The term “altcoin” is derived from the words “alternative coin” and was created to differentiate other cryptocurrencies from Bitcoin. In this article, we’ll examine altcoins and their potential future.

What is an altcoin?

The term “altcoin” is believed to have originated in the early days of cryptocurrencies, when the number of digital currencies began to explode.

Although new cryptocurrencies were constantly being introduced, Bitcoin consolidated its position as the dominant cryptocurrency. All other cryptocurrencies were considered alternatives to Bitcoin, and because of that, the term “altcoin” was born.

Today, there are thousands of different altcoins, each with unique characteristics, purpose, and community.

Despite Bitcoin still being the most well-known and widely used cryptocurrency, altcoins have gained considerable popularity and become an essential part of the cryptocurrency ecosystem.

Benefits of Altcoins

Bitcoin is considered the “true first” cryptocurrency, but altcoins have still played a significant role in developing the crypto market. In addition to market development, altcoins offer many other benefits for developing cryptocurrencies and crypto investors. A few of them are listed below.

- Learning by Experimentation: Altcoins allow developers to experiment with new ideas and technologies in the cryptocurrency space. For example, some altcoins are designed to be faster or more energy efficient than Bitcoin, while others focus on privacy or smart contract functionality.

- Community-driven innovation: Altcoins often have communities of passionate users about a particular project or technology. These communities can drive innovation by participating in development, providing feedback, and creating new cryptocurrency uses.

- Diversification: Altcoins can offer crypto investors good diversification options. There is much to choose from, so spreading your investments between several crypto projects should be easy. This can reduce risk and potentially increase returns.

- Solving specific problems: Some altcoins are designed for particular use cases, such as facilitating micropayments or storing digital value. These altcoins may offer their users unique features or benefits that Bitcoin does not have.

Overall, altcoins allow developers, investors, and users to explore new ideas and technologies in the cryptocurrency space and play a significant role in the cryptocurrency ecosystem.

What are the most popular altcoins?

When it comes to altcoins, the realm of cryptocurrencies extends far beyond the ever-popular Bitcoin. With a staggering selection of over 23,000 altcoins, pinpointing the definitive “most popular” option becomes daunting. Each altcoin holds a unique purpose, catering to different communities and stakeholders.

We can group them based on their intended applications to make sense of this vast altcoin universe, facilitating a clearer understanding of their popularity. By examining altcoins through the lens of purpose, we gain insights into which ones dominate their respective domains, circumventing the overwhelming task of selecting a single frontrunner from thousands of contenders.

From decentralized finance (DeFi) tokens like Compound and Aave, which fuel lending and borrowing ecosystems, to utility-focused altcoins such as Chainlink and Stellar, which facilitate seamless data integration and cross-border transactions, respectively, altcoins find their niche by serving specific functions within the blockchain landscape.

Moreover, altcoins targeting privacy-enhanced transactions, such as Monero and Zcash, appeal to individuals seeking enhanced anonymity, while Cardano and Polkadot spearhead the development of scalable and interoperable blockchain networks.

Navigating the expansive altcoin market demands a thorough understanding of the diverse projects underlying this crypto ecosystem. By recognizing the varying purposes of altcoins, we can identify the most popular contenders within specific niches rather than struggling to choose from an overwhelming array of choices.

DeFi altcoins

DeFi altcoins can be counted as all cryptocurrencies that are used or actively utilized on different DeFi platforms. Purposes of use for DeFi altcoins can be, for example, insuring the loans of the DeFi service and providing liquidity to the DeFi platform.

Stablecoins

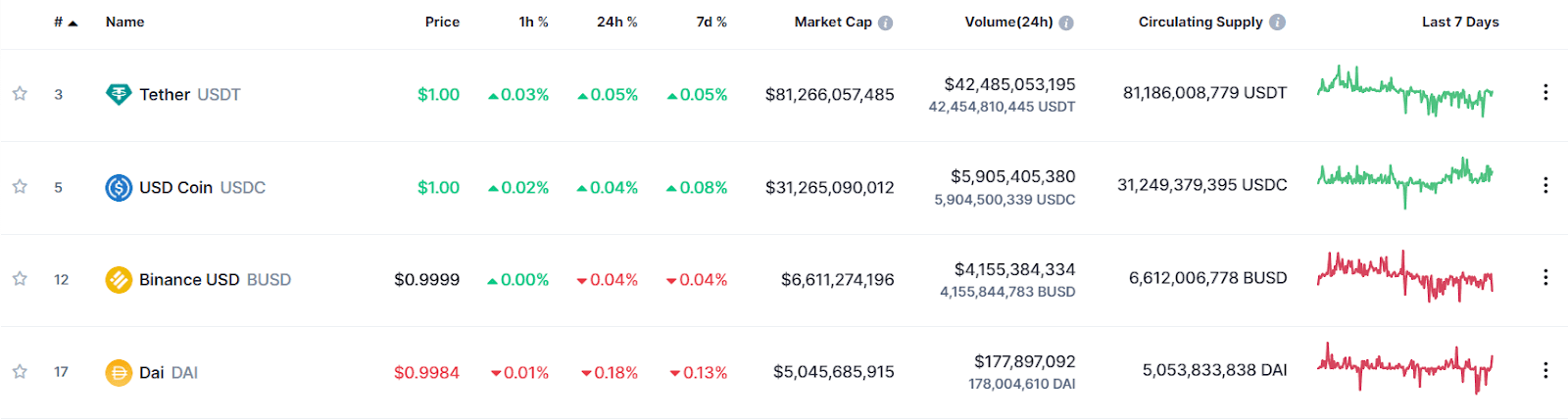

Stablecoins usually refer to cryptocurrencies whose value is tied to a fiat currency reserve. Such crypto-projects always try to keep a 1:1 ratio to the fiat currency reserve to which they are tied.

