The technical analysis for week 36 focuses on recent market correction, hedge funds, and South Korean kimchi premium.

Derivatives Market Liquidated

The digital asset market experienced a correction this week as the leading cryptocurrency Bitcoin dropped -14,32 percent, or $7-8K, from $52K level between September 7th and 8th. Bitcoin consequently continued to inch lower towards $45K level in following days. As examined in TA 35 last week, cryptocurrencies have ascended significantly across the market, rising from 40% to >300%. While the legacy cryptocurrencies have shown good performance, newer DeFi-related assets like Solana (SOL) have gained notable interest and buying pressure.

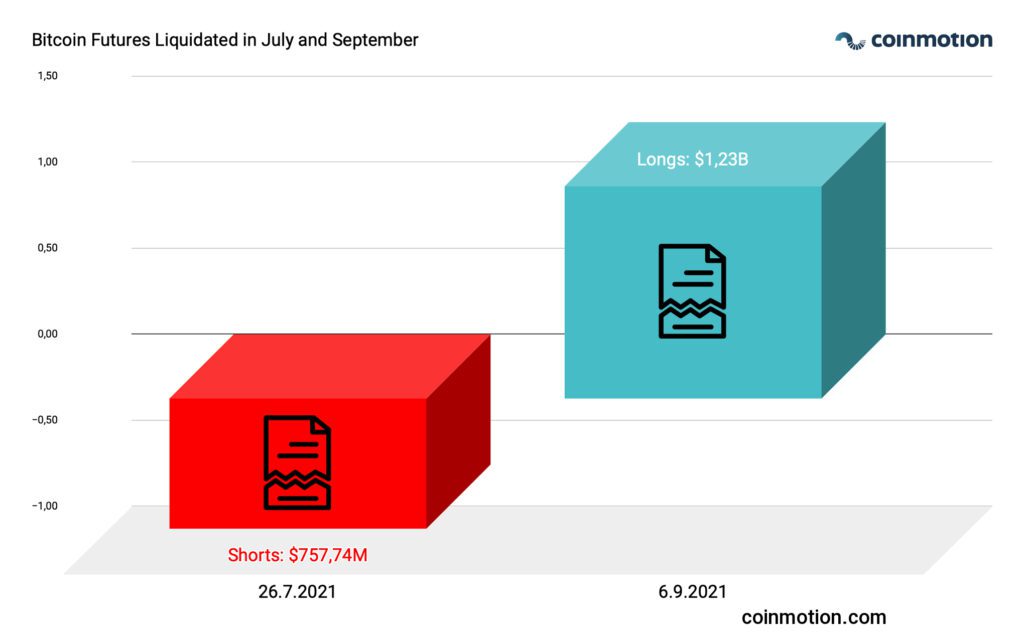

The market correction was clearly driven by derivatives market, instead of spot market. Exchange data shows no significant spot-related inflows or outflows, yet 1,23 billion USD worth of bitcoin futures were liquidated on 6th of September alone. These longs were calculated from exchanges including: Binance, BitMEX, Bybit, Deribit, FTX, Huobi, OKEx, and Bitfinex. As the embedded chart shows, $757,74 million worth of bitcoin shorts were liquidated in late July as market sentiment sharply shifted from bearish to bullish. The market seems to systematically flush out excess derivative accumulation by liquidating longs and shorts on a timely basis.

