The TA of week 36 explores the recent macro environment, central bank policies, and latest technical indicators. Additionally, we examine Ethereum’s quickly approaching Merge as well as the relationship between the US dollar and bitcoin.

The cryptoasset market gained moderate momentum ahead of Ethereum’s Merge event this Thursday. However, the gains were mostly lost due to the bearish 8,3 percent CPI print announced on Tuesday. The protocol-level upgrade and paradigm shift Merge is, by current estimates, set to occur around 7 am on Thursday morning (15.9). The leading cryptocurrency, Bitcoin, is up 4,9 percent from last week, and the decentralized finance platform Ethereum -0,7%. The markets are mainly supported by two factors: Merge anticipation and the weakening dollar index (DXY), which is giving the high beta assets some leeway.

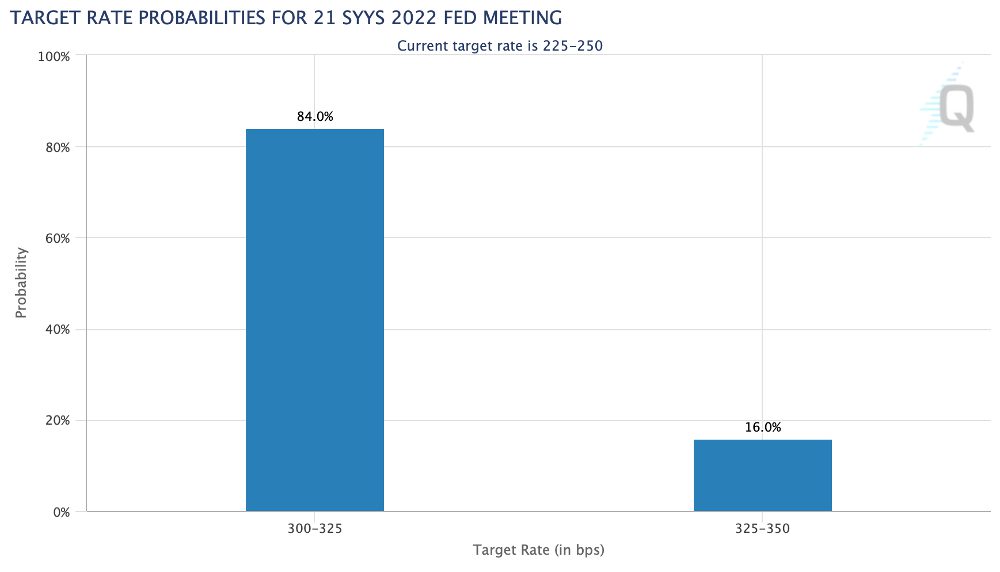

The August 2022 CPI data came out on Tuesday, indicating an 8,3 percent price climb on a yearly basis. The inflation has clearly decreased from July’s 8,5%; however, nervous markets sold off on the news, which pushed the leading stock market index, S&P 500, down -by 3%. CME’s data (above) shows how markets are expecting another 75 basis point rate hike in next week’s FOMC. Investment bank Nomura later expected the rate hike even to reach 100 basis points. Fed’s rhetoric has been particularly hawkish this year, cementing the continuation of rate hikes. Investors have been waiting for the Fed to pivot (hawkish -> dovish) for a while, but now it seems to be at least a couple of months away.

Essential Events This Week

Tuesday: CPI (8,3%)

Wednesday: PPI

Thursday: Ethereum’s Merge

Bitcoin’s spot price has been steadily trading inside the $20K confluence zone since the early summer correction. BTCUSD tried to break out towards the $25K level but was rejected in mid-August. Benchmarked against the previous 366-day bear cycle of 2018-2019, bitcoin’s bear market has only lasted for 220 days. However, many analysts believe bitcoin’s market cycles to become shorter over time. The 2018-2019 bear cycle formed a double bottom structure, which strongly resembles the spot price double bottom of summer 2022.

