Technical analysis for week 29/2021 explores how the decreasing centralization and difficulty of bitcoin mining give new opportunities for new operators. Additionally, whale activity is increasing, putting it at the front of the retail segment.

Mining Difficulty is Decreasing, Allowing More New Players

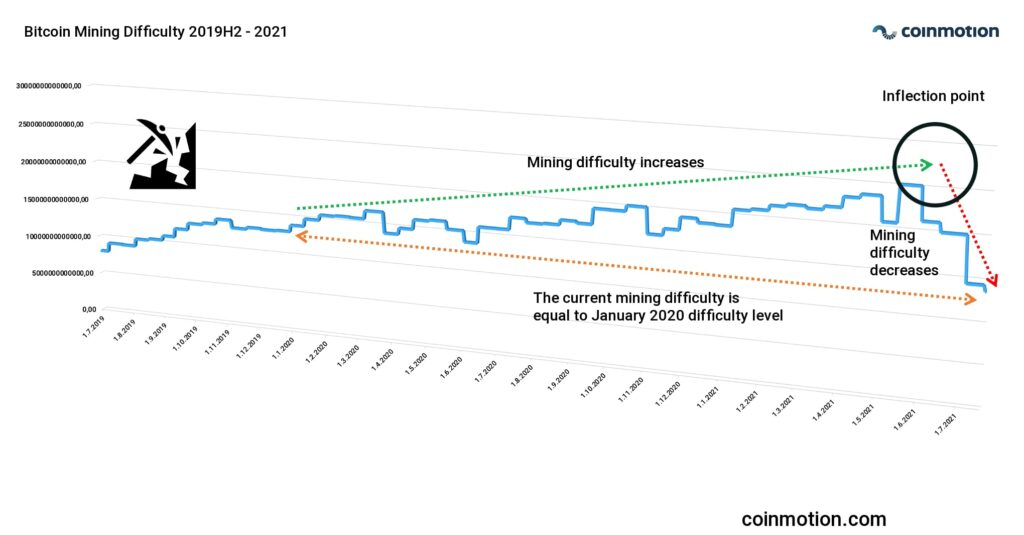

Bitcoin’s mining difficulty has dropped over 50 percent from its May 2021 peak. Implementing Bitcoin network’s original design, the network re-calibrates every 2016 blocks, or about every two weeks, resetting how tough it is for miners to mine. The built-in algorithm adjusts mining as the number of miners changes, essentially forming a self-regulating market.

Typically it takes 10 minutes for the bitcoin network to solve a block. However, at the end of July 2021, the block time slowed down to 16-minutes before the recent difficulty adjustment.

It’s estimated that China alone was responsible for 65 to 75 percent of the global mining hash rate before this May. Bitcoin’s current difficulty decrease stems from China’s intervention with local mining operations, which led to a shut-down of significant infrastructure. Chinese miners have increasingly exited the country, opting for post-Soviet states, Europe, and North America. The July-2021 mining difficulty is equal to January 2020 level (orange indicator).

Normally, the harder the mining of new bitcoins gets, the bigger the boost of the BTC price is, and the other way around. Currently dropping difficulty and hash rate, which usually correlate together, are bearish indicators. However, there might also be a silver lining.

As mentioned, by estimation, 65% to 75% of all mining operations have been located in China. In other words, the country has been a centralized location, contrasting with one of bitcoin’s fundamental features, decentralization. As centralized mining fades away from mainland China, we’ll probably see a new, more diverse mining infrastructure in the future.

In addition, we can expect miners to see an uplifting market for revenue and profit as competition and difficulty decrease. The lower barrier to entry to the mining industry is likely to attract more small-scale and even micro-scale miners, decentralizing the network even further.

Whales Are Accumulating BTC Again

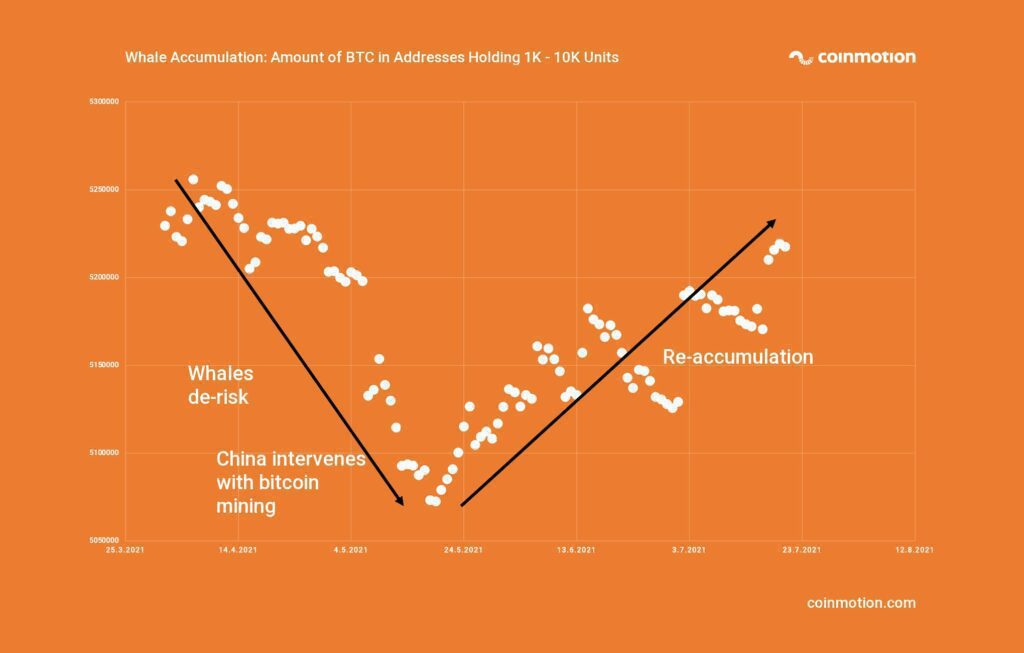

While retail segment(s) reportedly suffered enormous losses from leveraged position liquidations, whales seem to continue accumulating BTC after the presumed market bottom. In this context, whales refer to bitcoin addresses with 1,000-10,000 bitcoin units.

When exploring the data more closely, we can see the whales reducing exposure in the early second quarter (Q2) of 2021, well before the May drop. Whales are known for front-running the retail segment, and the current data shows them accumulating again, anticipating a recovering market in Q3 and Q4.

Market Recovers in the Wake of Elon Musk’s Cautiously Bullish Views

The B Word was the most anticipated bitcoin-related event last week, and it included insightful keynotes from Elon Musk, Cathie Wood, and Jack Dorsey. The crowd was particularly following Musk’s statements, which turned out to be cautiously bullish for the crypto scene:

- “Most likely Tesla would resume accepting bitcoin.”

- “I don’t plan to sell any bitcoin, SpaceX won’t sell, Tesla won’t either.”

- “Three things I own, outside of SpaceX and Tesla, are Bitcoin, some Ethereum, and some Dogecoin.”

- “Government interference in currency is a source of error.”

- “In general, I’m a supporter of Bitcoin.”

Musk also announced that the SpaceX company invested its cash reserves in bitcoin.

The market gave a warm welcome to Musk’s statements, lifting BTCUSD up around 10 percent during the following days. Bitcoin also gained the long-awaited volume and buying pressure, breaking the bearish momentum. At least, for now.