Long-Term Holders (SOPR) Unaffected

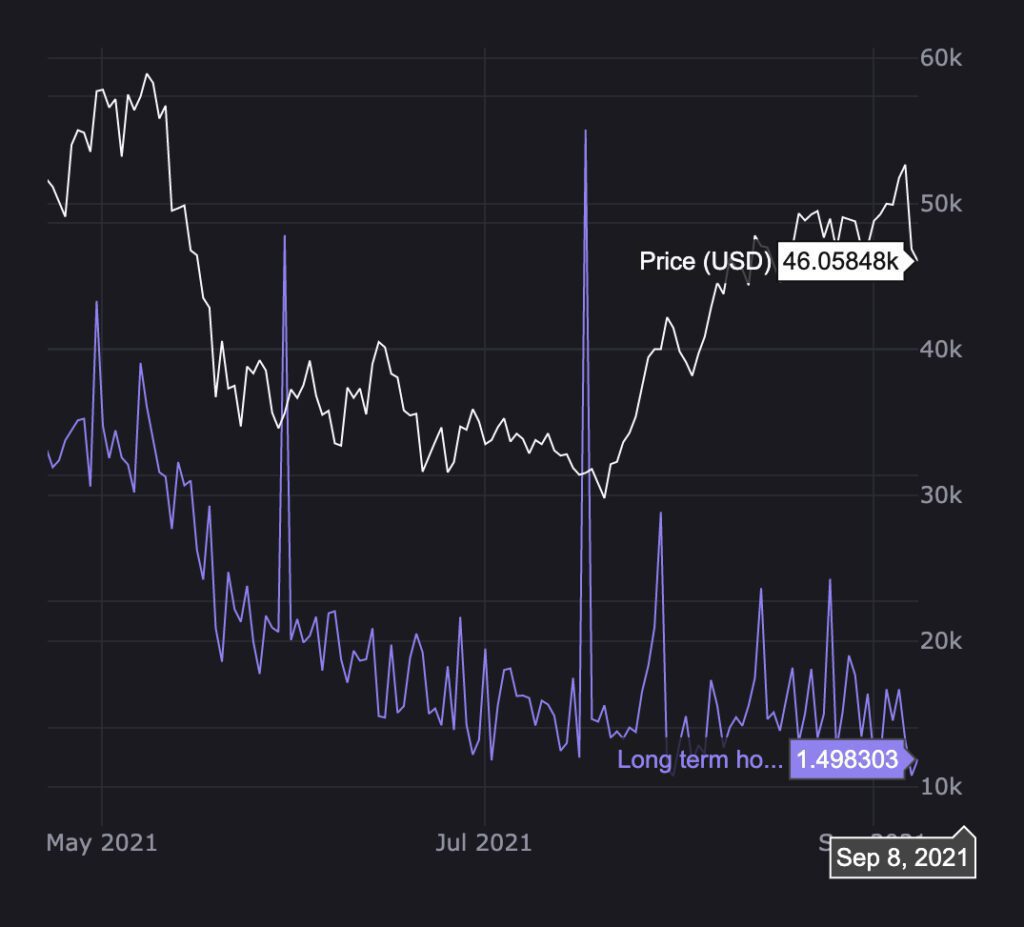

Spent Output Profit Ratio, or SOPR, indicates long-term holders still being at profit despite the recent spot price correction. Long Time Holder version of Spent Output Profit Ratio, called LTH-SOPR, is currently at 1,5. Above 1 implies that coins held for more than 155 days are selling at a profit (on average).

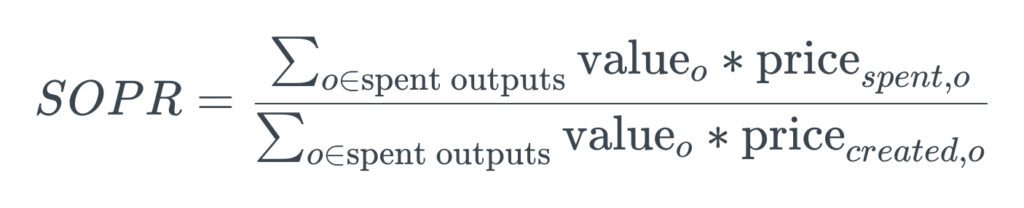

SOPR aims to estimate the profit ratio of market participants by comparing the value of outputs at the spent time to created time. In essence, it estimates if the distribution of spent transaction output is in profit or not. SOPR is calculated as the USD value of spent outputs at the spent time (realized value) divided by the USD value of spent outputs at the created time (value at creation).

The SOPR indicator can be interpreted with following logic:

SOPR >1: Native units moved in certain timescale are selling at profit, by average.

SOPR <1: Native units moved in certain timescale are selling at loss, by average.

There are also numerous other indicators derived from the SOPR, we’ll explore them in upcoming TAs.

