The technical analysis of week 24 charts the radically shifting market sentiment, which has led bitcoin to a clear uptrend. At the same time, we examine bitcoin’s breakout from the surface of the 200-day moving average and the breakdown of a multi-month technical resistance level. In addition, we assess the correlation between bitcoin and the stock market.

The crypto market is again in a euphoric mood after a multi-month downtrend. Within the last seven days, the leading cryptocurrency, bitcoin, has strengthened by 20 percent, as the correlation between it and altcoins has weakened. At the same time, bitcoin’s dominance has risen above the psychological level of 50 percent for the first time since spring 2021.

The combined market cap of cryptocurrencies has increased by 9,07 percent within 24 hours, now reaching 1,07 trillion euros.

Since its technical inflection point at the turn of the year, bitcoin has been trying to follow its rising trend line (white), although staying there has occasionally proven to be challenging. After the parabolic advance of early spring, bitcoin has, at the same time, remained within its lateral channel (pink).

The main support levels for bitcoin are the 200-day moving average (yellow), from which the cryptocurrency just bounced off. The wave of the realized price (blue) acts as a lower support level. Bitcoin is still in the pre-halving accumulation cycle (turquoise) ahead of the 2024 halving event, as it sets the broad guidelines for the market.

Sources: Timo Oinonen, CryptoQuant

On Tuesday night, bitcoin managed to break its April-June resistance level (white), which for months has blocked the spot price’s bullish efforts (yellow). Crossing the resistance line indicated by the turquoise arrow also makes the line a new support level.

Sources: Timo Oinonen, CryptoQuant

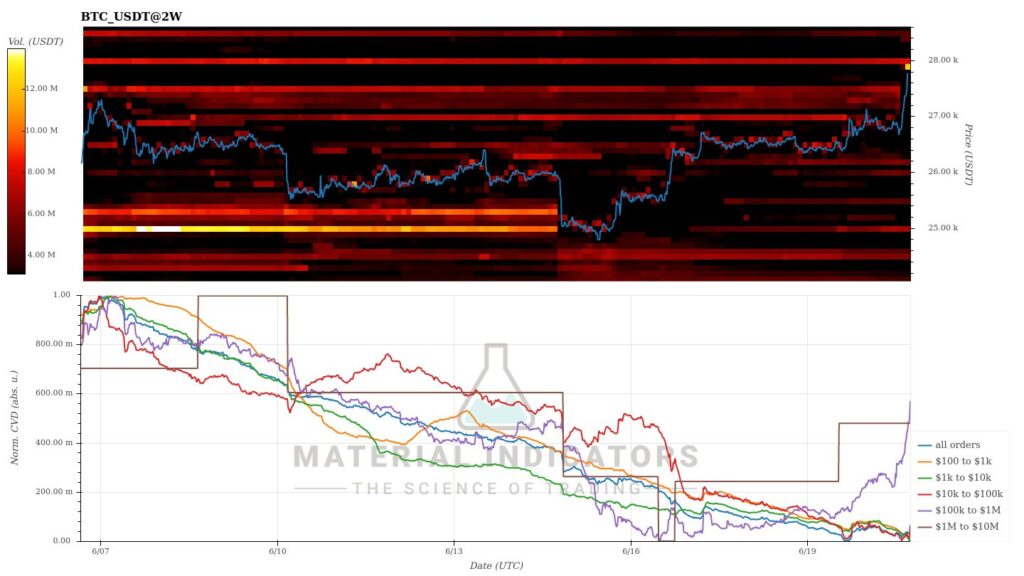

The Material Indicators heat map reflects the short-term technical change. Even though bitcoin’s $25 000 support levels were removed in mid-June, the spot price has managed to continue its upward angle. Cumulative volume delta (CVD) indicates an increase in whale-level demand.

