The TA of week 41 focuses on multiple technical indicators, including the bullish divergence of bitcoin’s relative strength index (RSI) and spot price. Additionally, we interpret bitcoin’s market cycles and try to understand if Grayscale’s GBTC is worth investing in.

A Bullish Divergence

The cryptocurrency markets saw a glimpse of hope as the leading cryptocurrency, bitcoin has been able to hold its $19K level, even reaching close to $20K. Many industry analysts attended the recent Future Blockchain Summit of Dubai, in which Tone Vays gave surprisingly bullish views on the market. Vays sees a spot price reversal ahead, as bitcoin has a tendency to rise out of its bear cycle. He argued that the reversal either happens in “price or time”.

“Bitcoin is the only unconfiscatable asset.”

– Tone Vays

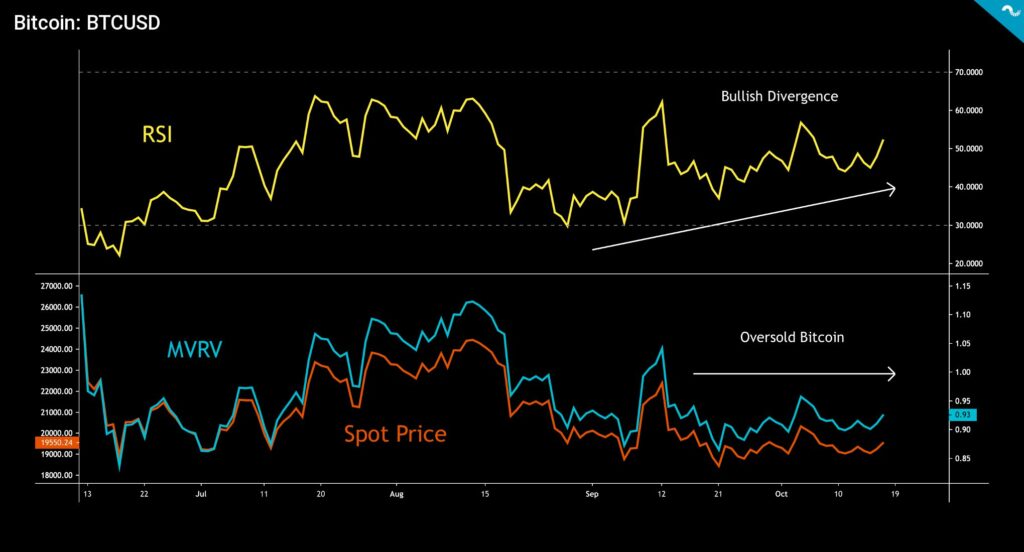

Bitcoin’s technicals (1D) currently form an interesting pattern, which simultaneously shows the oversold spot price (orange) and MVRV indicator (turquoise), which have diverged from the rising RSI since September. This setting creates a classic bullish divergence pattern. The relative strength index reached an oversold reading in September, followed by an RSI higher low and a spot price lower low. These signals indicate bullish technical momentum, and traders are looking at a possible entry point here.

