The technical analysis of week 50 breaks down into bitcoin’s critical support zone and realized price. In addition, we evaluate CPI, derivative exchanges, and, in the bigger picture, bitcoin’s price projections for 2023.

Bitcoin Touching The Critical Support

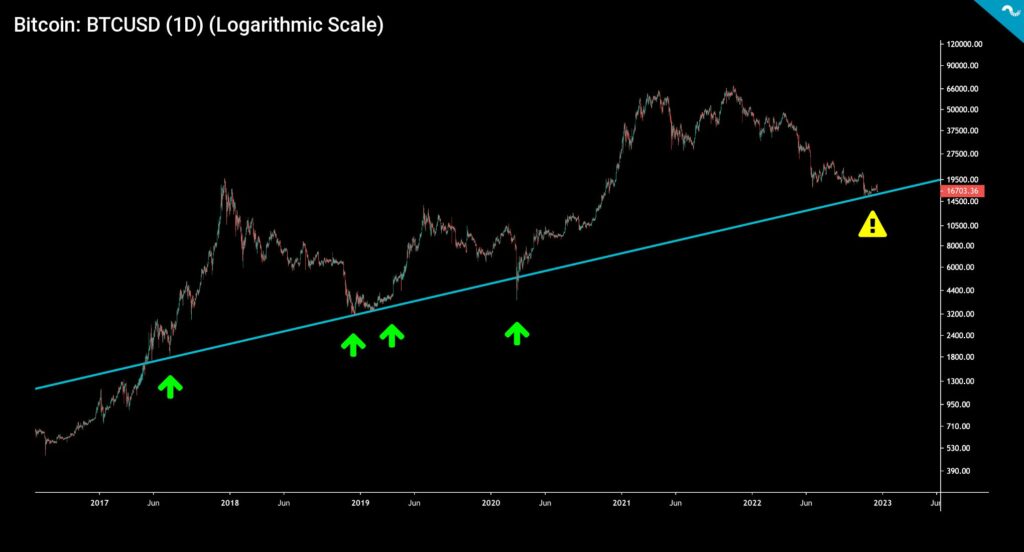

The price development of the leading cryptocurrency, bitcoin, has continued as slightly sluggish since last week, leading to spot price dropping about two percent. The price of bitcoin (logarithmic scale) is currently supported by the multi-year trend line (turquoise), on which the cryptocurrency has oscillated since the summer of 2017. If Bitcoin falls through that support line, the next support area can be found on the surface of $15K.

There is still a considerable amount of uncertainty (FUD, fear, uncertainty, and doubt) in the market, which stems from the previous FTX crisis and newer doubts related to the DCG. However, when investors panic, it is good to remember that the vast majority of doubts are, by default, unfounded. Analyst Tone Vays announced on Monday (19.12) that he would stick to his 20 percent bitcoin allocation.

The spot price of Bitcoin has fallen below the realized price (turquoise) since mid-June. If we do not consider local increases above the realized price, the spot has now been oversold for a total of 189 days. From the point of view of the realized price, the current bear cycle has already exceeded the 2018-2019 bear market in length, where the spot price fell below the realized price for 133 days. The realized price acts as a support level for the spot price, with bitcoin heavily undervalued, but in the current bear scenario, the realized price has become a resistance level.

The price development of the market has continued its downward trend since last week, with the leading cryptocurrency, bitcoin falling by around -3 percent on a weekly basis. The decentralized finance ether token has weakened at a steeper angle than bitcoin, ending up with a weekly decline of almost -8%. As a general rule, higher beta DeFi tokens have depreciated more than the leading cryptocurrency. Chainlink, Aave, and Uniswap have all fallen by more than -10 percent in a week. BNB, the native token of the Binance exchange, has clearly taken a hit from the FUD rumors and has weakened by -14 percent on a weekly basis. The stock index S&P 500 has weakened by a considerable -5 percent in a week, but the price development of gold is still moving in an almost sideways direction.

7-Day Price Performance

Ethereum (ETH): -7,5%

Uniswap (UNI): -13,3%

Stellar (XLM): -11,4%

Get started with Bitcoin Litecoin Ethereum AAVE USDC Stellar Ripple

Join Coinmotion and buy your first cryptocurrencies within minutes!

