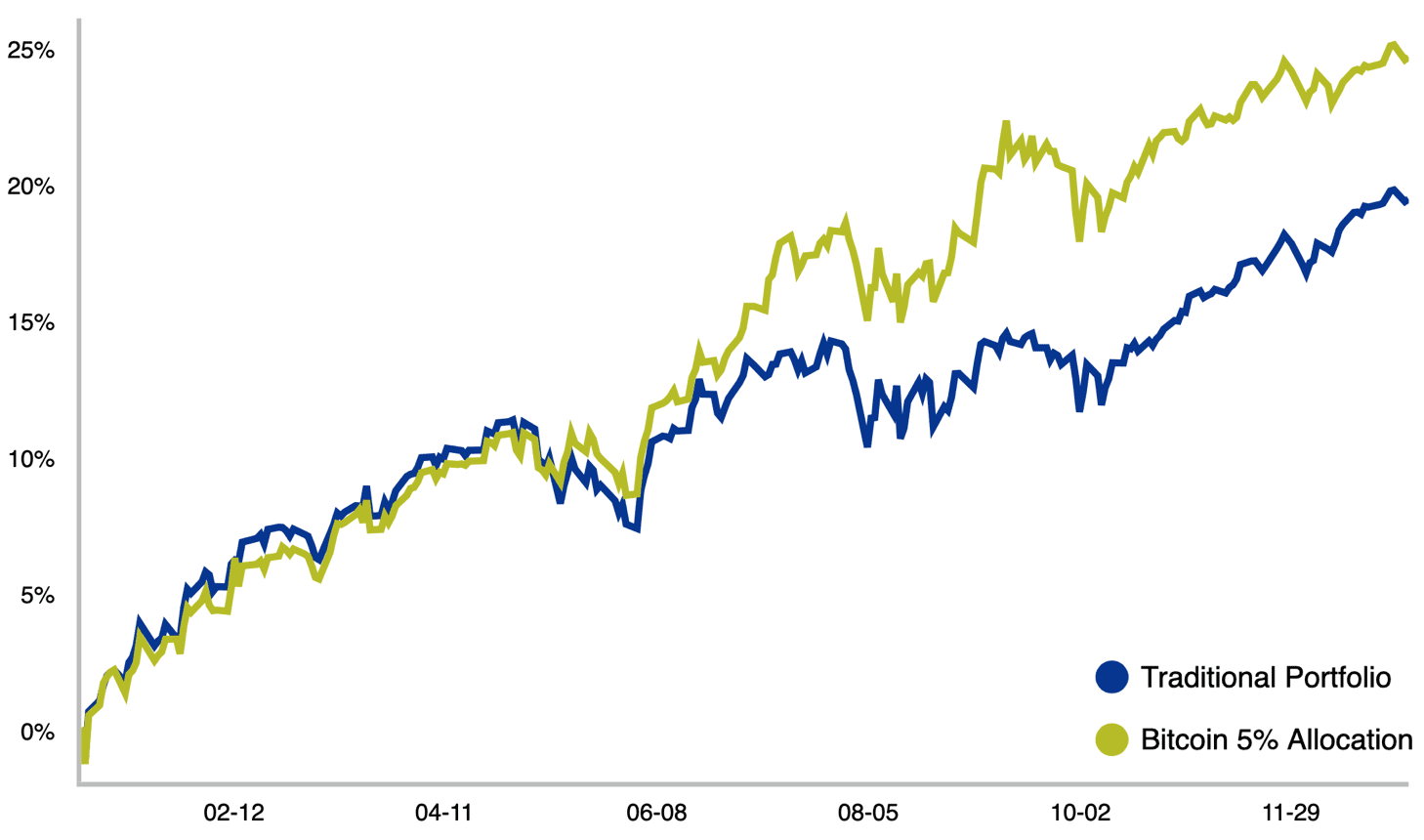

Even a small amount of bitcoin enhanced the performance of 60/40 portfolio through 2019. Namely, a 5% allocation to bitcoin provided 24,58% annual total return compared with 19,37 of the traditional portfolio. Sharpe ratios were relatively close with 2,448 for traditional and 2,999 for bitcoin enhanced portfolio respectively.

