The technical analysis of week 23 maps the recovering crypto market with technical and fundamental indicators. In addition, we familiarize ourselves with, e.g., cryptocurrency correlations, market segmentation, and Bitcoin dominance. We also consider the situation of the Binance and Coinbase exchanges and the outlook for bitcoin.

The price development of the crypto market has continued in a fearful mood since last week, with the leading cryptocurrency, bitcoin weakening by around three percent. The market is still weighed down by the realization of the regulatory risk in the form of the US Securities and Exchange Commission SEC.

On Monday, June 5th, the SEC announced that it was suing the Binance.US platform and Binance’s CEO Changpeng Zhao, known as CZ. Binance has to answer a total of 13 charges, which include operating the exchange without a proper license.

The attack by the Securities and Exchange Commission continued on Tuesday, June 6th, when it sued the Coinbase exchange. Coinbase is accused of, e.g., the sale of unregistered securities. The SEC’s attacks on these two mainstream exchanges have brought clear selling pressure to the market. Binance-linked tokens have naturally taken a more severe hit, with Binance Coin (BNB) weakening by -23 percent in two weeks.

From a technical perspective, bitcoin has continued in its ascending channel, rising 56 percent since the beginning of the year. Between January and April of this year, Bitcoin rose almost 100 percent during a parabolic phase, moving from there to the current technical correction.

The moderately falling spot price is supported by two critical indicators. The first of these is the 200-day moving average (orange), above which bitcoin has remained since January. The 200-day moving average is at the level of $23 000, and the spot price can be expected to bounce off its surface. In a worse scenario, bitcoin finds support from the realized price wave (grey), which is located around $20 000.

Sources: Timo Oinonen, CryptoQuant

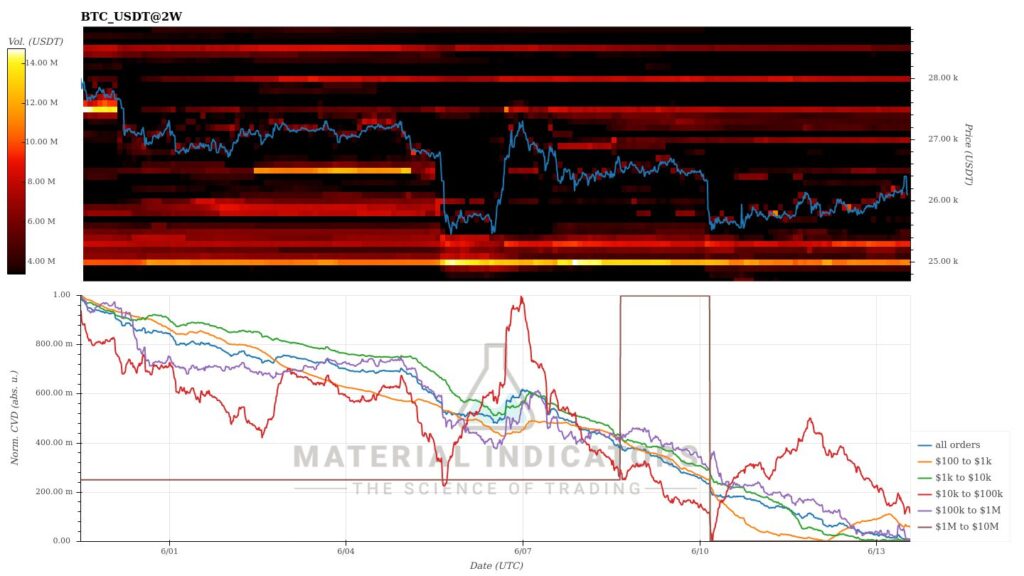

The Material Indicators heat map shows how a clear support zone has formed at $25 000. The current market sentiment suggests that the spot will fall further. Cumulative volume delta (CVD) indicates a holistic decline in demand. Last week’s demand from whales has also subsided.

Source: Material Indicators

The price development of cryptocurrencies has continued with small gains since last week as the dark clouds of regulatory risk gathered in the sky. Bitcoin and Ethereum, the largest cryptocurrencies by market value, are diverging from their mutual correlation. However, in the seven-day time frame, the correlation between BTC and ETH is still at the level of 0,92.

Tokens with higher beta and lower market cap have taken a big hit, as usual. Many of them are also weighed down by the SEC’s securities classification. Litecoin, which will meet its halving event in 48 days, fell more than expected, 13,5 percent. The positive trend of XRP can be interpreted as describing the success factor of Ripple Labs against the SEC.

