Last week a story surfaced on international media about a so called bitcoin “double-spend”, meaning the same coins being used twice. This supposedly spelled the end for Bitcoin, since such a flaw would imperil the whole system. As a result of this misconception, the already correcting price started sinking even lower.

However, in reality no double-spend ever happened. Instead the event was merely a natural part of the Bitcoin network’s standard operation. This week we will explain more about this double-spend canard that needlessly spooked the markets.

In other news we will talk about the recent global computer chip shortage, which also affects Bitcoin mining. Furthermore we have the growing number of Bitcoin nodes, as well as institutional interest remaining strong despite price swings.

Last week’s news can be read here.

Bitcoin double-spend did not happen

On the 20th day of January several media sources mistakenly reported that a so called “double-spend” scenario had occurred in Bitcoin’s blockchain. The term refers to a situation where the same funds are sent twice to two different recipient addresses.

The media even suggested this would be a deadly blow to Bitcoin, since one of the main principles of developing the Bitcoin protocol was to avoid such situations. As a result of the false news, Bitcoin’s price also immediately began tumbling downward, adding to the already ongoing correction.

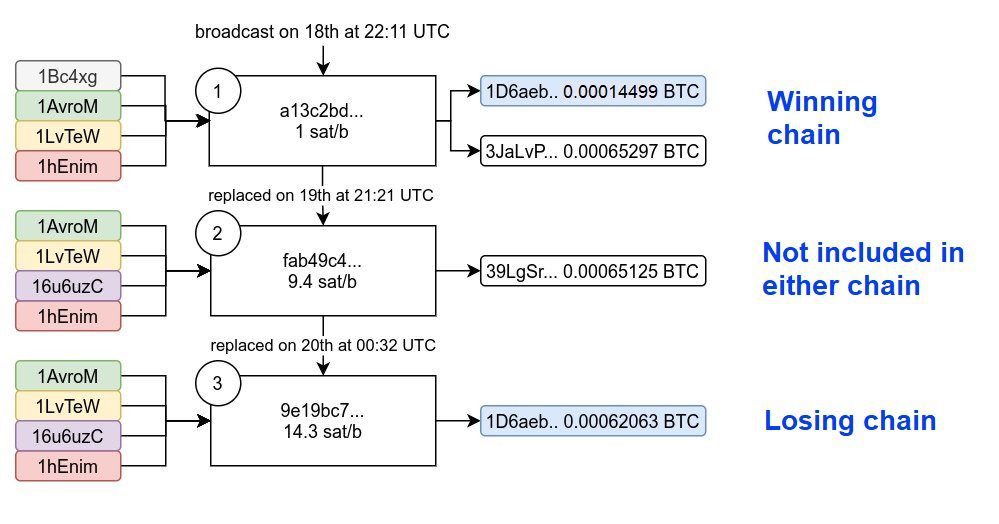

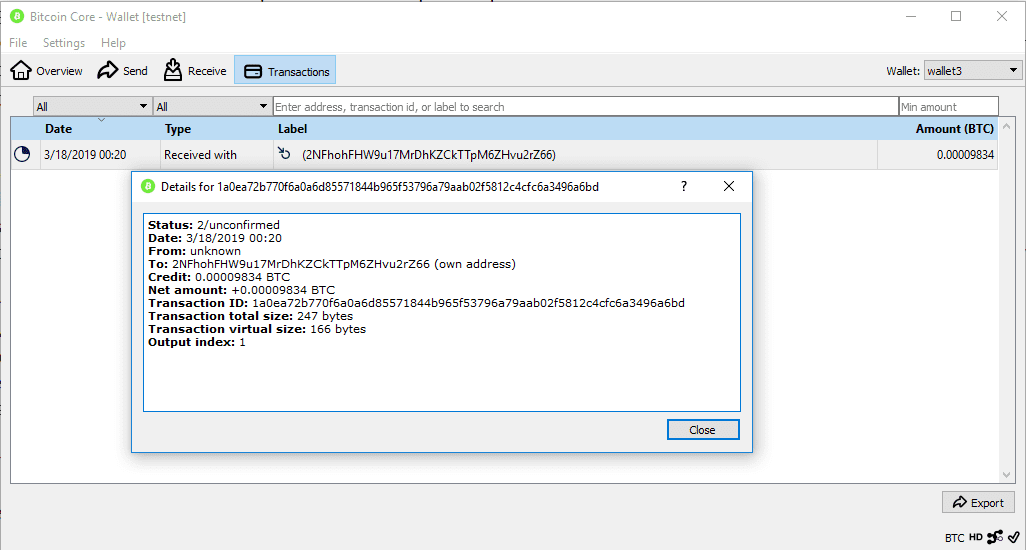

However, in reality no double-spend ever happened. What happened was that a small amount of BTC was sent simultaneously as the blockchain split in two. Therefore the same transaction was visible in two different blocks.

