The TA of week 13 focuses on recent technical and fundamental indicators. Additionally we explore how Luna Foundation Guard of Terra ecosystem is challenging MicroStrategy in the institutional Bitcoin game.

Despite the increasing geopolitical and macro-level risk, the cryptocurrency market has been aligned with positive technical indicators during past seven days. Bitcoin has ascended 1,9 percent in a week and its decentralized finance rival Ethereum 4,9%. The decentralized finance has been busy with coins like Aave and Solana rising in the range of 30%.

The leading stock market index S&P 500 remained almost flat (0,23%) and gold even weakened -0,56%. If we believe in gold’s investment narrative as an inflation hedge, it should be performing better in the current environment.

7-Day Price Performance

Bitcoin (BTC): 1,9%

Ethereum (ETH): 4,9%

Litecoin (LTC): -3,8%

Aave (AAVE): 31,8%

Chainlink (LINK): 2,8%

Uniswap (UNI): 3,5%

Stellar (XLM): 4,7%

XRP: -2,3%

– – – – – – – – – –

S&P 500 Index: 0,23%

Gold: -0,56%

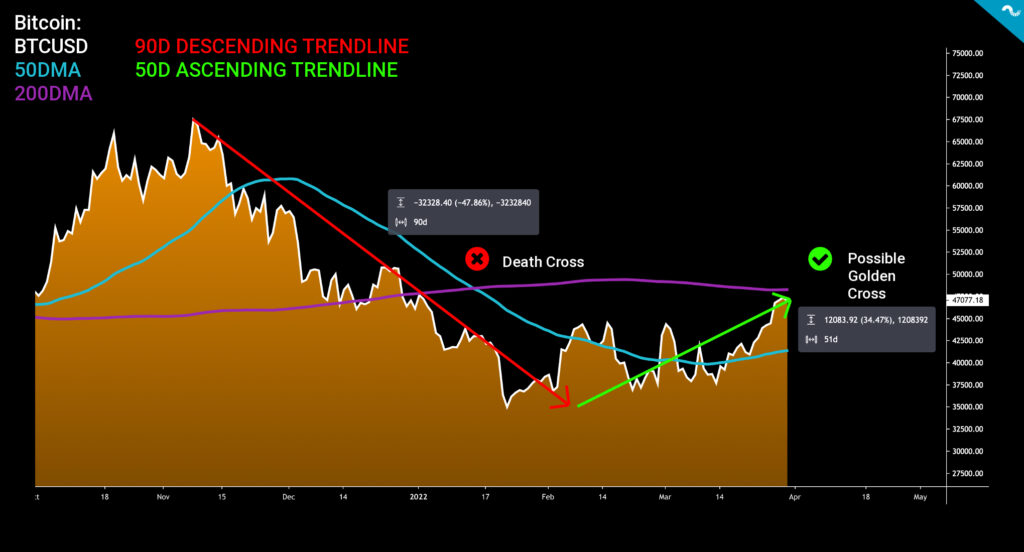

Bitcoin has continued its positive momentum wave, rising 35 percent in last 50 days. Bitcoin’s spot price is currently taking back some of the losses suffered during the 90-day bear cycle from November to February. Interestingly there’s a possibility of bitcoin forming a Golden Cross pattern during second quarter (Q2) of 2022.

Bitcoin faced a Death Cross situation in early January as 50-day moving average (turquoise) fell below the 200-day moving average (purple). Golden Cross is an inverse Death Cross and requires 50DMA to cross 200DMA. The Golden Cross would be a substantially bullish technical signal for the spot market.

Luna Foundation Guard Challenges MicroStrategy in Bitcoin Accumulation Game

Bitcoin is an exceptionally scarce asset and its institutional demand is growing. The institutional Bitcoin scene was recently joined by an entity called Luna Foundation Guard, a non-profit organization behind Terra (LUNA) ecosystem. According to their own statement the purpose of Luna Foundation Guard is to support the Terra ecosystem and to advance the sustainability and stability of Terra’s algorithmic stablecoins.

