The technical analysis of week 13 scans the latest technical indicators and price projections. We also delve into bitcoin halving, market cycles, and correlations. At the same time, we assess Binance’s situation and the upcoming Shanghai update of Ethereum.

Bitcoin in a Multi-Year Confluence Zone

The price development of the crypto market has continued to be moderately positive since last week, with the leading cryptocurrency, bitcoin rising by around four percent. Investor sentiment is still optimistic after bitcoin has climbed almost 70 percent year-to-date. Tone Vays, the well-known options trader and analyst, announced that he still retains the 100 percent bitcoin allocation.

On a technical level, bitcoin is now trying to break its multi-year support and resistance level (white), which stretches back to 2020 as a confluence level. As the embedded chart shows, the confluence level served as bitcoin’s support twice in 2021 and once in 2022. Bitcoin passed its technical inflection point (pink) at the turn of the year, followed by strong bullish momentum.

Sources: Timo Oinonen, CryptoQuant

Bitcoin is now heading toward its “fair price” of $41 520, which would represent a 48% price increase from the current $28K level. Bitcoin is also in the sights of the 2019 projection we published in February, which indicated a price of $46 092 by July.

Sources: Timo Oinonen, CryptoQuant

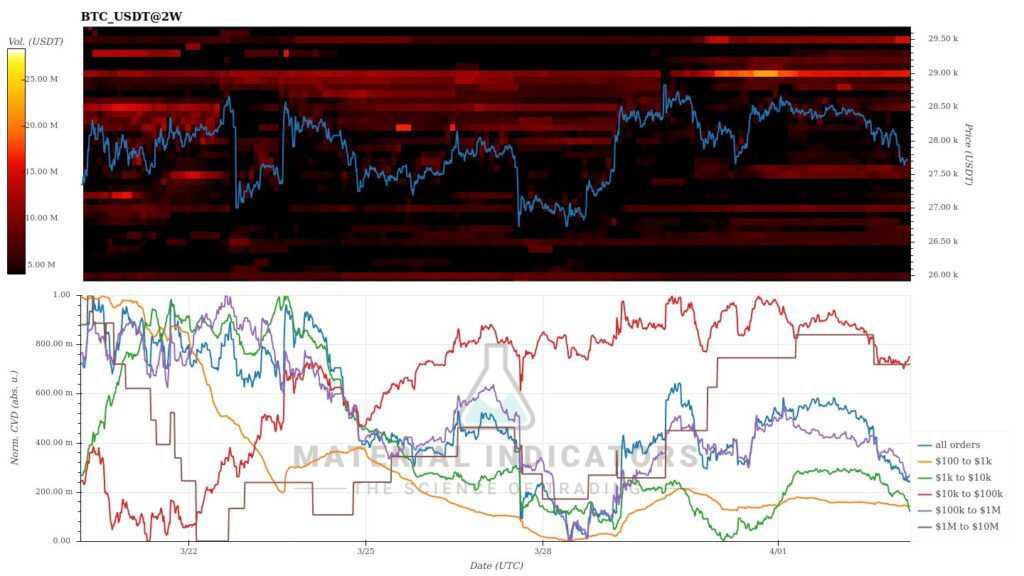

The Material Indicators heat map shows that bitcoin’s main resistance level is almost exactly at 29 000 dollars, and bitcoin needs additional momentum to pass it. Should a surprising macro-level event bring selling pressure to the market, bitcoin’s nearest support levels are located close to $20 000.

