The technical analysis of week 38 assesses the latest technical and fundamental indicators. Additionally, we explore an ETF scenario that could boost bitcoin by 73 percent. We also delve into bitcoin’s seasonality, cyclicality, and MicroStrategy’s accumulation strategies.

The weekly outlook of the cryptocurrency market has continued in a moderately bearish sentiment, with bitcoin weakening by about three percent. The market remains cautious as investors attempt to price in the impact of a spot ETF and the upcoming halving event. At the same time, institutions like MicroStrategy are preparing for macro events by increasing their holdings, with the company’s acquisitions expanding by 217 percent compared to the previous year.

Jeff Booth, a Bitcoin ecosystem venture capitalist, recently appeared in an interview with Aimstone, mentioning that some Bitcoin-related companies are offering returns even better than the cryptocurrency itself:

“I believe we can massively beat bitcoin’s rate of return by investing in companies that extend the network and drive the future.” – Jeff Booth

As high-beta risk assets, bitcoin and other cryptocurrencies have suffered from the end of the zero-interest-rate cycle and periods of quantitative easing. However, many experts, such as Raoul Pal, see the era of interest rate hikes coming to an end, and many anticipate a return of easing measures. Despite an extremely challenging market environment, bitcoin has managed to strengthen by almost 60 percent since the beginning of the year.

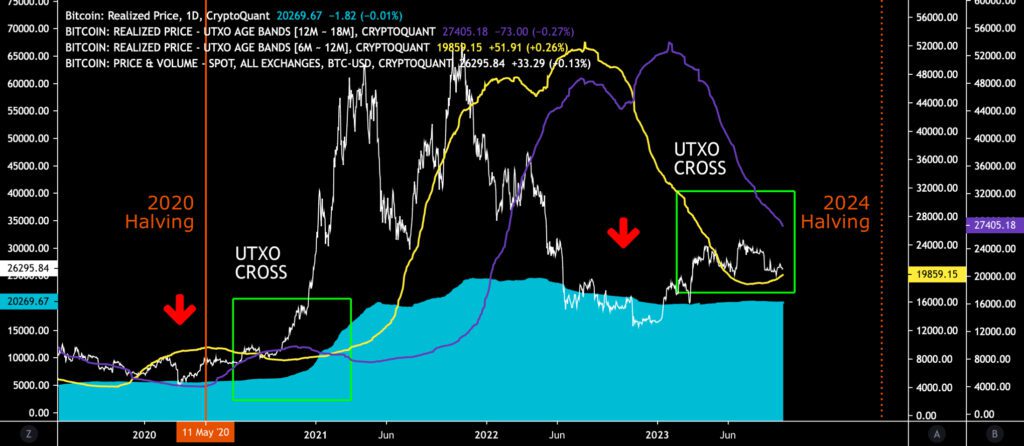

From a purely technical perspective, bitcoin is at a critical inflection point once again, with the fourth quarter offering potential upward momentum. The turquoise realized price wave, located at $20 270, serves as a key support level for bitcoin. The realized price wave also represents the average price of all bitcoin purchases, indicating that the majority of bitcoin investors are currently above break-even.