LFG’s public bitcoin address: bc1q9d4ywgfnd8h43da5tpcxcn6ajv590cg6d3tg6axemvljvt2k76zs50tv4q

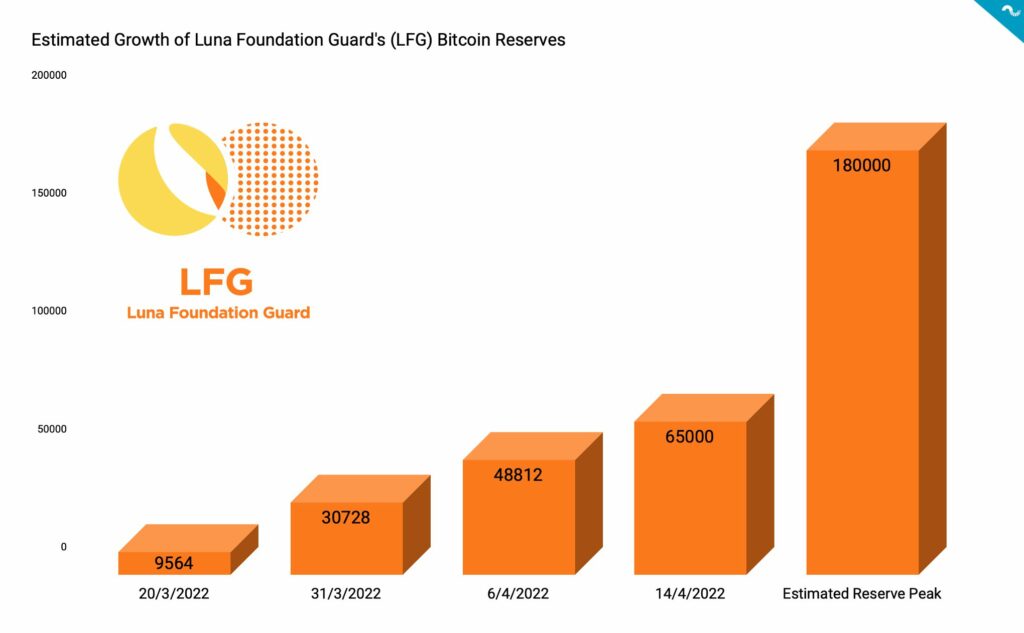

Do Kwon, the founder of Terra, announced the plan of purchasing $3 billion worth of bitcoin units in March and LFG’s coin reserves have been growing since. LFG’s bitcoin address (above) shows the entity currently holding 30 728 bitcoins and the amount is estimated to increase to 65 000 units by mid-April.

The 30 728 bitcoins places Luna Foundation Guard among 30 biggest addresses in terms of bitcoin units and LFG currently holds more coins than El Salvador. The estimated reserve peak of Luna Foundation Guard will be 180 000 bitcoins and consequently it might eventually outclass MicroStrategy in terms of bitcoin treasuries. Terra’s founder Do Kwon has stated his goal is to become the second largest holder of bitcoin behind Satoshi Nakamoto.

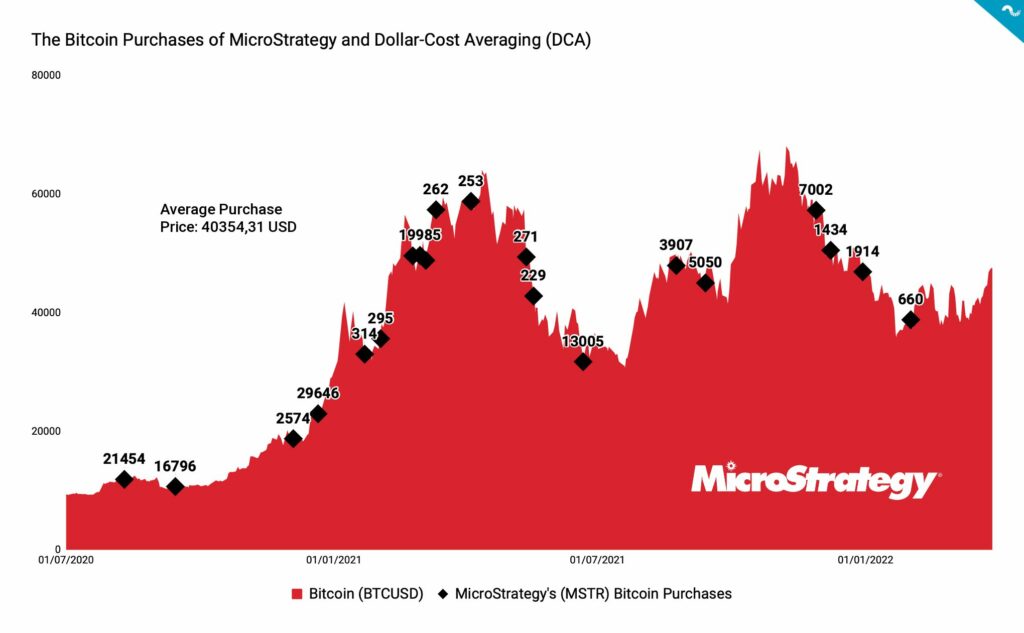

The prominent Bitcoin institution MicroStrategy (MSTR) currently holds 125 051 bitcoin units, purchased using the dollar-cost averaging method (DCA). As the embedded chart shows MSTR has been consistently buying BTC since summer 2020 with an average purchase price of 40354 USD. Michael Saylor recently announced that MicroStrategy plans to take on $205 million loan to buy more bitcoins.