Source: Material Indicators

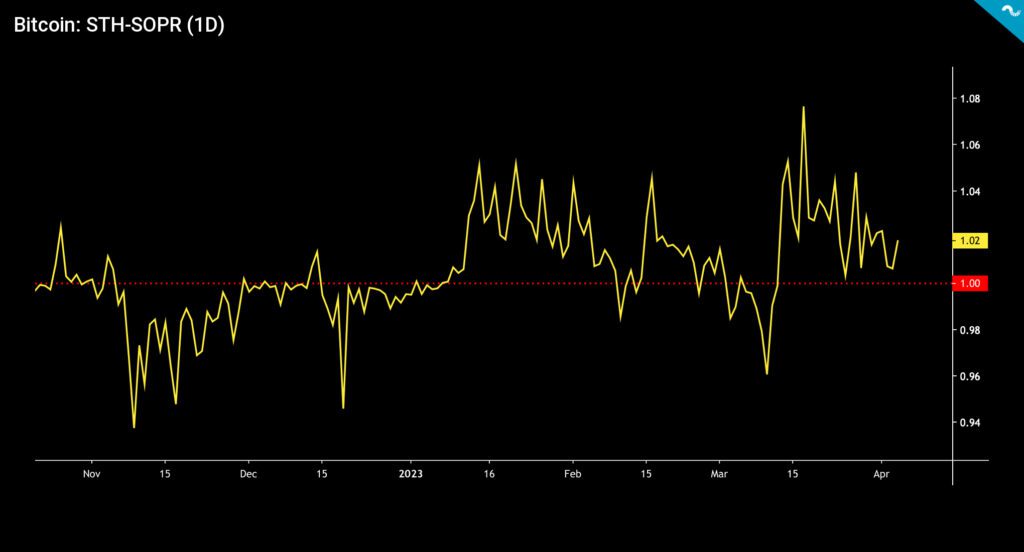

The early year and especially March, were profitable times for short-term investors. The STH-SOPR metric (yellow), which describes the traders’ break-even point (red, one), peaked at 1,08 in mid-March.

Sources: Coinmotion Research, CryptoQuant

Cryptocurrencies have risen moderately in the seven-day time window, with price growth focused on more speculative tokens. As the leading cryptocurrency, bitcoin rose almost four percent, and Ethereum, which is preparing for the Shanghai update, has climbed almost 9%. The higher beta Aave and Uniswap have both strengthened by almost 10 percent.

At the same time, the “meme coin” Dogecoin has risen by more than 30 percent in a week, countering the rest of the market. Dogecoin got a surprise boost when tech mogul Elon Musk changed Twitter’s traditional bird logo to a Shiba Inu dog. Musk is a well-known internet humorist, so it is difficult to say whether this is so-called trolling or more serious planning. Elon Musk has previously hinted at using Dogecoin on multiple platforms.

The momentum of XRP, which rose by 36 percent in a month, has now frozen, as the currency climbed only 5% on a weekly basis. Investors previously estimated that Ripple Labs, the company behind XRP, was likely to win its legal battle. Both the S&P 500 index and gold have had a promising week, rising around three percent each.

7-Day Price Performance

Bitcoin (BTC): 3,6%

Ethereum (ETH): 8,8%

Litecoin (LTC): 3,5%

Aave (AAVE): 9,2%

Chainlink (LINK): 7,1%

Uniswap (UNI): 8,9%

Stellar (XLM): 14,5%

XRP: 5%

Get started with Bitcoin Litecoin Ethereum AAVE USDC Stellar Ripple

Join Coinmotion and buy your first cryptocurrencies within minutes!