S&P 500 Index: -4,6%

Gold: -0,2%

The macro market can be interpreted as showing signs of healing. Annual CPI (blue) has turned to a clear decline, which gives the central bank Fed room for a possible easing of monetary policy. Analysts such as Luke Gromen expect the Fed to pivot in 2023. A gradual return to quantitative easing (QE) by the Fed would improve the outlook for high-beta investments.

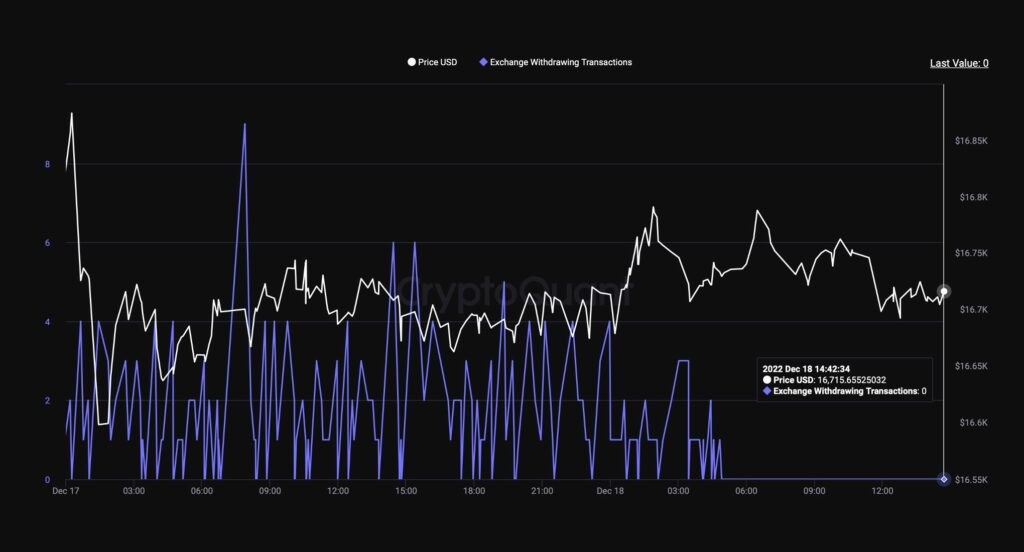

OKX Exchange Freezed Withdrawals

While Binance and DCG Group are facing strong FUD rumors, the OKX exchange spooked investors by suspending withdrawals between Sunday (19.12) and Monday (20.12). Later, the exchange commented that the interruption was due to a disturbance in its cloud service. The company also assured that it will move away from the dependency relationship of one cloud service in order to reduce the single point of failure risk. The company later revealed that the problems were exclusively caused by the Alibaba Cloud service. OKX wallets can be monitored in real-time on the Etherscan page.

There is currently an intermittent connection error with our cloud provider which is affecting the user experience. Our dev team is resolving it with them. Funds are safe. Sorry for any inconvenience caused. 🙏

