The technical analysis of week 48 ponders whether bitcoin’s market base has already been reached? In addition, we go through numerous technical indicators, such as chop zone, realized price, and relative strength index. At the same time, we assess the probability of a Fed’s pivot move and its consequences for high-beta asset classes.

Cautiously Recovering Markets

The digital asset market has started to show signs of recovery after being shaken by the FTX crisis. Bitcoin, the leading cryptocurrency by market value, is up nearly five percent in a week, showing clear short-term growth momentum. The positive trend has led analysts, such as Charles Edwards (Capriole Investments), to estimate that the market bottom is close. Analyst and trader Tone Vays is still sticking to his 20 percent allocation.

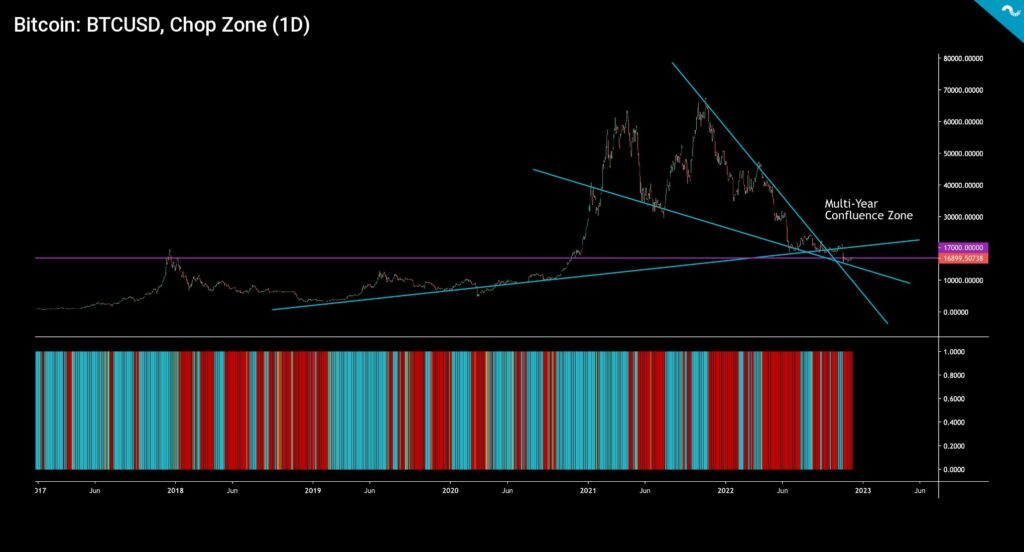

Bitcoin has found new vertical support from its multi-year level of $17 000 (purple). At the same time, $17K serves as the intersection of three different trend lines (turquoise), which are decisive for the future direction of bitcoin. Bitcoin’s chop zone indicator (below in the chart) is reminiscent of 2019 when the spot price started to recover after a long bear market.

The spot price of Bitcoin has fallen below the realized price (turquoise) since mid-June. If we do not consider minor local increases above the realized price, the spot has now been oversold for a total of 174 days. From the point of view of the realized price, the current bear cycle has already exceeded the 2018-2019 bear market in length, where the spot price fell below the realized price for 133 days. The realized price acts as a support level for the spot price in a neutral scenario, but in the current setting, the realized price has become a resistance level.

Cryptocurrencies have projected a positive price trend for two weeks. The leading cryptocurrency, bitcoin, has strengthened by 5,9 percent in a two-week window, while the ether token has risen by almost 13 percent. Litecoin, known as “bitcoin’s test network,” has reached an upward angle of more than 34 percent in two weeks, which can be considered a remarkable achievement. Higher-beta tokens like Uniswap have seen a significant boost, with the decentralized exchange Uniswap’s native token up nearly 20 percent in two weeks. The stock market index S&P 500 and gold have both continued their recovery from last week.

7-Day Price Performance

Bitcoin (BTC): 4,9%

Ethereum (ETH): 7,9%

Litecoin (LTC): 10,8%

Aave (AAVE): 6,9%

Chainlink (LINK): 8,4%

Uniswap (UNI): 17,4%

Stellar (XLM): -2,2%

XRP: -1,3%

Get started with Bitcoin Litecoin Ethereum AAVE USDC Stellar Ripple

Join Coinmotion and buy your first cryptocurrencies within minutes!