S&P 500 Index: 3,3%

Gold: 2,9%

Bitcoin’s Breakaway from the Technology Index

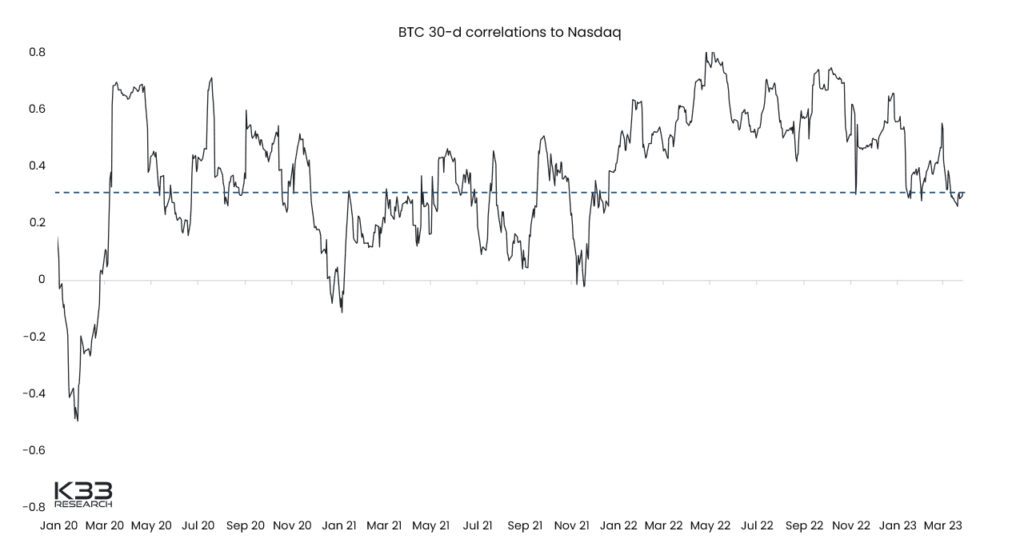

While the spot price of bitcoin has increased by more than 70 percent since the turn of the year, its correlation with the stock market is clearly weakening. After the central bank Fed began its quantitative tightening in the spring of 2022, Bitcoin fell in close correlation with high-beta tech stocks. In the spring of 2022, the correlation between bitcoin and the technology-focused Nasdaq 100 index temporarily rose to 0,8.

Since then, the correlation between bitcoin and the technology sector has weakened, falling by -60 percent from 0,75 in October to the current correlation value of 0,3.

Source: K33 Research

Bitcoin’s volatility has increased in relation to the Nasdaq index. The increased volatility can be explained by the strengthening of bitcoin in relation to the technology index, but the liquidity of the crypto market may also be a part of the reason. Since the collapse of the FTX exchange, market liquidity has decreased, leading to weaker support levels for up-and-down movements.

Source: Kaiko

In a historical context, bitcoin was long considered an “uncorrelated” asset class. The thesis defended itself for a long time until, in the Saylor cycle of 2020, bitcoin’s price development began to approach the stock market. The mainstreaming of bitcoin, the maturing of the market, and the interest of institutions brought bitcoin closer to the direction of the macro market.

However, interpreting the correlation between bitcoin and the stock market may be more complicated than previously thought. The high correlation between bitcoin and the S&P 500 index can be seen to also offer protection to bitcoin in the event of a market crisis, and the correlation may, at the same time, keep devaluations reasonable. However, the current drop in correlation is happening in the middle of bitcoin’s positive momentum, so the decoupling clearly benefits investors.

Bitcoin in Pre-Halving Accumulation Cycle

“The 2024 Bitcoin halving will be the most important halving of all time. Bitcoin is about to become the hardest asset in the world with certainty. The inflation rate of Bitcoin will drop to half of gold, overtaking gold as the best store of value in the world. A big turning point.” – Charles Edwards, Capriole Investments

As mentioned earlier, bitcoin passed its technical inflection point at the turn of the year, where the multi-year descending and ascending trend lines met. In addition to the technical inflection point, the approaching halving event of 2024, which is estimated to take place in 388 days, provides momentum for bitcoin.

The estimated date for bitcoin’s next halving event is 29.4.2024, and it will increase the scarcity of the cryptocurrency by dropping the block reward from 6,25 to 3,125. The halving event of bitcoin’s sister currency Litecoin has an estimated date of 3.8.2023.

To visualize the market and halvings, the recent price development of bitcoin can be divided into two cycles: The distribution cycle (purple) and the pre-halving accumulation cycle (turquoise). The distribution cycle spans back to the 2021 bull market, and its endpoint is located in the same area as bitcoin’s technical inflection point. In November 2022 bitcoin entered a new pre-halving accumulation cycle where investors are trying to price in the halving. Using previous halving events as a benchmark, a six-figure spot price level after the 2024 halving would be reasonable.

