An escalating amount of institutions are looking to gain Bitcoin exposure. This article focuses on Bitcoin’s institutional value proposition, including an in-depth analysis of MicroStrategy and Grayscale.

Bitcoin is considered an asset is driven by retail demand. In addition to the retail segment, institutional players have increasingly been entering the scene from 2020 onwards. While some of the companies like Grayscale were already founded in 2013, the larger scale inflow of institutions can be seen to have occurred last year.

In July 2020, Michael Saylor and his company MicroStrategy (MSTR) brought institutional Bitcoin thesis to wider audiences. Saylor announced MicroStrategy to explore purchasing bitcoin, gold, and other alternative assets instead of holding cash (USD). Saylor’s public statements mark a turning point in the way institutions consider Bitcoin and digital assets, leading to broader acceptance towards the asset class.

How to Define Bitcoin

As Bitcoin combines multiple different attributes, it’s sometimes hard to define it as an asset. One promising framework is dividing bitcoin into three categories: Digital property, digital money, and digital energy.

Digital Property

Bitcoin can be described as a scarce digital property in the new digital world. Unlike traditional property investments, bitcoin doesn’t depreciate in use and consequently loses its value. Only 21 million pieces of this digital property will ever exist. Additionally, the cost of storing this digital property is nonexistent.

Digital Money

Bitcoin is used as a form of money. Bitcoin is a good asset for transactional purposes and enhanced by the Lightning Network (LN) adoption, optimal for microtransactions. Unlike FIAT-derived currencies, bitcoin is hard-capped, and its monetary base can’t be increased. Satoshi devised a new way to manufacture sound money that requires tremendous work (PoW). Fiat currency systems manufacture free and inflationary money. There is no actual cost for the traditional financial system to create more dollar, euro, or yen currency units.

Digital Energy

During times of increasing energy prices and inflation, bitcoin can act as an energy battery. Native bitcoin units can be mined in distant locations with cost-effective and renewable energy sources. The units operate as a store of wealth and energy, ready for future use cases.

Institutional Bitcoin Thesis

Bitcoin’s institutional value proposition can be divided into three tranches: Defensive, opportunistic, and strategic.

Defensive

Bitcoin is an excellent hedge against inflation. Storing cash reserves in the corporate balance sheet is risky as fiat currency is losing its value in an escalating manner. According to recent data, Germany’s inflation is rising at the fastest rate in 28 years. Bitcoin offers companies a defensive hedge against unsustainable monetary policies.

Opportunistic

Bitcoin is a highly scarce asset class, and recent data shows only 7 percent of bitcoin’s supply being liquid. Bitcoin’s built-in scarcity combined with illiquid supply creates a setting for a perfect storm, potentially leading to parabolic price advances. Even allocating a small percentage of corporate cash reserves to bitcoin creates a huge upside opportunity. In a bigger picture, Bitcoin heavily disrupts the traditional finance industry, offering a valid decentralized alternative.

Strategic

Bitcoin allocation can be seen as a strategic investment, combining the company’s business moat with digital gold. As Michael Saylor mentioned, MicroStrategy’s software revenue grew at 0% per year until their bitcoin allocation. The bitcoin strategy was brilliant in a strategic sense but also enhanced MicroStrategy’s underlying software business.

The Institutional Bitcoin Market

Often dubbed the “Unofficial Bitcoin ETF,” MicroStrategy (MSTR) is the king of the institutional bitcoin market, currently holding 114042 native units. MicroStrategy announced its revolutionary strategy in July 2020, and the company has been purchasing bitcoin since using the dollar-cost averaging method (DCA).

MicroStrategy’s move was soon followed by automotive and technology company Tesla (TSLA), purchasing 48000 bitcoins. Tesla has tightened its bitcoin exposure since currently holding 42902 BTC. The third-largest treasury of publicly listed companies belongs to Galaxy Digital, an asset management company holding 16400 units. Galaxy Digital is perhaps best known for its CEO Michael Novogratz.

