The TA of week 46 focuses on Bitcoin whales, recent market action, and the latest developments in the (in)famous Mt. Gox case.

Whale Activity

The Bitcoin market is still largely unregulated and open for anyone to participate, including investors, traders, speculators, and whales. Bitcoin’s investor segments can roughly be divided into three parts: Retail investors, institutional investors, and whales. Whales are by default defined as investors who have at least 1000 bitcoin units at their disposal. Whale activity has been followed with particular diligence as these single investors can easily shift the whole market structure. Let’s look at brief summary of bitcoin’s whale action:

The BearWhale of 2014

Back in October 2014, a single investor placed a sell order for 30 000 bitcoins on Bitstamp at 300 USD per native unit. The coins were worth $9 million back in 2014, however today they’d be worth over $1,75 billion. The sudden sell-off of this magnitude created a huge threat to the relatively illiquid markets of 2014, but the bitcoin community was able to buy these coins, using organized buying pressure.

The Bitfinex Whales

The legendary “Bitfinex whales” have been active since bitcoin’s early days and have been both on sell-side and buy-side, depending on the market composition. Bitfinex exchange is known to be close to the stablecoin Tether (USDT) and there has been speculation on Tether’s use for market manipulation. The Bitfinex whales, or organizations behind it, were particularly active in 2017 bull market, however recently the whales have been bearish on bitcoin.

Michael Saylor

Michael Saylor, the main owner of MicroStrategy (MSTR), personally owns 17 732 bitcoin units, equal to $1,05 billion. In contrast to “legacy” bitcoin whales, Saylor has an institutional background and he’s transparent towards his intentions. Saylor is a well-known bitcoin bull and he’s usually in accumulation mode, following his investment philosophy. Saylor’s company MicroStrategy owns over 100 000 native bitcoin units.

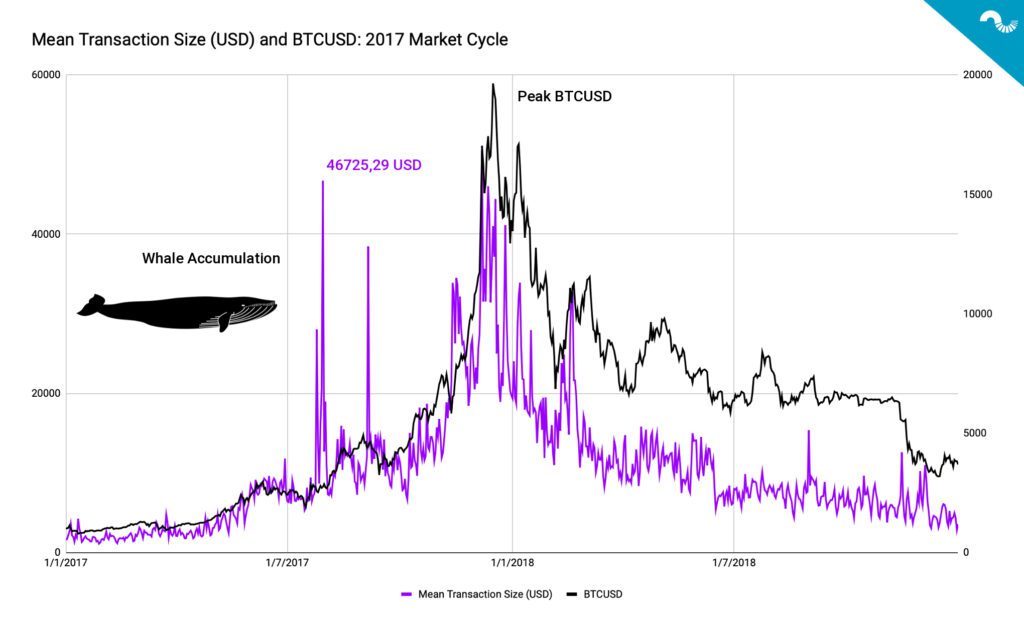

Whale behavior can be interpreted with bitcoin mean transaction data, showing the size of mean transaction for each day. Using 2017’s bull cycle as an example, mean transaction size started to spike in early Q3, rising to $46,7K in late July 2017. The mean transaction size saw multiple further spikes as the price ascended towards Q4 2017 peak.

