The technical analysis of week 25 charts bitcoin’s return to the critical $30 000 level. In addition, we delve into the growth of institutional demand and its reasons. We also study the differentiation of commodity- and security-classified tokens.

Significant new demand has been injected into the crypto market over the past seven days, pushing bitcoin up eight percent. In the time window of the last two weeks, the leading cryptocurrency has strengthened by almost 18%. Bitcoin is now being boosted by speculation about BlackRock’s ETF fund and a renaissance of institutional interest.

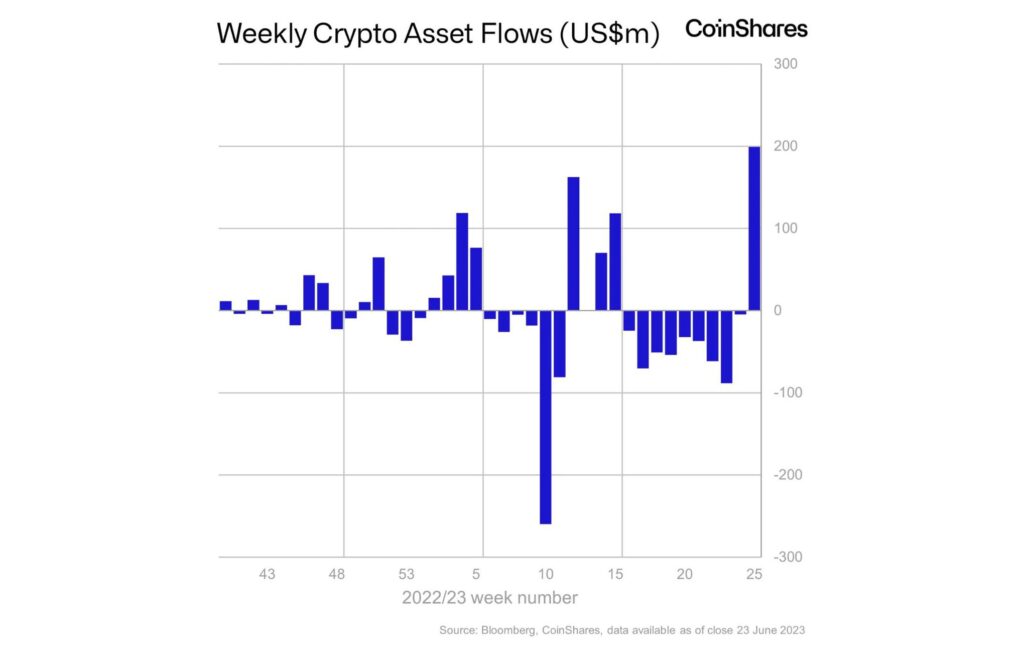

The emerging institutional demand is also indicated by CoinShares’ inflows of $199 million, representing the largest number since July 2022. The dramatic wave of demand also breaks the spring’s nine-week trend of outflows.

“Digital asset investment products saw the largest single weekly inflows since July 2022, totaling US$199m, correcting almost half of the prior 9 consecutive weeks of outflows. (…) This turn in sentiment didn’t trickle down to altcoins with only very minor inflows.” – James Butterfill, CoinShares

Butterfill’s comments support TA’s previous thesis about the growth of bitcoin dominance at the expense of altcoins and other tokens. After the U.S. Securities and Exchange Commission’s reclassification, bitcoin, which received a commodity classification, has clearly distinguished itself from altcoins (classified as securities).

