Bitcoin has been gaining incremental interest among investors as a unique form of asset class. Bitcoin offers exceptional value as non-correlated and censorship-resistant investment. However the threshold for starting acquiring bitcoin might be high for some traditional investors. On these grounds, Coinmotion has developed a Coinmotion Wealth service, especially aligned for entry-level clients looking for a way to make their first investments in bitcoin in a trusted and transparent manner. Coinmotion Wealth promises to deliver value to clients by executing all transactions with a full mandate or act as a consultative partner.

Coinmotion is operated by Prasos Ltd, a Finnish fintech company regulated by the Financial Supervisory Authority of Finland as an authorised Payment Institution and registered Virtual Asset Service Provider for virtual asset exchange and wallet provider (custody). Prasos has an extensive track record and reputation within the bitcoin & digital asset industry.

Coinmotion Coinmotion Wealth offers:

- Exchange platform that supports instant trading of bitcoin, litecoin, ethereum, ripple and stellar

- Secure cryptocurrency custodian service

- Exclusive insights and content

- Private crypto banking service with dedicated account manager

- OTC trading for larger sums with leading international counterparties

- Access to wide variety of Altcoins

- Local custodian bank for euros & fast and reliable payment options

If you are interested about the service, please contact our experts at [email protected].

Retail and institutional investments accumulating

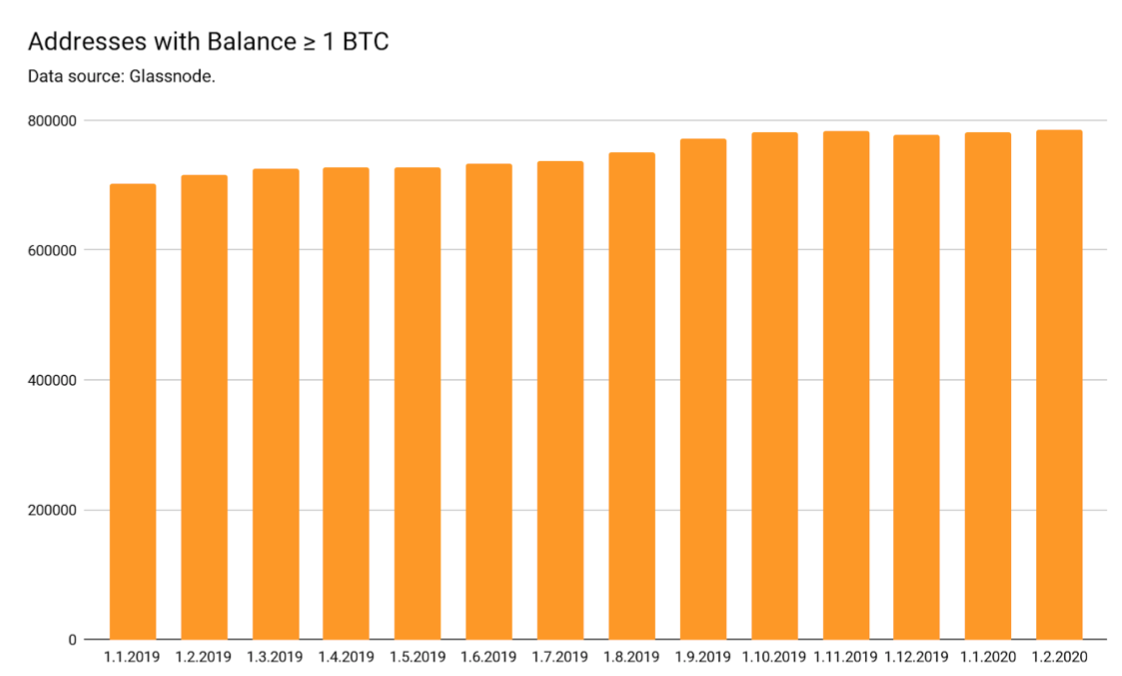

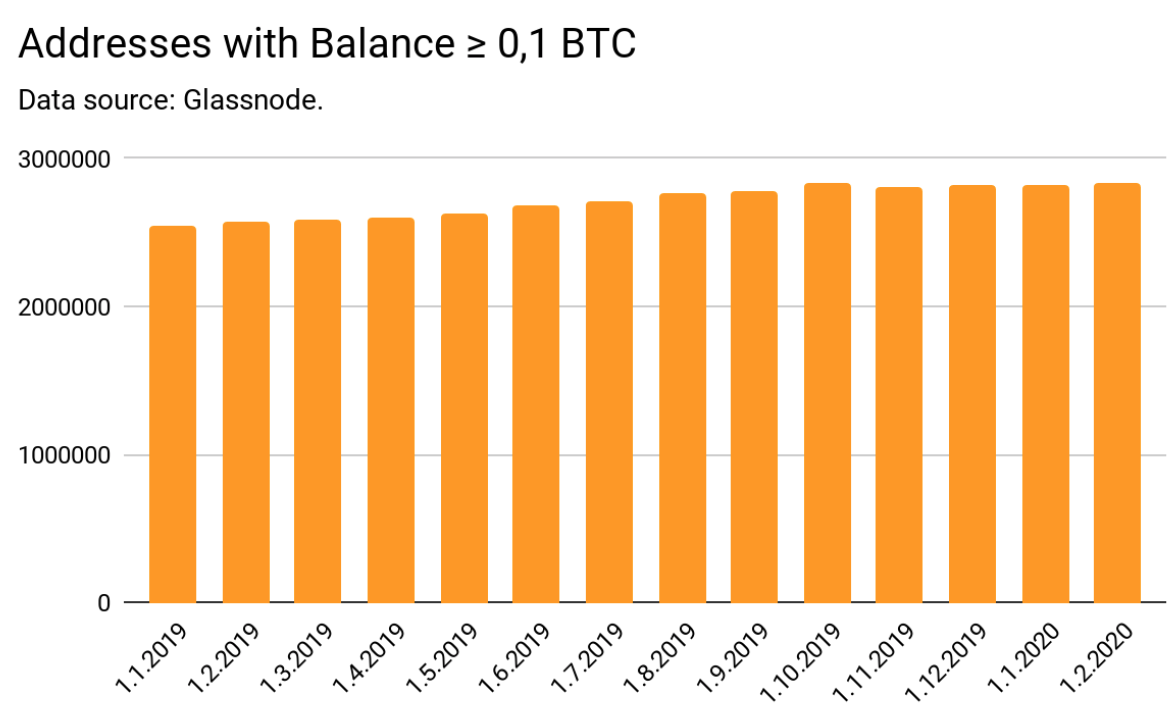

Recent data shows retail investor segment accumulating bitcoin, as the amount of addresses containing 1 and 0,1 bitcoin or more, has grown from 2019 into early 2020s.

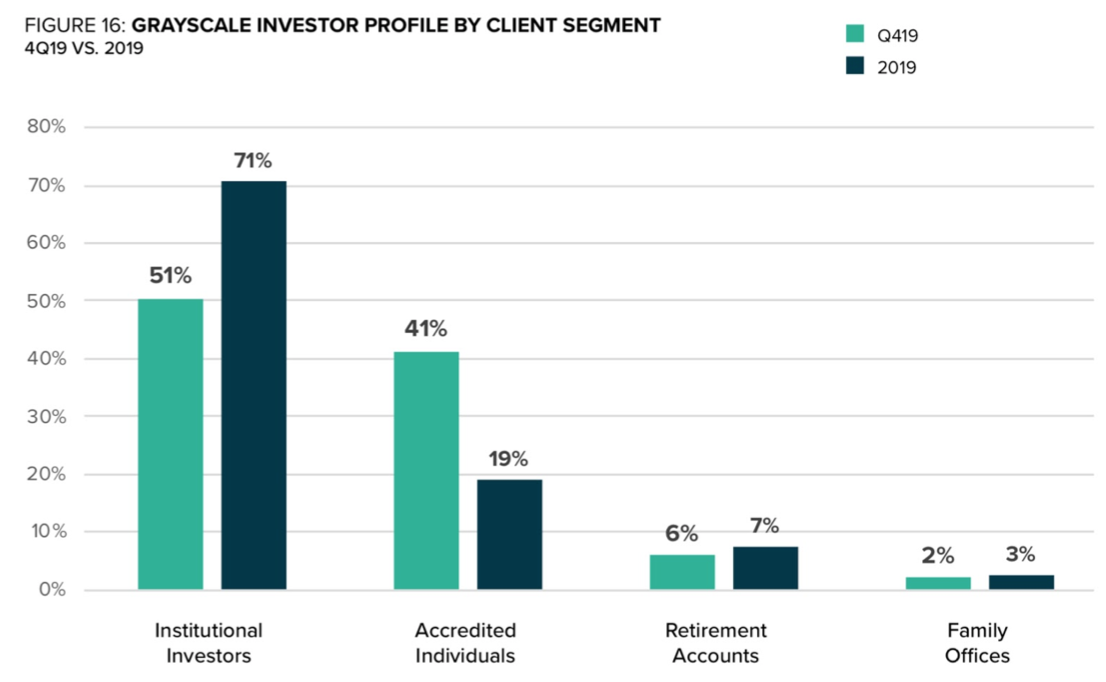

In addition to increasing interest in retail segment, institutional investors are entering the scene. According to data released by Grayscale Investments LLC, institutional investors were their largest client segment with 71% of investment capital inflows. These institutional investors were mainly hedge funds.

