The TA of week 39 focuses on technical indicators, including Bollinger bands and spot price compression. Additionally, we explore the possibility of a short squeeze and the Fed’s pivot.

Continuing Price Compression and Bollinger Band Squeeze

The leading cryptocurrency bitcoin was yet again able to retain its key $19K level, despite the escalating selling pressure of the stock market. The $19K can be interpreted as a multi-year support and confluence zone, dating back to the 2017 cycle’s peak. Bitcoin’s spot price is currently facing a multi-week price compression as well as a Bollinger band squeeze (blue). The Fed pivot speculations, combined with the Bollinger band squeeze, are seemingly forcing bitcoin upwards, potentially forming a bear market rally.

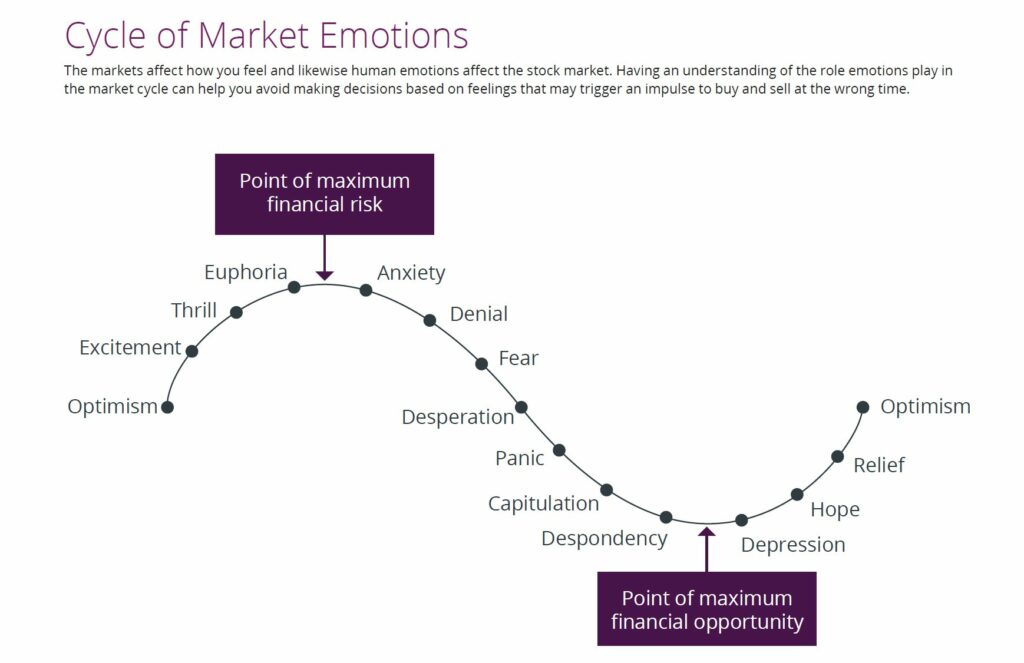

Bitcoin is currently down -57,97 percent this year, correlating heavily with technology-related stocks. We’re likely close to the cycle bottom, as many retail investors seem to have capitulated already. The moment of capitulation also represents the point of maximum financial opportunity, and smart money will accumulate at these levels.

Bitcoin’s spot price has recently formed a higher low after the lower low in mid-June. The ascending and descending trendlines (turquoise) form an inflection point, which indicates a potential spot price increase.

Bitcoin continues its moderate climb, rising 4 percent compared with the previous week’s 7,5%. Ethereum has stayed mainly flat within the seven days, moving just 0,8%. The decentralized exchange (DEX) Uniswap continued its upward rally, rising 13,3% after previous week’s 21,1%.

Bitcoin (BTC): 4%

Ethereum (ETH): 0,8%

Litecoin (LTC): 2,2%

Aave (AAVE): 3,4%

Chainlink (LINK): -3,0%

Uniswap (UNI): 13,3%

Stellar (XLM): 7,1%

XRP: 2,2%

Get started with Bitcoin Litecoin Ethereum AAVE USDC Stellar Ripple

Join Coinmotion and buy your first cryptocurrencies within minutes!

