The technical analysis of week 43 explores recent market optimism and the surge of “meme coins.” Additionally, we dive into multiple relevant technical and fundamental indicators, including Coinbase Premium Index and FOMC.

Markets Signaling Rising Optimism

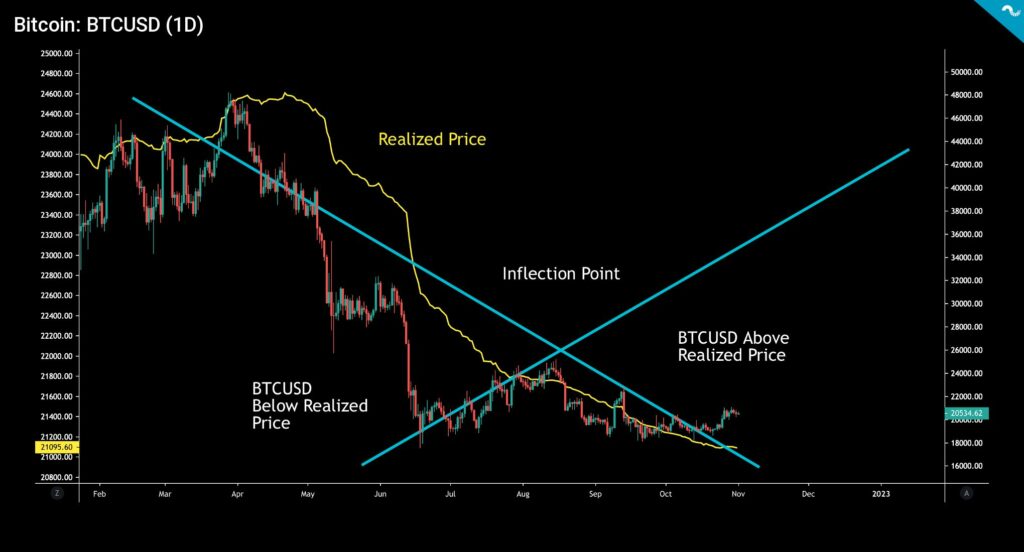

The digital asset market gained newly found momentum again, propelling the leading cryptocurrency, bitcoin, to a 5,8 percent ascent. According to CryptoQuant’s data, bitcoin’s spot price has been able to rise above the realized price (yellow) since early October. This is obviously a bullish sign. Bitcoin has also moved past the inflection point of ascending and descending trendlines (turquoise), forming a technical structure for a potential spot price climb.

Analyst and trader Tone Vays stated that his portfolio has been 100 percent in cash since August; however, he now has opted for a 20% bitcoin exposure. Macro analyst Alfonso Peccatiello estimates China to be exiting the zero covid policy soon. According to Peccatiello, the early stages of Chinese reopening would produce a non-inflationary growth boost. This scenario would be very supportive of risk assets.

Other analysts, like Luke Gromen, are expecting the central bank Fed to alter its course or pivot in 2023. Gromen sees the quantitative tightening to reduce as inflation numbers eventually go south. The pivot would mean a shift from quantitative tightening (QT) back to quantitative easing (QE). The epoch of QE and zero interest-rates was particularly fertile for high beta assets, like decentralized finance tokens.

The shifting market environment can be seen fueling the popularity of “meme cryptocurrencies” like dogecoin (DOGE). The leading meme coin has strengthened by almost 140 percent within seven days, and it momentarily eclipsed bitcoin and ether in terms of Kraken exchange trading volume. If we’re expecting an emerging alt season, surging meme coins are a promising indicator.

7-Day Price Performance

Bitcoin (BTC): 5,8%

Ethereum (ETH): 17,1%

Litecoin (LTC): 4,4%

Aave (AAVE): -0,2%

Chainlink (LINK): 11,9%

Uniswap (UNI): 18,1%

Stellar (XLM): -0,2%

XRP: 1,1%

Get started with Bitcoin Litecoin Ethereum AAVE USDC Stellar Ripple

Join Coinmotion and buy your first cryptocurrencies within minutes!

S&P 500 Index: 0,09%

Gold: -0,97%

– – – – – – – – – –

Bitcoin RSI: 59

As usual, bitcoin’s price performance was again eclipsed by ether, which climbed 17 percent in a week. Ether’s behavior has been in a continuing pattern since last week when ETH climbed 13%. The smaller cap DeFi tokens, like Uniswap and Chainlink, both ascended over 10%. The leading stock market index S&P 500, has remained almost flat within a week, while the traditional finance “safe haven” gold has weakened by almost one percent.

BB Squeeze Incoming Ahead of The FOMC

Bitcoin’s Bollinger band (BB) (turquoise) technical indicator is currently squeezing around the spot price, hinting toward an upcoming volatility spike. The last major BB squeeze was seen on October 25th, leading to bitcoin surging from the $19K level toward $21K. Wednesday’s FOMC meeting will again guide the larger market framework.

