The technical analysis of week 33 examines the dramatic increase of volatility as bitcoin encounters a new wall of selling pressure. The volatility growth is illustrated by the .BVOL7D index reaching its highest level in nearly five months. Additionally, we will explore why Bitcoin’s halving cycle has not been priced in and how tokens listed on Coinmotion have performed since the beginning of the year.

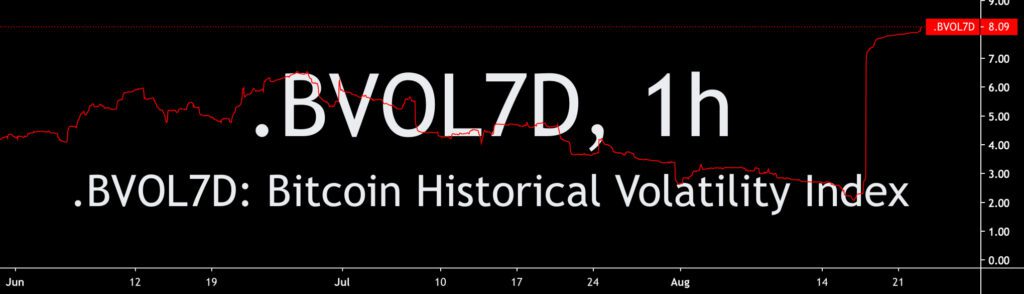

The cryptocurrency market outlook has turned significantly negative in the past seven days, with the leading cryptocurrency bitcoin weakening by -8,5 percent. The decline of spot price can also be seen as a return of volatility, as reflected in the .BVOL7D index provided by the BitMEX exchange. The weekly .BVOL7D is calculated as a logarithmic percentage change based on minute-level measurements of the XBTUSD price.

The volatility index surge began towards the end of week 33, and by Wednesday, August 23rd, it had already reached a reading of 8,09, representing the highest level of volatility measured in nearly five months. The last time the index reached such levels was amid the parabolic advance of March.

Source: BitMEX

Despite the technical correction, bitcoin has still risen by 55 percent against the United States dollar (USD) and 56 percent against the euro (EUR). As mentioned in the previous technical analysis, bitcoin’s ascent has been even more dramatic when compared to the national currencies of emerging markets, strengthening by 140 percent against the Russian rouble (RUB) and 280 percent against the Argentine peso (ARS).

At the same time, several medium and long-term value drivers can be identified behind bitcoin’s performance, with the most significant ones currently being the potential ETF approval and the upcoming 2024 halving event. The asset management firm Bitwise sees the forthcoming ETF as a watershed moment that would make it easier for institutions to gain exposure to bitcoin. Additionally, Bitwise believes that an ETF would enhance Bitcoin’s credibility in the eyes of savvy investors.

“An approval would make it vastly easier for investment professionals to gain exposure to bitcoin; ETFs are among the most popular and efficient vehicles to access key markets or investment themes. ETFs are uniquely structured to offer better price efficiencies than other products. ETF would likely be seen by many as a regulatory stamp of approval; it would communicate that the market has matured and is now ready for institutional investors to enter with confidence.” – Bitwise

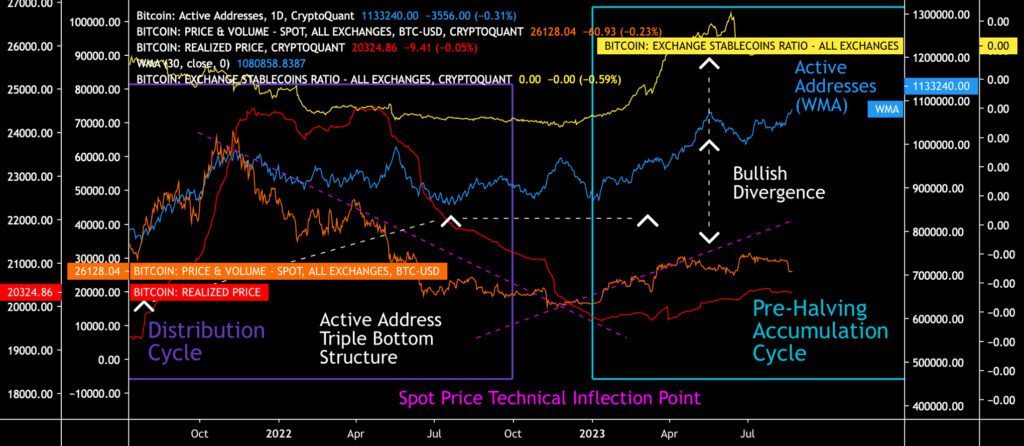

During the past week, the weakening spot price fell below the critical 200-day moving average for the first time since January. The 200-day moving average has been the primary support level for bitcoin during the spring, with the $20 000 realized price serving as a lower support level. The technical turning point from the beginning of the year also continues to support bitcoin, as the cryptocurrency moves within the pre-halving accumulation cycle.