Source: Material Indicators

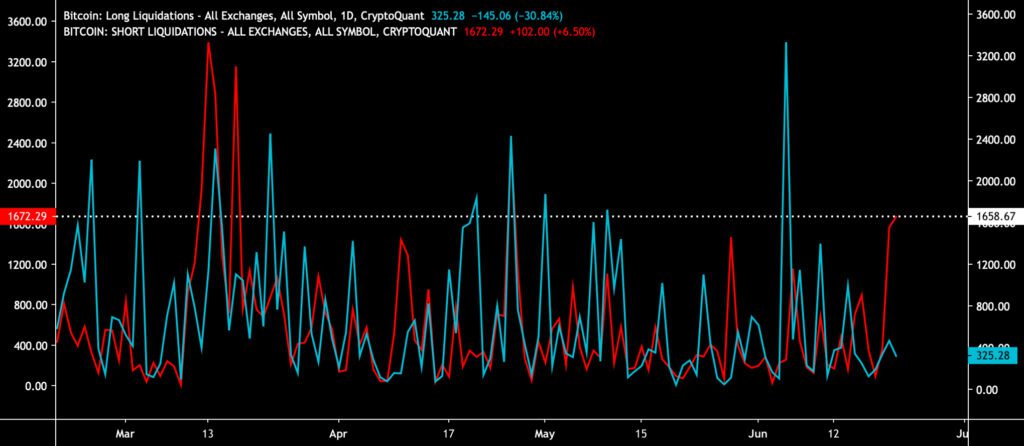

The derivatives market mirrors the reversal of the spot market, while liquidations of short positions (red) are at their highest level in three months. Since the beginning of June, liquidations of long positions (turquoise) have been in a clear decline.

Sources: Timo Oinonen, CryptoQuant

Bitcoin, the leading cryptocurrency, is now clearly diverging from other tokens. As bitcoin has strengthened by more than 20 percent in a week’s time window, the price development of other cryptocurrencies lags clearly behind, dropping their correlation in relation to bitcoin. However, Ethereum has tried to keep up with bitcoin.

Factors affecting the rise of bitcoin include ETF speculation and the rise of institutional interest, which together raise expectations for the cryptocurrency. In addition, the U.S. Securities and Exchange Commission’s (SEC) commodity classification clearly strengthens the two cryptocurrencies with the largest market capitalization. Similarly, the SEC’s security classification, or the possibility of it, weakens many smaller tokens.

7-Day Price Performance

Bitcoin (BTC): 20%

Ethereum (ETH): 14,3%

Litecoin (LTC): 16,9%

Aave (AAVE): 5,9%

Chainlink (LINK): 5,6%

Uniswap (UNI): 8,5%

Stellar (XLM): 9,6%

XRP: 4,1%

Get started with Bitcoin Litecoin Ethereum AAVE USDC Stellar Ripple

Join Coinmotion and buy your first cryptocurrencies within minutes!

S&P 500 Index: -0,2%

Gold: -1,9%

The Upward Trend of Commodity Tokens Continues

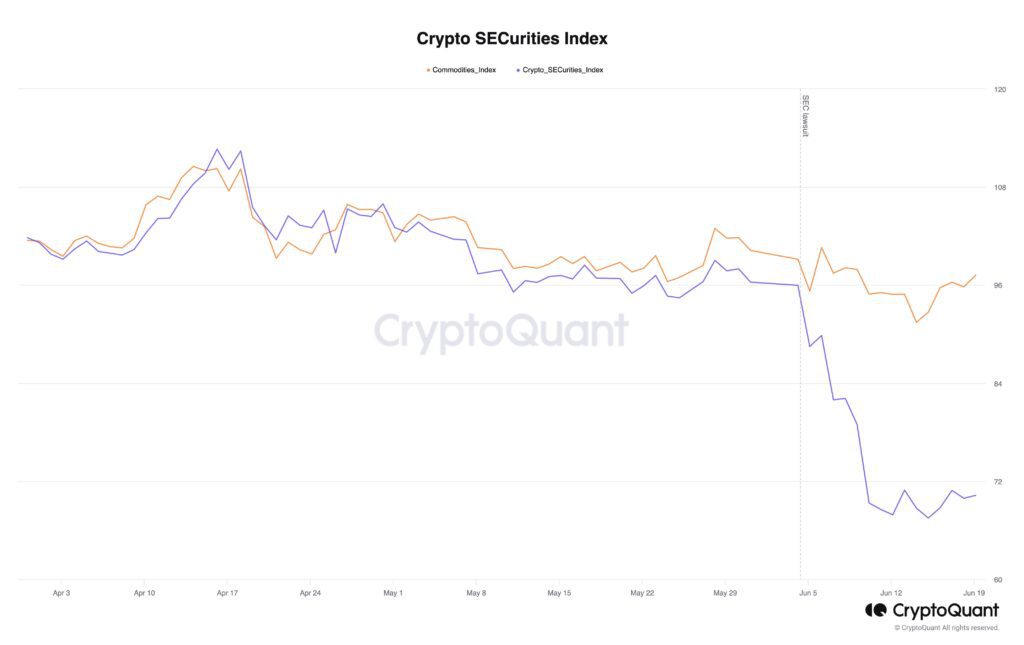

On Monday, June 5th, the SEC announced that it was suing the Binance.US platform and CEO Changpeng Zhao, known as CZ. Binance has to answer a total of 13 charges, which include operating the exchange without a proper license.