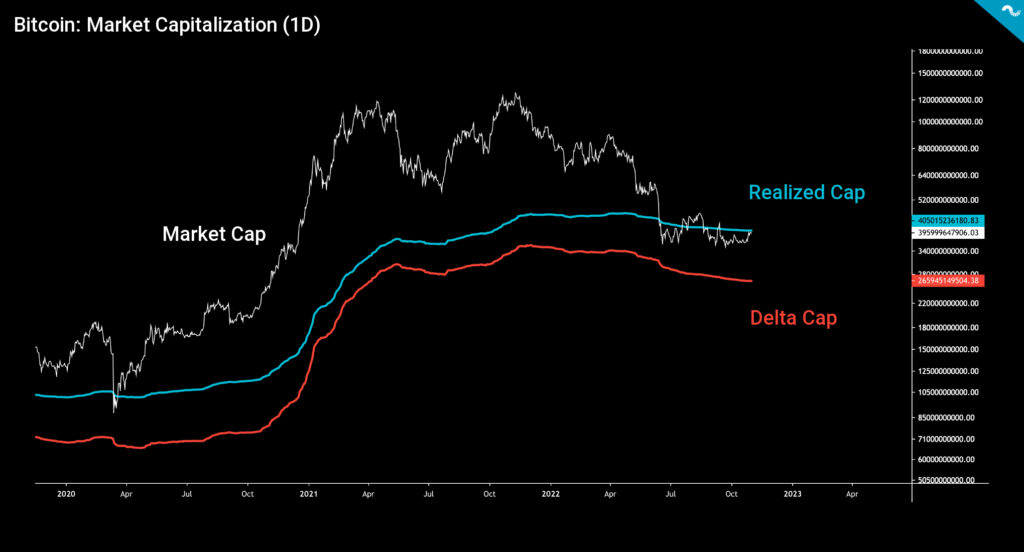

Bitcoin’s market capitalization (white) has almost reached its realized cap (blue), setting as scene for potential upward momentum. Bitcoin’s delta cap (red) acts as the worst-case scenario support line.

Meme Coins Surging

Late October and early November saw a sudden surge in so-called “meme cryptocurrencies,” including dogecoin (DOGE). Dogecoin has strengthened significantly over seven days, climbing almost 130 percent. As mentioned above, Kraken’s dogecoin trading volume has surpassed both bitcoin and ether, and DOGE’s current volume is approximately twice the volume of the latter. This raises a question, does someone know something we don’t know? Billionaire and technology entrepreneur Elon Musk has been playing with the dogecoin adoption concept for years, suggesting adding the cryptocurrency as a Twitter subscription payment option.

Maybe even an option to pay in Doge?

— Elon Musk (@elonmusk) April 10, 2022

There’s ongoing speculation that Musk will actually add dogecoin as the de facto currency of Twitter. Additionally, investors are estimating an upcoming mean reversion and creating short-squeeze liquidation opportunities. Only one thing is certain, the market will remain highly speculative.

“The markets can remain irrational longer than you can remain solvent.”

– John Maynard Keynes

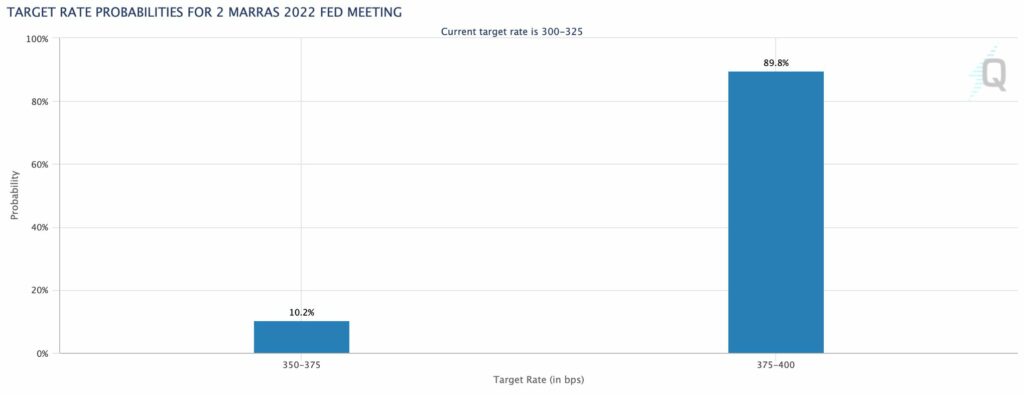

All Eyes on Wednesday FOMC

The central bank Fed is about to have a meeting again on Wednesday in the form of an anticipated FOMC. Investors are now betting that the rate hike will be 50 or 75 basis points in order to further control inflation. According to CME, 89,8 percent of investors are forecasting a 75 basis point increase, while only 10,2% expect a 50 bps hike to take place. Analyst and trader Tone Vays recently commented the probability is around 50-50 as Vays is skeptical towards CME’s data. Nevertheless, here are some scenarios for the FOMC:

25 BPS: Priced in. Exceptionally positive market reaction

50 BPS: Priced in. Positive market reaction

75 BPS: 80% priced in. Sideways market

100 BPS: 20% priced in. Negative market reaction

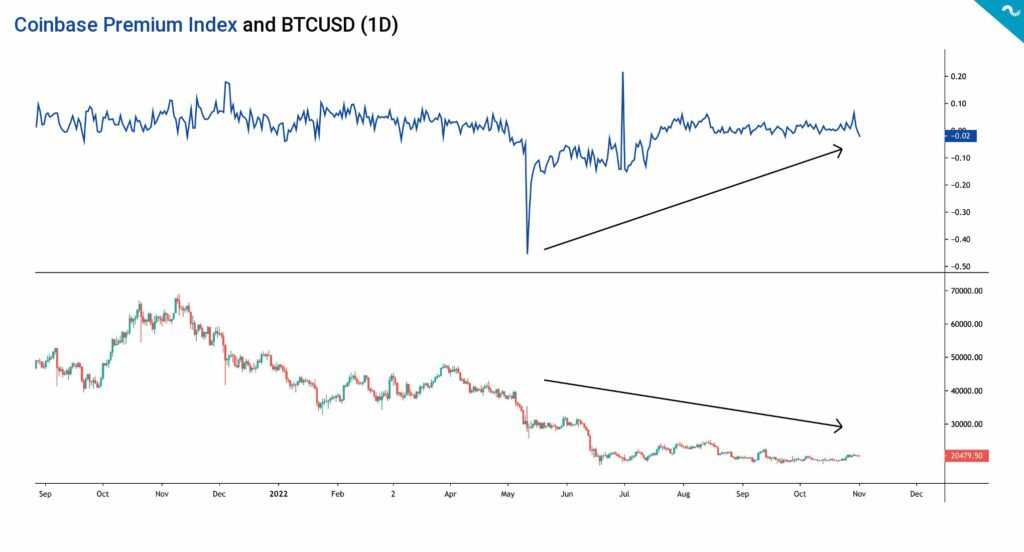

Coinbase Premium Index Indicating Growing Interest in US

Coinbase was one of the first publicly traded crypto exchanges in the world (ticker: COIN), making it probably the most legally transparent exchange of all. Coinbase is known to have a set of characteristics that attract American institutions and high-net-worth individuals (HNWI). The embedded chart uses Coinbase’s Premium Index that measures the percentage difference between the bitcoin price on Coinbase (USD pair) and on Binance (USDT pair).

Recent data shows how the Coinbase Premium Index has been growing since May’s institutional selling pressure, correlating inversely with bitcoin’s spot price. The main interest is currently coming from US-based investors, even though the market remains highly uncertain. At the same time, Asian investors still remain relatively negative, following China’s previously implemented cryptocurrency ban, zero covid policies, and diminishing growth. The next year will show if North America continues to gain ground as bitcoin’s important source of buying pressure. Coinbase will be one of the first exchanges to fill the growing appetite.

What Are We Following Right Now?

San Francisco-based fund manager Bitwise starts to offer active trading strategies designed to capitalize on market inefficiencies across the crypto market to cater to institutional clients. The firm said it had hired Jeffrey Park, formerly of Corbin Capital and Morgan Stanley (MS), to head the new active strategy trading team.

1/ Today, I'm excited to unveil something we've been working on at @BitwiseInvest for over a year —

— Hunter Horsley (@HHorsley) November 1, 2022

Bitwise is expanding into active.https://t.co/u3Tbm4asmx

We've had a front row seat in crypto for over 5 years. The future is bright & opportunities are expanding.

A thread—

Nathaniel Whittemore’s wrap-up on the correlation between bitcoin and the stock market.

Digital asset analysts and “influencers” should be careful with their market comments after the EU’s MiCA comes into effect. According to the new MiCA, commenting on cryptoassets in media without disclosure can be considered market manipulation.

Crypto influencers beware: Commenting on crypto assets in (social) media without disclosure and profiting from the effects of that will be considered market manipulation in the EU once MiCA is in force.@zachxbt pic.twitter.com/BflVXPazjS

— Patrick Hansen (@paddi_hansen) November 1, 2022

Stay in the loop of the latest crypto events

- What does Elon Musk buying Twitter mean for cryptocurrencies?

- Uniswap is preparing for the NFT and Web3 markets

- Germany picked as the world’s most crypto-friendly economy & Nuri went bankrupt

The views, thoughts, and opinions expressed in the text belong to the author and not necessarily to the author’s employer, organization, committee, or other group or individual.

Get started with Bitcoin Litecoin Ethereum AAVE USDC Stellar Ripple

Join Coinmotion and buy your first cryptocurrencies within minutes!