— OKX (@okx) December 18, 2022

Bitcoin’s Prospects and Projections for 2023

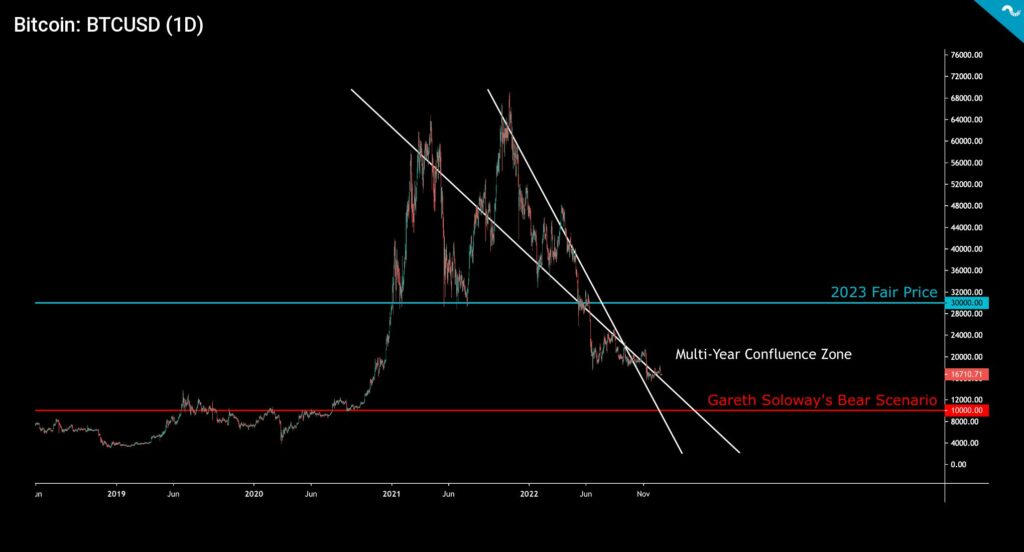

As the year draws to a close, many are now thinking about the prospects of the bitcoin market for the next year. If we look back at the time horizon, bitcoin was in an accumulation cycle (purple) from 2019 to 2020, then entering a parabolic price movement and a 2021 distribution cycle (red). Last year’s bull cycle was exceptional in its double-peak structure, while in 2017, the spot price only reached one peak. After cycles of accumulation and distribution, Bitcoin is once again in a new pre-halving accumulation cycle (blue), which will continue until the 2024 halving event. The price of bitcoin is also supported by the multi-year support and confluence level (white), on the surface of which the price trend seeks direction.

This year, Bitcoin received several educated price projections, but few of them came true. In July, we estimated Deutsche Bank’s target price of $28 000, which will clearly not be realized this year. However, the fair price for 2023 would be $30 000, close to DB’s previous target price. The well-known trader and analyst Gareth Soloway has given several excellent assessments of bitcoin’s price development over the years. He predicted that the spot price of bitcoin will decline after the November market peak of 2021. However, in his latest statements, Soloway’s rhetoric towards bitcoin has been more positive, and he commented that he is at least “lukewarm” about the outlook.

In Soloway’s bear scenario, Bitcoin would fall to the $10K level, which he has considered unlikely. Bitcoin’s falling price also offers it an opportunity to break away from the stock market correlation, which has fallen -30 percent from September’s 0,65 to the current 0,45 (Pearson, 90 days). Bitcoin is currently at the same price level as at the beginning of the 2020 parabolic cycle, taking support from its multi-year support and confluence levels. The market recovery in 2023 will take place through the retail segment because it has been quick to react to the cyclical fluctuations of the crypto market. Institutions remain more cautious as this year has seen several trusted institutional players run into trouble.

The estimated date for the halving event in 2024 is April 13, so at the time of writing, it is 480 days away. The selling pressure on Bitcoin is clearly weakening, and at the same time, there are a large number of unprotected short positions in the market. If a positive turn is seen in the macro market, the spot price may cause a short squeeze setup.

Bitcoin’s next halving will happen in block 840 000 and will reduce the block reward from 6,25 to 3,125. In the previous halving cycle, the spot price of bitcoin increased by 1263 percent between 2016 and 2020. If the same trend continues, Bitcoin will reach the level of 100 000 euros in 2024.