Events like this are completely normal and do not affect Bitcoin’s functionality in any way. After the blockchain was split, miners together chose a new chain as the only valid one. So while the transaction appears to have happened twice, the single accepted chain means it was actually only registered once in the blockchain.

In conclusion all the fuss about Bitcoin’s supposed deadly mistake was merely a widespread misconception of how the blockchain works. Nothing extraordinary, new or negative happened, and Bitcoin continues to perform as well or even better than before.

BTC price drops have not halted institutional interest

Bitcoin’s declining price does not appear to have slowed down the accumulation desires of Bitcoin whales and large institutions. According to Glassnode, the number of wallets containing more than 1 000 BTC grew while bitcoin’s price dropped below $30 000 dollars.

Glassnode reports that the number of wallets with more than 1 000 BTC did decrease toward the end of last year, but then began rising soon after the new year.

Also data by South Korean blockchain analysis firm CryptoQuant suggests institutional investors are on the move again. According to CryptoQuant BTC transactions are still high in numbers, but transfers from exchanges have not increased. This indicates that a majority of transactions are done without exchanges, which is a common procedure for institutional investors.

“Because institutional investors tend to have longer time frames in mind when investing, they are unlikely to be phased by January’s price decrease and potentially happy to make investments at lower prices,” commented Adam James from crypto exchange OKEx.

Number of BTC nodes breaks new record

The number of Bitcoin nodes has reached a new all-time high. According to Bitnodes.io, a website keeping count of nodes, there are currently 11 976 nodes active in the network. Another measure by coin.dance puts the number of active nodes at 11 810.

The earlier record for active nodes was reached in January 2020. Back then there were roughly 11 250 active nodes.

Bitcoin nodes refer to computers sharing the Bitcoin network while connected to other computers operating under the same rules. Such a computer logs and updates the entire Bitcoin blockchain and also allows other computers and Bitcoin client programs to copy and read Bitcoin’s blockchain.

The more Bitcoin nodes are present in the network, the safer and more independent the entire system becomes. Bitcoin nodes are also regarded as one of the securest ways to store bitcoins.

BTC thieves impersonate Microsoft

Coinmotion has recently received reports about scammers presenting themselves as Microsoft’s technical support. The perpetrators often speak English and call from foreign numbers.

In a typical scam the caller claims the target’s computer is infected by a virus and pretends to offer assistance to fix it. As one might guess, in reality no virus exists.

If the target follows the instructions, the scammers may then gain access to remotely control the target’s computer. If the computer contains bitcoins, the perpetrators will try to transfer them to their own addresses.

If bitcoins are safely stored on the computer, thieves cannot steal them even if they gain control of the computer. If passwords or other details in turn are stored elsewhere on the computer, they may be vulnerable to discovery.

The best way to avoid scams is to simply not answer calls from unknown foreign numbers. If one does happen to answer, the most important thing is to not follow the scammer’s advice. It is very rare that honest support workers would make calls of such nature.

Computer chip shortage also affects BTC mining

A global shortage of computer chips has also impacted Bitcoin and cryptocurrency mining, reports Reuters. Computer chip producers simply have no time to manufacture the chips in pace with their growing demand.

The demand for cryptocurrency mining equipment has exploded together with bitcoin’s new price records. The stocks of miner manufacturers are empty, but demand still runs rampant.

The scarcity of computer chips favors particularly large mining entities, who can afford paying higher prices for new equipment. Concerns have been raised that this further centers mining power to a few actors.

Aside crypto mining, the chip shortage also affects other sectors such as the production of computers, smartphones and cars. In crypto mining the shortage is even more dire, as chip producers have decided to focus more on traditional sectors regarded as more stable than the crypto industry.

Fake Satoshi trolls with copyright claims

Craig Wright, a man claiming to be Bitcoin’s creator and widely regarded a fraud, has struck again. This time Wright has targeted the original white paper published in 2008 by Bitcoin’s anonymous creator Satoshi Nakamoto.

So far Wright has presented no proof to support his claim and has been met with skepticism. Now he has decided to file a copyright claim for the original text of Bitcoin, despite the text originally being published with an open license.

Due to Wright’s demands the original white paper text has been removed from several websites, including Bitcoin databank Bitcoincore.com. The removal does not mean anyone actually believes Wright’s claims or that they would even pass in court. Instead the actions are a preventive measure to avoid wasting resources by fighting over the trivial matter in court.

Craig Wright has a long history of suing people for seemingly pointless things, regardless of what chances the suits actually have to succeed. Despite most likely being a mere hoaxer, his actions have still managed to cause harm to the Bitcoin community.