The TA of week six observes bitcoin’s recent price action and technicals. Additionally we explore how LEO token is traded by whales, and what investment bank JPMorgan says about Bitcoin.

Bitcoin Crosses The Essential 50 Day Moving Average

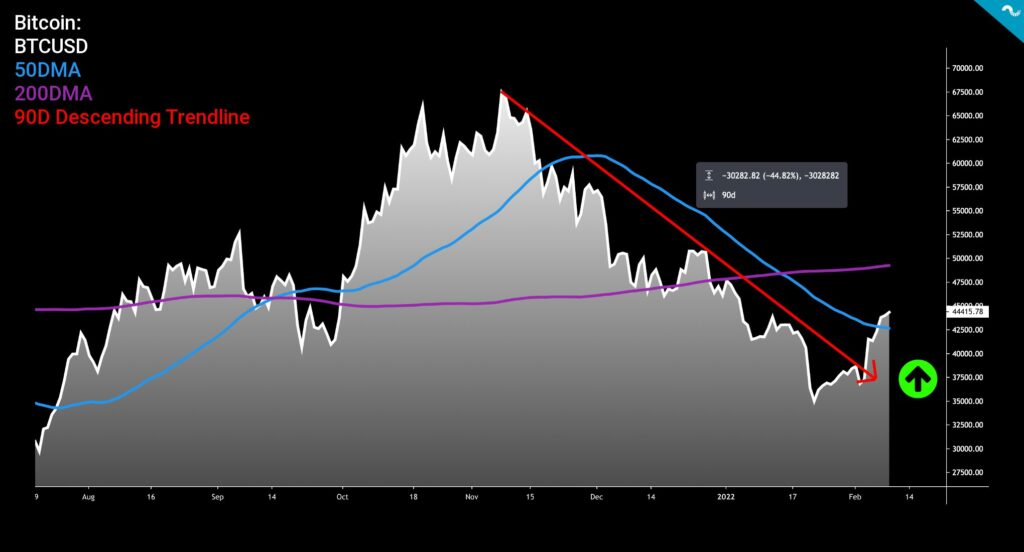

Bitcoin has been gaining new upward momentum over the span of two weeks, after bitcoin’s spot price found a local bottom at $35K. This new strength ends a 90-day long epoch of price decline (red) that originated from mid-November. The leading cryptocurrency Bitcoin has gained 17,7 percent in last seven days, while the leading decentralized finance platform Ethereum is up 16,9%.

7D Price Performance

Bitcoin (BTC): 17,7%

Ethereum (ETH): 16,9%

50 and 200 day moving averages (DMA) have been useful indicators for interpreting bitcoin’s volatile price action. In mid-September 50DMA (blue) crossed 200DMA (purple) to the upside, creating a “Golden Cross” setting. Bitcoin consequently followed the 50DMA up to 2021’s peak of $68K. In January 2022 the 50DMA crossed 200DMA again, this time to the downside, creating a “Death Cross” setting. Bitcoin’s price crumbled shortly after, however it also stabilized in late-January.

↑ Golden Cross: 50DMA Crosses 200DMA to The Upside

↓ Death Cross: 50DMA Crossed 200DMA to The Downside

This week bitcoin’s spot price crossed 50DMA to the upside again, which is obviously a bullish signal. Bitcoin hasn’t crossed 50DMA in this fashion since early October of 2021 and that composure led to a spot price rally. If bitcoin is able to support the current bullish sentiment, we might even see a Golden Cross again in Q1 – Q2.