Sources: Timo Oinonen, CryptoQuant

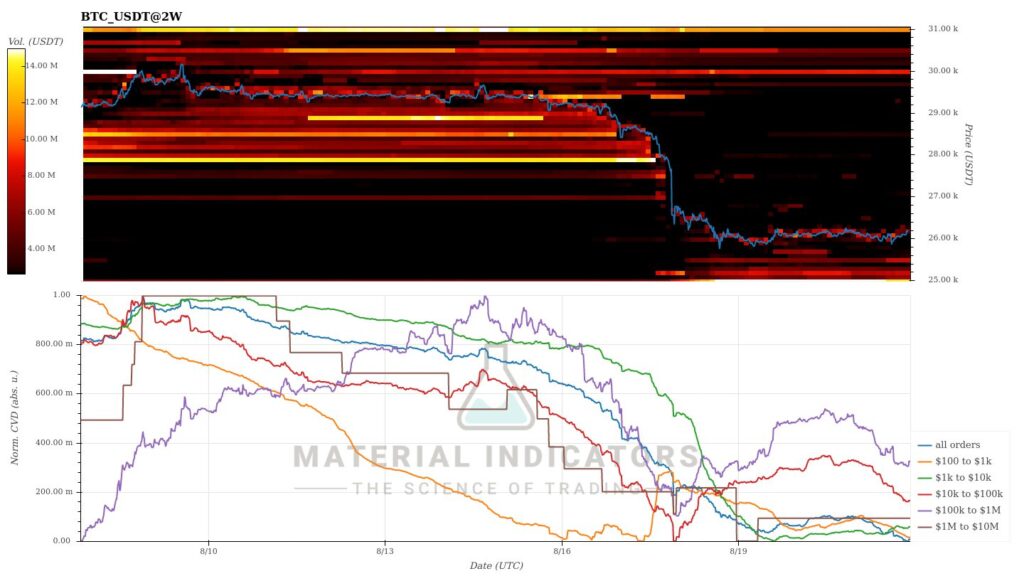

The Material Indicators’ heat map reveals a breakdown of technical support levels under the pressure of the spot price. However, the $25 000 level is strengthening as bitcoin support. Cumulative Volume Delta (CVD) indicates a weakening of short-term demand across all demand areas.

Source: Material Indicators

As weekly market volatility of the cryptocurrency market has increased, bitcoin has weakened by -8,5 percent in seven days. The second-largest cryptocurrency by market capitalization, Ethereum, has dropped by -7,3 percent in correlation with bitcoin. Among the major decliners in Coinmotion’s portfolio were Litecoin (-11 percent) and Uniswap (-11,3 percent). The price of XRP, which gained significant popularity in July, fell by -9,4 percent. Stellar, which was previously the subject of classification speculations, is the only cryptocurrency that has reached positive territory, rising by 2,1 percent.

Seven Day Price Performance

Bitcoin (BTC): -8,5%

Ethereum (ETH): -7,3%

Litecoin (LTC): -11%

Aave (AAVE): -4,1%

Chainlink (LINK): -5,8%

Uniswap (UNI): -11,3%

Stellar (XLM): 2,1%

XRP: -9,4%

Get started with Bitcoin Litecoin Ethereum AAVE USDC Stellar Ripple

Join Coinmotion and buy your first cryptocurrencies within minutes!

S&P 500 Index: 0,7%

Gold: 1,3%

The Halving Cycle Is Not Priced In

Amid the technical correction, it’s essential to keep in mind the long-term perspective, which includes Bitcoin’s upcoming spring 2024 halving event. The halvings, which occur in four-year cycles, are a crucial part of the Bitcoin ecosystem and can be effectively utilized in interpreting price developments. Using the most recent halving event in 2020 (turquoise) as a reference, bitcoin’s spot price increased by 1263 percent between the halvings of 2016 and 2020.