Source: CoinShares

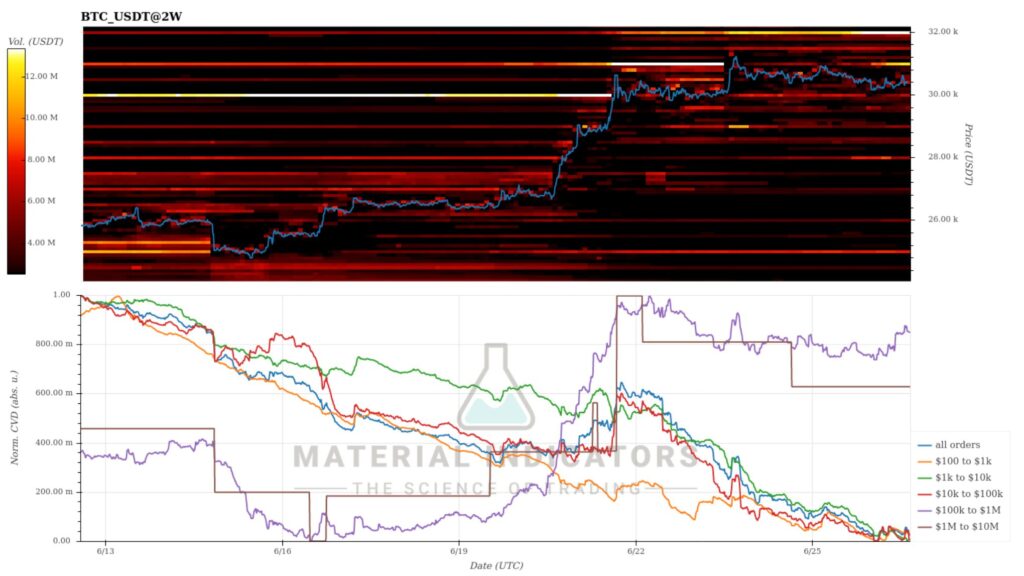

From a purely technical point of view, bitcoin managed to break through its April-June resistance level (white), which for months has blocked bullish efforts of the spot price (red). Crossing the resistance line indicated by the green arrow also makes it a new support level.

Sources: Timo Oinonen, CryptoQuant

CryptoQuant’s data shows the spot price made a flash rise to $56K, indicating a possible target price for this year. Technical analysis has previously estimated that bitcoin could reach $46 000 before the end of the year.

The current market composition is very similar to the post-bear cycle year of 2019. As Mark Twain famously said, “History doesn’t repeat itself, but it rhymes.” If the 2018-2019 cycle is used as a reference point, bitcoin could rise above $40 000 this year. Between January and July 2019, the spot price of bitcoin rose from $3808 to $10 570, a percentage gain of 178%.

Sources: Timo Oinonen, CryptoQuant

The Material Indicators heatmap looks promising, with new support forming at $30 000. At the same time, the purple and brown graphs of the cumulative volume delta tell about the elevated whale level demand.

Source: Material Indicators

Bitcoin has risen almost eight percent since last week and almost 18 percent in the two-week time window. Ethereum’s price development, on the other hand, seems to be fading, dropping its correlation with bitcoin. Litecoin, which will meet its halving event in 34 days, strengthened by more than eight percent.

Many of the higher beta tokens listed on Coinmotion have gained new momentum. In seven days, Aave strengthened by 18,7 percent and Stellar by 23,6%. The downward trend of the leading stock index S&P 500, forms a clear divergence from the crypto market.

7-Day Price Performance

Bitcoin (BTC): 7,8%

Ethereum (ETH): 4,3%

Litecoin (LTC): 8,1%

Aave (AAVE): 18,7%

Chainlink (LINK): 16,4%

Uniswap (UNI): 13,3%

Stellar (XLM): 23,6%

XRP: -2%

Get started with Bitcoin Litecoin Ethereum AAVE USDC Stellar Ripple

Join Coinmotion and buy your first cryptocurrencies within minutes!

S&P 500 Index: -0,2%

Gold: -1,5%

The Divergence of Security and Commodity Tokens

On June 5th, the U.S. Securities and Exchange Commission (SEC) announced that it was suing the Binance.US platform and CEO Changpeng Zhao, also known as CZ. Binance has to answer a total of 13 charges, which include operating the exchange without a proper license.

The SEC’s onslaught continued on Tuesday, June 6th, when it sued Coinbase. Coinbase is accused of, e.g., the sale of unregistered securities. The commission’s attacks on these two mainstream exchanges have brought clear selling pressure to the market. Binance-linked tokens have naturally taken more of a hit, with Binance Coin, or BNB, weakening by -23 percent in a month.

At the same time, the SEC divided cryptocurrencies and tokens into two main groups, one of which includes “commodity tokens” and the other “security tokens.” The radical classification places only bitcoin and ethereum in the commodity group, securing their status. Most altcoins belong to the latter group of securities, making their exploitation challenging in the United States.

Security classified tokens include at least: sol, ada, matic, fil, sand, axs, chz, icp, near, vgx, dash, flow, mana, algo, nexo, atom, bnb, busd, and coti.