Total Return (%)

Traditional: 19,37%

Bitcoin Enchanced: 24,58%

Total Return (10K USD)

Traditional: $1936,78

Bitcoin Enchanced: $2458,07

Annualized Return (%)

Traditional: 19,37%

Bitcoin Enchanced: 24,58%

Annualized Return (10K USD)

Traditional: $1936,78%

Bitcoin Enchanced: $2458,07%

Sharpe Ratio

Traditional: 2,448

Bitcoin Enchanced: 2,999

Max Drawdown

Traditional: -3,58%

Bitcoin Enchanced:-3,63%

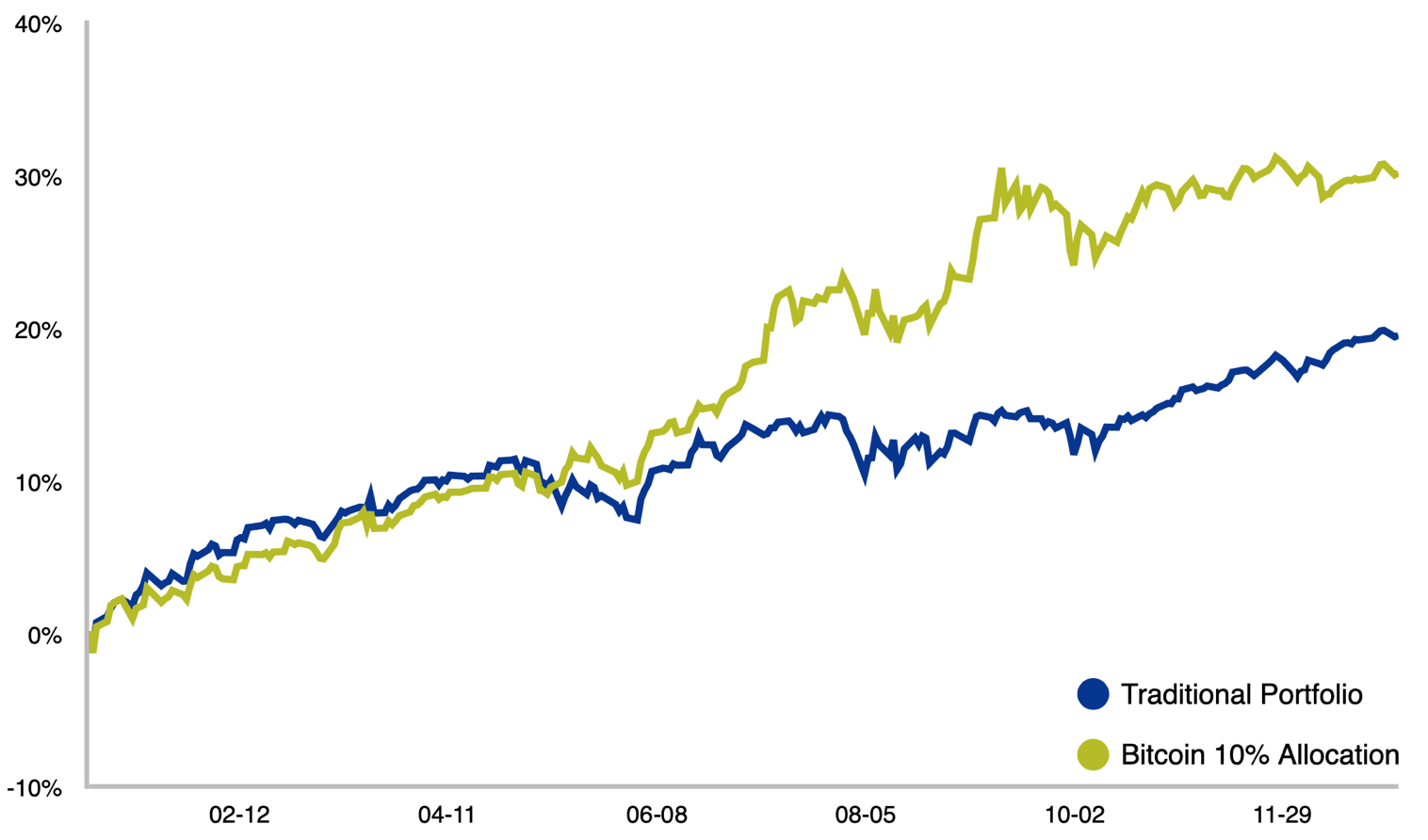

60/40 Portfolio with 10% Bitcoin Allocation

Additional bitcoin in portfolio offers additional benefits. For instance, a 10% bitcoin allocation uplifted the total return of model portfolio into 30,02 percent, well above the 19,37% benchmark. Sharpe ratio for 10% bitcoin portfolio grew to 3,043 and maximum drawdown to -4,89%.

Total Return (%)

Traditional: 19,37%

Bitcoin Enchanced: 30,02%

Total Return (10K USD)

Traditional: $1936,78%

Bitcoin Enchanced: $3001,55%

Annualized Return (%)

Traditional: 19,37%

Bitcoin Enchanced: 30,02%

Annualized Return (10K USD)