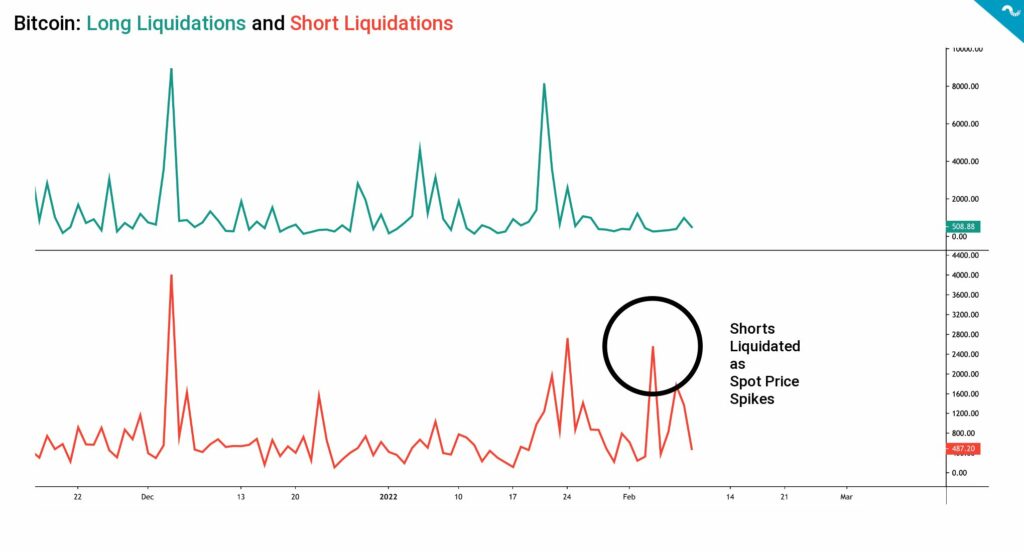

Bitcoin’s trend reversal has been supported by the liquidation of short positions as $229 million worth of shorts were liquidated in past seven days. As a consequence the Estimated Leverage Ratio (ELR) has shown signs of weakening, dropping 0,2. A moderate deleveraging would be healthy for the market as leverage has a tendency to act as a ballast to the market. Further price increase might even create a short squeeze situation which is even more bullish for the upward momentum.

Did The Bitfinex Whales Frontrun Markets with LEO Token?

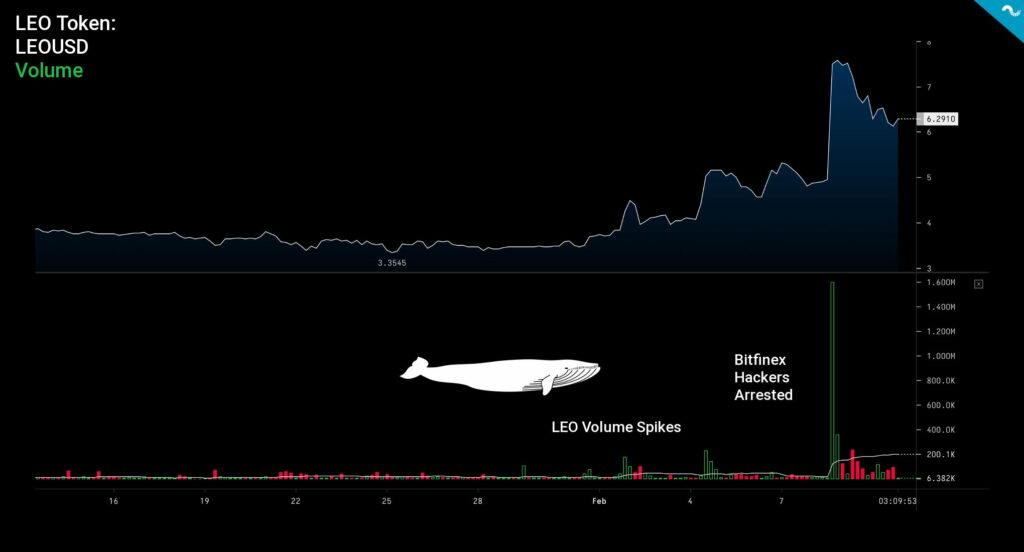

The cryptoasset markets are heavily influenced by whales, who by default own at least 1000 native bitcoin units. Whale activity is closely followed by traders and particularly the whales of Bitfinex have gained increasing attention. Bitfinex whales lifted their heads above the water again this month as a long saga of Bitfinex hack seemingly came to an end. Bitfinex suffered a security breach in 2016 when $4,6 billion (current valuation) worth of bitcoins were stolen. The hackers were arrested this week and U.S. government seized $3,6 billion worth of Bitfinex-related assets.

While this story is interesting per se, it also unfolds another market-related anomaly. Bitfinex’s LEO token exploded upwards following the arrest, as markets speculate that at least 80 percent of the recovered funds will be used to repurchase and burn outstanding LEO. The repurchase and burn will be implemented within 18 months from date of recovery. Makes sense, right? It does.

However, when you look at market data closely you can see that a heavy amount of whale-level LEO accumulation was already started in late January. That is weeks before the actual arrest. It is certain that someone had better, or insider, information on the case and consequently had the ability to frontrun other market participants. Someone out there knew more. This is a textbook example of whale activity and information asymmetry.

The LEO token and other exotic assets can be purchased via Coinmotion’s Coinmotion Wealth service.

JPMorgan Gives $150K Long-Term Target for Bitcoin

The US-based investment bank JPMorgan recently published a report on Bitcoin’s current and future state of affairs. The strategist team, led by Nikolaos Panigirtzoglou, sees a 38 000 USD valuation as “fair price” for bitcoin. In the longer time horizon the strategists see bitcoin potentially climbing to 150 000 dollar level.

JPMorgan states that Bitcoin is currently approximately four times as volatile as gold. The said volatility is currently main institutional concern and a big challenge for Bitcoin, according to JPM. The bank also estimates that the market has not yet seen a true capitulation phase and more selling pressure might be ahead.

Nevertheless we should keep in mind that JPMorgan has historically been notably bearish on Bitcoin and some of theses statements might be biased towards their interests. Still, the $150K long-term target is reasonable and shows how the bank is taking a more friendly approach towards cryptoassets as whole.