Halvings literally halve the block reward paid to miners, which dropped from 12,5 bitcoin units to 6,25 in 2020. Similarly, the halving event in 2024 will once again halve the block reward, reducing it to 3,125.

Sources: Timo Oinonen, CryptoQuant

Another factor that defines bitcoin’s price history is the spot price increase between the halving event and the subsequent price peak. Between the 2016 halving and the 2017 peak (ATH, red), BTCUSD rose a total of 2922 percent. Similarly, between the most recent halving event in 2020 and the peak in 2021, the spot price increased by 654 percent.

Previous halving cycles have escalated into parabolic price trends, and between 2012 and 2016, the spot price saw a peak increase of 5187 percent. Halving events can be seen as catalysts for both pre and post-halving price surges.

The upcoming halving event of 2024 is expected to generate a new spot price peak (ATH, yellow) in either 2024 or 2025. If bitcoin continues to follow the structure of previous halving cycles, one can expect the price to rise to over $100 000. Therefore, the halving cycle is not priced in the bitcoin’s current spot price.

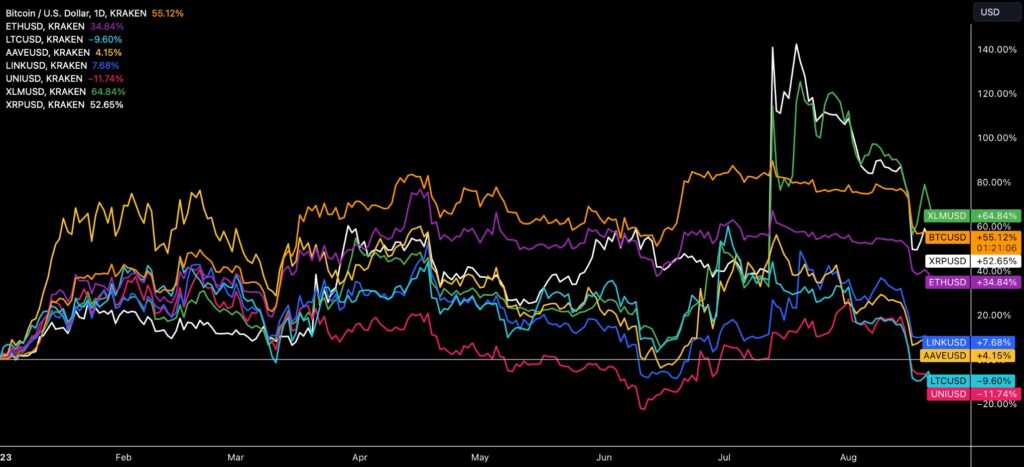

Stellar leads the Coinmotion-listed token performance in 2023

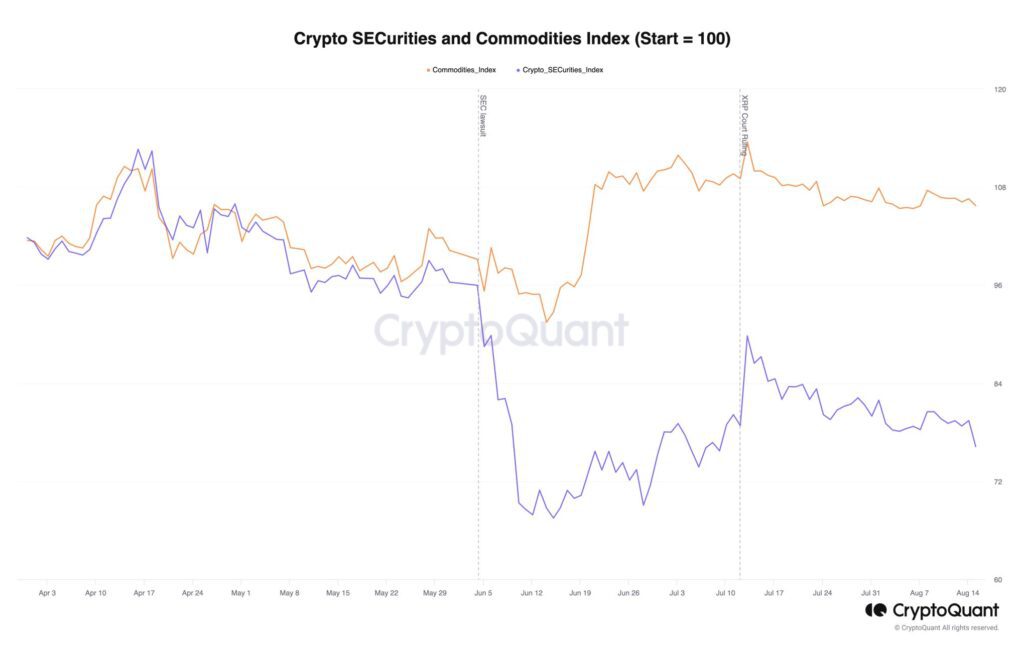

The mutual hierarchy of tokens listed on Coinmotion underwent a radical shift last week as XRP and Stellar declined following their July rallies. In July, classification speculations propelled both XRP and Stellar to over 120 percent YTD gains, with the U.S. Securities and Exchange Commission (SEC) announcing the commodity classification of XRP. At the same time, speculation around Stellar escalated, with investors speculating that the cryptocurrency might end up on the commodity classification list. However, the SEC has not yet confirmed its stance on Stellar.