Cryptobanking & Diversifying portfolio with bitcoin

When looking at 20-year annualized returns by asset class, 60/40 strategy has been a relatively stable option, offering 5,2 percent return annually. S&P 500 fared slightly better, offering 5,6%. While these returns well outpace the traditional investor (1,9%), the real inflation-adjusted return for 60/40 is closer to 3,5% per annum. We’re also witnessing the longest bull market in history for stocks so the long-term perspective might be biased.

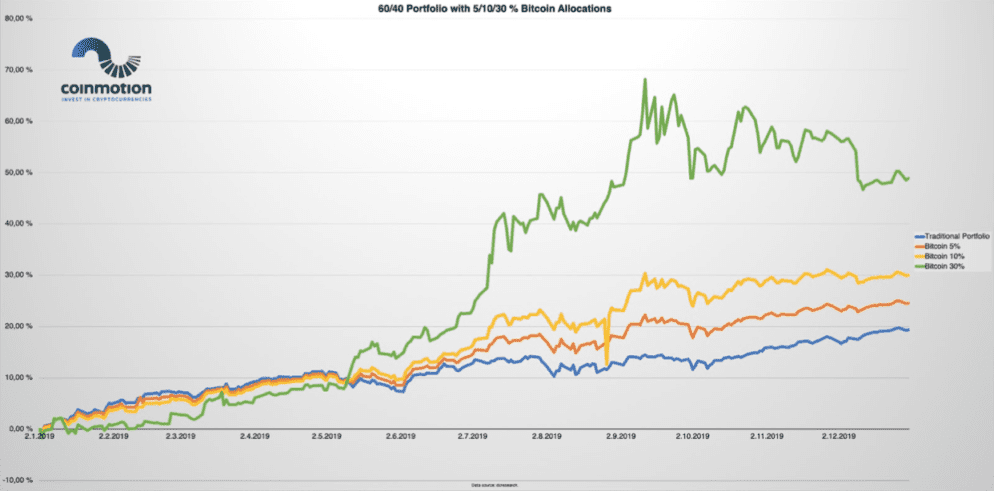

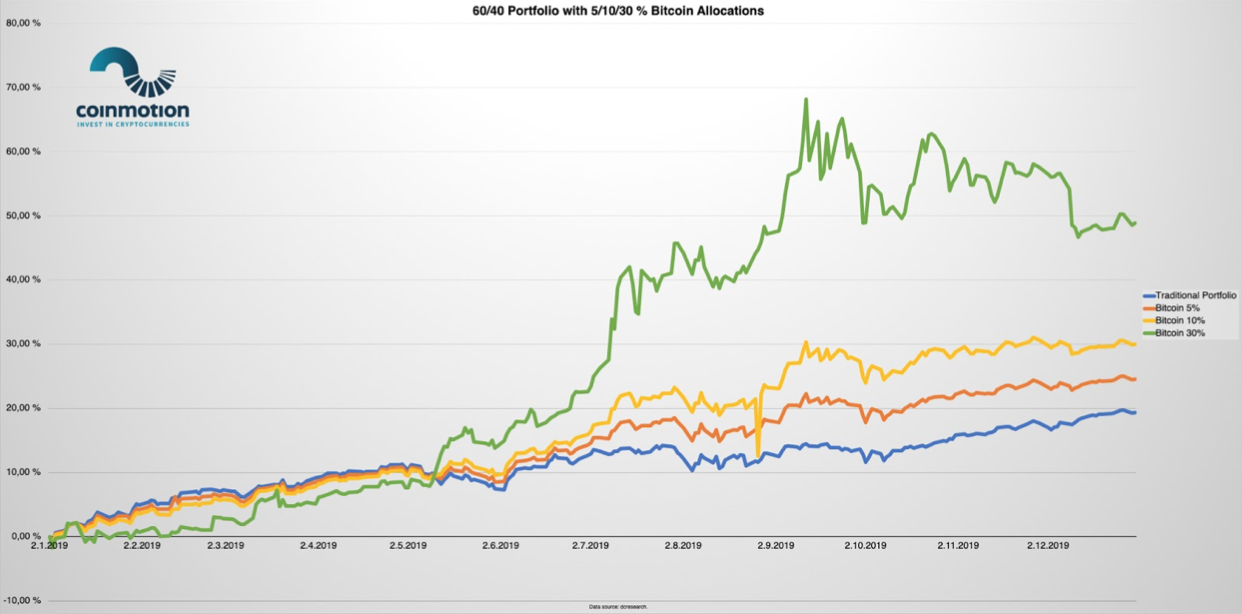

What would be the optimal allocation for bitcoin in traditional portfolio? Arca has done actual research on the question. By their estimation, optimal portfolio would call for an allocation of 14,21 percent bitcoin. By dcreseach’s financial model, even a small allocation significantly enhances portfolio performance. As the traditional portfolio offered 19,37% return, 5% bitcoin allocation lifted the performance to 24,58%. Respectively, 10% bitcoin allocation increased the return to 30,02% and 30% allocation up to 48,9%. Bitcoin offers substantial positive effects and diversification benefits for a portfolio.