Sources: Timo Oinonen, CryptoQuant

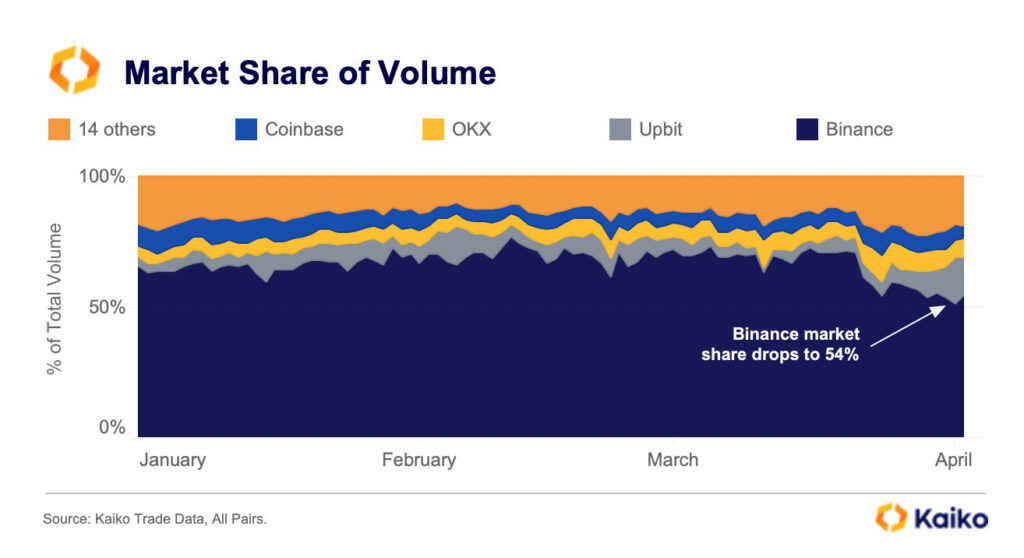

Binance Rapidly Losing its Market Share

In the previous technical analysis, we assessed how Binance’s stablecoin BUSD (Binance USD) had lost a significant part of its market share. In addition to these previous challenges, Binance appears to have lost 16 percent of its global market share at the end of the first quarter (Q1) of 2023, dropping its dominance to 54 percent.

Arcane Research (nowadays K33 Research) reported earlier in January how Binance’s share of bitcoin’s spot volume was up to 92 percent at the end of 2022. The reading is based on e.g. the end-of-year collapse of its competitor FTX, which left the playing field entirely to Binance. At the beginning of 2022, Binance’s share of the spot volume was only 45%, so the exchange’s share of the volume more than doubled within just 12 months.

So how did Binance achieve a dominant market position, and is the phenomenon beneficial to the cryptoecosystem? It can be argued that the rise of Binance is not so much due to the “betterness” of the exchange but rather the lack of competitors of the same scale. Although the operations of the FTX exchange has subsequently been revealed to be morally questionable, it nevertheless played an important role as Binance’s main competitor.

The organicity of spot volume data can still be treated with mild skepticism. Binance’s fee structure makes the platform attractive to trading bots, and a significant amount of wash trading takes place through it. In other words, the data does not necessarily give an organic and truthful overall picture of the volume situation.

As in all industries, competition is good. From this point of view, the sovereign strengthening of Binance is not beneficial to the industry, and it ultimately does not serve the exchange itself either because the innovations usually stem from a healthy competitive environment. As an unregulated exchange, Binance forms a single point of failure, which in itself violates the industry’s principle of decentralization. The reduction of Binance’s dominance in favor to other exchanges is a necessary path for the reputation and future of the industry.

