Another week has passed and it’s time to peek inside the wondrous world of cryptocurrencies. This time we will take a look at institutional investors, meaning the big boys and girls on the markets.

According to a new study already more than a third of all institutional investors have invested in bitcoin and cryptocurrencies. This marks a clear rise from previous years. The study also estimates up to nine out of ten investors may own crypto in the future.

In other news we have transaction fees. The Ethereum network recently saw two small transactions in which millions were paid in fees without any apparent reason. Meanwhile a fresh report states that transaction fees may not be a problem for cryptocurrencies, but rather an advantage rooting out unnecessary use.

Furthermore we have privacy coins that are not so private, suspicions regarding Binance and CoinMarketCap as well as Craig Wright, who now claims to have been behind the infamous Mt. Gox hack.

Last week’s news can be found here.

A third of all institutional investors own crypto

Already over a third of all institutional investors have invested in cryptocurrencies. According to a survey by Fidelity Investments, approximately 36% of the whole world’s institutional parties are involved in crypto investing.

Fidelity’s survey also states that interest in crypto varies geographically. In the United States 27% of investors own crypto assets, marking a rise from last year’s 22%. In Europe the number is closer to 50%, meaning nearly half of all investors own virtual assets.

The most popular crypto investment by far is bitcoin. More than 25% of all interviewed investors reported owning bitcoins. The second most popular cryptocurrency is the Ethereum blockchain’s ether, owned by 10% of investors.

Investors also seem to have faith in the continued growth of cryptocurrency investing. According to the survey, 91% of companies believe at least half a percent of their investments will comprise of crypto assets within five years.

Chainalysis can now track Zcash and Dash

Blockchain analysis service Chainalysis has announced they are now able to track privacy coins Zcash and Dash. According to Chainalysis it is generally wrong to even label Zcash and Dash as privacy coins, since they are far from anonymous.

Chainalysis also reports that many independent wallet programs supporting Bitcoin and Litecoin have more advanced privacy than Zcash or Dash, even if these crypto are not presented as anonymous.

According to Ryan Taylor, CEO of Dash Core Group, developers of the project are satisfied by Chainalysis’ support. Reasons behind this include that better traceability also gives political and legal clarity. The more anonymous a cryptocurrency is, the more negatively it is likely to be met by policymakers.

This phenomenon is visible in the case of Monero, regarded as one of the most private coins. Lately several cryptocurrency exchanges have stopped exchanging Monero, citing regulatory problems related to its advanced privacy as a reason.

CoinMarketCap accused of favoring Binance

The world’s most popular cryptocurrency statistics service CoinMarketCap has recently met heavy criticism. In April the service was bought by crypto exchange giant Binance, whereafter CoinMarketCap’s practices have seen some changes. After these changes Binance suddenly got full points from CoinMarketCap.

The change has stirred suspicions, since Binance was earlier placed 15th in the ranking between crypto exchanges. Nonetheless, CoinMarketCap claims the altered algorithms do not favor their new owner and have already been in development a longer time.

At the core of CoinMarketCap’s statistics reform is a will to unify all data into one number. This means that for instance bitcoin and ether markets are weighed together, while they used to be assessed separately. CoinMarketCap also stated they have started using machine learning, whereby the site will produce more accurate data over time.