Bitcoin as a hedge

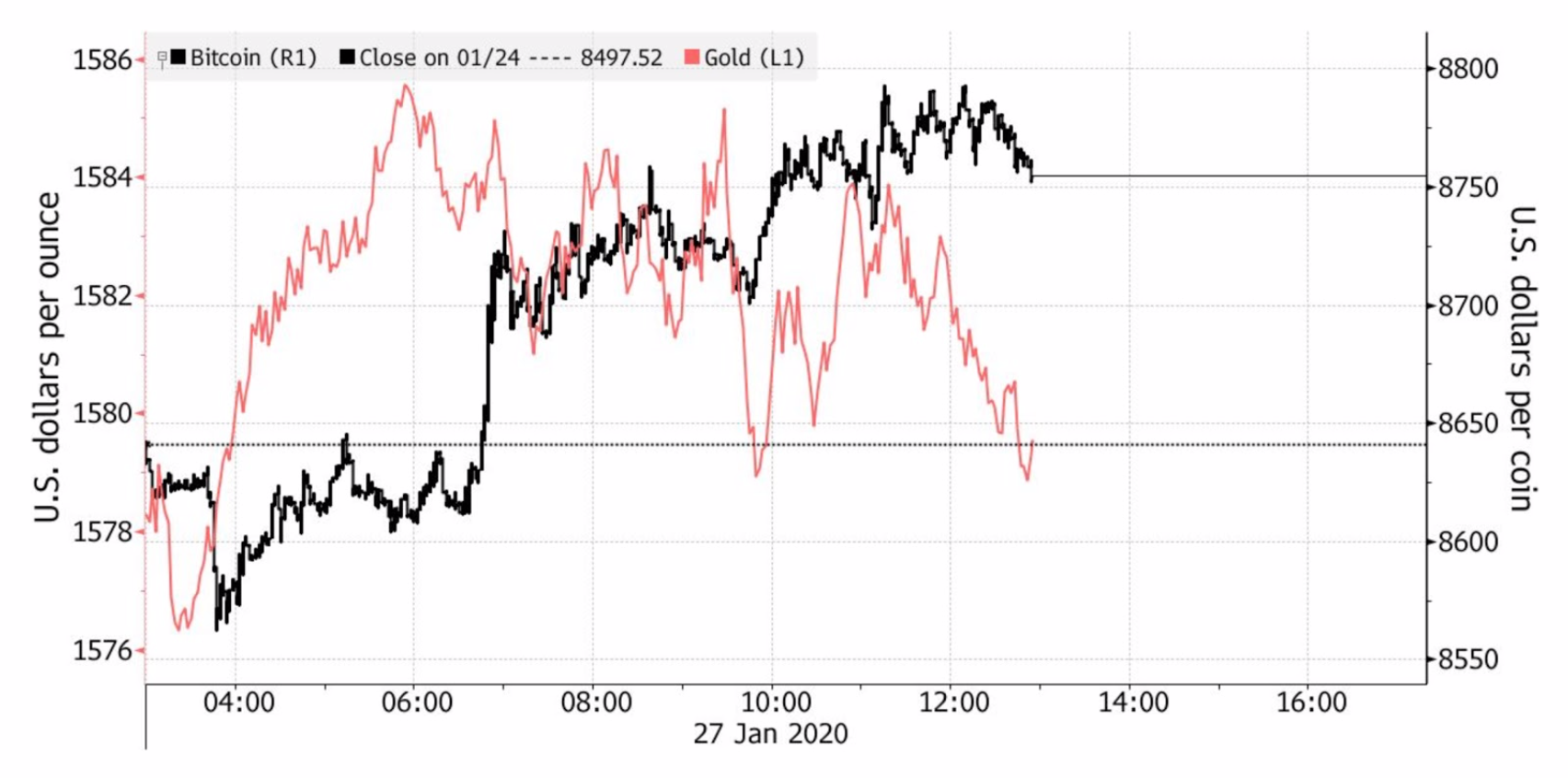

During early 2020, bitcoin’s correlation with gold has been increasing with escalating coronavirus fears.

