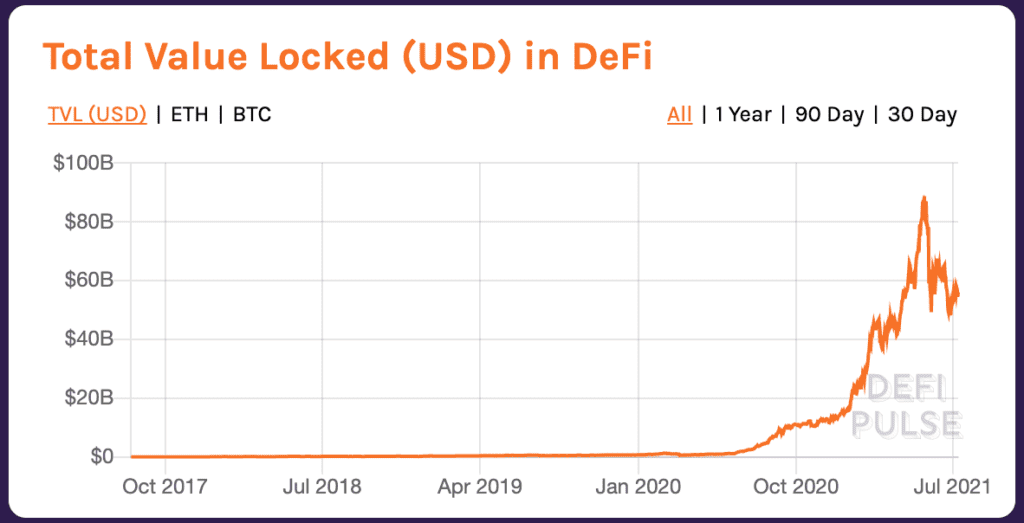

The world of decentralized finance, or DeFi, is booming. The total amount of value in the DeFi ecosystem as a whole, also known as the “total value locked” (TVL), has more than triple in the first seven months of 2021. Additionally, some smart contract platforms are developing infrastructure that would support the entrance of institutional investors into DeFi.

There are myriad ways that investors are using to enter into DeFi markets. Those with higher levels of technical proficiency may try their hand at practices like yield farming or liquidity mining; others choose to purchase and hold the tokens associated with the decentralized applications (or dApps) that they use the most.

However, both of these practices may carry relatively high levels of risk. Yield farmers run the risk of losing their holdings in periods of high market volatility. Similarly, dApp tokens with relatively small market capitalization may be subject to extreme price volatility. In some cases, small dApp tokens are the target of market manipulation.

Therefore, investors with a relatively lower appetite for risk may choose to enter the DeFi sphere from a different angle: layer-one blockchains.

What are Layer-One (L1) Blockchains? (Smart Contract Platforms)

L1 chains are essentially the basis of the entire DeFi ecosystem. These blockchain networks enable their users to create and deploy smart contracts used to create decentralized applications. In this way, L1 chains are somewhat comparable to the internet: myriad web applications exist on top of the internet’s underlying data infrastructure. Investing in a layer-one blockchain could be compared to investing in a small piece of the internet itself rather than investing in one of the applications that sit on top of it.

Unlike the internet, however, there are many L1 blockchains on the market. Therefore, the big question for many investors is this–which L1 chain will ultimately support the biggest DeFi ecosystem? In other words, which blockchain will rule them all?

Different blockchains for different purposes

Do we know the truth? It may be none of them–or, at least, that’s what some analysts believe: that many L1 blockchains will ultimately co-exist with one another, connected by sidechains and layer-two solutions. In other words, there may not be any single blockchain that supports the entire blockchain ecosystem; there will likely be many.