Stablecoins are often used to protect a crypto portfolio against inflation and reduce portfolio volatility.

Meme coins

Memecoins have been popular for a long time, especially among younger investors.

Due to their often humorous nature, meme coins are highly volatile and prone to sudden price fluctuations. In some cases, the price of a meme coin can be driven up by social media hype or celebrity mentions of that coin rather than any underlying value or technological innovation.

Summarization

The list of different altcoin groupings could be continued endlessly because, nowadays, almost all cryptocurrencies have a specific purpose.

However, if you think about the most popular altcoin purely based on market capitalization, it is Ethereum. Ethereum currently has the second-largest market capitalization of the entire crypto market.

The Ethereum blockchain is also enjoying great popularity among various altcoin projects. Most altcoins are built on top of the Ethereum blockchain.

Altcoin rates

Altcoin rates are often more volatile than Bitcoin rates (excluding stablecoins). This is a good thing to remember when considering investing in them.

Why are altcoin rates so volatile compared to Bitcoin? There are several reasons for this, but the most significant reason is the lower liquidity of altcoins compared to Bitcoin.

Since almost all altcoins have lower trading volumes than Bitcoin, it may be easier for large buyers or sellers to adjust the price with their actions significantly.

Another significant reason for the volatility of altcoins is pure speculation. Since many altcoins are still in development, they have very few actual or value-adding use cases.

This makes them more susceptible to price speculation based more on hype and rumor than any fundamental value proposition.

It is also worth noting that most altcoin rates are strongly linked to the Bitcoin rate. This is because many altcoins are traded against Bitcoin instead of fiat currency, which makes them vulnerable to Bitcoin exchange rate fluctuations.

For example, if the value of Bitcoin falls sharply, it can also cause the price of altcoins to fall.

(What is the share of the market value of Bitcoin in the market value of the entire crypto market)

Future of altcoins

In the future, the term “altcoin” could be abandoned, or its use will be significantly reduced. This is purely because an altcoin is a somewhat outdated term that does not accurately reflect the diversity of cryptocurrencies currently available.

You can already notice the change in the use of the term. The term altcoin often refers to a relatively new crypto project with a smaller market value.

Even the most significant stablecoin projects, such as USDT and USDC, have grown so extensive that they are no longer considered altcoins.

In addition, some crypto investors speculate that Ethereum might overtake Bitcoin in market cap in the future. In practice, this would mean that Ethereum would become the most popular cryptocurrency, displacing Bitcoin.

In conclusion

All in all, in the ever-evolving landscape of cryptocurrencies, altcoins refer to all digital assets apart from Bitcoin. While the debate surrounding this classification persists, one thing remains evident: many altcoins possess tremendous potential.

However, distinguishing the frontrunners from the rest becomes complex work as the crypto sphere expands. Countless altcoins emerge daily, each harboring unique characteristics and aspirations. These projects, driven by innovative technologies such as blockchain, are poised to shape the future of finance and beyond.

As the altcoin market matures, investors and enthusiasts seek opportunities beyond the pioneering Bitcoin. The emergence of altcoins signals a transformative era where decentralized technologies converge with traditional industries, reshaping economies and empowering individuals.

Alternative coins — Frequently asked questions

Initially, the term altcoin was coined to describe all cryptocurrencies besides Bitcoin. According to this concept, Ethereum is also an altcoin.

However, altcoin often refers to a relatively new crypto project with a smaller market value.

All altcoins currently have lower liquidity than Bitcoin. As a result, large institutional investors can significantly influence the price of altcoins with their buy and sell orders.

You can seek stability in your portfolio through, for example, stablecoins with their value tied to fiat currency.

Purely in terms of the market cap, the most popular altcoin is Ethereum. It has the second largest market cap in the crypto market, and its blockchain is used by most of the various altcoin projects.

Some crypto-investors even speculated that Ethereum would overtake Bitcoin in market value in the future.

Stay in the loop of the latest crypto events

- BRC20 tokens: How they differ from other cryptocurrencies

- Are We Approaching a V-shaped Correction?

- BRC20 tokens & Less Liquidity, More Volatility?

- Will the “Sell in May” Anomaly hit the Crypto Market?

- Bitcoin Still in Accumulation Cycle, Despite the Correction

- Exploring Ethereum’s Shapella upgrade: What you need to know

- How can decentralization save us in a world driven by AI?

- Beginner’s guide: How to invest in Bitcoin

Get started with Bitcoin Litecoin Ethereum AAVE USDC Stellar Ripple

Join Coinmotion and buy your first cryptocurrencies within minutes!

The views, thoughts, and opinions expressed in the text belong to the author and not necessarily to the author’s employer, organization, committee, or other group or individual.