Bitcoin is the cryptocurrency that sets in motion a worldwide phenomenon that proponents insist is the next revolution in wealth while others are more skeptical. Regardless of what you think, you can’t deny the explosive growth of Bitcoin and other related cryptocurrencies in recent years. One of those alternatives with strong potential is Cardano. Bitcoin vs Cardano, which one is better to Invest In?

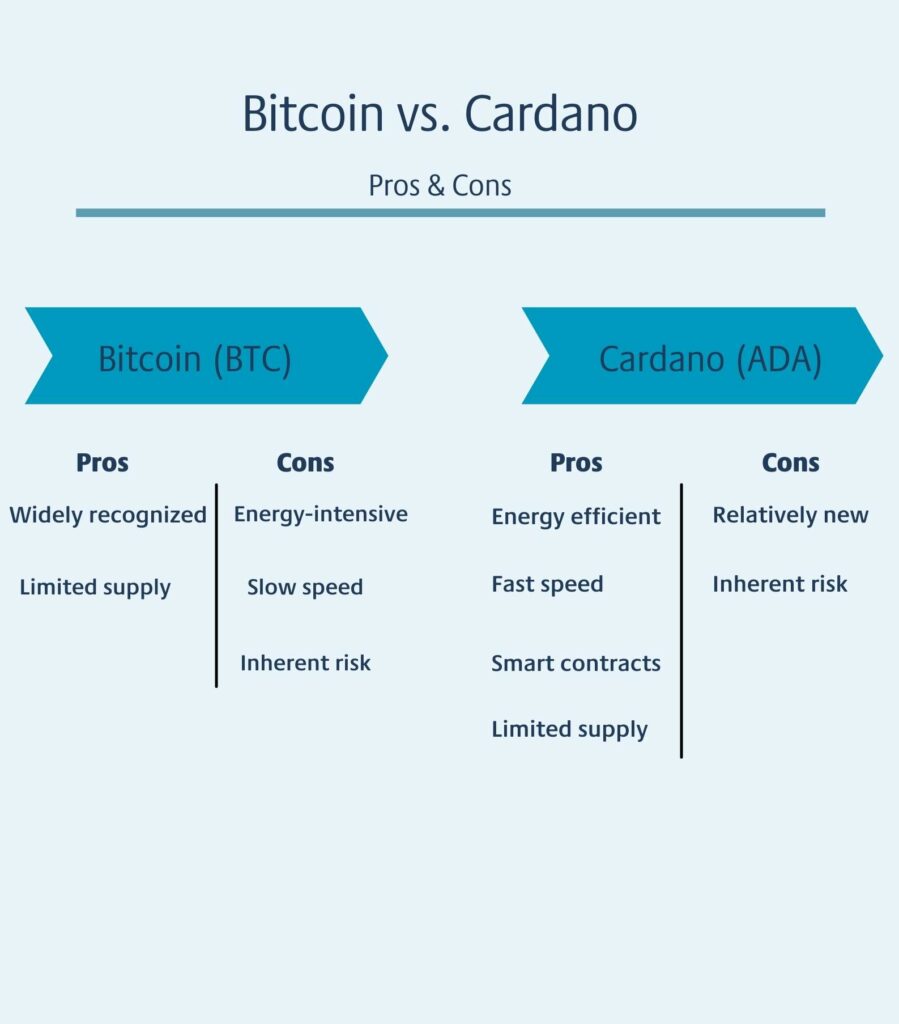

The question that investors need to ask themselves is, “Which one is worth the risk?” All cryptocurrencies come with some inherent risks, advantages, and disadvantages.

Depending on your own preferences and tolerance for risk, the choice between the two can be a difficult one, so this guide will outline some of the differences between Bitcoin and Cardano.

Read on to learn the key differences between Bitcoin and Cardano.

Making a Case for Bitcoin: Is it better to invest in Bitcoin vs Cardano

One of the most recognizable names in the industry, Bitcoin (BTC), has the advantage of being first to the party. Because cryptocurrencies rely on name recognition and popularity, investors often look to this one first.