From July to August, XRP and Stellar outperformed bitcoin’s price development, but XRP recently fell below Bitcoin with a YTD price increase of 52,65 percent. Meanwhile, bitcoin has strengthened by 55 percent since the beginning of the year. Somewhat surprisingly, Stellar remains the top performer among the cryptocurrencies listed on Coinmotion, rising by a respectable 64,84 percent since the start of the year.

Uniswap and Litecoin continue to underperform among the exchange-listed tokens, with the former declining by -11,74 percent and the latter by -9,6 percent year to date. Contrary to expectations, Litecoin’s price development has remained negative despite the halving event. Aave and Chainlink are in positive territory on a YTD basis, albeit with only modest gains in 2023. Ethereum, performing at a mid-level, has risen by 34,84 percent since the beginning of the year.

Source: TradingView

The segmentation created by the SEC in early June continues to serve as a market watershed. The commission divided cryptocurrencies and tokens into two main categories, with one being “commodity tokens” and the other “securities tokens.” The initial classification initially placed only bitcoin and Ethereum in the commodity group, thereby securing their status. Now, XRP can also be counted among the commodity-classified tokens.

Source: CryptoQuant

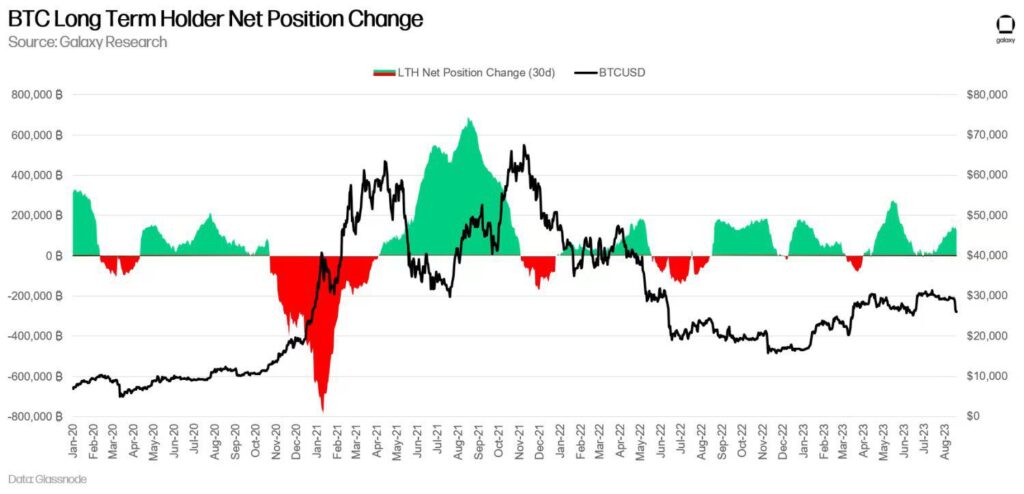

Whales in Accumulation Mode Despite the Technical Weakness

Galaxy Research’s market data indicates that whales have been accumulating their holdings in recent weeks, in contrast to the declining spot price of bitcoin. The Long-Term Holder (LTH) indicator has been showing 100 000 bitcoin unit buying pressure during the past week.