The stock index S&P 500 gained 2,5 percent in the week, and gold weakened by -1,4%.

Source: Cryptowatch

7-Day Price Performance

Bitcoin (BTC): -2,8%

Ethereum (ETH): -6,6%

Litecoin (LTC): -13,5%

Aave (AAVE): -8,6%

Chainlink (LINK): -11,1%

Uniswap (UNI): -3,8%

Stellar (XLM): -7,5%

XRP: -4,4%

Get started with Bitcoin Litecoin Ethereum AAVE USDC Stellar Ripple

Join Coinmotion and buy your first cryptocurrencies within minutes!

S&P 500 Index: 2,5%

Gold: -1,9%

The Good and Bad News of the FOMC

The Fed announced late Wednesday night that the FOMC meeting would freeze the rate hikes, meaning the interest rate would remain in the range of 5 to 5,25 percent. The reaction of the stock market was positive, as expected, with the S&P 500 index ending clearly up.

Regarding bitcoin, the FOMC reflects both good and bad news. First, moderate interest rates generally support the high-beta asset classes that bitcoin falls into. If inflation has now reached its peak in the United States, the interest rate can be predicted to decrease gradually, strengthening the cryptocurrency’s prospects in the long term.

On the other hand, bitcoin’s short-term price reaction is a bit worrying, as it is under clear selling pressure while tech stocks like Nvidia are rising. While the investment narrative and outlook for bitcoin remain good, bearish altcoins are undermining it, with the correlation still significant.

Learn more: Exploring altcoins updated meaning in 2023

Is the SEC Redefining the Market?

The new line of the US Securities and Exchange Commission (SEC) can be seen as a watershed, as it splits tokens into two categories. The first category includes Bitcoin and Ethereum, which the SEC has classified as “commodities.” The commission has defined many altcoins as “securities,” making their supply and use more difficult.

To date, the SEC has defined the following tokens as securities: sol, ada, matic, fil, sand, axs, chz, icp, near, vgx, dash, flow, mana, algo, nexo, atom, bnb, busd, and coti.

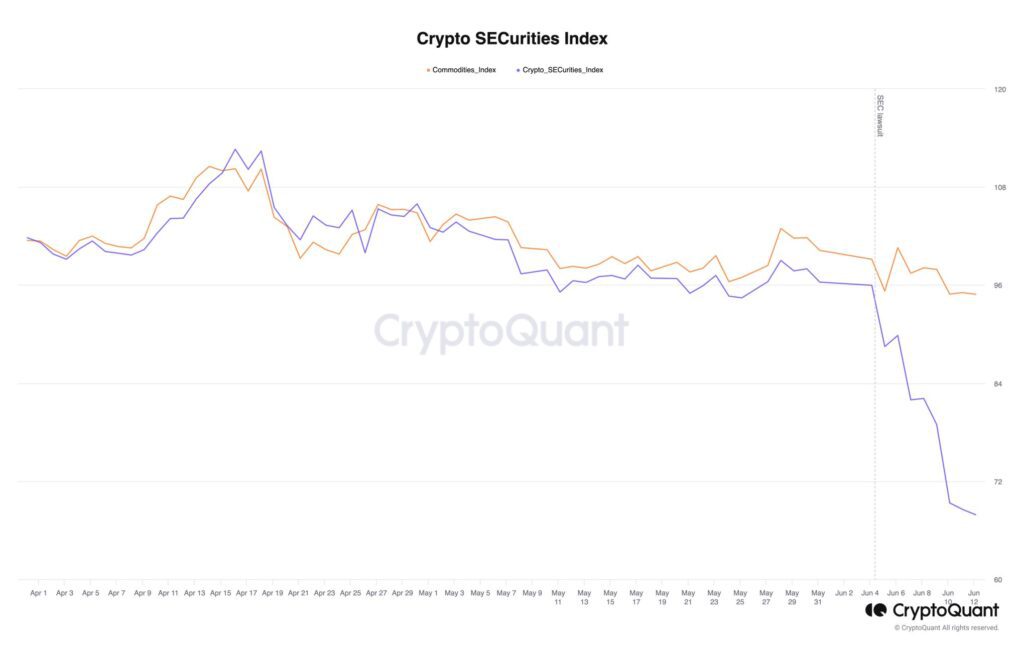

The crypto securities index compiled by CryptoQuant shows how the prices of tokens (purple) defined as securities by the SEC fell by almost -30 percent after the commission’s definition. Bitcoin and Ethereum, which fall into the commodity category, have again continued their sideways movement in the same time window. The divergence between the two groups is clear, dividing the market into winners and losers.