Sources: Timo Oinonen, CryptoQuant

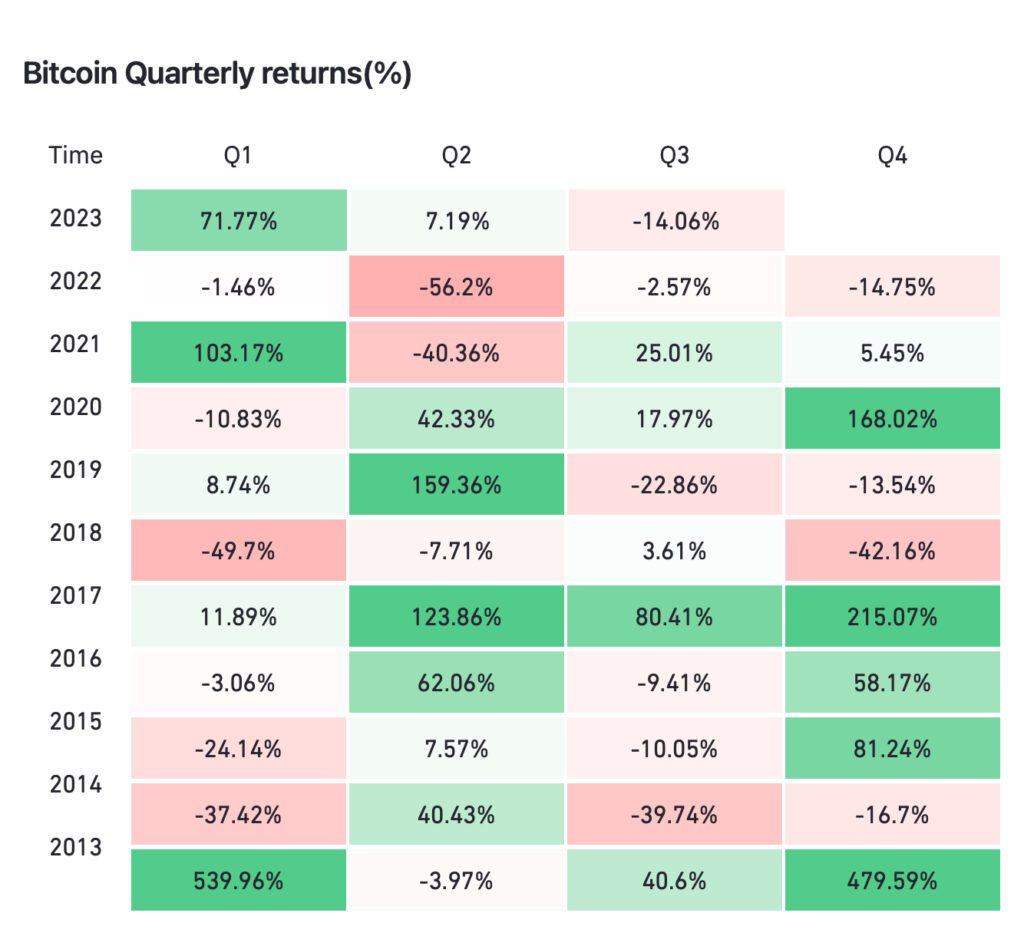

Bitcoin’s seasonality may provide an uplift here as the market transitions into the fourth quarter (Q4) on Sunday. Historically, Q4 has been favorable for bitcoin, offering upward momentum in six out of ten quarters. Conversely, Q1 and Q3 have been less favorable for bitcoin, with the cryptocurrency weakening over the course of six historical quarters.

Source: Coinglass

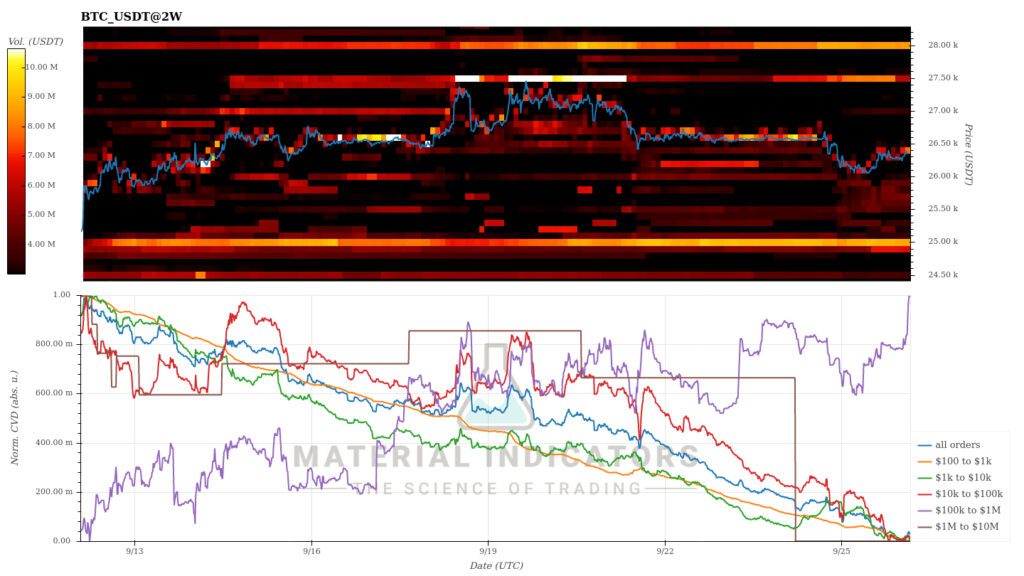

Material Indicators’ heat map indicates the strengthening of the $25 000 support zone. At the same time, the heat map suggests that short-term whale demand is at a high level.