– – – – – – – – – –

S&P 500 Index: 3,29%

Gold: 4,66%

– – – – – – – – – –

Bitcoin RSI: 51

A Short Squeeze Ahead?

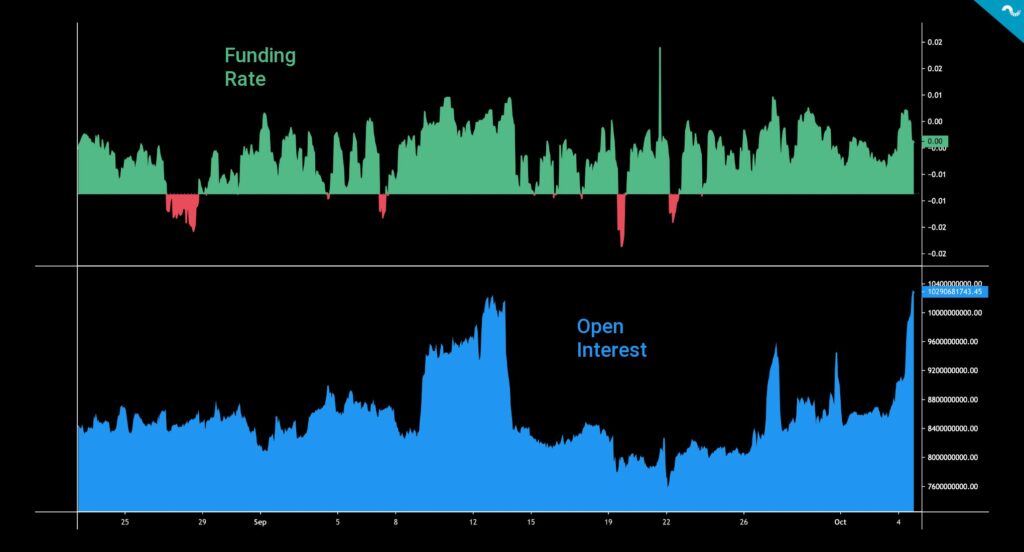

Bitcoin’s open interest, i.e., the number of contracts or commitments outstanding in futures and options, has climbed to its highest level since May this year. The open interest has now breached $10,3 billion and shows no signs of retraction. The rising open interest and spot price hike form a possible setting for a short squeeze scenario, which would effectively trap short contracts. The number of investors sitting on the sidelines is exceptionally high, and S&P 500-related small-scale speculators are currently at their lowest stock exposure levels since 1990.