MicroStrategy (MSTR), Michael Saylor, and DCA

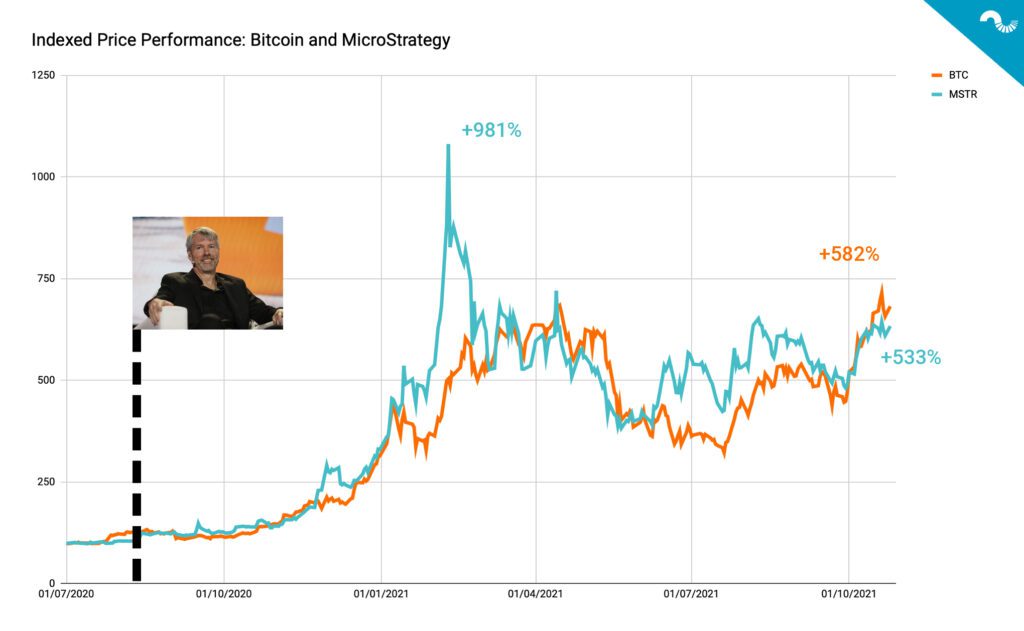

Michael Saylor’s effect on the bitcoin market has been monumental since summer 2020. Bitcoin (BTCUSD) has increased +582 percent since MicroStrategy announced its new path in terms of price performance. MicroStrategy’s new direction has also been incredibly beneficial for the publicly listed company itself, with MTSR stock growing parabolically almost 1000% from Q3 2020 to Q1 2021. Saylor has disclosed he holds 17732 bitcoins with an average buy price of $9882.

“Bitcoin is the most universally desirable asset property in space and time. It’s the property with the lowest maintenance cost.” – Michael Saylor.

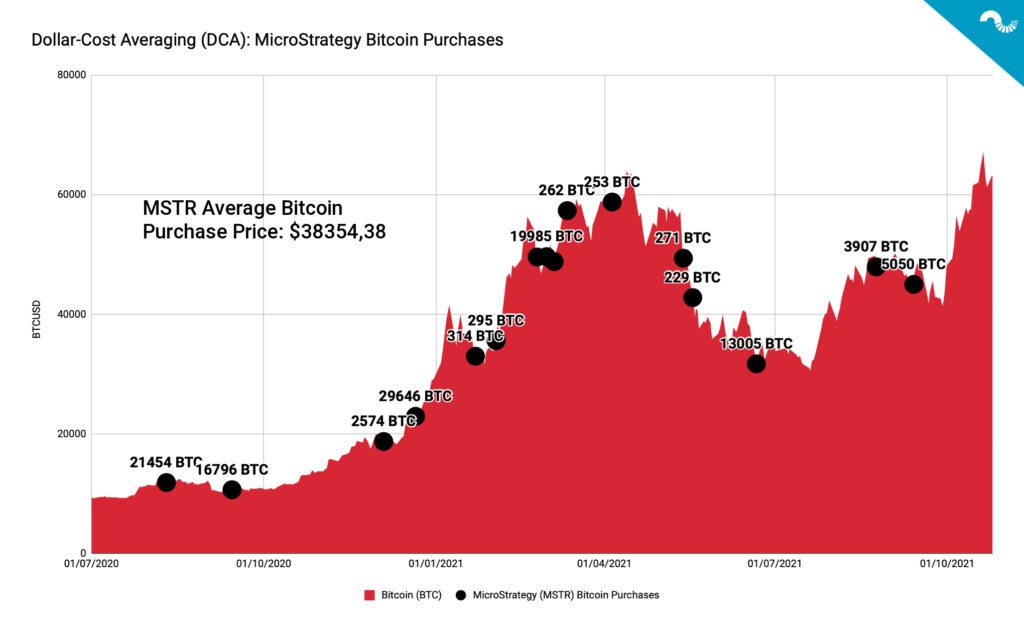

How did MicroStrategy purchase its 114042 bitcoin units? The answer is dollar-cost averaging (DCA). Dollar-cost averaging is an investment strategy in which the investor divides the total amount invested across periodic purchases of a target asset to reduce the impact of volatility on the overall purchase. The purchases occur regardless of the asset’s price and at cyclic intervals.