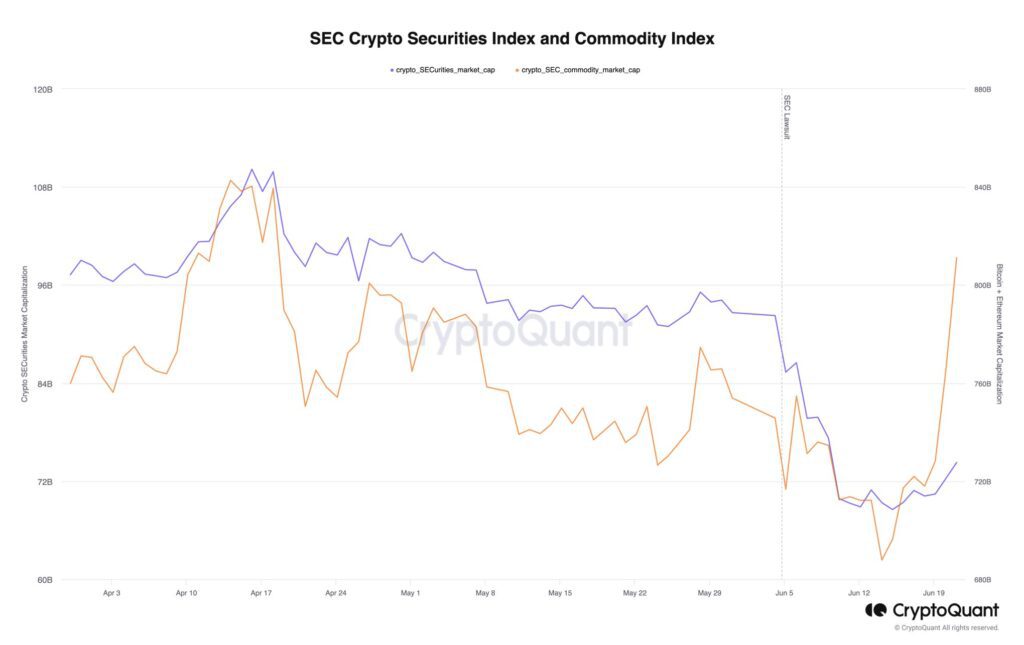

Source: CryptoQuant

Commodity-rated tokens (orange) weakened slightly after the SEC actions, but in mid-June, they continued to rise as currencies worked their way back toward May’s valuation levels. At the same time, commodity-classified bitcoin is boosted by BlackRock’s ETF application and other institutional projects.

After the commission’s lawsuits, the indexed prices of commodity-classified tokens have increased by 9,2 percent, climbing from 99,16 to 108,31 on the indexed scale. The prices of securities-classified tokens (purple), on the other hand, have fallen -21,2 percent after the lawsuit, weakening on the indexed scale from 95,98 to 75,67.

The market capitalization of commodity-classified tokens has increased by 8,8 percent since the SEC’s actions, while the market cap of security-classified tokens has weakened by -19,5%. In conclusion, the U.S. Securities and Exchange Commission has divided the market into new “losers and winners” while strengthening the positions of Bitcoin and Ethereum.

Source: CryptoQuant

The strengthening of bitcoin’s position can also be seen in ProShares’ Bitcoin Strategy ETF (BITO), whose largest inflows in 2023 brought its size to over $1 billion.