Traditional: $1936,78

Bitcoin Enchanced: $3001,55

Sharpe Ratio

Traditional: 2,448

Bitcoin Enchanced: 3,043

Max Drawdown

Traditional: -3,58%

Bitcoin Enchanced: -4.89%

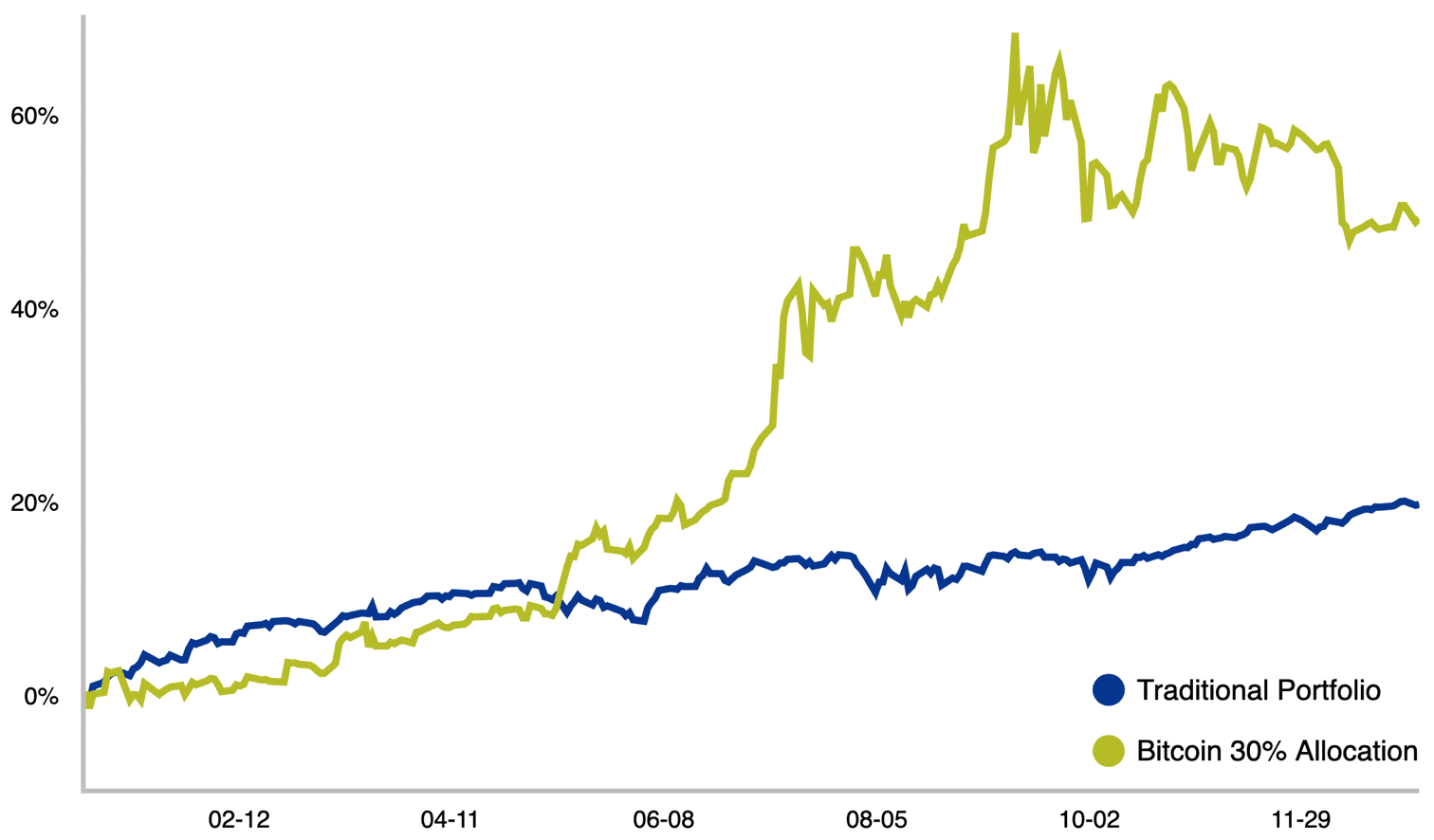

60/40 Portfolio with 30% Bitcoin Allocation

30 percent allocation into bitcoin provides significantly higher results. Moreover, annual total return for 30% BTC allocation rised to astonishing 48,9%. Exempli gratia, a 100 000 USD investment to the model portfolio in 2019 would have resulted a total return of 48 904,8 USD. While a 30% allocation to bitcoin might sound radical, it truly delivers.

Total Return (%)

Traditional: 19,37%

Bitcoin Enchanced: 48,9%

Total Return (10K USD)

Traditional: $1936,78

Bitcoin Enchanced: $4890,48

Annualized Return (%)

Traditional: 19,37%

Bitcoin Enchanced: 48,9%

Annualized Return (10K USD)

Traditional: $1936,78

Bitcoin Enchanced: $4890,48

Sharpe Ratio

Traditional: 2,448

Bitcoin Enchanced: 2,081

Max Drawdown

Traditional: -3,58%

Bitcoin Enchanced: -12,78%

Diversify portfolio with bitcoin: 60/40 Portfolio with 5/10/30% BTC Allocations

The author is an experienced bitcoin market analyst. He runs the bitcoin and blockchain consulting company dcresearch.