Source: Material Indicators

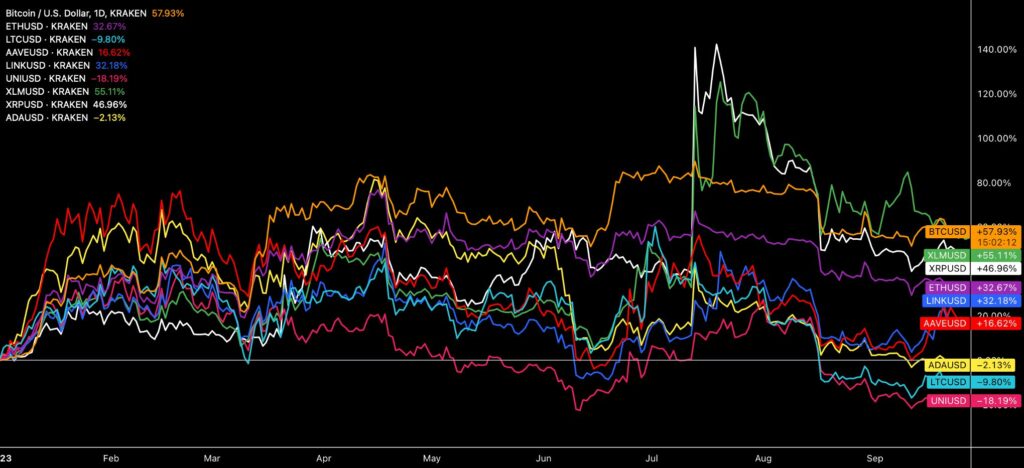

Bitcoin’s dominance still divides the market, with altcoins generally weakening in relation to the leading cryptocurrency. Bitcoin, which has depreciated about three percent against the dollar in a week, narrowly leads the YTD price performance among currencies listed on Coinmotion, rising 58 percent since the beginning of the year. Following bitcoin, the best-performing cryptocurrencies are Stellar (55%) and XRP (47%), as they surged over 120% and 140% amid the July SEC classification speculations. Their price performance has since clamed down.

The market is also weighed down by the S&P 500 stock index, which has seen a nearly -4% decline. In September, Uniswap, Litecoin, and Cardano have formed their own negative segments, with their YTD performance turning negative. Uniswap, a previous favorite among retail customers in past years, has declined significantly, sliding down -18% since the beginning of the year.

Source: TradingView

7-Day Price Performance

Bitcoin (BTC): -3,3%

Ethereum (ETH): -2,7%

Litecoin (LTC): -4,1%

Aave (AAVE): -1,4%

Chainlink (LINK): 8,3%

Uniswap (UNI): -2,7%

Stellar (XLM): -5,2%

XRP: -3,4%

Cardano (ADA): -3,5%

Get started with Bitcoin Litecoin Ethereum AAVE USDC Stellar Ripple

Join Coinmotion and buy your first cryptocurrencies within minutes!

S&P 500 Index: -3,8%

Gold: -0,3%

Can an ETF Scenario Uplift Bitcoin by 73%?

Last week’s TA covered Bloomberg’s Eric Balchunas’ views on the upcoming spot ETF. Balchunas estimated a 75 percent likelihood of the ETF approval by the end of the year, which is a clear increase from Bloomberg’s previous 65 percent forecast. As the ETF decision approaches, front-running strategies are popular for the end of 2023 and early 2024. Bitcoin’s fair value (yellow) is currently trading at $45 159, also serving as a sound target price. There is a noticeable gap structure (white) between the spot price and fair value, representing a 73 percent profit opportunity.

Sources: Timo Oinonen, CryptoQuant

The launch of the ETF could potentially trigger a reflexive phenomenon, leading investors to rapidly buy bitcoin, causing the spot price to react parabolically. This scenario is based on George Soros’s reflexivity theory, which examines the impact of positive feedback loops on investors’ expectations and realities. The disparity between these two factors can result in price trends that significantly deviate from equilibrium prices.