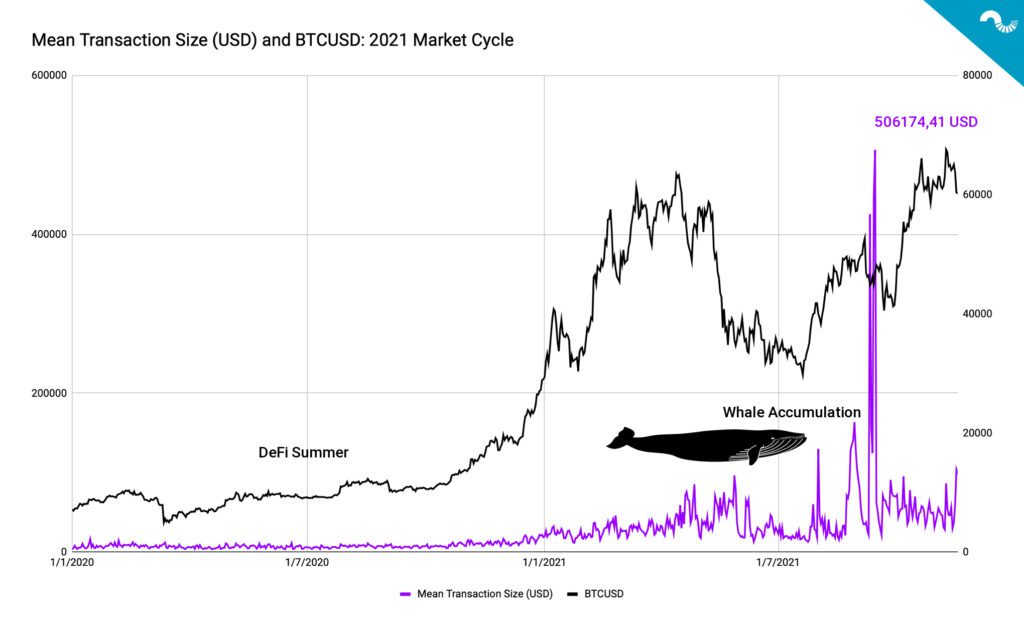

The 2017 data can be used as a benchmark for 2021’s mean transaction size and price action. Like in 2017 the transaction size has peaked in early Q3 this year, rising to double tops of $425K and $506K during mid-July. If we mirror the 2017 and 2021 data, the mean transaction size pattern would indicate significant unused upside potential for bitcoin’s spot price in between Q4 2021 and Q1 2022.

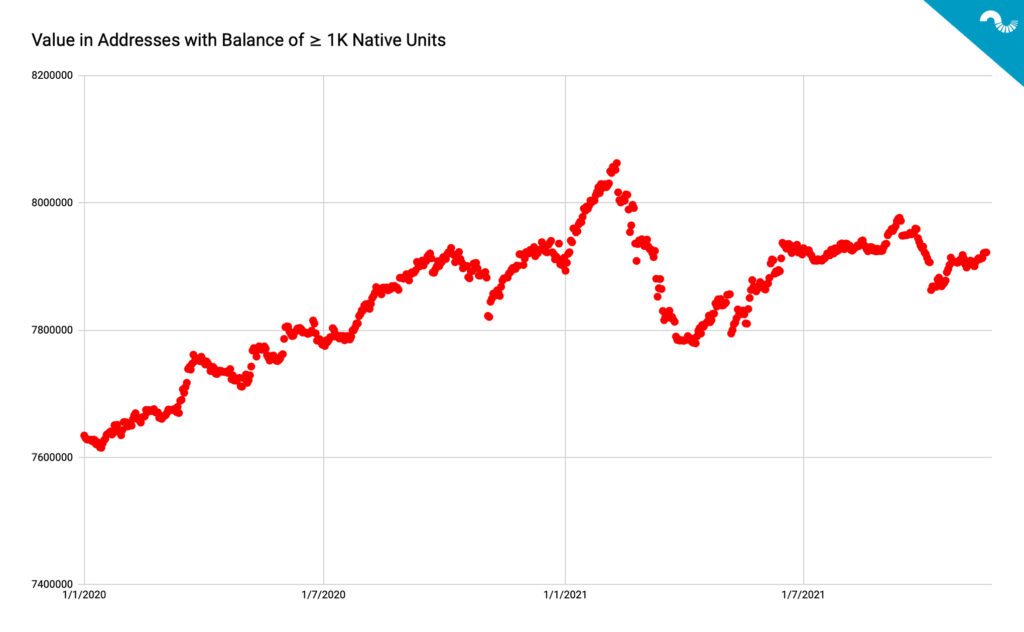

The amount of bitcoin units in large addresses reveals that whales have been front-running the market again. As bitcoin’s bull cycle grew from Q3 2020 into Q1 2021, the whales started to derisk well before May’s eventual correction. Address data shows the amount of native bitcoin units decreasing heavily in March 2021, two months before the large correction. Whales have been accumulating since the May’s correction, slightly reducing risk in October.