S&P 500 -index: 1,1%

Gold: 2,7%

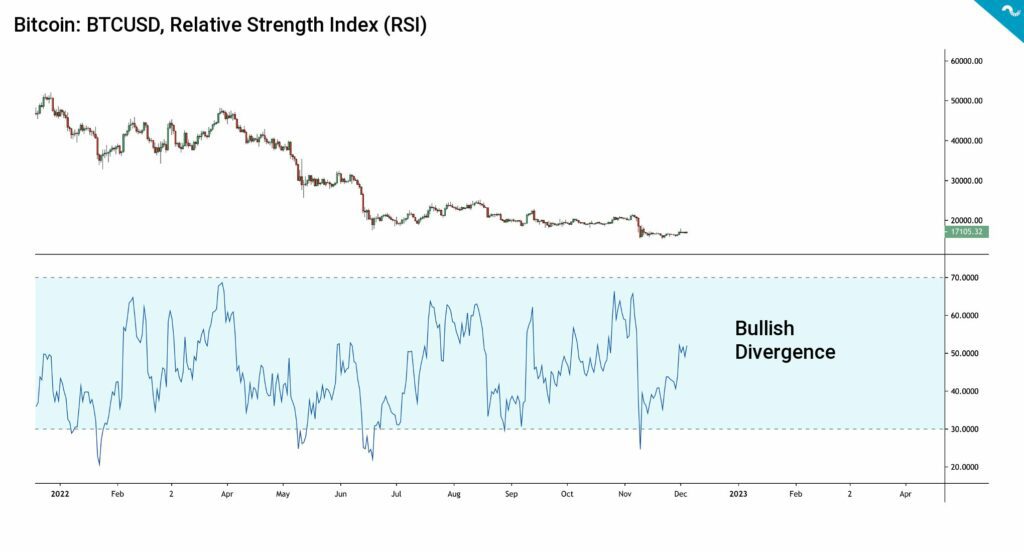

On a technical level, the spot price of bitcoin and the relative strength index RSI (blue) continue to form a bullish divergence setup. The bullish divergence allows a technical rise toward the $20K level of the realized price.

The Return of The Liquidity?

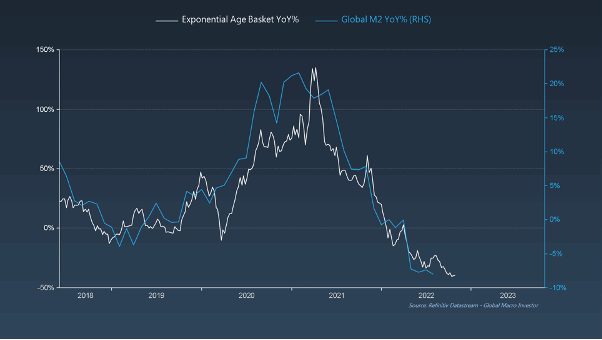

In his latest newsletter, Raoul Pal discussed the state of the macro market, where he sees moderate optimism. In correlation with Luke Gromen’s market views, Raoul Pal estimates that the Fed is turning its hawkish monetary policy towards a dovish one. Quantitative tightening (QT) would therefore be replaced by quantitative easing (QE). Pal sees the spot price of bitcoin as highly correlated with the M2 monetary aggregate (i.e., money supply). The cyclical price development of Bitcoin has risen as the amount of money has expanded and fallen as the supply has become scarcer (chart below). Raoul Pal also reminds us that Paul Tudor Jones emphasizes the performance of high beta assets in a QE scenario.

Pal also sees the M2 supply strongly correlated with high-beta growth tech stocks (chart below).