Saylor in Accumulation Mode, Again

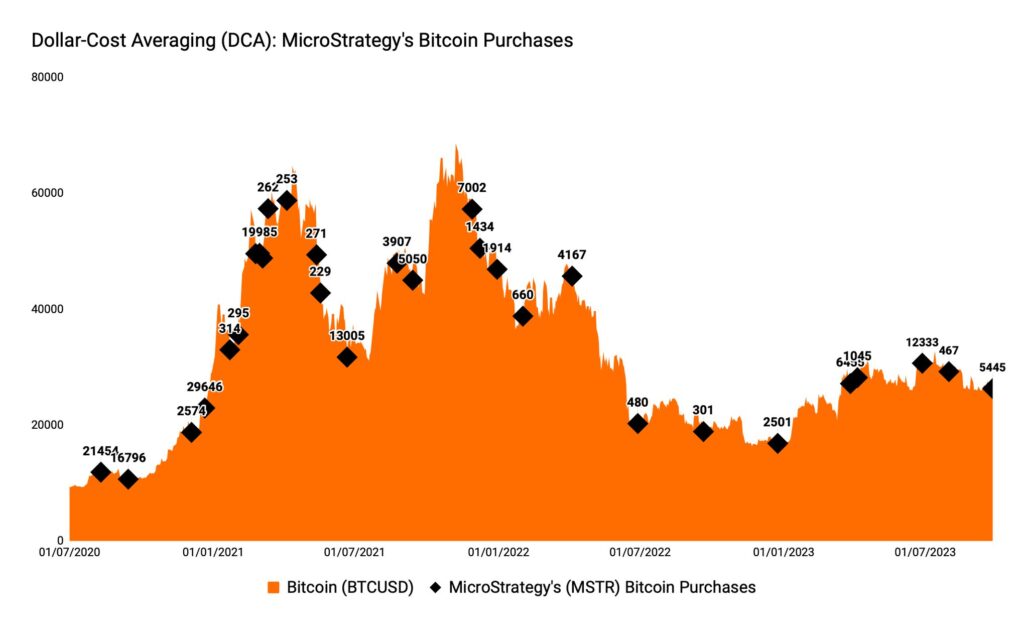

MicroStrategy (MSTR), which has established itself as a leading Bitcoin institution over the years, announced on Monday that it has increased its holdings by 5445 new bitcoin units, bringing the company’s total ownership to 158 245 bitcoins. MicroStrategy’s history of involvement with Bitcoin dates back to 2020, when the company announced its intention to replace its cash reserves with alternative assets. In the same year, the company’s then-CEO and current Chairman of the Board, Michael Saylor, made his famous bitcoin endorsements.

Sources: Coinmotion Research, Coin Metrics

MicroStrategy employs a dollar-cost averaging (DCA) strategy in its bitcoin purchases while also aiming to capitalize on the market’s inherent cyclicality. The chart above illustrates that the company’s buying program was particularly active in the years 2020 and 2021, coinciding with bitcoin reaching the peak of its previous bull cycle.

Conversely, MicroStrategy has reduced its buying program during bearish cycles, such as in 2022. Last year, the company’s bitcoin acquisitions amounted to a modest 8109 units as the market reached its inflection point towards the end of the year. With the economic conditions improving this year, MicroStrategy has once again accelerated its buying program, acquiring a total of 25 745 bitcoin units as of September. This represents a 217 percent increase in the quantity of bitcoin purchased compared to the previous year.

Sources: Timo Oinonen, CryptoQuant

As mentioned in the previous interview, Jeff Booth suggested that Bitcoin-related companies might offer returns even better than bitcoin itself, and MicroStrategy is a prime example of this phenomenon. Since the beginning of the year, MicroStrategy’s stock (MSTR) has surged by 119 percent, outperforming the underlying asset class bitcoin (58 percent). From January to July, MicroStrategy’s upward trajectory was even steeper, reaching 219 percent.

Before the official approval of the spot ETF, MicroStrategy can be seen as an “unofficial ETF”, and due to its prominent position, its stock can be considered a leading indicator for bitcoin.