On January 27th global stocks plunged on concerns over the impact of the deadly coronavirus, meanwhile the largest cryptocurrency bitcoin gained up to 5,8% while gold rose as much as 1,1%.

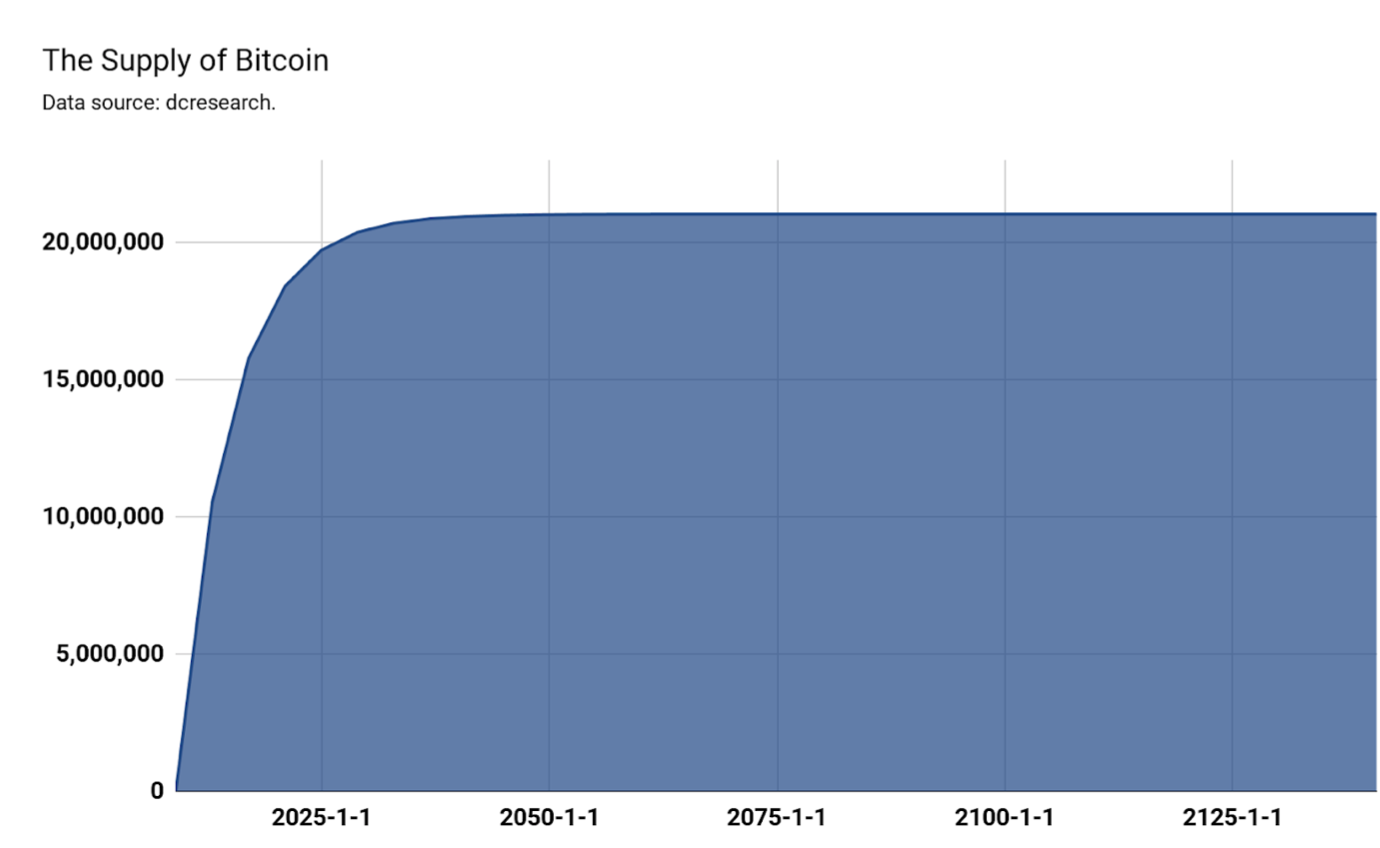

Bitcoin as a scarce digital gold

Bitcoin’s indelible features make it one of the scarcest assets available. By design, only 21 million bitcoins will ever exist. Bitcoin’s supply tightens over time, rendering the asset increasingly rare and potentially more expensive. By historical data, bitcoin halvings have been a trigger for bullish trends. The next halving event is expected to occur in May 2020.