Hedge Fund Bitcoin Shorts Decreasing

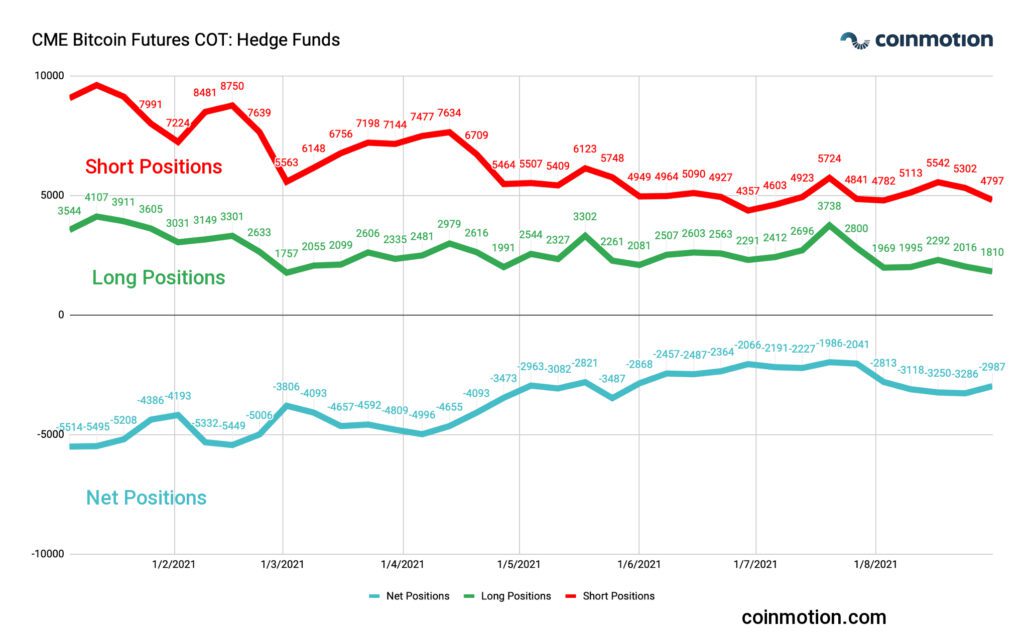

COT, or commitment of traders report, shows hedge funds being relatively bullish, or at least less bearish on bitcoin. The leveraged money has decreased its short positions from early year >8000 contracts to current 4797 contracts. Long positions have been decreasing too, dropping from early January 3544 contracts to current 1810. Hedge funds have historically been sceptical towards bitcoin, shorting it by default, consequently a low amount of shorts is a promising indicator for BTCUSD.

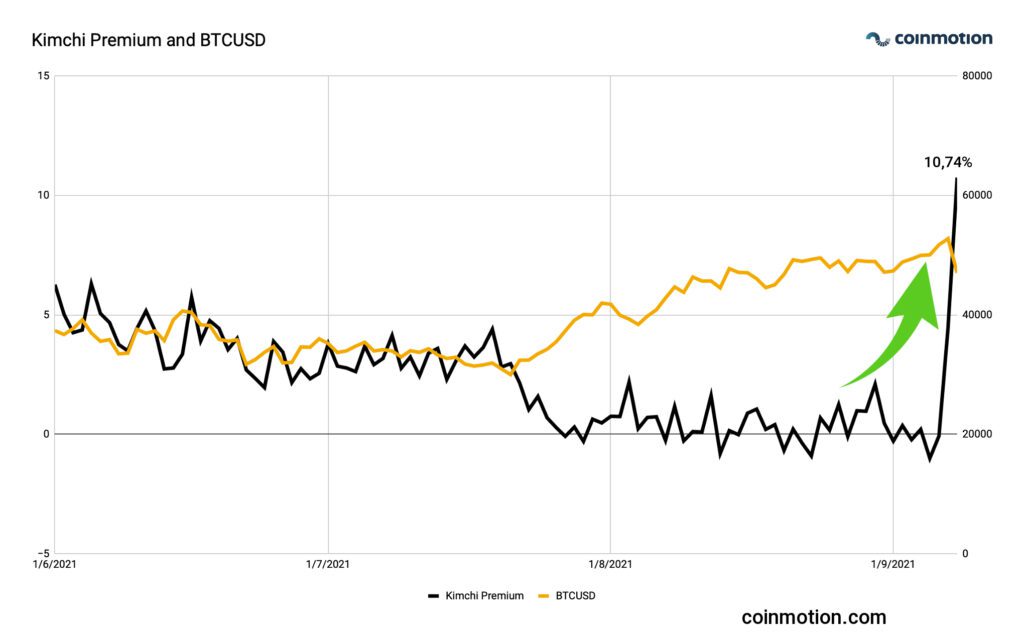

Kimchi Premium Rises >10%

Kimchi Premium, named after South Korea’s fermented vegetable dish, is an indicator that reflects the state of Bitcoin market and potential demand in Asia. The Kimchi premium stayed in close proximity to 5 percent range since May’s drop and descended close to zero in August. The Kimchi premium climbed against expectations to over 10% following the spot price correction this week, possibly showing a trajectory for Q4 bitcoin spot price.

Kimchi premium was firstly acknowledged in 2016 early bull cycle and it soared to 54% during last-cycle January. 2018. Kimchi premium climbed to over 20% on two occasions this year: Mid-April and mid-May. These two anomalies mirrored market overheating and bitcoin spot had a large correction afterwards. The contemporary climb to 10,74% can be interpreted as a sign of accumulation.