MicroStrategy has purchased BTCUSD on sixteen occasions with an average purchase price of 38354,38 USD. DCA removes much of the detailed work of attempting to time the market in order to make bitcoin purchases at the best prices. In summary, MicroStrategy has entered a buy & hold mode: Only on the buy-side, holding regardless of the market situation.

In addition to bold Bitcoin and DCA strategies, the ownership structure of MicroStrategy is interesting. Traditional finance companies own a significant part of MSTR shares, BlackRock alone 14,33 percent. As mentioned before, MicroStrategy is perceived as the “Unofficial Bitcoin ETF,” and smart money has seemingly found a convenient way to gain bitcoin exposure via MicroStrategy ownership.

Ten Largest Owners of MicroStrategy (MTSR):

Michael Saylor: 23,7%.

BlackRock Fund Advisors: 14,33%.

Capital International Group: 12,25%.

The Vanguard Group: 8,83%.

First Trust Advisors: 3,36%.

SSgA Funds Management: 3,15%.

Morgan Stanley & Co: 2,35%.

Dimensional Fund Advisors: 2,12%.

Invesco Capital Management: 1,82%.

Morgan Stanley Investment Management: 1,78%.

Geode Capital Management: 1,75%.

Grayscale and Competition

Launched back in 2013, Grayscale is one of the iconic institutional bitcoin companies of the industry. Grayscale is known for its crypto-related funds, including GBTC, ETHE, and others. Grayscale was long the only practical way for traditional money to invest in digital assets, and it used its monopoly position to charge notable fees (2%).

Recently Grayscale has been facing increasing competition from new ETFs, first in Canada and now in the U.S. as companies like ProShares are launching their ETFs. The futures-based ProShares Bitcoin Strategy ETF (BITO) just launched but has trouble following the underlying asset (bitcoin). BITO is currently down -7.64%, compared with GBTC’s -0,83%. Grayscale plans to convert GBTC into a spot ETF as soon as possible.

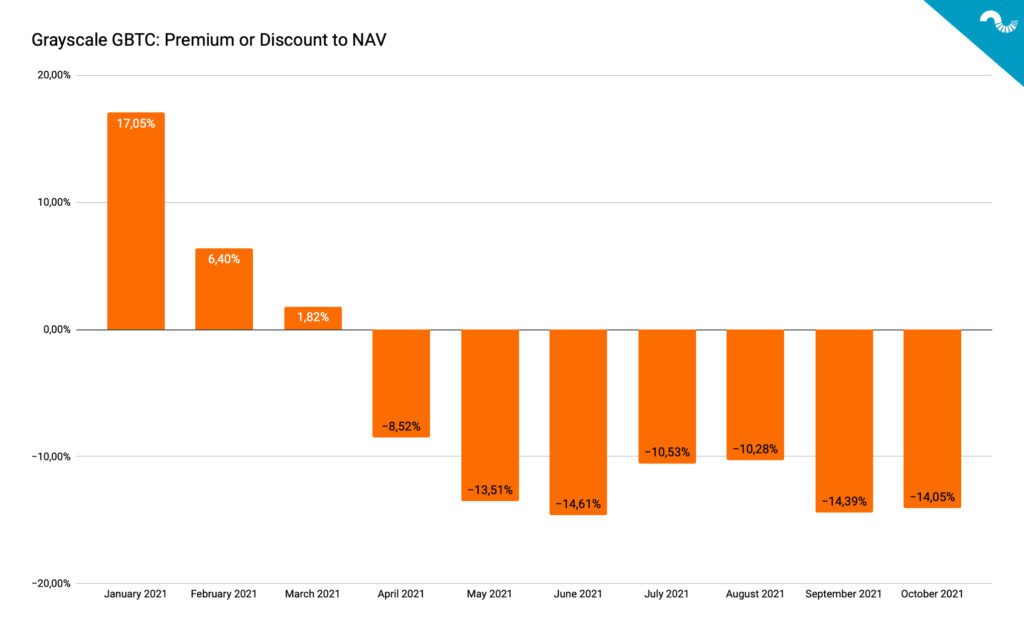

One of the most interesting features of GBTC has been its premium over bitcoin’s price, peaking at +132,6 percent in late May 2017. Premium, or discount to net asset value (NAV), refers to the difference between the nominal value of the trust holdings versus the market price of the holdings.

Recently the premium has been on a downward trajectory, descending from January +17,05% to June -14,61%. The dropping premium (or discount) was a leading indicator of bitcoin’s price during previous years and recently in Q1 and Q2 2021. Investors are currently pricing in the possible GBTC ETF conversion, and the premium could bounce to positive numbers again.