MVRV Sell Zone: > 3,7

MVRV Buy Zone: < 1

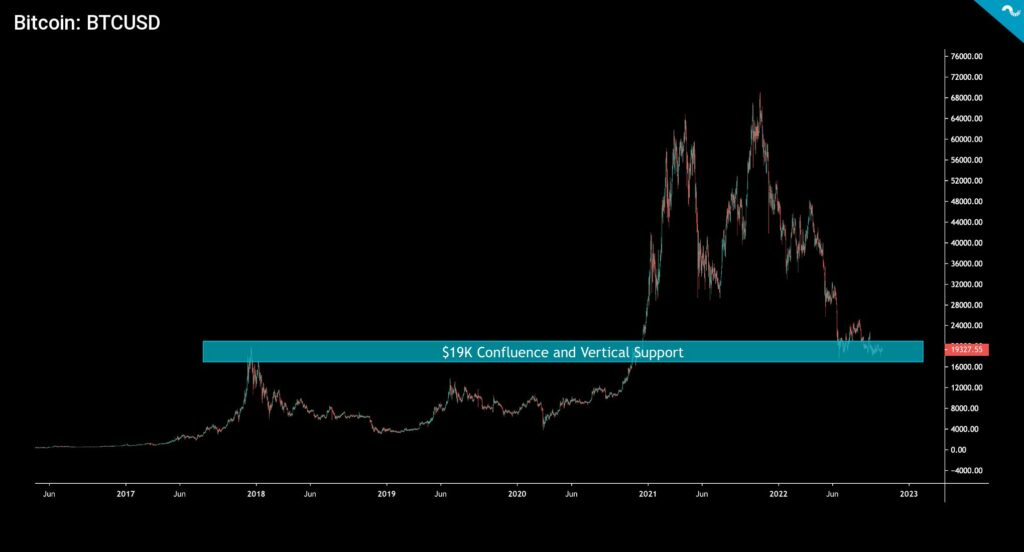

Bitcoin (1D) has been trading in close proximity to its $19K confluence and vertical support zone (turquoise) since early June. The critical zone dates back to the 2017 and 2020 bull cycles.

Another Bollinger Band Squeeze Incoming

Bitcoin’s spot price movements (2H) can be interpreted by Bollinger bands (violet), which alternately squeeze or expand around BTCUSD. After a tight BB squeeze on October 12th, the spot price fluctuated from 18 000 dollars to almost $20K. The following Bollinger band expansion calmed the market for a while. Now bitcoin’s spot price is again getting ready for a BB squeeze, which would likely give BTCUSD fresh upward momentum.

Bitcoin was able to reach the spot price green zone, rising to a 1,2 percent climb after last week’s -2,9% drop. Ethereum also reversed its course from last week -3,2% to a positive 2,4%. The token of the decentralized lending platform Aave made a complete reversal from last week’s -5,2 percent decline into the 15,3% climb of the past seven days. Uniswap also reversed its course from last week’s -10% to plus 10%. The leading stock market index S&P 500, was propelled into a 3,65 percent climb after the previous week’s negative numbers. Somewhat surprisingly, gold continued its decline, weakening -1,38 percent after last weeks -3,3%.

7-Day Price Performance

Bitcoin (BTC): 1,2%

Ethereum (ETH): 2,4%

Litecoin (LTC): -0,5%

Aave (AAVE): 15,3%

Chainlink (LINK): -0,4%

Uniswap (UNI): 10%

Stellar (XLM): -3,2%

XRP: -4,1%

Get started with Bitcoin Litecoin Ethereum AAVE USDC Stellar Ripple

Join Coinmotion and buy your first cryptocurrencies within minutes!

S&P 500 Index: 3,65%

Gold: -1,38%

– – – – – – – – – –

Bitcoin RSI: 49

Is Bitcoin Approaching The End of Bear Cycle?