Source: Kaiko

Ethereum Will Implement its Shanghai Update Next Week

According to the current schedule, the Shanghai update of the decentralized finance platform Ethereum will be implemented as early as next week, April 12th. At the same time, Shanghai enables investors to unstable their tokens, which might generate a wave of selling pressure.

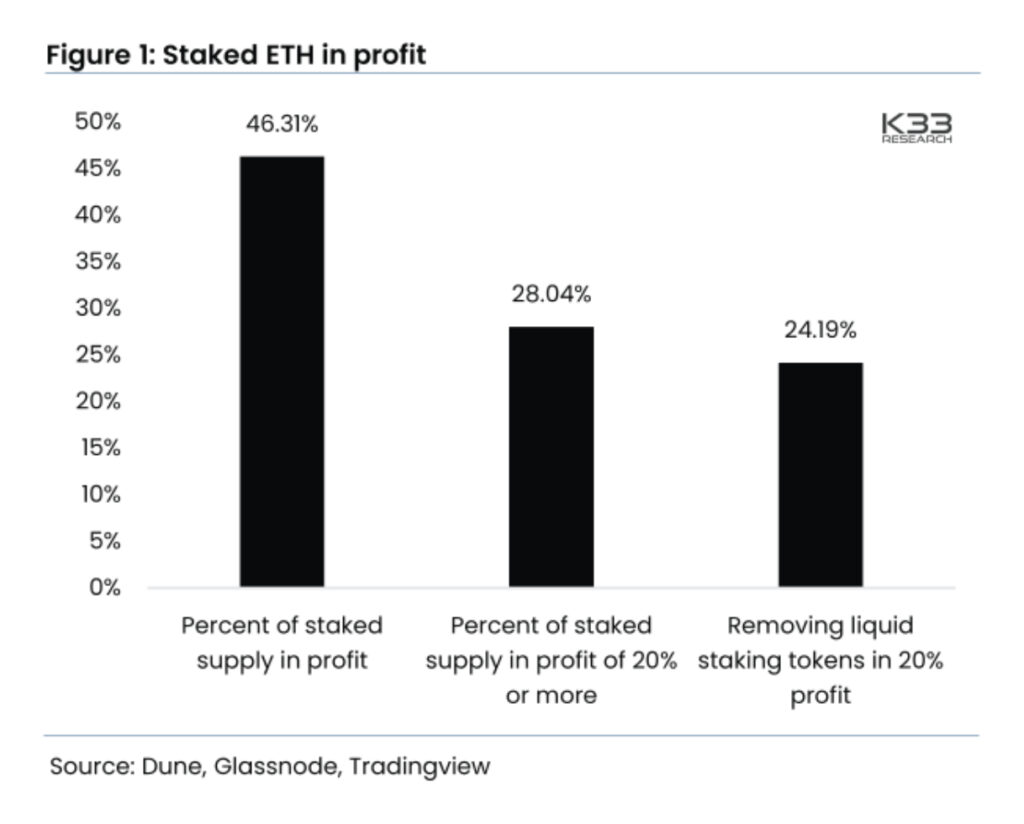

According to K33 Research, 46 percent of the staked ETH supply is currently at a profit, while 28% of the supply is at a profit of more than 20 percent. Ethereum has weakened against bitcoin this week, with the ETHBTC trading pair falling to a 9-month low of 0,064.

Source: K33 Research

What Are We Following Right Now?

The luxury hyper-sports car manufacturer Bugatti has launched a selection of NFT collectibles on the Bitcoin blockchain. The NFTs of the “Asprey Bugatti Egg Collection”, which resembles the shape of an egg, are numbered. The first hundred NFTs are priced between 20 000 and 50 000 dollars, while the NFTs numbered from 100 to 111 are priced from $200 000 upwards.

“The purest perfect shape of nature is the egg.”