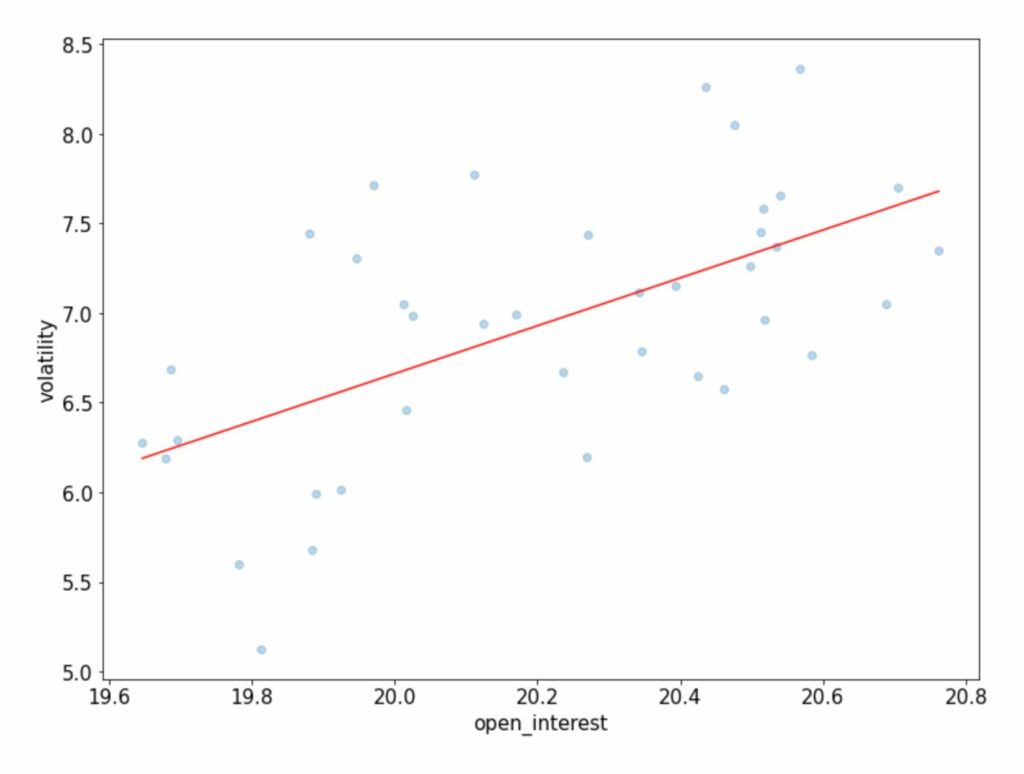

Statistical analysis shows how bitcoin’s open interest (independent variable) has been in a positive correlation with volatility (response variable).

↑ Increasing OI: Higher liquidity and volatility, positive price trend

↓ Decreasing OI: Escaping liquidity and volatility, negative price trend

Markets Are Anticipating a Potential Fed Pivot

The American central bank Fed has been implementing exceptionally hawkish monetary policies this year, raising rates on multiple occasions. While the zero (or negative) rate season was a fertile environment for most asset classes, the high-interest rates are wreaking havoc everywhere. Fed’s tight policies have also resulted in the dollar index DXY rocketing 15,11 percent this year.

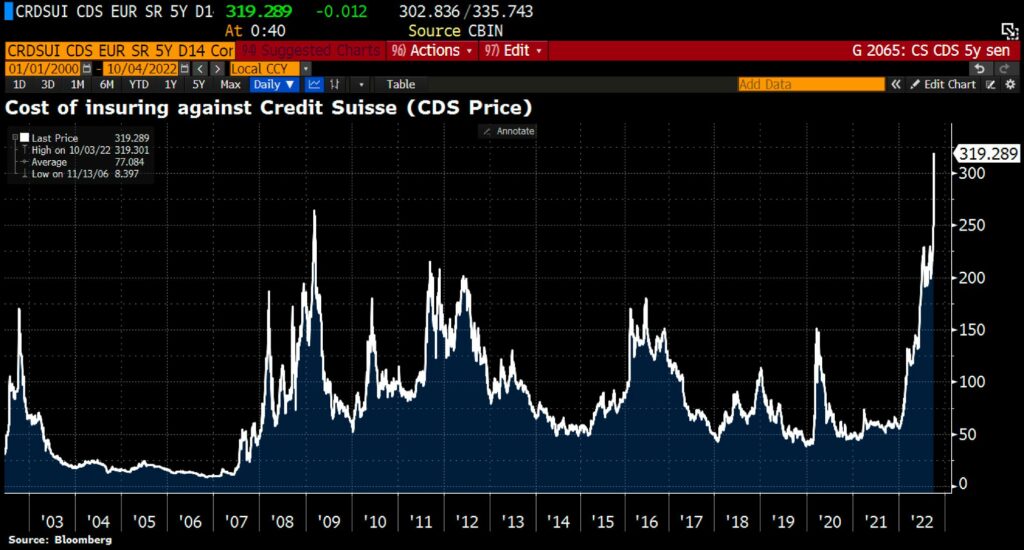

Additionally, the European energy crisis is starting to show its true multiplicative effects as the investment bank Credit Suisse drifts towards troubled waters. The cost of buying insurance against Credit Suisse defaulting on its debt soared to a record high on Monday as the Swiss bank failed to calm market concerns around the strength of its balance sheet.