After a long epoch of declining spot prices, bitcoin has reached a potential technical “golden cross” setting. Bitcoin’s 50-day (cyan) and 200-day (red) moving averages reached a “death cross” setting back in May, as 50 DMA fell below 100 DMA. Now the two indicators are approaching again, signaling a potential shift in bitcoin’s course. Back in May, the approaching death cross setting acted as a leading indicator to the spot price, and the 50 and 200 DMA setting might lead spot price yet again.

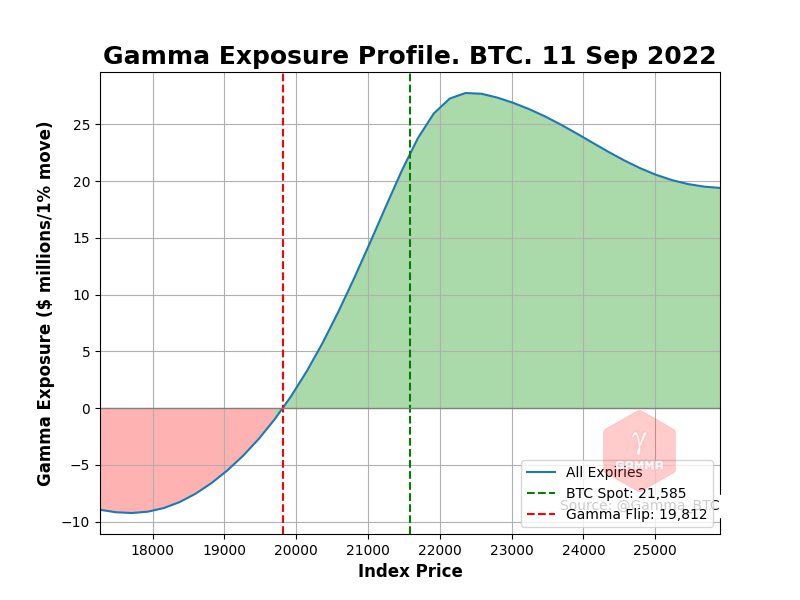

Bitcoin’s gamma exposure profile (GEX) of market makers shows a positive trend towards spot price levels of $22K and $23K, which mark the maximum gamma exposure. The GEX starts to drop after $23K level, confirming the relevance of these levels to market makers.

Bitcoin and other cryptocurrencies have found new momentum since last week; however, the market remains volatile due to the announcement of CPI data. S&P 500 strengthened by almost 5 percent from Monday to Monday. Looking at Kraken’s volume data, Bitcoin’s trading volume is currently approximately double ($155M) compared with Ethereum’s ($71,8M). Previously in August, the trading volume of Ethereum momentarily surpassed Bitcoin in a volume-based “flippening”.