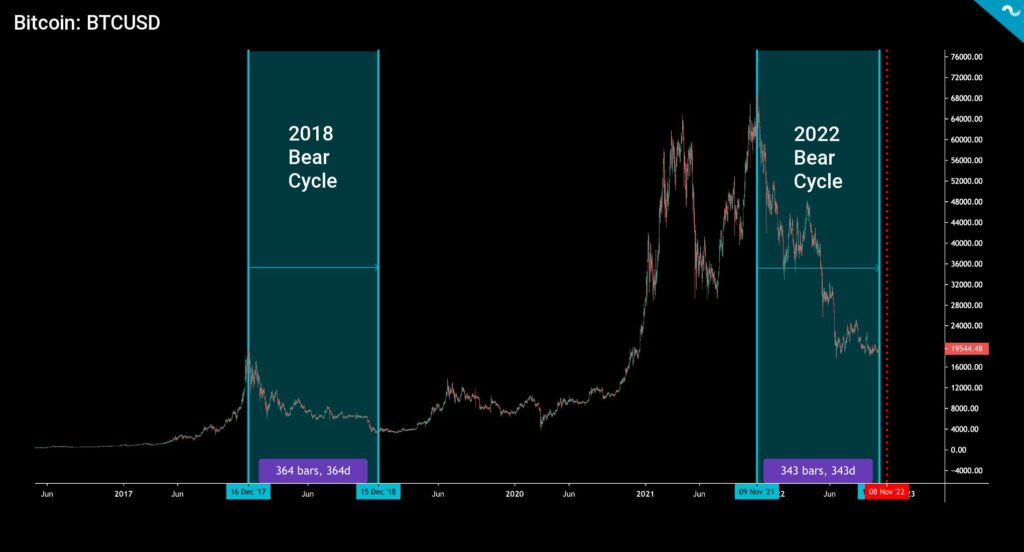

Bitcoin’s current “crypto winter” (1D) has now lasted for 343 days, and many investors are wondering when we’re about to see proper positive momentum again. When benchmarked against the last major bear cycle of 2018, bitcoin could quickly be approaching its spot price bottom. The 2018 bear cycle (left segment) lasted for 364 days before reaching its eventual bottom, while the current cycle (right segment) is only 21 days from that target (red). In summary, the last bear cycle would indicate bitcoin bottoming in 21 days.

The bull cycle of 2021 had a special and rare double-top structure, while 2017’s single-cycle top in December was very sharp. After 2017, it took almost three years for bitcoin to fully recover. Some analysts argue that market cycles are getting shorter over time; however, the macro environment of 2022 remains highly uncertain. Markets regarded the zero interest rate policy as a “new normal,” and climbing rates now form a wide shock effect across the field. However, rate hikes are nothing new in a historical context, and markets will likely absorb the stress over a longer time horizon.

The Aptos (APT) Airdrop and Drama

A new layer one (L1) token, Aptos (APT), was launched early Wednesday after confirming listings from Binance, Coinbase, and FTX. The Aptos launch was nothing short of dramatic, promising to airdrop a total of 20 076 150 APT tokens to a total of 110 235 participants. Users who completed an application for an Aptos Incentivized Testnet, or minted an APTOS:ZERO testet NFT, were eligible.

The airdrop launch itself didn’t go according to the plan, and apparently, some individual users were able to receive a huge amount of APT tokens. In the early hours of Aptos chain history, someone was market selling 189 567 APT tokens on Binance (picture). The APT/USD spot price consequently dropped from $15 to $13. Since then, the spot price has declined even further, dropping to the current level of $8. This represents an over -42 percent decline within the first 24 hours.

The Speculative Grayscale GBTC Trade

Launched back in 2013, Grayscale is one of the iconic institutional bitcoin companies in the industry. Grayscale is known for its crypto-related funds, including GBTC, ETHE, and others. Grayscale was long the only practical way for traditional money to invest in digital assets, and it used its monopoly position to charge notable fees (2%). Recently Grayscale has been facing increasing competition from new ETFs, first in Canada and also in the United States. Grayscale plans to convert GBTC into a spot ETF as soon as possible.

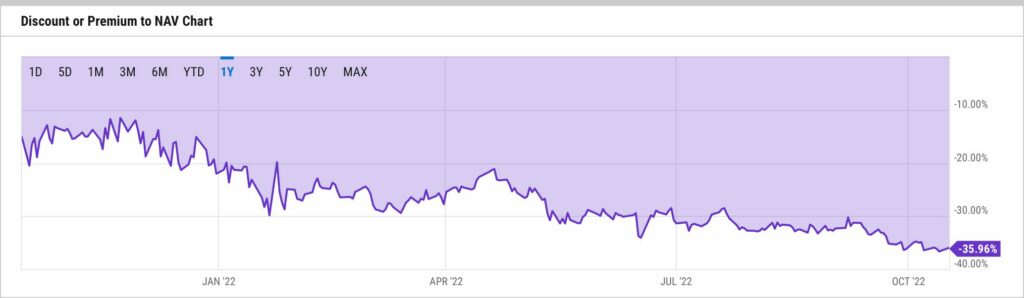

One of the most interesting features of GBTC has been its premium over bitcoin’s price, peaking at +132,6 percent in late May 2017. Premium, or discount to net asset value (NAV), refers to the difference between the nominal value of the trust holdings versus the market price of the holdings. Since 2021, the premium has been on a downward trajectory, descending from early 2021 29 percent to the current -36%. The dropping premium (or discount) was a leading indicator of bitcoin’s price during previous years.