Source: CryptoQuant

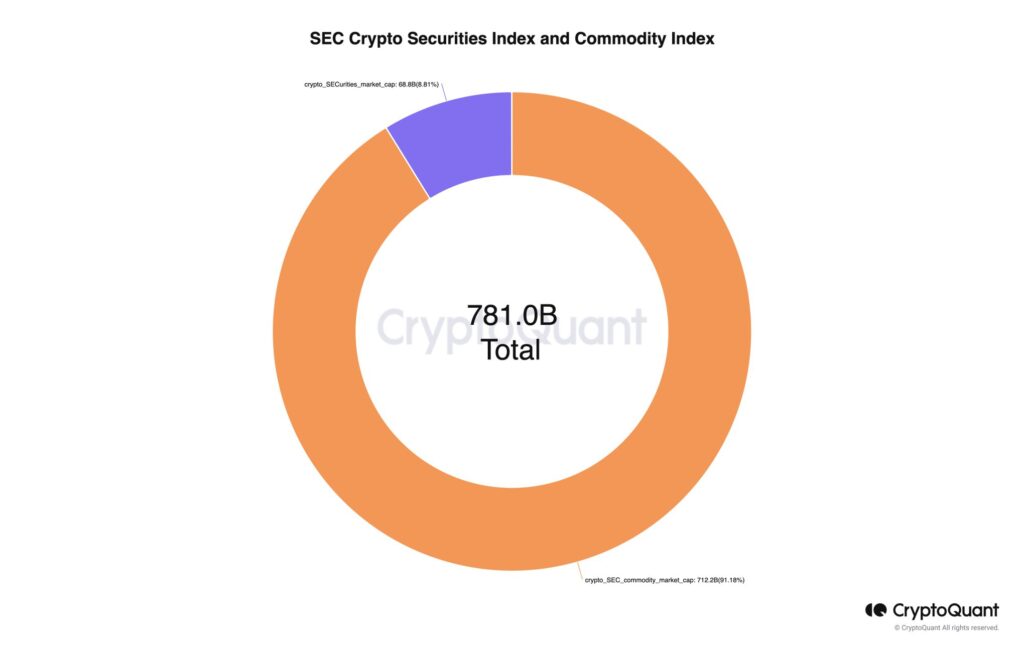

It’s good to remember that the market value of Bitcoin and Ethereum is huge compared to tokens that have received security status. The two largest cryptocurrencies in the commodity category (orange) have a market value of more than $700 billion, while the market value of security tokens (purple) remains around $70 billion.

Source: CryptoQuant

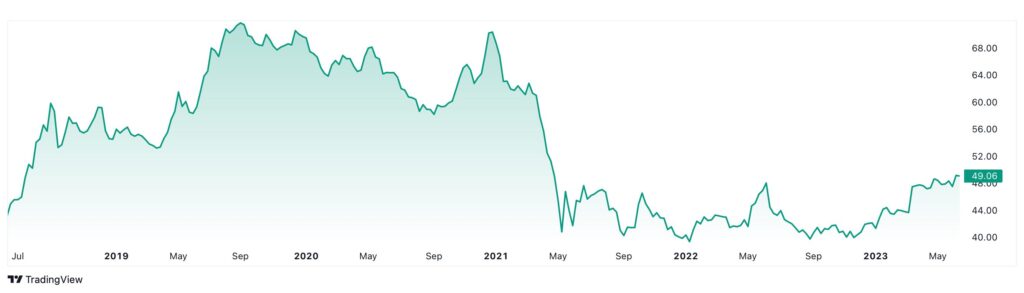

The natural continuation of this trend is the growth of Bitcoin dominance, as it has risen to its highest level since spring 2021. In the current regulatory environment, dominance can be predicted to continue to grow.