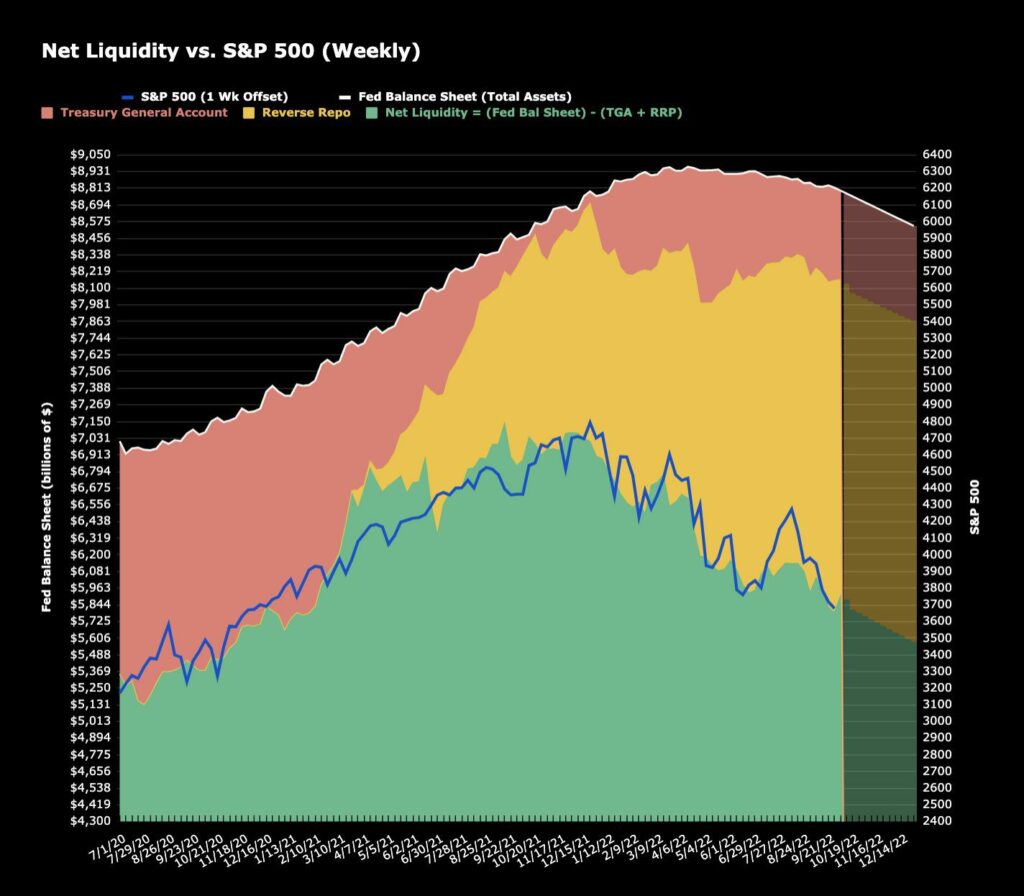

According to investment bank J.P. Morgan, hedge funds are short at record levels, however, there are signs of shifting momentum. This week, U.N. and IMF both warned Fed about unsustainable inflation control policies, which have been especially rough on emerging markets. The two institutions might easily force Fed to alter its course from hawkish to dovish, although this move would likely fuel inflation further. S&P 500 saw a massive pump in net liquidity this week, mirroring a potential bear market rally.