Bitcoin (BTC): 4,9%

Ethereum (ETH): -0,7%

Litecoin (LTC): 2,8%

Aave (AAVE): -6,2%

Chainlink (LINK): -1,8%

Uniswap (UNI): -5,5%

Stellar (XLM): 2,4%

XRP: 2%

– – – – – – – – – –

S&P 500 Index: 1,96%

Gold: 0,23%

– – – – – – – – – –

Bitcoin’s 90-Day Pearson Correlation with S&P 500 Index: 0,51

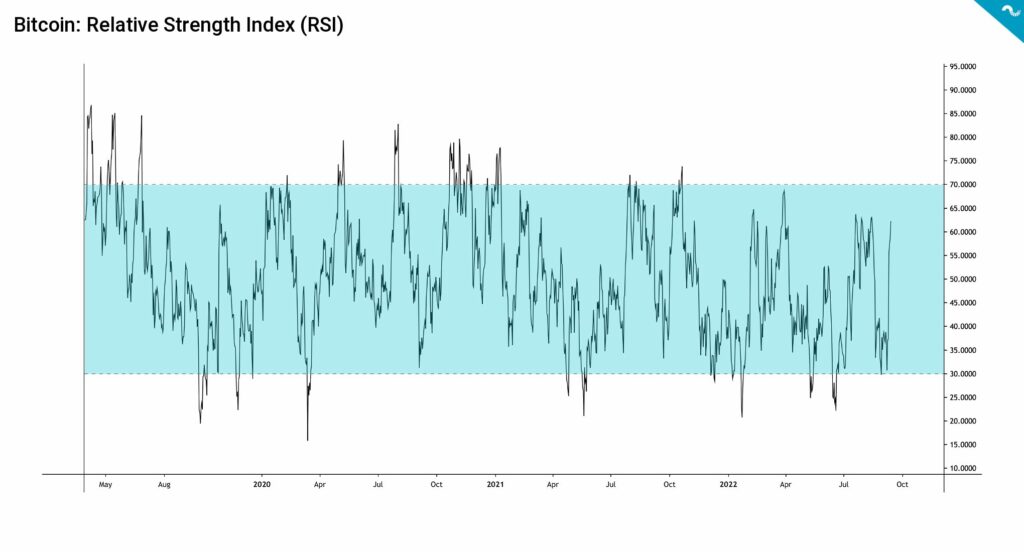

Bitcoin RSI: 62

Bitcoin’s relative strength index (RSI) has climbed to 62 and is currently forming a bullish divergence to the spot price.

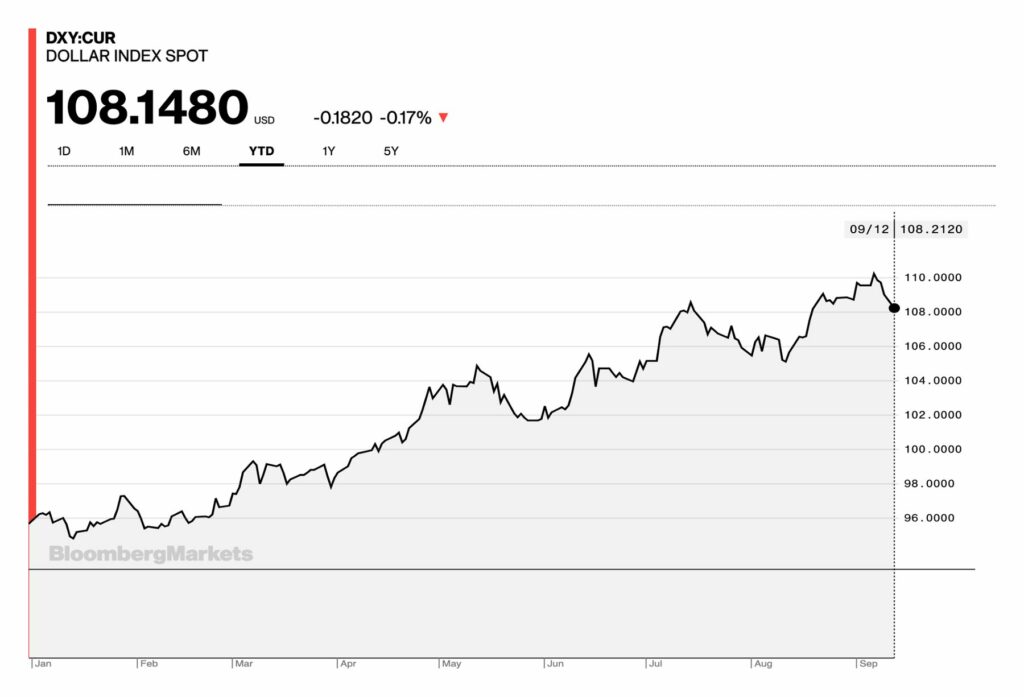

Has The US Dollar Index (DXY) Finally Reached its Peak?