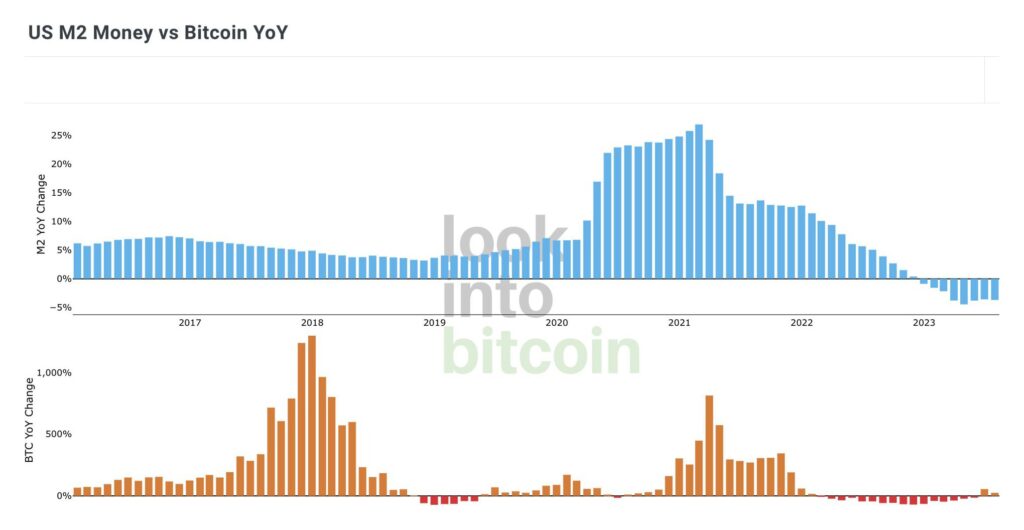

Bitcoin’s Cyclicality and M2 Monetary Aggregate

In a macroeconomic environment that is unusually challenging, the relationship between bitcoin and the M2 monetary aggregate has become a topic of discussion among many experts. Raoul Pal, among others, is firm in his belief that bitcoin’s spot price has historically correlated with the growth and contraction of the circulating money supply. At the same time, Pal has anticipated the end of a quantitative tightening (QT) cycle and the beginning of a new round of quantitative easing (QE). The initiation of a new QE cycle by the U.S. Federal Reserve would provide much-needed liquidity for high-beta cryptocurrencies and tokens.

Data from the LookIntoBitcoin website provides an interesting perspective on this issue by comparing the M2 money supply to bitcoin’s annual price changes. During the dramatic price surge of 2017, the M2 money supply did not increase significantly, indicating bitcoin’s dominant retail-driven demand during that period. New ICO fundraising rounds also fueled the 2017 rally. In contrast, during the 2020-2021 cycle, bitcoin was supported by an exceptional stimulus campaign that rapidly increased the circulating dollar supply by a significant percentage.

Comparing these two cycles, one can assess that the parabolic rise of 2017 was exceptional in bitcoin’s history. Conversely, the following cycle, correlated with the M2 money supply, could have been more parabolic. Now, experts are evaluating that the money supply is once again turning towards growth, creating an emerging positive environment for bitcoin and other cryptocurrencies in 2024.

Source: LookIntoBitcoin

What Are We Following Right Now?

Finnish fintech company Equilibrium has launched a new layer 1 blockchain called Gevulot.

ANNOUNCING: GEVULOT – A permissionless & programmable L1 blockchain for deploying zk provers and verifiers as on-chain programs.

— Gevulot (@gevulot_network) September 11, 2023

Gevulot offers decentralised proving for arbitrary proving workloads with performance to match centralised provers.https://t.co/xqtjnYgqwC

The legendary Mt. Gox saga is once again seeing further developments, as the bankruptcy estate’s attorney has announced that the reimbursements will be delayed until October 2024. Next year may mark the final culmination point for a long-running story that dates back to the hacking incident in 2011.

In late 2021, Mt. Gox released an official rehabilitation plan to return lost assets to investors. Creditors have been given the option to receive their reimbursements in the form of U.S. dollars (USD), bitcoins (BTC), or Bitcoin Cash (BCH).

Institutions like Fortress Investment Group have acquired Mt. Gox claims from investors who are willing to convert their claims into cash immediately. These claims have also formed a liquid market for speculators over the years, as each creditor is expected to receive approximately 20 percent of their original deposit.

The MtGox trustee did inform creditors that the repayment deadline for base repayments, early lump sum repayments and intermediate repayments has been pushed back to October 31, 2024.

— MtGoxBalanceBot (@MtGoxBalanceBot) September 22, 2023

Earliest repayments could happen towards the end of the year, but in sequence.#MtGox $BTC pic.twitter.com/vopXKZnjJJ

Michael Saylor, the Chairman of the Board at MicroStrategy, provided a market update at the BTC23 conference in Vienna. Saylor sees the institutional demand escalating.

Stay in the loop of the latest crypto events

- Dive into Cardano (ADA): A newcomer’s comprehensive guide

- Identify trends, buy and sell signals with technical indicators: Lesson #7

- How to send money home via crypto: Remittance made easy

- Bitcoin Dominance Divides the Market

- How technical analysis works in crypto: Lesson #6

- Continuing the Transformation: Coinmotion Welcomes New CEO Antti-Jussi Suominen

- Aave: The DeFi Powerhouse Changing the Crypto Landscape

Get started with Bitcoin Litecoin Ethereum AAVE USDC Stellar Ripple

Join Coinmotion and buy your first cryptocurrencies within minutes!

The views, thoughts, and opinions expressed in the text belong to the author and not necessarily to the author’s employer, organization, committee, or other group or individual.