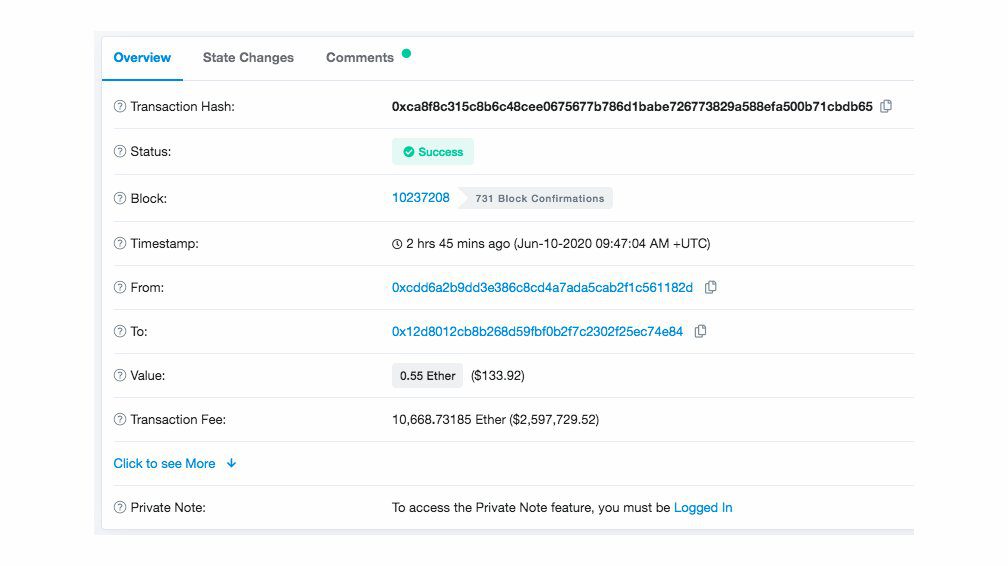

Small Ethereum transaction sent with millions in fees

Last Wednesday an unknown Ethereum user sent a transaction worth roughly $133 dollars while using a transaction fee amounting to$2.6 million dollars. Normally a transaction in the Ethereum blockchain costs around 50 cents.

A day later on Thursday another transaction of 350 ethers was sent from the same wallet. Also this time the sender paid a fee of $2.6 million dollars for the transaction.

At the moment there is no further information on the transaction’s sender or receiver. The sender seems to be rather wealthy, since the wallet still contains over $11 million worth of ether after wasting $5.2 million on transaction fees.

Mining group Spark Pool that processed the transaction is trying to figure out the sender’s identity in order to verify it it was just a mistake or something else.

Transaction fees prevent unnecessary use

Blockchains enabling free transactions are prone to different disturbances and attacks, report blockchain researchers. According to the report an overwhelming majority of transactions in EOS, Teos and XRP Ledger have no actual value or are sent from users to themselves.

“Our analysis reveals that only a small fraction of the transactions are used for value transfer purposes. In particular, 96% of the transactions on EOSIO were triggered by the airdrop of a currently valueless token; on Tezos, 76% of throughput was used for maintaining consensus; and over 94% of transactions on XRPL carried no economic value,” the researchers state.

Generally the research concludes that if blockchain transactions have no costs, the blockchain will see an overflow of unnecessary or harmful transactions. Even low transaction fees have a notable effect in minimizing unnecessary transactions.

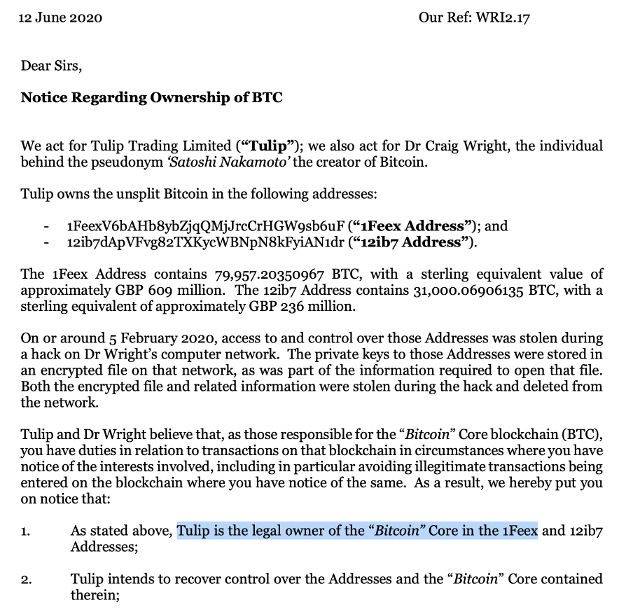

Craig Wright involved in Mt. Gox hack

Australian businessman Craig Wright has claimed responsibility for the infamous Mt. Gox hack via his lawyers. The news was reported by Monero developer Ricardo Spagni.

Wright is currently entangled in a trial accused of having stolen bitcoins from his deceased business partner Dave Kleiman. Wright claims to own at least a part of the so called Tulip Trust, which is a group of Bitcoin wallets including roughly 1.1 million bitcoins.

According to Spagni one of these wallets is the same address starting with ‘1Feex’ to which bitcoins stolen from Mt. Gox were originally moved. Wright’s lawyers have verified the address belongs to him.

At this point it is still highly uncertain if Wright actually has any connection the Mt. Gox hack. Wright has on several earlier occasions presented groundless claims, and it is quite possible this case is also a ruse.