The relationship between the US dollar index (DXY) and bitcoin has been a hot topic during this bear cycle, as the dollar has been showcasing exceptional strength characteristics. The dollar has had a rare 13,7 percent climb from early January 96 level to the current 109. DXY has formed an inverse correlation to bitcoin, and its strength is clearly poison to the crypto markets. The dollar – bitcoin relationship can be interpreted by the following logic:

DXY ↑ -> BTC ↓

DXY ↓ -> BTC ↑

Credit Expansion ↑ -> BTC ↑

Credit Contraction ↓ -> BTC ↓

In addition to the dollar – bitcoin relationship, cryptocurrencies have been heavily affected by credit expansion. As a general rule, bitcoin has been benefiting from credit expansion and rising alongside it. Consequently, the current credit contraction cycle has been challenging for the leading cryptocurrency. Praeterea, the impact of credit expansion and contraction has been even more pronounced towards small-cap tokens and NFT market valuations.

All Eyes on The Merge

The leading decentralized finance platform Ethereum is quickly approaching its defining “Merge” event, which is only a day away. The Merge is expected to occur during the morning hours (7 am) of Thursday, and markets are generally expecting the Merge to act as a catalyst for Ethereum’s price appreciation. The main selling point of the Merge will be the classification of Ethereum as a “green” and “ESG friendly” blockchain. Asset managers are increasingly aware of ESG-related topics, and significantly lower energy consumption would make Ethereum easier to sell to investors. The green narrative would also allow Ethereum to differentiate itself from PoW-based Bitcoin.