Source: Tradingview

About the Situation of Binance and Coinbase

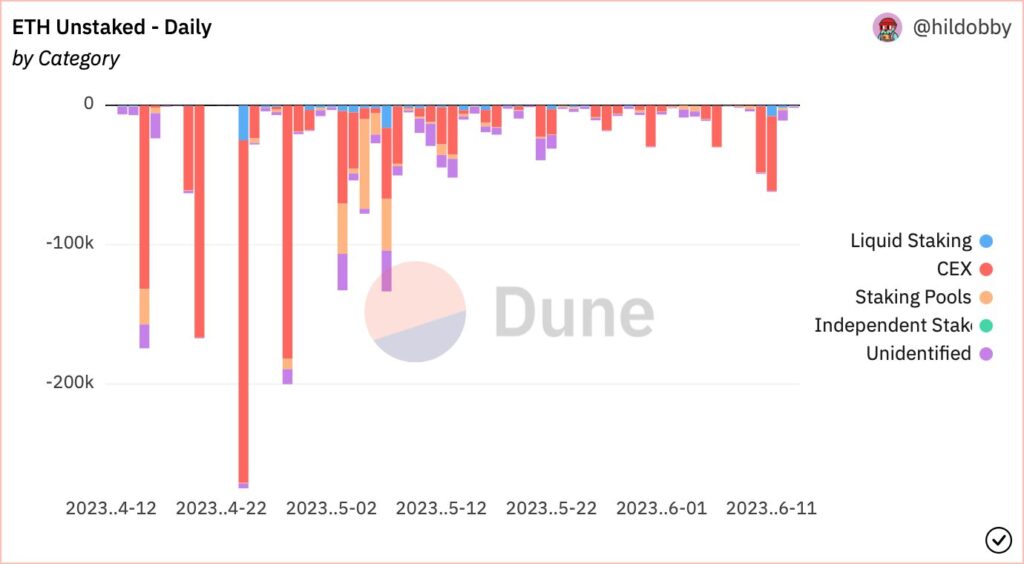

At the same time, the regulatory impact on the crypto market is illustrated by the amount of ETH token unstaking taking place in centralized exchanges (CEX). The pressure on Binance and Coinbase is causing investors to move their funds to decentralized exchanges (DEX) and cold storage.

Sources: Dune Analytics, @hildobby

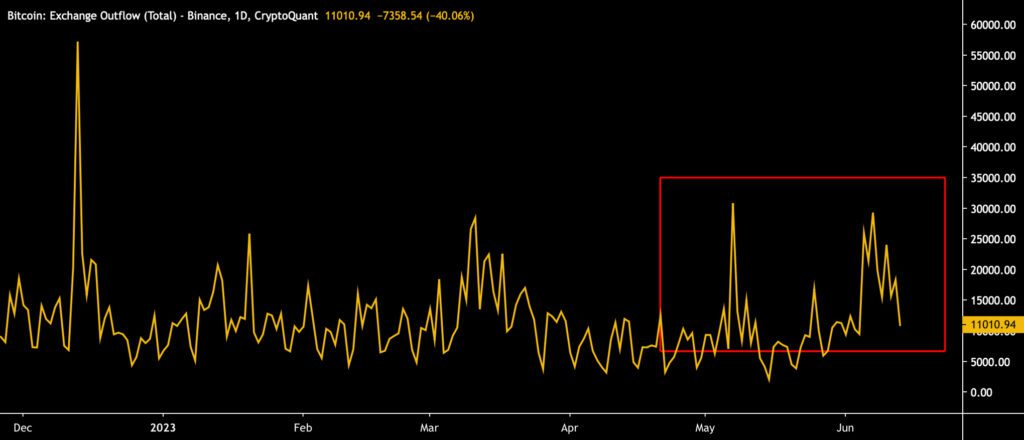

Exchange outflow data shows that Binance has clearly taken a hit from the tightening of the regulatory field. Binance outflows are on the rise in early June (orange), ascending to 30 000 bitcoin units on a daily basis.

Binance’s difficulty factor is raised by its own Binance Coin (BNB) token, which has dropped -23 percent in two weeks. Binance will be forced to sell its liquid token portfolio to support BNB while bringing selling pressure to the entire market. Although Changpeng Zhao (CZ) denies BNB support purchases, market data from Hyblock indicates otherwise. The situation can be compared to the situation of the FTX exchange and Alameda Research with their FTX Token (FTT).