Generational shift of wealth

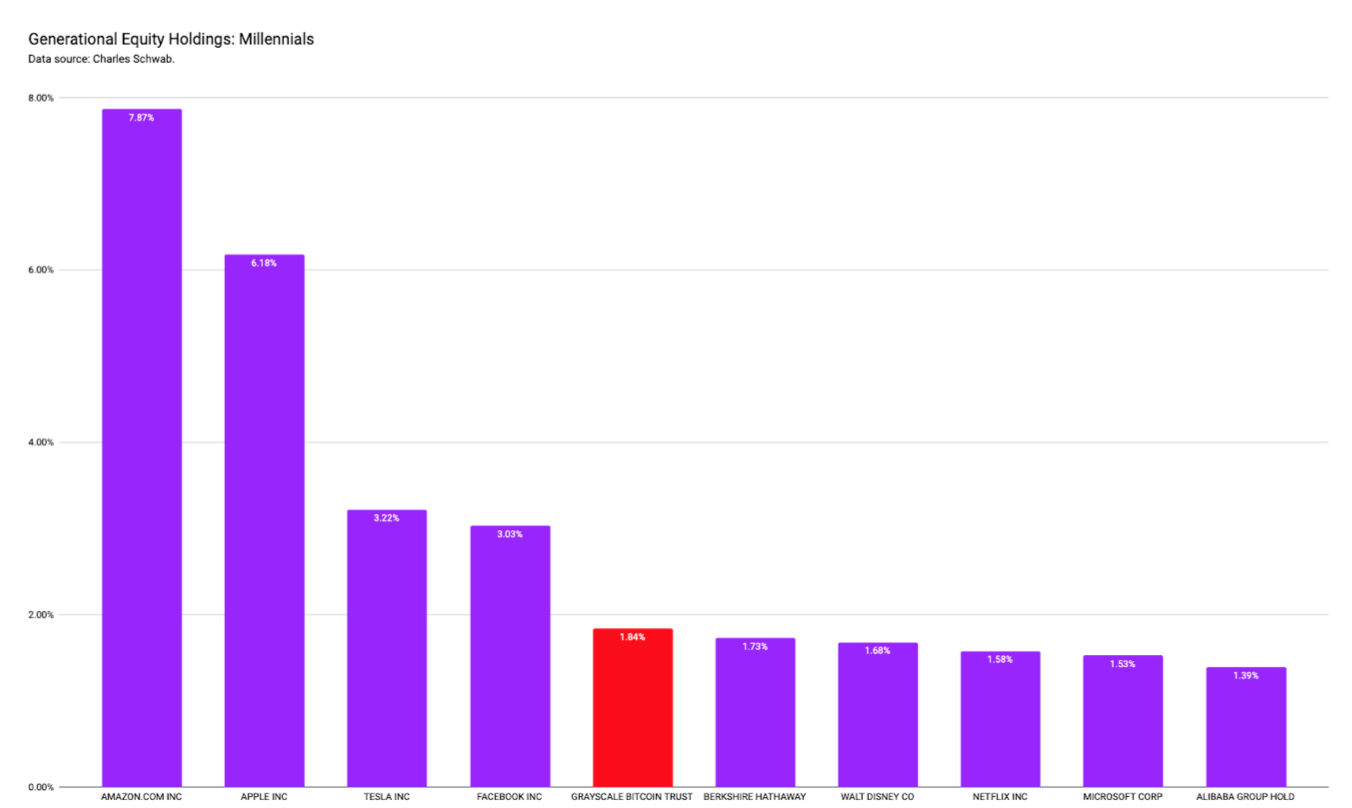

Millennials are about to inherit the wealth accumulated by previous generations. By a recent research conducted by Charles Schwab, millennials prefer bitcoin over many ordinary company stocks like Microsoft, Netflix, or Walt Disney.

The report shows that millennials (currently aged between 25-39) have a higher holding in Grayscale’s Bitcoin Trust (GBTC) investment product at 1,84% than Netflix stock at 1,58%. Schwab publishes this report every quarter and collects data from nearly 142 000 retirement plan participants who currently have balances between 5000 and 10 million USD in their Schwab Personal Choice Retirement Account.