The attack by the Securities and Exchange Commission continued on Tuesday, June 6th, when it sued the Coinbase exchange. Coinbase is accused of, e.g., the sale of unregistered securities. The SEC’s attacks on these two mainstream exchanges have brought clear selling pressure to the market. Binance-linked tokens have naturally taken more of a hit, with Binance Coin, or BNB, weakening by -21 percent in a month.

This week, “commodity tokens” (orange) have continued to rise as they work their way back toward May’s valuation level. “Security tokens,” on the other hand, have gone mostly sideways, unable to recover from their -30 percent drop. At the same time, the commodity-classified bitcoin is being uplifted by BlackRock’s ETF application.

Source: CryptoQuant

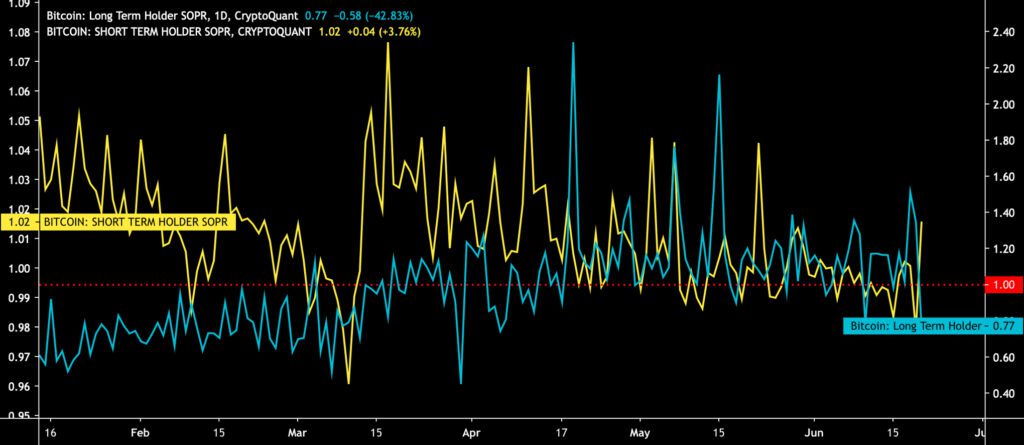

The STH-SOPR indicator (yellow), which describes short-term investors’ profitability, has risen to 1,02, representing the highest level in more than a month. STH-SOPR was below the red break-even point (1) for a long time due to the weakness of the spot price. Long-term investors are currently countering short-term investors, with the LTH-SOPR reading at 0,77. If the strength of the bitcoin spot price remains, long-term investors will also rise above the red break-even line.

Sources: Timo Oinonen, CryptoQuant

Developed by Renato Shirakashi, the SOPR indicator is calculated by dividing the realized price of bitcoin (USD) by the value of the original bitcoin transaction. Or, in simplified terms, the selling price divided by the purchase price. SOPR indicates whether the average bitcoin investor is in profit or at a loss. The SOPR indicator is usually divided into two parts: Short-term holders (STH-SOPR) and long-term holders (LTH-SOPR). The SOPR indicator can be interpreted with the following logic:

