In theory, investing is simple. First buy, then hold and then sell. In theory we only need to take care of these three steps, after which we gain profit as a result of successful selling. It certainly isn’t rocket science. Therefore, it’s pointless to lose your sleep while brooding over investment decisions, since investing really is this simple.

But is something missing – it can’t all be that simple after all?

Yes. While investing, in theory, only means buying, holding and selling, it is often not mentioned what investing means in practice. Next we will focus on ways to make theory into successful practice.

Investing in practice

If investing is very simple in theory, what about practice? What does investing practically mean and what is it about?

If investing is put in an everyday perspective, it practically refers to our real time use, meaning how much time we dedicate to make investment decisions and most of all how rationally we use this valuable time. In time use the most important aspect is not the amount of time but its quality.

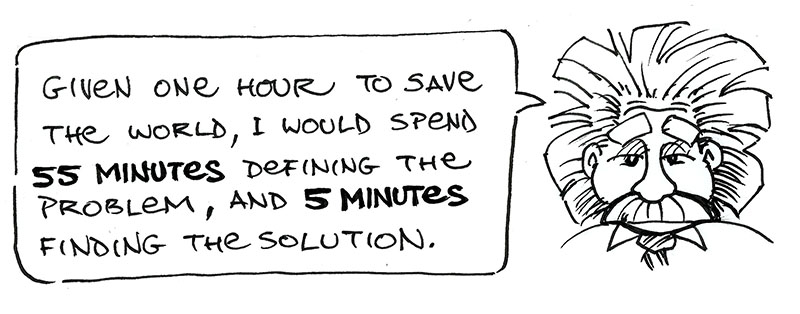

As an example we can use the famous Nobel laureate nuclear physicist Albert Einstein and his way of solving problems. If Einstein had a problem he wanted to solve and was given one hour to do so, he would use 55 minutes to understand the problem and only 5 minutes to solve the problem through action. In summary, 92% of the time should be used to qualitatively understand the problem and only 8% for solving the problem by taking action.

Einstein solved problems by focusing on understanding them. The same can be applied to investing.

Making an investment decision

Making investment decisions is primarily problem solving, When to buy, how long to hold, and when to sell. However, this is only the part of the problem solving worth spending those 5 minutes for, whereas understanding the investment should comprise a much larger share of 55 minutes.

It’s worth remembering that even if we can’t control time itself, we can control our use of time. We should, therefore, use our own time better, since understanding the problem is of higher quality for a good investment, whereas the investment itself is action based on qualitatively understanding the problem. This qualitative understanding of problems is in investment circles called analysis.

In conclusion, it’s pointless to roll around in bed in the middle of the night brooding over whether we should buy, hold or sell. If you’ve used your time rationally to understand and gather facts about the investment, there is no need or room for such brooding.

Bitcoin as an investment

If we think of bitcoin as an investment, we should use 92% of our available time to understand bitcoin as an investment. In turn 8% of our time should be used for making the investment decision, meaning whether we buy, hold or sell. This doesn’t directly mean we should deeply understand bitcoin as a concept, phenomenon or technology. It certainly helps to understand bitcoin’s background technology better, but most of all we should understand bitcoin as an investment.

If we are investing in bitcoin, we should maintain our focus strictly on understanding bitcoin as an investment rather than a concept, phenomenon or technology.

The core of this is to focus our time use strictly on what we are doing, instead of being distracted by irrelevant factors, which might otherwise be useful but are not strongly related to making an investment decision. We all have a limited amount of time to use, so we should focus that to achieve something of quality. Focusing is a very relevant part of a successful investment decision.

How to invest for example in bitcoin?

As an example we can take bitcoin’s mainstream news, according to which many still make their investment decisions. If we own one bitcoin and read from the news that bitcoin’s price has doubled in a couple months, we should use 92% of our time to understand why bitcoin’s price has doubled in a couple months. Thereafter we should use the remaining 8% of our time to make an investment decision about buying more, holding or selling. There’s no reason to rush to a decision if we don’t know the facts. Facts must be examined and understood in order for us to act consistently.

It would of course be best if we’d already used 92% of our time to examine the probabilities of bitcoin’s price rising or falling in the next couple months. Then we would have at least some picture of how we should act if bitcoin’s price rises or falls strongly. This would enable us to make a quicker investment decision with the remaining 8% of our time, if the predictions of a strong rise or fall are realized.

The harsh reality of making investment decisions

All too often people seem to use 92% of their time for making an investment decision and 8% for understanding its backgrounds, and in this very order meaning a quick emotion-based decision followed by a quick attempt to understand what one just did. It’s therefore no wonder if investment decisions lack in quality, since the qualitative relation of our time use leaves much room for improvement. I also personally feel a deep sting in my heart, since I admit to having had made such decisions often and have almost always regretted them afterward.

This is worth remembering

What we should remember is this: We can not affect time, but we can affect our time use. Investing is practically making choices about our own time use. Therefore we should use our time effectively by strictly focusing it in the right relation as we make decisions. I’ve personally experienced the following model to be functional.

If you have one hour to make an investment decision:

- First try to understand the investment for 55 minutes

- Then make the investment decision in 5 minutes

And indeed in this very order. Now you are thinking of investment decisions like Einstein. At least almost.

Even though investing isn’t as hard as nuclear physics, these simple tips will not guarantee you more than theoretical profits on the markets. Real profits often require much more understanding and skill. If you already start thinking about making investment decisions early like Einstein, you can at least make them more logical. And anything logical is simple, as investing should be. To compress everything into one word: Simple.

The writer is a board member of the Finnish cryptocurrency organization Konsensus ry and has years of experience in different investment fields, including cryptocurrencies.