Pro: Widely Recognized

Almost everybody knows about Bitcoin, including those who otherwise have no interest in cryptocurrency. This popularity has resulted in extensive institutional recognition, and the organizations that support and accept cryptocurrency almost inevitably allow for Bitcoin.

Having a high adoption rate is a positive sign that a currency will endure in the long term. Bitcoin, of course, has the head start in this department.

Investors can even gain exposure to Bitcoin in the traditional capital markets, including through dedicated Bitcoin Futures, Bitcoin ETFs, and other publicly traded companies with direct exposure to Bitcoin.

Con: Energy-Intensive

Mining Bitcoin requires a notoriously high amount of energy. This is relevant to miners and people interested in responsible investing and green projects.

Studies have shown that total mining operations use up more electricity than entire developed nations. However, Bitcoin mining energy consumption isn’t always bad energy consumption.

Investors should be mindful of the impacts of energy consumption. In some cases, this may increase the cost to mine individual coins. In other cases, it could make energy-intensive cryptos the target of environmental regulations.

Con: Slow Speed

During the BTC mining process, powerful computers must create new blocks by solving complicated equations, enabling a more secure coin, and preventing double-spending. However, this process takes a long time to complete and can put a cap on BTC’s efficiency.

Investors looking for the most efficient cryptocurrencies should look for coins that leverage smart contracts and the fastest iterations of blockchain technology, such as Cardano, Ethereum, and other Ethereum-based coins.

Con: No Smart Contracts

Another pitfall of Bitcoin is its lack of support for smart contracts. Simply put, Bitcoin doesn’t allow developers to build applications in it, directly affecting the usability of the blockchain.

However, this tradeoff does come with the added benefit of a more secure network. So, depending on what you’re looking for in crypto, this may be a debatable point.

Investors looking for highly scalable and futureproof coins will want to look for cryptos that use smart contracts. However, the lack of smart contracts doesn’t mean you shouldn’t invest in a coin.

Making a case for Cardano: Is it better to invest in Bitcoin vs Cardano

Cardano (ADA) began as a project from one of the founders of Ethereum, and, as a result, it shares some of the characteristics of its “predecessor.”

Pro: Energy-Efficient

Unlike Bitcoin, Cardano has the advantage of being based on the “Proof of Stake (PoS)” concept. Miners can validate transactions and blockchain at a speed proportional to how many coins they have. This system is an evolution of the previous “Proof of Work (PoW)” concept that required expensive mining operations.

As a result, Cardano manages to use up far less electricity during transactions compared to Bitcoin and runs faster as well.

Investors will not have to worry about potential regulation and exponentially increasing costs with an energy-efficient coin like Cardano.

Pro: Fast Speed

Transaction speed is much faster under Cardano. Expect at least 257 transactions per second compared to only 5 for Bitcoin. New developments are also looking to further boost this figure, such as the new scaling solution known as Hydra 2.

Investors will never have to worry about scaling challenges like those faced by Bitcoin several years back. Cardano uses the latest blockchain technology to ensure transactions are processed rapidly, making it more user-friendly and increasing the likelihood of mainstream adoption.

Pro: Smart Contracts

A holdover from Ethereum, Cardano supports the “smart contract” transaction protocol. This feature helps control and document contracts and agreements to reduce fraud, reliance on intermediates, and accidental exceptions.

Smart contracts take the form of programs running in the Cardano blockchain that only execute when certain conditions are met. Both parties, in this case, can be certain of the outcome.

It’s important to note that ADA is only recently rolling out support for smart contracts, and technically Bitcoin itself could adopt the technology later as well.

Investors should see smart contracts as a useful tool that boosts the number of use cases available for crypto they are thinking of investing in.

Con: Relatively New

Having been launched only in 2017, Cardano is a relatively new cryptocurrency and will struggle with gaining a high adoption rate early on, thanks to a low market cap.

Of course, no one knows what the future will be like. Cardano has seen a few instances of rising value, but investors should be aware of the increased risk of working with a coin in its infancy.