— Bugatti (@Bugatti) April 3, 2023

– Carlo Bugatti @AspreyStudio#BUGATTI #ASPREYBUGATTI #ABEgg #BitcoinNFT #Phygital pic.twitter.com/MhAZdO7Yvl

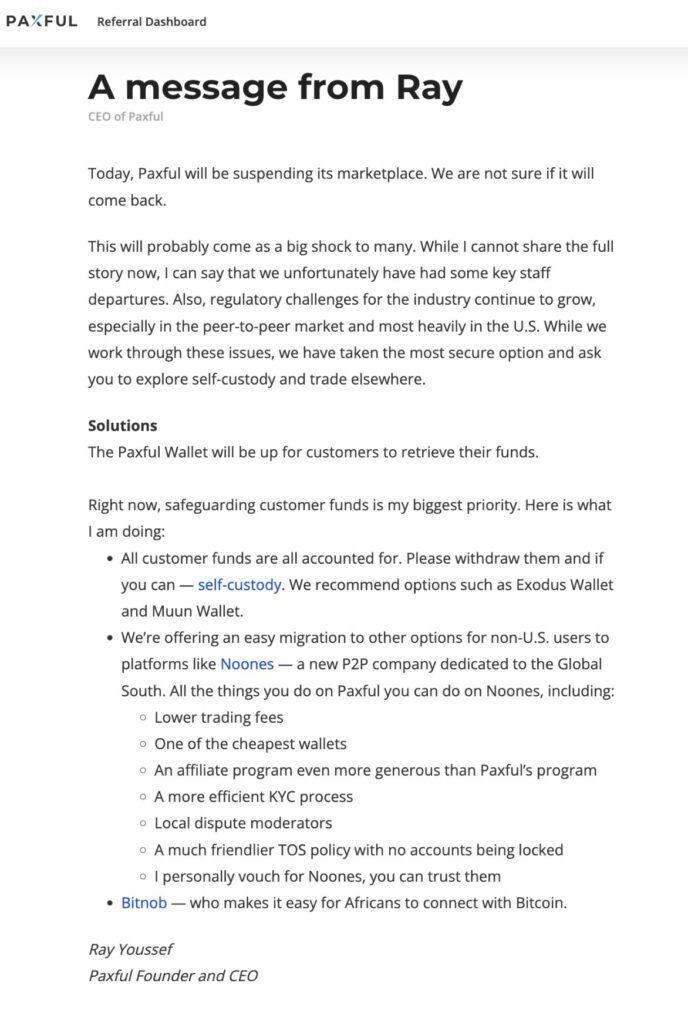

The traditional P2P marketplace Paxful is shutting down. The company, which used to be profiled as a competitor to the recently discontinued LocalBitcoins, is familiar to Finns through its Tallinn office and Estonian founders.

Although the Paxful company itself will cease to exist, insider information says that founding member Ray Youssef will continue P2P operations under a new company called “Noones”. According to unofficial information, clients can even log in to the Noones service with old Paxful credentials, but I’d wait the information to be verified.

An in-depth discussion on Central Bank Digital Currencies (CBDC) by the Bell Curve team. Is the main purpose of CBDCs to enhance efficiency, increase the power of the central government, or a combination of both?

Stay in the loop of the latest crypto events

- How can decentralization save us in a world driven by AI?

- Technical Analysis: MicroStrategy as Market’s Leading Indicator

- Why is Bitcoin rising in 2023?

- What has happened in the crypto market in Q1 — and what is to come?

- Bitcoin Retains its Momentum Amid the Chaos

- Aave launches native stablecoin GHO

- New Bitcoin NFTs spark discussion — What are Bitcoin Ordinals?

- EUROe stablecoin — First EU-regulated stablecoin launched in Finland | Interview with Juha Viitala

Get started with Bitcoin Litecoin Ethereum AAVE USDC Stellar Ripple

Join Coinmotion and buy your first cryptocurrencies within minutes!

The views, thoughts, and opinions expressed in the text belong to the author and not necessarily to the author’s employer, organization, committee, or other group or individual.