MicroStrategy is seen as the pioneering Bitcoin institution and it started its journey back in the summer of 2020, when CEO Michael Saylor announced a new strategy to replace USD-based reserves with alternative assets. Saylor has since published his famous institutional Bitcoin thesis, which highlights defensive, opportunistic, and strategic aspects.

Bitcoin Supply Shock Ahead? Exchange Reserves Historically Low

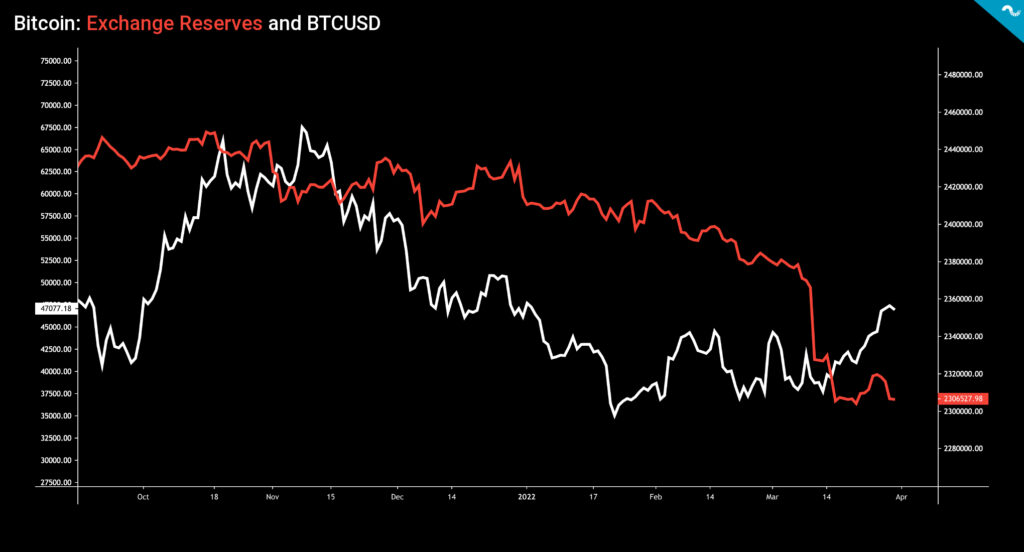

Bitcoin’s exchange reserves (red) have continued their decisive downtrend, forming a descending pattern dating back to early 2020. The decrease is likely driven by the relocation of bitcoin units into long-term cold storage. Bitcoin’s exchange reserves additionally took a big leap downwards in mid-March, correlating inversely with the spot price.

Recent analysis shows how only 24 percent of the current supply of bitcoin is liquid, meaning that bitcoin’s illiquid supply has increased to 76%. This inherent illiquidity combined with growing OTC demand from institutions like Luna Foundation Guard and MicroStrategy and will drive BTCUSD upwards.

In addition to Bitcoin’s exchange reserves, Ethereum’s exchange reserves are dropping in close correlation. Ethereum is becoming a more scarce asset and smart money prefers to accumulate Ether units off-exchange. The exchange reserves of both assets have decreased from 2020 to 2022 forming a secular multi-year downtrend.

↑ Increasing Exchange Reserves: Bearish, indicating bitcoin selling pressure

↓ Decreasing Exchange Reserves: Bullish, indicating accumulation to cold storage

What Are We Reading Right Now?

Analyst Lyn Alden remarks that the total value locked (TVL) of decentralized finance is becoming more distributed among different protocols.

Market share for DeFi TVL used to be 97% concentrated on one blockchain, but it's increasingly distributing across multiple blockchains.https://t.co/unqG1D8kGV pic.twitter.com/W3a3uuCCyr

— Lyn Alden (@LynAldenContact) March 30, 2022

Analyst Willy Woo sees huge headwinds for bitcoin, including rising spot and futures demand, accumulation, and market in post-reset state.

"Macro headwinds" vs BTC fundamentals…

— Willy Woo (@woonomic) March 25, 2022

1) on-chain (spot) demand keeps climbing

2) futures demand returns for the first time since November

3) capitulation has signalled

4) the market has fully reset

5) accumulation has already happened

Probably a decoupling will continue.

Entrepreneur and trader Arthur Hayes estimates Ethereum to reach $10 000 by the end of 2022.