Market Deleverages Slightly, ELR Still High

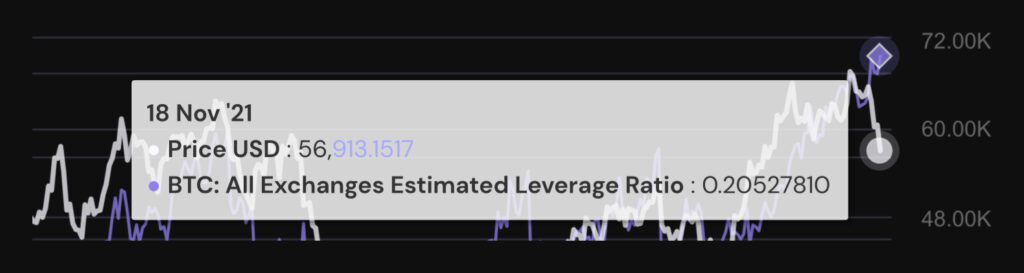

Like explored in the technical analysis of week 45, the Estimated Leverage Ratio (ELR) has been climbing to all-time highs in last few weeks, indicating a possibly overleveraged market. This week the ELR dropped slightly, leading to some healthy deleveraging. A lower ELR and spot price correction would be good for the bitcoin market, as the excessive amount of leverage weighs bitcoin’s spot price down. As a self-correcting system, the market usually fixes itself by flushing out surplus leverage.

Is The Mt. Gox Risk Priced in?

The rise and fall of exchange Mt. Gox has been one of the most interesting, yet notorious, stories in the cryptocurrency industry. Founded in 2010 and eventually closed in 2014, the former exchange has been going through an extensive rehabilitation program, which includes paying back $9 billion to Mt. Gox’s formed clients. The terms for compensation were finalized this week and analysts expect the payments to begin in first (Q1) or second (Q2) quarter of next spring (2022).

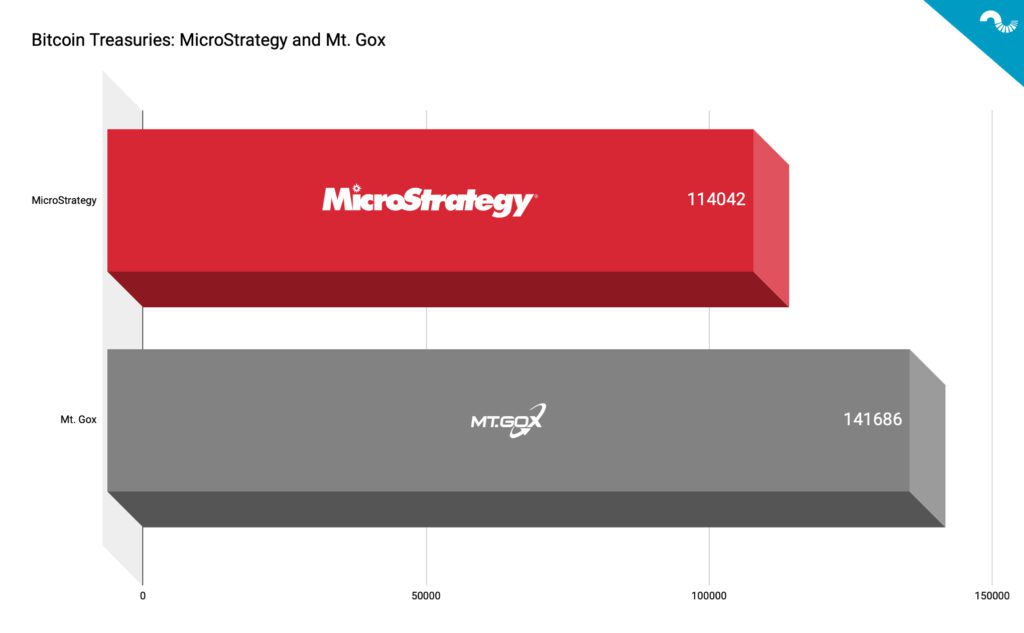

Market participants follow the Mt. Gox situation with scrutiny as the exchange still holds a notable amount of bitcoins, totaling to 141 686 bitcoin units. Using MicroStrategy as a benchmark, Mt. Gox currently holds 24,24 percent more bitcoin units than the leading institutional bitcoin company MSTR.

The big question obviously is will the early bitcoin investors liquidate their coins, as the repayment program is implemented? This question will be speculated into 2022, however Julian Liniger of Relai commented he’s not expecting a majority of Mt. Gox to be sold. Most of the early Gox-related investors are fundamentally into bitcoin and it’s possible they’d not cause significant selling pressure.