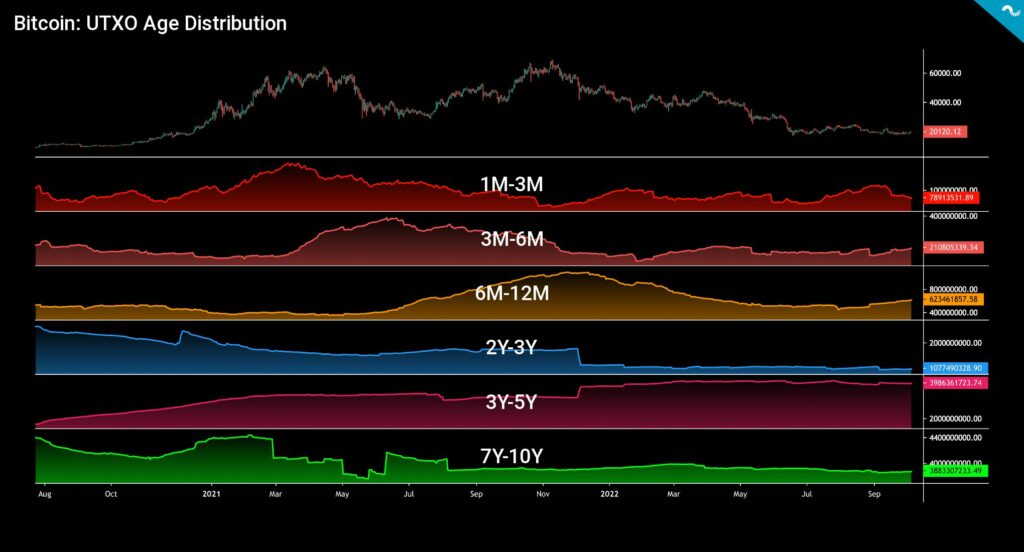

UTXO Age Distribution Shows Accumulation

Bitcoin’s mysterious creator Satoshi Nakamoto originally designed the cryptocurrency as a transparent network. Transparency allows researchers to deeply explore the network and its underlying UTXO structure. UTXO Age Distribution, or more commonly known as HODL Waves, presents a macro view of Bitcoin investor behavior. The UTXO data is usually divided into six segments, which we explore further here:

- The red 1M-3M waves represent short-term traders, and this wave has been selling since early September. Short-term holders have been suffering notable losses, and their commitment is low.

- The 3M-6M wave (pink) mirrors swing traders, who have been accumulating recently. The swing traders reduced their exposure significantly in late 2021.

- The yellow 6M-12M wave also shows accumulation after a long curve down since November 2021 spot price highs.

- The blue 2Y-3Y wave represents longer-term investors, who heavily exited the market after November’s all-time highs. The 2Y-3Y wave shows institutional selling pressure.

- The purple 3Y-5Y band mirrors the commitment of very long-term hands, and this cohort hasn’t been selling since late 2021. This segment is one of the reasons why bitcoin’s price has been so resilient in 2022.

- The green 7Y-10Y wave shows no significant change from 2021 to 2022. The 10-year-old coins are usually held by “holders of last resort”. These coins might also fall in the “lost coin” category.

What Are We Following Right Now?

The citizens of the Swiss city Lugano will be able to pay merchants in bitcoin (BTC) and tether (USDT). The city wants to onboard over 2000 businesses before the end of October 2022.

🇨🇭 Paying at McDonald's with #Bitcoin in Lugano, Switzerland. pic.twitter.com/8IdcupEEKQ

— Bitcoin Magazine (@BitcoinMagazine) October 3, 2022

According to Kathy Jones, Fed may consider slowing the pace of rate hikes due to high volatility.

There are several reasons why the Fed may consider slowing the pace of rate hikes. Right now – this is the one I'm watching. Vol this high is unsustainble. In the past, it has led to serious financial market problems. pic.twitter.com/HMODWLJhSg

— Kathy Jones (@KathyJones) October 4, 2022

Analyst PlanB says bitcoin’s current $20K spot price level is the new $4K, and a potential spot price bounce lies ahead.

$20,000 is the new $4,000 (in 2018/19) and $250 (2015) and $5 (2012), we know what happens next pic.twitter.com/erk0pPE3nJ

— PlanB (@100trillionUSD) October 4, 2022

The views, thoughts, and opinions expressed in the text belong to the author and not necessarily to the author’s employer, organization, committee, or other group or individual.

Get started with Bitcoin Litecoin Ethereum AAVE USDC Stellar Ripple

Join Coinmotion and buy your first cryptocurrencies within minutes!