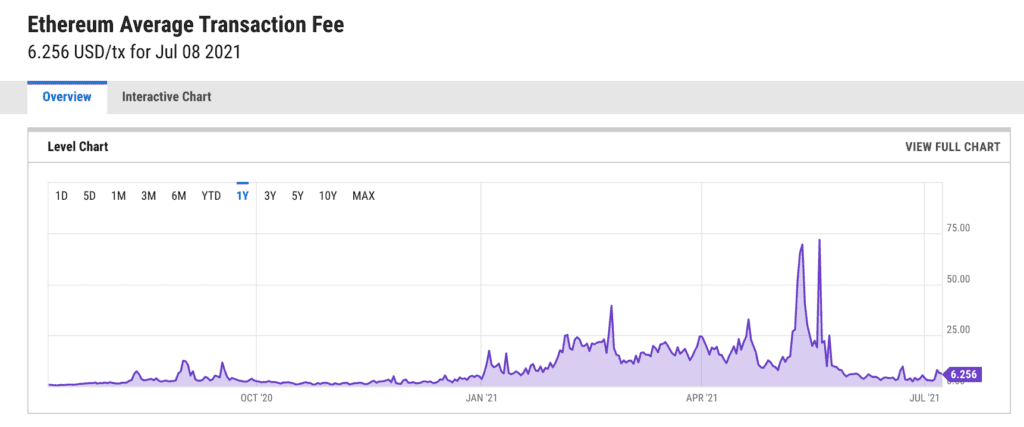

Still, some chains are inevitably going to be more dominant than others. Currently, the Ethereum network has both the largest number of users and the largest community of developers. However, Ethereum has not gone without its share of growing pains. In early 2021, the network was plagued by astronomical transaction fees, a factor that drove some users and developers to take their business elsewhere.

As a result, many other L1 blockchains have risen to prominence. Notably, the Binance Smart Chain (BSC) gained significant transactional volume at the height of Ethereum’s surging transaction fees; in addition to BSC, networks like Solana, PolkaDot, Terra, and others have grown in popularity.

Popular Layer-One Blockchains: Key Facts & List of Smart Contract Platforms

Binance Smart Chain (BSC)

- Launched by Binance in 2020, the Binance Smart Chain (BSC) is known for low fees and fast transactions.

- Some users are concerned about centralization on BSC: it relies on a system of just 21 validators, while Ethereum has over 77,800 validators.

- BSC’s native token is the Binance Coin (BNB).

Polkadot (DOT)

- Polkadot is a tool that users can use to create entire blockchains that can be integrated with one another, which can afford dApp developers a greater degree of control and flexibility than the Ethereum network.

- Polkadot’s infrastructure consists of multiple blockchains known as “parachains” or “parathreads,” as well as the “relay chain,” which allows independent blockchains to trustlessly share information and transactions.

- Polkadot’s native token trades under the symbol DOT.

Solana (SOL)

- The Solana protocol was designed to facilitate decentralized app (DApp) creation with high transaction throughput and scalability capabilities.

- Solana introduces a unique consensus algorithm called “proof-of-history” (PoH). PoH is also combined with proof-of-stake (PoS) consensus on Solana.

- Solana’s native token trades under the symbol SOL.

Cardano (ADA)

- Cardano operates on a proof-of-stake consensus mechanism known as Ouroboros. The algorithm is reportedly four times more energy-efficient than bitcoin’s proof-of-work algorithm.

- Cardano’s primary use cases facilitate transactions in its native cryptocurrency and act as a platform for dApps.

- Cardano’s native token trades under the symbol ADA.

Algorand (ALGO)

- Algorand was reportedly the first blockchain to implement a pure proof-of-stake consensus protocol.

- It can process up to 1,000 transactions per second and has a block completion time of 4.5 seconds. Algorand’s development team is working to increase the transaction speed to 46,000 TPS.

- Algorand’s native token trades under the symbol ALGO.

Essential Factors to Consider When Evaluating L1 Tokens & Smart Contract Platforms

While each of these L1 chains appears to be growing consistently, it’s impossible to know which of them will eventually support the largest and most robust decentralized finance ecosystems. Therefore, if you’re thinking of investing in any L1 blockchain tokens, here are a few things to consider:

- Scalability: How many transactions can the network process at one time? Is there a mechanism that allows the network to process transactions in times of high traffic efficiently?

- Composability: Can developers combine various components of the blockchain to design DeFi products and services? This allows developers to do more with less, leading to faster and more widespread innovation on a blockchain ecosystem.

- Sustainability: Does the blockchain have a large carbon footprint? How much energy does each transaction consume?

- Interoperability: How compatible is the L1 with other first- and second-layer solutions? Increased operability facilitates information sharing and also allows for easier smart contract execution and greater accessibility.

- Adoption: How large is the community of users and developers on the network? Does the network have incentives in place to onboard new groups of users and encourage behaviors that uphold the network?

- Atomicity: this feature, also known as “atomic composability,” helps guarantee that each transaction is considered a single unit of data movement. This helps to ensure the validity of each transaction and the overall security of the network.

No single layer-one blockchain is necessarily perfect for every application. Therefore, the future of decentralized finance will include many layer-one chains that are popular today and some that have not yet been created. While investing in L1 tokens may be slightly less risky than investing in DeFi dApp tokens, no investment is ever risk-free. Make sure you do your due diligence before investing in any cryptocurrency.

You should check out QED, the Oracle to rule them all. QED is a decentralised Oracle protocol with a robust economic model connecting multiple blockchains, smart contract platforms and off-chain data sources.