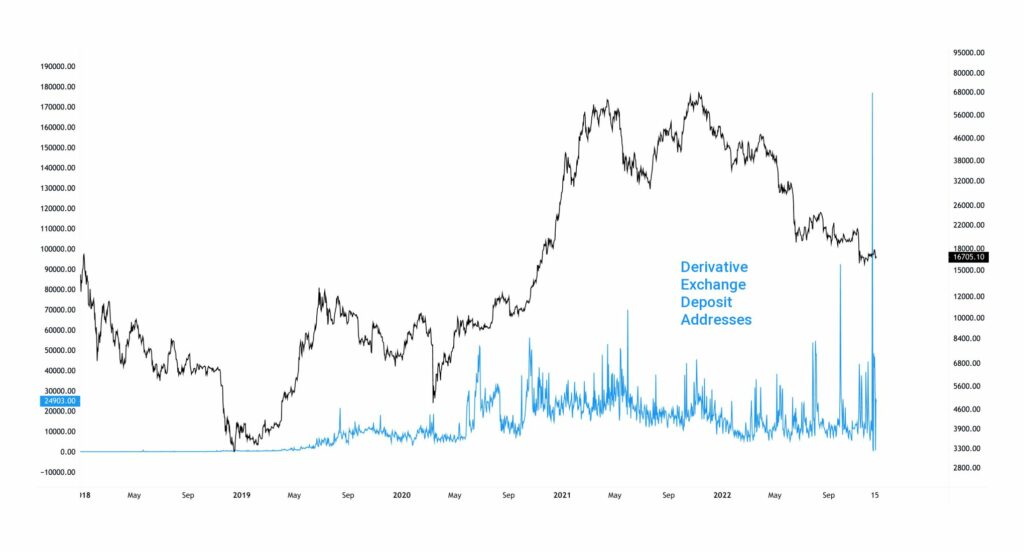

Derivative Exchange Deposits Rising

Despite the selling pressure of the spot price, or because of it, the number of stablecoins flowing into derivatives exchanges has reached a new record. At the same time, the number of bitcoin open interest is high, and the market is preparing for elevated volatility.

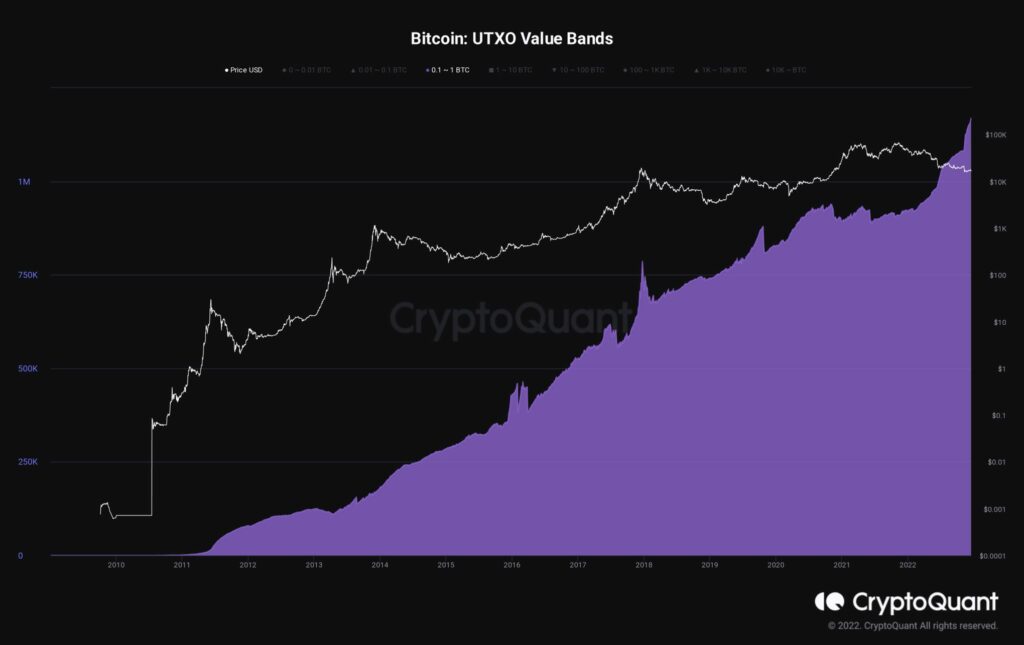

Another metric countering the weakness of the spot price is that UTXOs in the retail size category indicate accumulation. These investors in the size range of 0,1 to 1 native unit, therefore, accumulate bitcoin despite the negative general sentiment.

What Are We Following Right Now?

Hong Fang of the Okcoin exchange talks with David Lin about the situation of the exchanges and the outlook of the market towards 2023.

Senator Ted Cruz opens up his views on the relationship between Bitcoin and the state of Texas, digital central bank currencies (CBDCs), and energy policy.

Gareth Soloway and Rune Summers discuss bitcoin price scenarios, regulation, and trading.

Stay in the loop of the latest crypto events

- The crypto scam landscape: What to look out for?

- The Bank of Spain confirms the registration of Coinmotion as a cryptocurrency operator

- Technical Analysis: Bitcoin and Dow Theory

- Ledger’s new cold wallet & Stripe entering into collaborations

The views, thoughts, and opinions expressed in the text belong to the author and not necessarily to the author’s employer, organization, committee, or other group or individual.

Get started with Bitcoin Litecoin Ethereum AAVE USDC Stellar Ripple

Join Coinmotion and buy your first cryptocurrencies within minutes!