Bitcoin as a non-correlated asset class

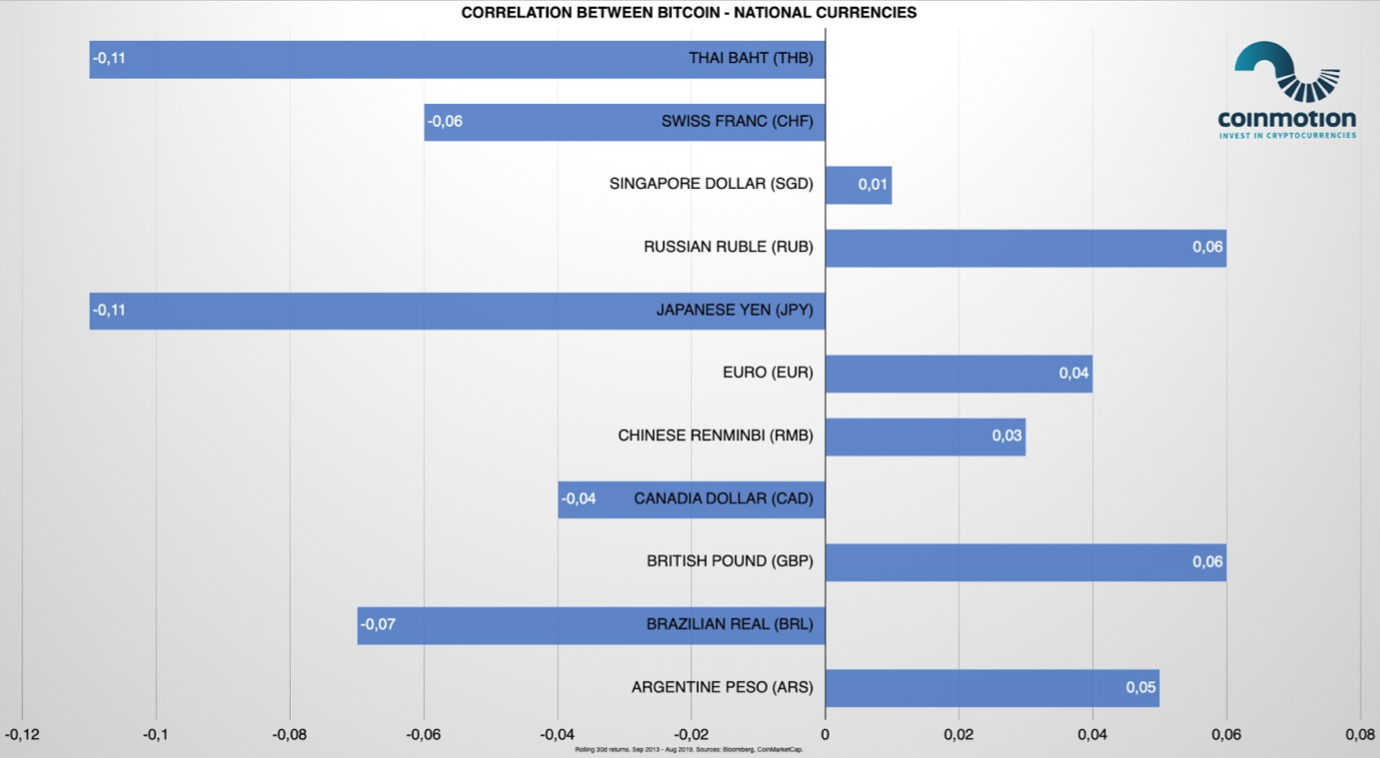

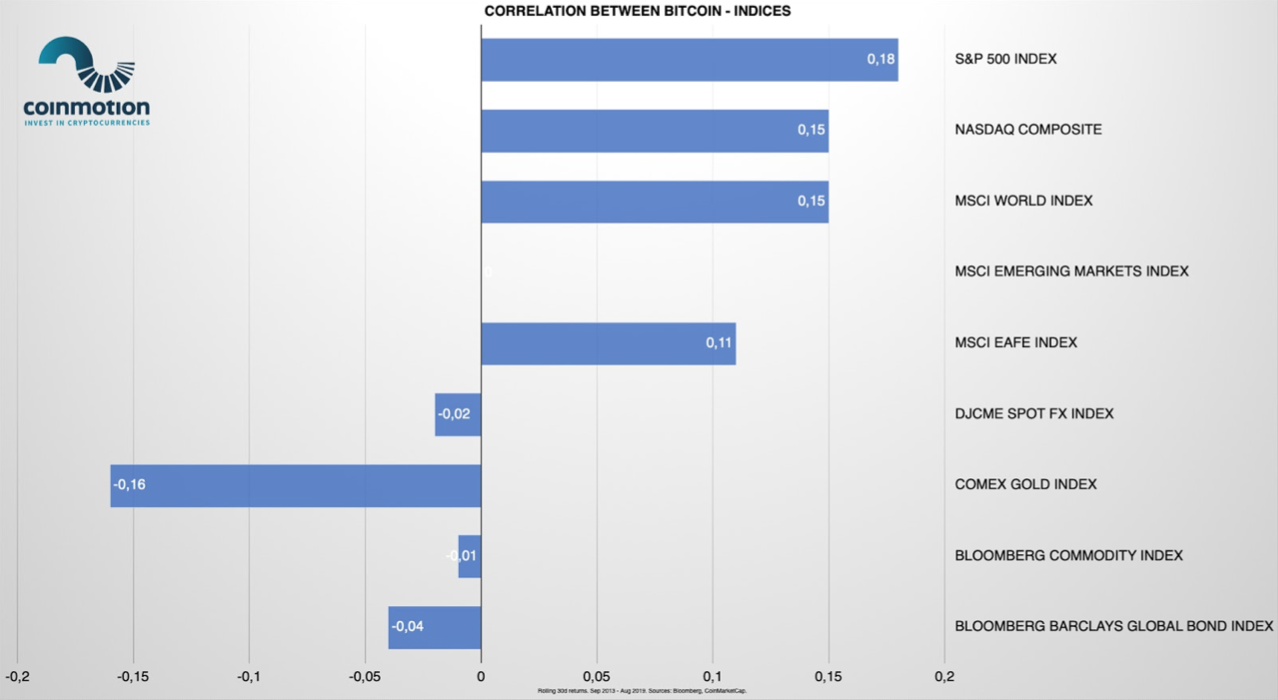

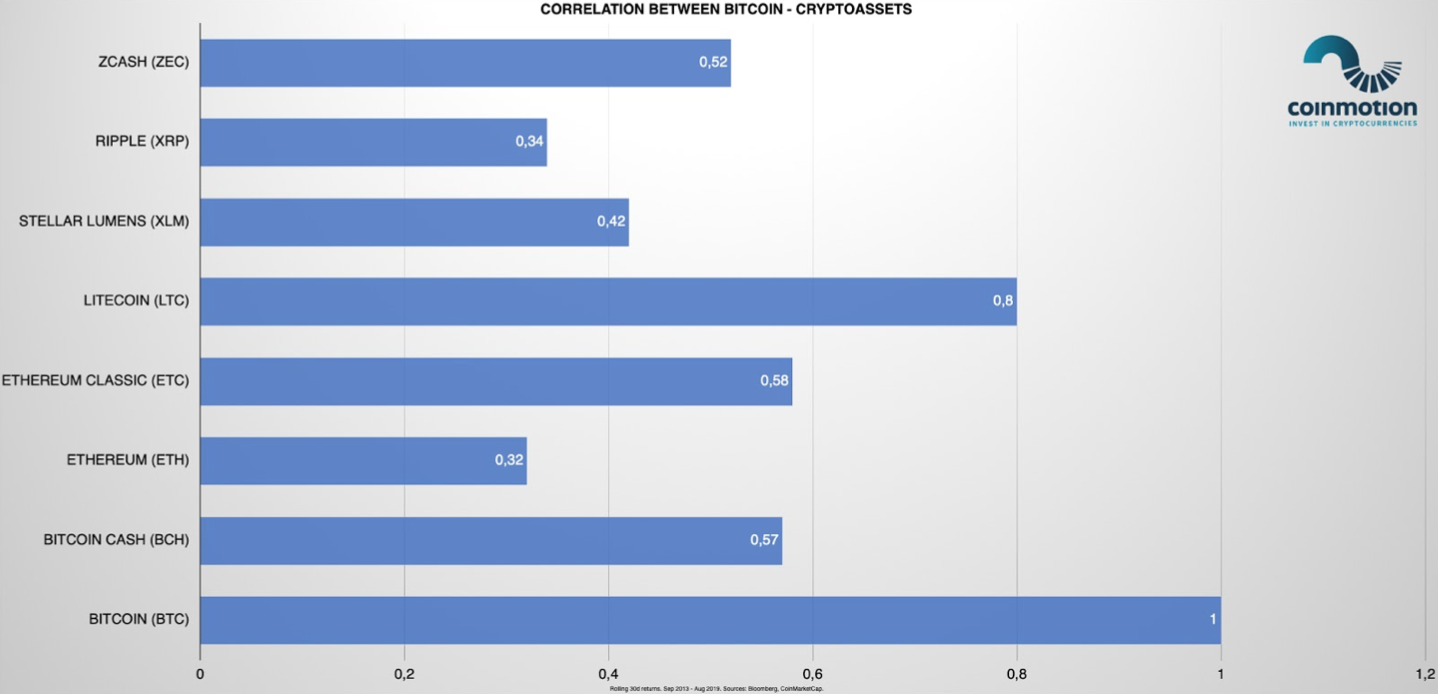

By historical data, bitcoin has been non-correlated with other asset classes, including national currencies, stock market, and indices.

Between 2013 and 2019 bitcoin’s correlation with S&P 500 Index was slightly positive 0,18. Bitcoin’s correlation with MSCI Emerging Markets Index was zero within the same time time frame. Between 2013 and 2019, bitcoin’s correlation with COMEX Gold Index was -0,16.

Bitcoin’s non-correlation makes it potential asset class for hedging systemic risk and diversifying your portfolio.

Want to know more about Coinmotion’s cryptobanking service? Contact us!