Source: Bloomberg

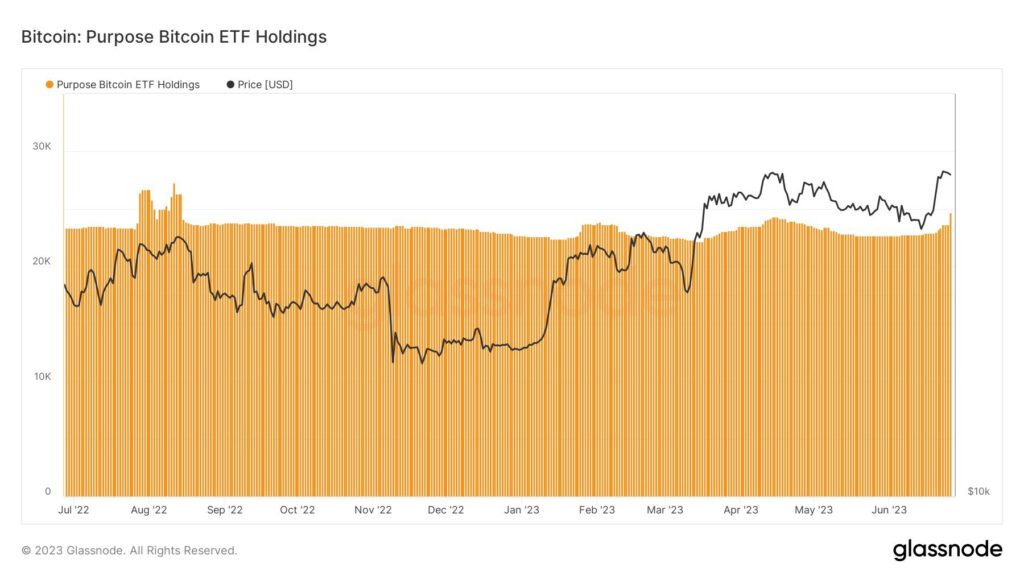

At the same time, Canadian Purpose Bitcoin ETF’s assets have exceeded 24 700 bitcoin units, representing the largest reading in 2023.

Source: Glassnode

Bitcoin Dominance at 2023 Peak

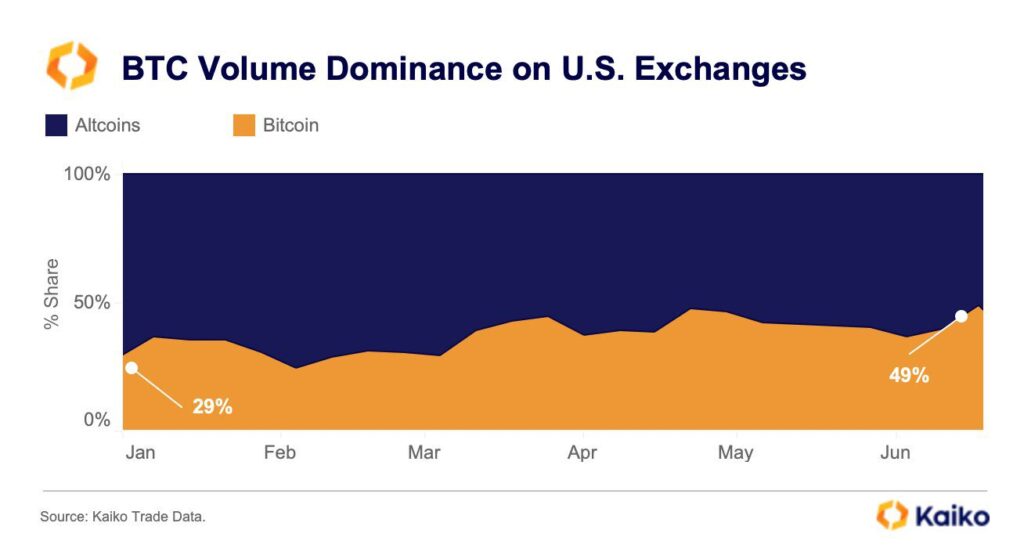

The divergence between bitcoin and altcoins described in the previous section is also reflected in the growth of bitcoin dominance. According to Kaiko, bitcoin’s volume dominance on U.S. exchanges has grown from 29 percent at the beginning of the year to the current 49 percent. The increase in dominance from January to June has therefore jumped by a whopping 69 percent.

Source: Kaiko

Although the SEC’s classification only applies to its domestic market, the regulatory action also has an impact on the overall credibility of various blockchain projects. The commission’s ability to spread uncertainty with its securities classification is, therefore, a clear threat. In the current regulatory environment, bitcoin’s dominance can be predicted to continue to grow.

About the Competitive Position of Binance and Coinbase

Binance and Coinbase, which have been targeted by the SEC, are now closely monitored, as blockchain data enables greater transparency than the traditional market. Both exchanges mirror the state of the market and the change in the regulatory environment. At the beginning of the year, Binance’s spot market share was more than 90 percent, making the exchange a potential single point of failure. A better distribution of volume among medium-sized exchanges is a healthy development trend for the industry.