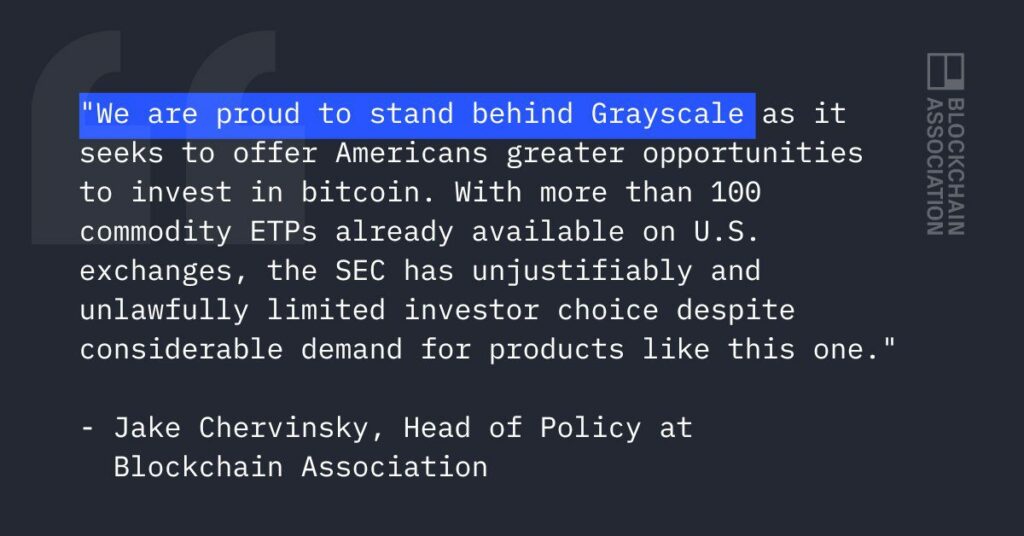

Grayscale’s attempts to convert GBTC into an ETF form have been rejected by SEC so far. However, the company has filed a lawsuit against the SEC, calling the spot ETF rejection “arbitrary, capricious, and discriminatory.” Recently the American Blockchain Association showed major support for Grayscale. Some investors now believe that Grayscale would have credible chances of success in its lawsuit and spot ETF application.

A speculative investor could now buy GBTC shares with a -36% price cut and profit later by the ETF listing. Obviously, in this blue-sky scenario, we assume that the spot ETF will be approved in the foreseeable future.

What Are We Following Right Now?

Guy Turner, the co-founder of Coin Bureau, discusses the crypto winter, Bitcoin, and the Great Reset. He chats about CBDCs, carbon credits, and how Bitcoin is the “best weapon” against this impending “control”.

The housing market is in bad shape. Homebuyer traffic has collapsed to its lowest levels since the 2008 subprime crisis.

Homebuyer Traffic just collapsed to lowest level since start of 2008 Housing Crash.

— Nick Gerli (@nickgerli1) October 18, 2022

-61% YoY. Not good. pic.twitter.com/8NGB0PAj58

While the European Central Bank (ECB) is expected to start tapering (QT), its balance sheet is showing no signs of shrinking yet.

ECB seems not even thinking of reducing its balance sheet, and can't even manage stagnation. Total assets has risen by €6.1bn to €8,778.1bn driven by QE. Since record in Jun, balance sheet has shrunk by just €57bn. Total assets still equates to 81% of Eurozone GDP vs Fed's 35% pic.twitter.com/BPfC3KbGCL

— Holger Zschaepitz (@Schuldensuehner) October 19, 2022

Gain knowledge and read our weekly insights

- Crypto adaption moving further as Google accepts cloud payments in crypto

- Binance blockchain hacked for $570 million & Swiss McDonald’s accepts Bitcoin

- Europe becoming more crypto-friendly & NFT sales are declining

The views, thoughts, and opinions expressed in the text belong to the author and not necessarily to the author’s employer, organization, committee, or other group or individual.

Get started with Bitcoin Litecoin Ethereum AAVE USDC Stellar Ripple

Join Coinmotion and buy your first cryptocurrencies within minutes!