SOPR > 1 = Seller in profit

SOPR < 1 = Seller at a loss

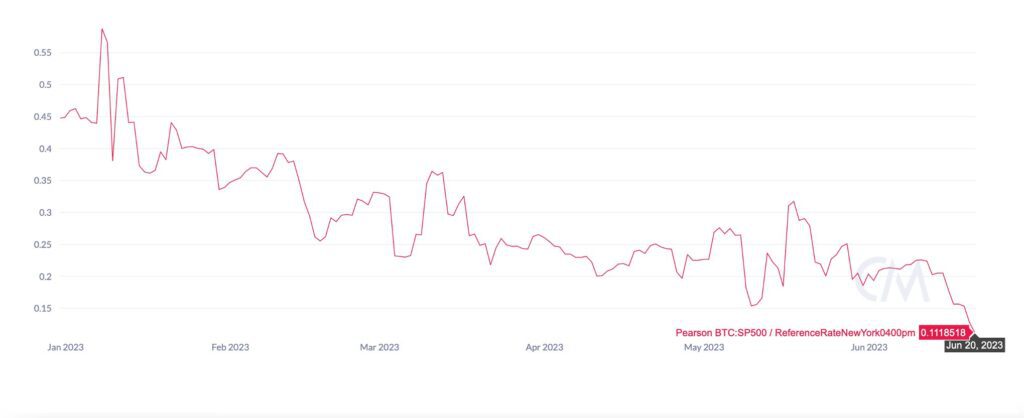

Bitcoin has Clearly Decoupled from the Correlation of the Stock Market

Bitcoin was long considered an “uncorrelated” asset whose price development took place separately from traditional asset classes. This narrative was especially true in the cryptocurrency’s early years when its correlation with the S&P 500 index was close to zero. However, that changed in 2020, when Michael Saylor launched his famous Bitcoin thesis while making large bitcoin allocations through his company MicroStrategy (MSTR). With escalating institutional interest, bitcoin’s correlation with the stock market increased.

The correlation remained high until last year’s bear cycle. In 2023, bitcoin’s dependence on the stock market has again been in a downtrend. This year, the Pearson correlation between bitcoin and the S&P 500 has dropped from 0.6 in January to 0,1 today. The drop from January to June has therefore been -83 percent.

Source: Coin Metrics

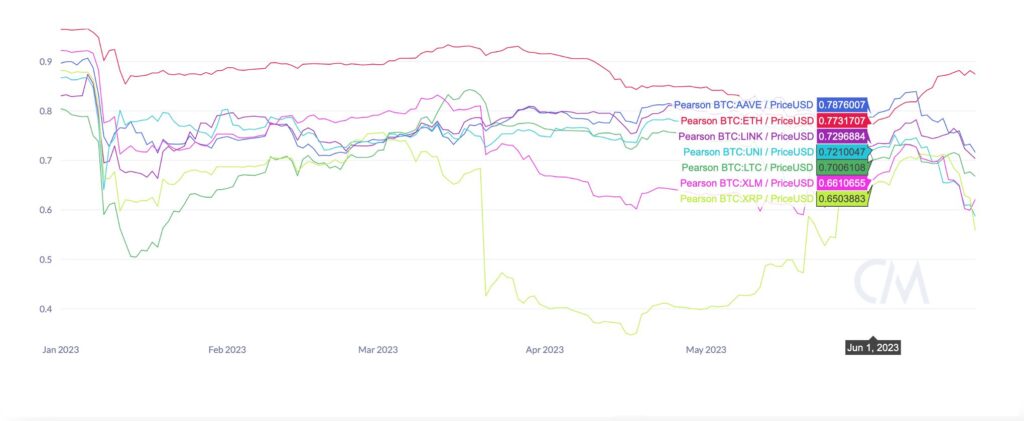

In addition to the decreasing correlation of the stock market, bitcoin is clearly breaking away from the direction of the altcoins listed on Coinmotion. In the background, bitcoin’s special regulatory status, ETF plans, and other institutional demands have an effect.

Source: Coin Metrics

Exchange Reserves Still in Steep Decline

Large exchanges currently have approximately 2 million bitcoin native units in their reserves, and the flows of these bitcoin reserves are a suitable tool for interpreting the broader market. Exchange reserves mirror investor behavior with the following logic: In a boom cycle, assets often move from exchange accounts to private wallets and long-term cold storage.

This trend is particularly visible in the bitcoin on-chain data. Similarly, in a bearish cycle, investors move their bitcoins back into an exchange, usually to convert them into fiat currencies, stablecoins, or other cryptocurrencies.

The exchange reserves of Bitcoin and Ethereum follow a common secular downward trend, the beginning of which spans back to the beginning of 2020. The outflow of units from the exchanges is also affected by the trend towards decentralized exchanges (DEX), which usually do not store their customer funds. However, the main reason behind the phenomenon is the transfer of the two most valuable cryptocurrencies into cold storage. The combined market capitalization of Bitcoin and Ethereum is currently 717,9 billion dollars.

Sources: Timo Oinonen, CryptoQuant

↑ Positive sentiment: Native units flow back to private wallets, long-term storage

↓ Negative sentiment: The number of native units on the stock exchanges is increasing. Units are converted to fiat, stablecoin, or cryptocurrency