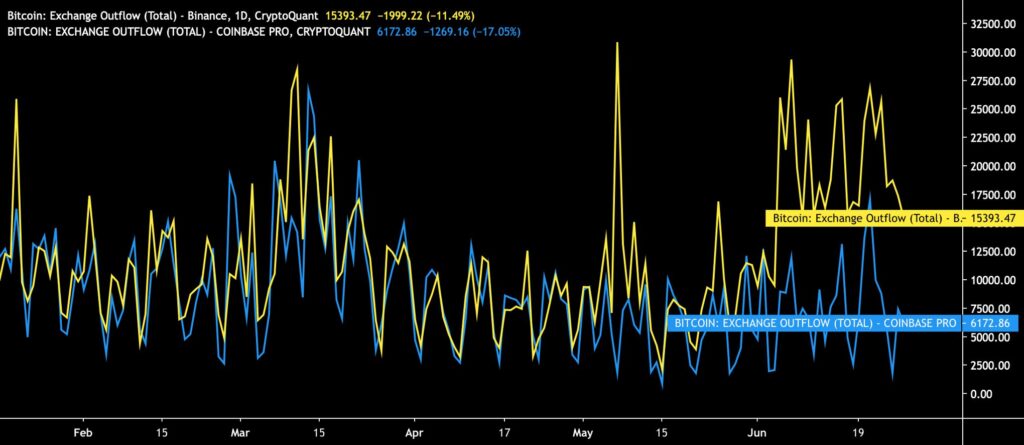

The bitcoin outflow data from the exchanges show that Binance clearly took a bigger hit than Coinbase as the regulatory field tightened. Binance outflows were on a significant rise in early June, peaking at 30 000 bitcoin units on a daily basis.

Sources: Timo Oinonen, CryptoQuant

Binance’s difficulty factor is raised by its own Binance Coin (BNB) token. Binance will be forced to sell its liquid token portfolio to support BNB’s falling price, generating selling pressure on the entire market. Although Changpeng Zhao (CZ) has denied BNB support purchases, market data from Hyblock indicates otherwise. The situation can be compared to the situation of the FTX exchange and Alameda Research with FTX Token (FTT).

The price development of BNB (red) looks dangerous as the price of the token has fallen by -25 percent in a month. In the past, Binance’s huge growth spurt was fueled by speculative high beta tokens, many of which are at risk of being placed on the SEC’s securities classification list. In addition, the company grew during the zero interest rate cycle, with the financial environment now significantly more challenging.

Sources: Timo Oinonen, CryptoQuant

Coinbase’s outflows have remained more modest. At the end of June, around 6000 bitcoin units flowed out of the exchange. The COIN share of the listed Coinbase has risen almost 60 percent since the beginning of the year, and the exchange does not have its own platform token to support it. In contrast to Binance, Coinbase’s philosophy has been more sustainable growth in accordance with compliance guidelines.

What Are We Following Right Now?

Prime Trust, operating in the state of Nevada, is apparently guilty of serious misconduct. According to the court, Prime “lost access” to its wallets and used customer funds to patch up its balance sheet. “Don’t trust, verify.”

FID alleged Prime Trust lost access to legacy wallets in 2021 and used customer assets to buy back crypto

— db (@tier10k) June 27, 2023

oh brother https://t.co/2rrW2jpmDr pic.twitter.com/zjebYPAkcA

CrossBorder Capital’s Michael Howell explains why liquidity might be returning.

Blockchain and market cycle analyst Rational Root opens up his views on the state of the market.

Stay in the loop of the latest crypto events

- Coinmotion Adds Two New Strategic Board Members to Strengthen its Position in the Digital Currency Market

- Bitcoin Decouples from the Stock Market and Altcoin Correlations

- Ripple (XRP): Empowering the future of digital currency

- The Déjà Vu of Bitcoin Dominance

- Coinmotion Teams Up with Fenergo for the Next Level in AML Compliance

- Is Web3 the future of the Internet?

- Exploring altcoins updated meaning in 2023

- BRC20 tokens: How they differ from other cryptocurrencies

- How can decentralization save us in a world driven by AI?

Get started with Bitcoin Litecoin Ethereum AAVE USDC Stellar Ripple

Join Coinmotion and buy your first cryptocurrencies within minutes!

The views, thoughts, and opinions expressed in the text belong to the author and not necessarily to the author’s employer, organization, committee, or other group or individual.