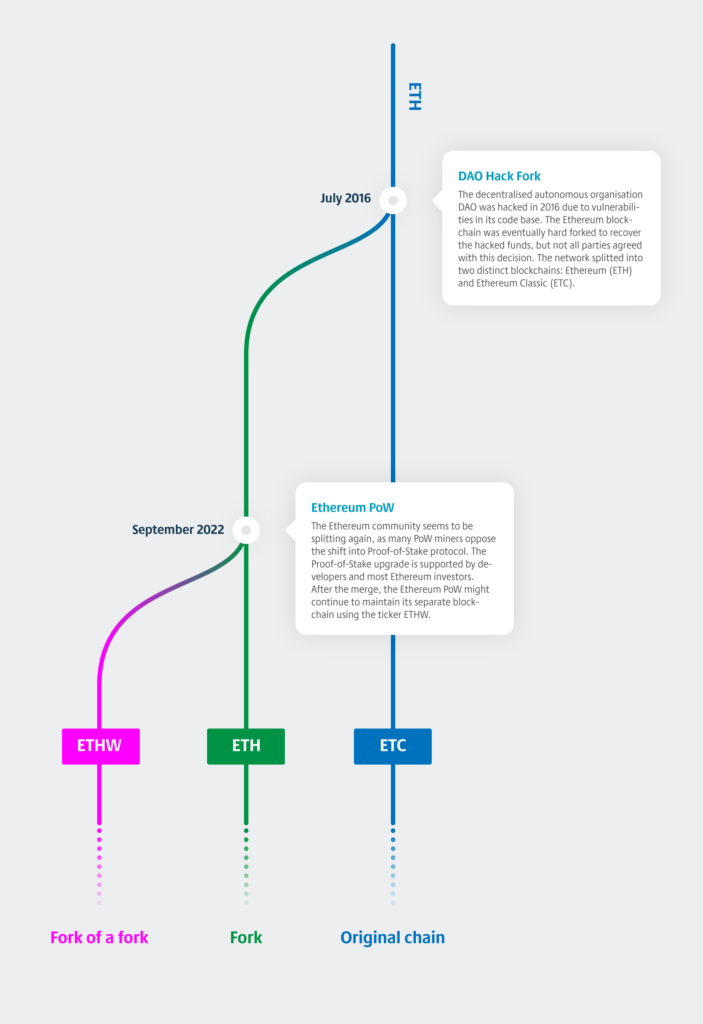

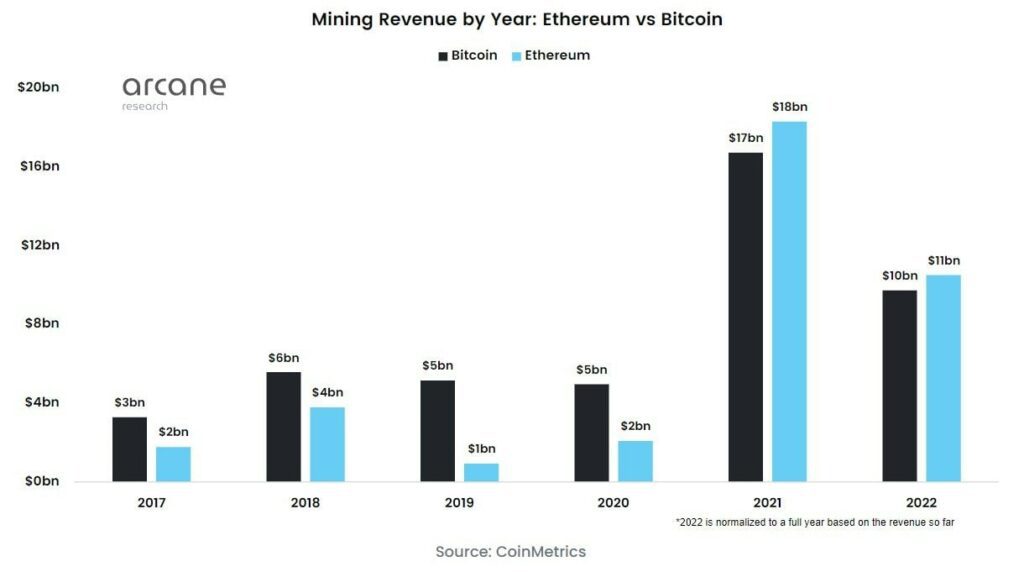

Despite the high hopes for the Merge, dark macro clouds seem to be moving in. In the current macro environment, the Merge might even be a “sell-off” event in case investor expectations don’t match the reality. The Merge itself makes Ethereum a significantly more scarce asset and will definitely act as a long-term horizon value driver. Ethereum’s mining revenue has been $11 billion so far in 2022, compared with Bitcoin’s $10B. Consequently, the PoW Ethereum has been a significant source of value for the mining industry. Although the EthereumPoW movement seemed to gain traction at first, supported by exchanges like Poloniex, Huobi, and BitMEX, the chances for a long-term surviving ETHW fork are slim. The former PoW Ethereum miners seem to be pivoting into alternatives like Ravencoin (RVN), which has climbed 108,4 percent within just 14 days.

What Are We Following Right Now?

Norway is building a Central Bank Digital Currency (CBDC) that will be based on Ethereum’s Layer 2 technology.

The current ERC-20 contract of #CBDC of the Norwegian central bankhttps://t.co/AMI6tQdCkX pic.twitter.com/bgjmaivlzj

— Mikko Ohtamaa 🐮 (@moo9000) September 13, 2022

Dynamic NFTs promise to have organic real-world utility.

1/ NFTs can be more than just static jpegs on a blockchain.

— Michael Robinson ⬡ (@77MichaelR) September 11, 2022

Dynamic NFTs provide a canvas for real-world utility.

A few dynamic #NFT (#dNFT) use cases: pic.twitter.com/VDUu8gvx5P

Housing markets are in bad shape globally. Existing home sales have fallen for six consecutive months, down -26 percent in half a year.

Housing markets around the globe are getting whacked.

— 𝐓𝐗𝐌𝐂 (@TXMCtrades) September 12, 2022

Australia in particular has a bunch of variable rate mortgages under special pressure as rates rise.

Over 55% of New Zealand mortgages are up for renewal in the next calendar year.

This is fine. 😳https://t.co/YsLJ6pSQj8 https://t.co/QBXcQc1Yqr pic.twitter.com/el4e043yue

The views, thoughts, and opinions expressed in the text belong to the author and not necessarily to the author’s employer, organization, committee, or other group or individual.