Source: Galaxy Research

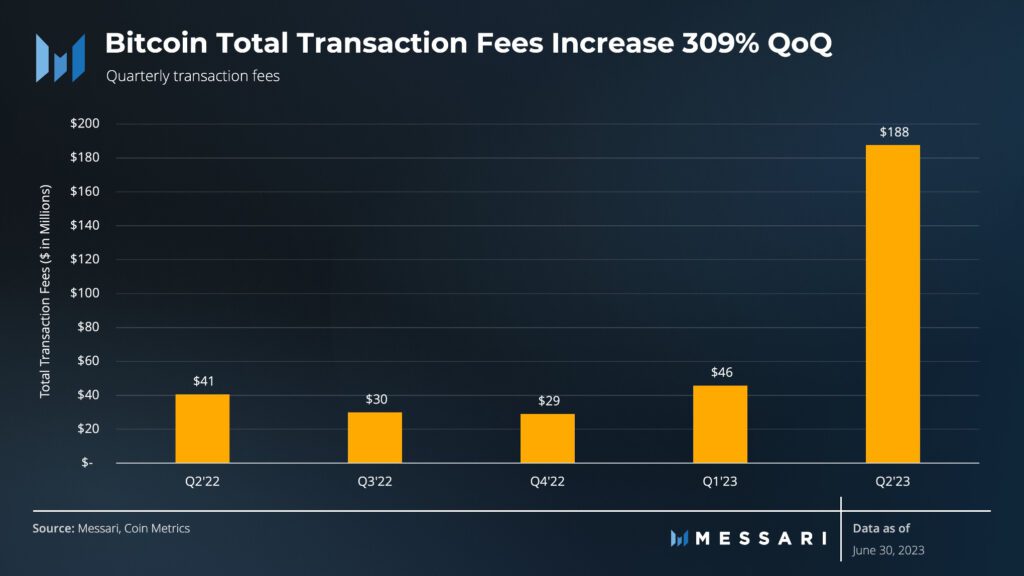

Another indicator of bitcoin’s strength is the rise in transaction fees to $188 million in the second quarter of this year. Transaction fees remained modest in the final quarter of 2022 and the first quarter of 2023, with a cumulative increase of 309 percent recorded between Q1 and Q2. Concurrently, the number of transactions on the Bitcoin network increased by 44 percent between the first and second quarters of 2023.

Sources: Messari, Coin Metrics

What Are We Following Right Now?

Can Argentine presidential candidate Javier Milei mainstream Bitcoin’s role in South America? Libertarian Milei has previously made positive comments regarding Bitcoin while opposing the role of central banks. His goals also include reducing the dominant position of the state in society. Bitcoin has risen by over 280 percent against the Argentine peso national currency (ARS) since the beginning of the year.

The traditional blockchain technology company Blockstream is stockpiling mining equipment while preparing for a new Bitcoin bull cycle.

Bitcoin developer Blockstream is betting that the cryptocurrency is poised for a massive rebound, and it's buying up crypto mining rigs to sell for a profit later should the prediction hold https://t.co/uysV89cpg2

— Bloomberg Crypto (@crypto) August 23, 2023

Analyst Lyn Alden’s latest book, “Broken Money,” has finally been released on the Amazon platform. In her book, Alden explores the life cycle, evolution, and inflation of national currencies. At the same time, she assesses their weaknesses and makes arguments in favor of assets like gold and bitcoin.

My new book, Broken Money, is now available on Amazon.

— Lyn Alden (@LynAldenContact) August 23, 2023

Paperback and hardcover versions are currently available, with ebook and audiobook versions on the way. It'll also be available through other distribution partners soon as well:https://t.co/OgmNgf2M9i

Stay in the loop of the latest crypto events

- Crypto Investing Made Simple: Lesson #1

- Price Projections for 2023 and 2024

- Understanding cryptocurrencies and the blockchain: Lesson #2

- Stellar Lumens — Unveiling a global digital payment protocol

- Ripple Labs score a major victory against SEC over XRP

- Fenergo FinTalks with Coinmotion Interim CEO Pasi Matilainen | Navigating Crypto Regulation

- Saylor Enters the Accumulation Mode, Again

- Coinmotion Adds Two New Strategic Board Members to Strengthen its Position in the Digital Currency Market

- Ripple (XRP): Empowering the future of digital currency

Get started with Bitcoin Litecoin Ethereum AAVE USDC Stellar Ripple

Join Coinmotion and buy your first cryptocurrencies within minutes!

The views, thoughts, and opinions expressed in the text belong to the author and not necessarily to the author’s employer, organization, committee, or other group or individual.