Sources: Timo Oinonen, CryptoQuant

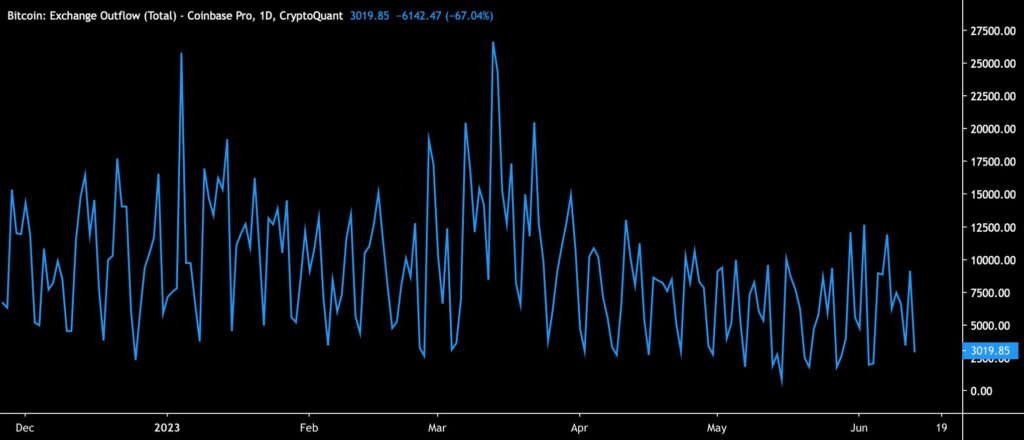

Coinbase’s outflows, on the other hand, have remained more modest. In mid-June, only about 3000 bitcoin units flowed out of the exchange. Coinbase’s COIN stock is up nearly 60 percent since the start of the year, and the exchange doesn’t have its own BNB-like token.

Sources: Timo Oinonen, CryptoQuant

Amid the challenges of Binance and Coinbase, it is good to remember that the US Securities and Exchange Commission SEC’s jurisdiction does not extend to platforms like Coinmotion. Coinmotion operates within the framework of European regulation and the future MiCA. As a payment institution and provider of virtual currency, Coinmotion’s operations are supervised by the Finnish Financial Supervisory Authority.

Bitcoin Mirrors Certainty in Uncertain Markets

The leading cryptocurrency and digital asset, bitcoin, is now facing a paradigm shift in terms of regulatory risk. However, the regulatory risk is not a direct threat to bitcoin per se, as U.S. Securities and Exchange Commission (SEC) does not classify bitcoin as a security. The current selling pressure is coming from the direction of market makers, who recently dumped a huge number of Binance-related altcoins, collapsing the liquidity.

In contrast to the challenging market environment, bitcoin’s technical and fundamental indicators mirror its strength. The spot price recoiled in late 2022, forming a technical inflection point (pink), and bitcoin has been following the rising trendline since.

Sources: Timo Oinonen, CryptoQuant

Praeterea, bitcoin’s active addresses (blue) are rising, and they have formed a wide triple bottom structure (white), which generates a bullish divergence to the spot price. Additionally, the exchange stablecoin ratio (yellow) is reaching new highs, forming another bullish divergence.

In the broader picture, bitcoin’s market behavior can be segmented into accumulation (turquoise) and distribution (violet) phases, which together form a multi-year series of cycles. Institutional money has traditionally favored accumulation cycles, while retail investors have been active in distribution cycles. Bitcoin’s history is also defined by halving events, which are always preceded by a pre-halving accumulation cycle (turquoise).

What Are We Following Right Now?

Andreas Steno Larsen predicts that inflation will decrease, allowing for a possible drop in interest rates.

Food prices are now going to fall off a cliff. It is the only feasible outcome both in the US and in Europe. 9 charts on inflation in the US ahead of the report here -> https://t.co/AGLH7KR9w0 pic.twitter.com/Y0qdVsqKEJ

— AndreasStenoLarsen (@AndreasSteno) June 12, 2023

Mark Yusko and Michael Ippolito discuss the latest twists and turns in the market. Yusko sees the Fed’s rate hike cycle as over, meaning potentially better times for high-risk investments.

Is the decentralized finance protocol Curve in trouble?

$131M worth of $CRV is at risk of liquidation if the price drops by 35%.

— An Ape's Prologue (@apes_prologue) June 14, 2023

The Curve Founder has borrowed $110M in stablecoins against all his $CRV – 50% of the circulating supply.

This could have severe implications for DeFi, with lending protocols at risk of accruing bad debt pic.twitter.com/Q3EWJfTyTf

Stay in the loop of the latest crypto events

- Ripple (XRP): Empowering the future of digital currency

- Coinmotion Teams Up with Fenergo for the Next Level in AML Compliance

- Is Web3 the future of the Internet?

- Raoul Pal Forecasts a Liquidity Renaissance

- Exploring altcoins updated meaning in 2023

- BRC20 tokens: How they differ from other cryptocurrencies

- How can decentralization save us in a world driven by AI?

Get started with Bitcoin Litecoin Ethereum AAVE USDC Stellar Ripple

Join Coinmotion and buy your first cryptocurrencies within minutes!

The views, thoughts, and opinions expressed in the text belong to the author and not necessarily to the author’s employer, organization, committee, or other group or individual.