Investors should always be wary of “newer” cryptos. Keep in mind that the broader crypto markets can be volatile, which puts pressure on newer coins.

Attributes That Apply To Both: Is it better to invest in Bitcoin vs Cardano?

Some characteristics are shared between BTC and ADA, both selling points and sources of concern.

Pro: Limited Supply

There can only be 21 million Bitcoin tokens in existence, and a similar limitation is up for Cardano. This limitation on supply and production is what drives up the value of the currency and helps protect against inflation. Cryptocurrency enthusiasts often refer to these coins as a digital gold standard for this reason.

Investors should see limited supply as a way to control the influx of new coins. By limiting the number of new coins that enter circulation, crypto can better control the rate of inflation.

Con: Inherent Risk

As mentioned before, all cryptocurrencies have inherent and unavoidable risks. No one knows which ones will have wide adoption rates in the future or where the value will go. Bitcoin and Cardano are no exceptions.

Investors should always be aware of the inherent risk that comes with investing in cryptocurrencies. While crypto investments can be incredibly profitable, like any form of investing, there are no guarantees.

Other Differentiators

The following list includes characteristics that are not necessarily “pros” or “cons” but rather descriptors of the differences between the two currencies.

Governance: Is it better to invest in Bitcoin vs Cardano?

Cryptocurrency proponents often argue that a currency with no central governing authority is ideal since it eliminates a single group’s chance to exploit it. This argument does indeed apply to Bitcoin, as it does not have a central foundation.

Three entities actually govern Cardano:

- The IOHK, blockchain research and engineering organization

- The Cardano Foundation

- EMURGO, another blockchain technology company

The development of ADA goes under these organizations, and new changes in the protocol happen largely through them. Some experts argue that this structured approach allows for more steady growth of the currency.

Investors can heavily benefit from strong governance. A cryptocurrency with strong governance means it has engaged leadership, a strong community, and general support from the market based on the roadmap it’s executing towards.

Long vs. Short-Term: Is it better to invest in Bitcoin vs Cardano

Trading Cardano is fast and quick thanks to lower processing times, but those wanting a more stable passive income opportunity might want to look into the long-term viability of Bitcoin.

What we think is that long-term investors should stick with BTC, but those looking for a short-term and potentially more lucrative investment should consider ADA.

The Final Takeaway: Is it better to invest in Bitcoin vs Cardano?

Ask any cryptocurrency trader today, and you’ll likely hear more enthusiasm for Bitcoin than Cardano. Not many people have even heard of the latter, and there’s no doubt that Bitcoin’s value will always have peaks in the future.

At the same time, Cardano does have its own set of unique strengths like smart contracts and faster, more efficient processing. ADA can be seen as a more technologically advanced option that will likely see success anyway, at least in short.

Another consideration is that, because BTC is the most popular cryptocurrency on the market, its trends tend to reflect in other currencies as well, including Cardano. Of course, which ones to add to your portfolio depends on your own needs and preferences as a cryptocurrency investor.

Bitcoin and Cardano on Coinmotion

Are you looking to trade Bitcoin or Cardano? Sign up for a free Coinmotion account today, and instantly gain access to the cryptocurrency markets.

Bitcoin is available for all Coinmotion users to buy, store, and sell. Cardano is available to Coinmotion Wealth customers — in summer 2021, ADA became the most OTC-traded coin for them. Coinmotion Wealth is a free service for all users who invest more than 10,000 euros on Coinmotion. To learn more about what Coinmotion Wealth can do for you, click here.

The following piece does not include any investment advice. It is worth noting that investing in any digital asset includes risks, which should be carefully assessed before making important decisions.

The views presented in the piece are the author’s own views and do not represent Coinmotion’s opinions.

One Response

Looking at the way ADA is progressing in value market compared to Bitcoin, ADA is pretty slow in value growth. Even the prediction for the next 5 years (which I know is very hypothetical) growth, it supports more for Bitcoin.

ADA is a great project, only time will tell abiut the vakue creation.