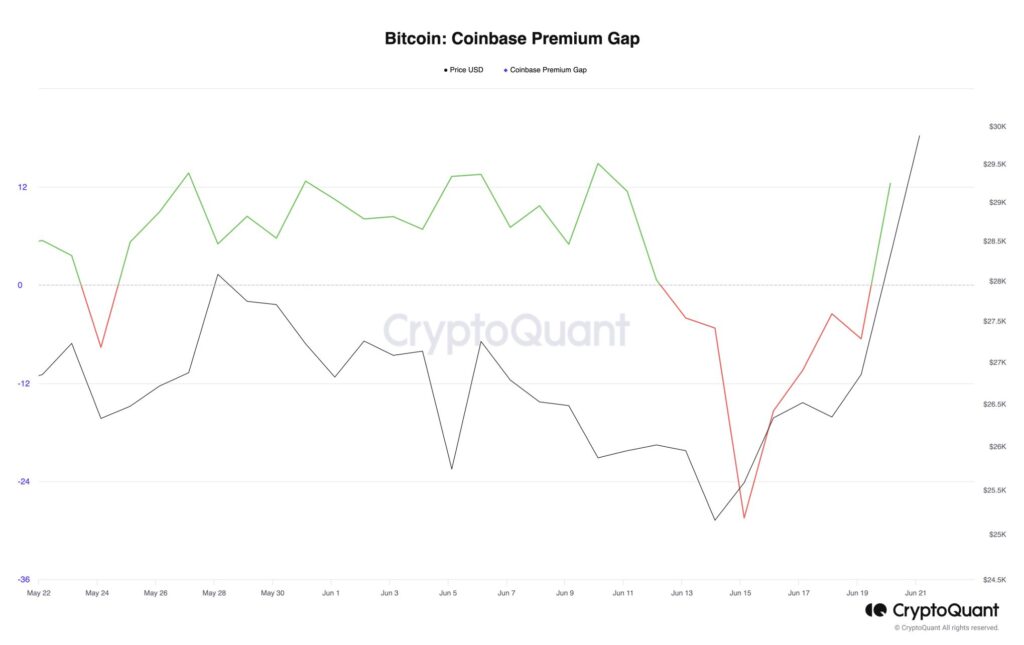

The Coinbase Premium Signals Growth in U.S. Demand

The Coinbase premium hit the market with two capitulation points last year, both in the late spring and the end of the year. However, the premium has reached an exceptional climb in the year 2023.

With the spot price of bitcoin climbing 20 percent during 24 hours, the premium has clearly turned its direction upwards, telling about the growth in North American demand. At the same time, the premium is a positive signal amid the challenging US regulatory environment. Although the change in the regulatory line has been radical, in the long run, it still gives the market a clear operating framework. In addition, the current segmentation into security and commodity tokens clearly strengthens bitcoin’s position.

Source: CryptoQuant

Coinbase was one of the first publicly listed crypto exchanges in the world (trading symbol: COIN), and the company is also one of the most transparent players in the industry. These features attract American institutions and high-net-worth individuals (HNWI) to Coinbase.

What Are We Following Right Now?

The multinational Deutsche Bank AG, which employs 67 500 people, has applied for a German license that would entitle it to offer custody services for digital assets. These digital assets include cryptocurrencies like bitcoin and other tokens.

Deutsche Bank has applied for regulatory permission to operate a custody service for digital assets such as crypto currencies https://t.co/chiYXXk8fx

— Bloomberg Crypto (@crypto) June 20, 2023

Raoul Pal, whose models we have discussed before, predicts that the “exponential era” will continue. Pal’s exponential age portfolio is up more than 60 percent since the start of 2023.

The Exponential Age theme, continues, well exponentially….

— Raoul Pal (@RaoulGMI) June 21, 2023

The Exponential Age basket is up over 60% YTD… 1/ pic.twitter.com/zFrGQPS1HM

The United Kingdom and its new prime minister Rishi Sunak are looking for a new approach to support the growth of the cryptocurrency industry. The launch date of the future regulatory update has been announced as October 8th, 2023.

How should crypto investments be marketed and promoted?

— web3kc.eth (@kingscounselxyz) June 19, 2023

The UK Government has just published new proposals.

The aim: to protect consumers without stifling innovation. pic.twitter.com/wlhPx8Bgk3

Stay in the loop of the latest crypto events

- The Déjà Vu of Bitcoin Dominance

- Ripple (XRP): Empowering the future of digital currency

- Coinmotion Teams Up with Fenergo for the Next Level in AML Compliance

- Is Web3 the future of the Internet?

- Raoul Pal Forecasts a Liquidity Renaissance

- Exploring altcoins updated meaning in 2023

- BRC20 tokens: How they differ from other cryptocurrencies

- How can decentralization save us in a world driven by AI?

Get started with Bitcoin Litecoin Ethereum AAVE USDC Stellar Ripple

Join Coinmotion and buy your first cryptocurrencies within minutes!

The views, thoughts, and opinions expressed in the text belong to the author and not necessarily to the author’s employer, organization, committee, or other group or individual.