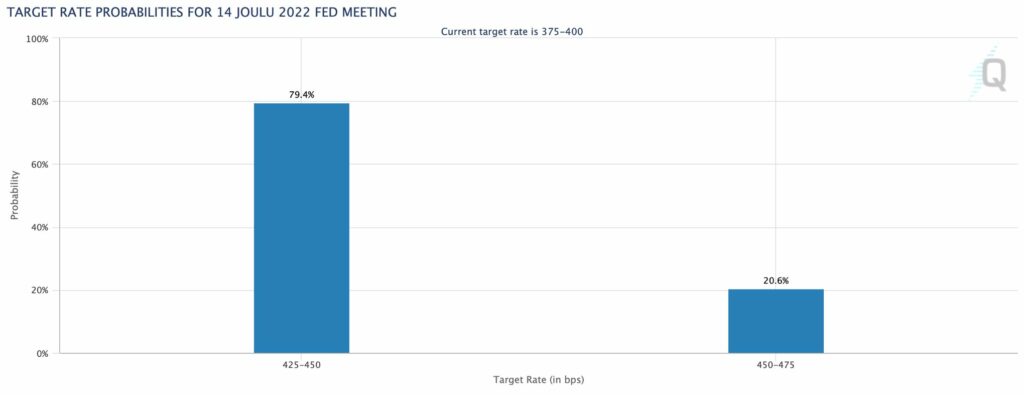

The Fed’s next FOMC meeting happens nine days away, next week. After Powell’s dovish rhetoric last week, CME sees the possibility of a 50 basis point rate hike as 79,4 percent. At the same time, the probability of a 75 basis point increase is estimated to be only 20.6%.

A 25 basis point interest rate hike scenario would be unlikely, but it would generate an exceptionally positive market reaction. The market will also react positively to the expected 50 basis points scenario. A rate hike of 75 basis points seems unlikely, and its impact on the market would be negative.

25 BPS: Priced in. Exceptionally positive reaction

50 BPS: Priced in. Positive reaction

75 BPS: 50% priced in. Negative reaction

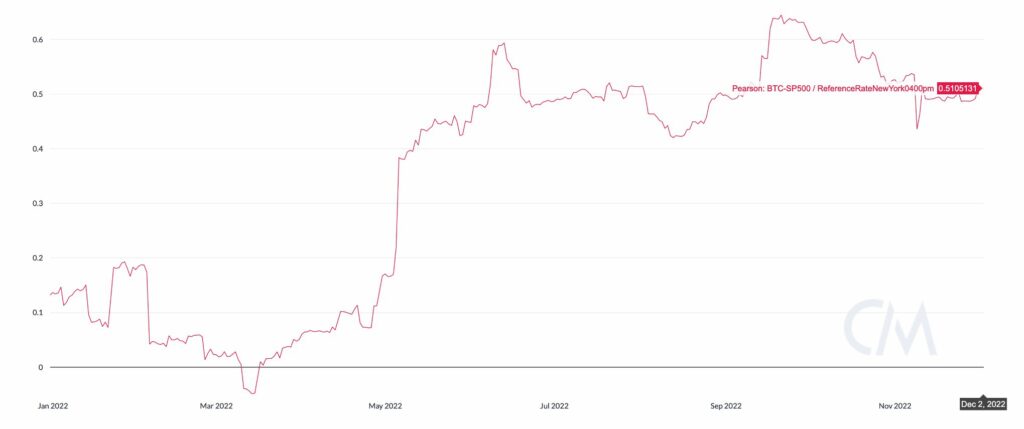

Bitcoin and Stock Market Correlation in Slight Decline

Bitcoin was long considered a low-correlation asset class with a weak correlation to the S&P 500 index. Bitcoin’s low correlation with other assets was a reality until it became mainstream, and the “Saylor Cycle” of 2020 saw a significant increase in positive correlation. While as recently as 2017, the correlation between bitcoin and the leading stock index was close to zero, the 90-day Pearson correlation rose to 0,64 in the fall of this year, which represents the highest correlation ever.

There has been speculation about a possible decoupling phenomenon, which would mean bitcoin returning closer to the roots of zero correlation. Signs of a possible breakout were seen in November-December when the correlation turned down to its current level of 0,51. The fundamental question is whether we want bitcoin to break away from the correlation of the stock market at all. Several big-name analysts are now waiting for the Fed’s pivot move, which would undoubtedly bring new momentum to the stock market. As the stock market continues to strengthen, the correlation with bitcoin will likely remain strong, although a sovereign breakout of high-beta assets is always a possible scenario.

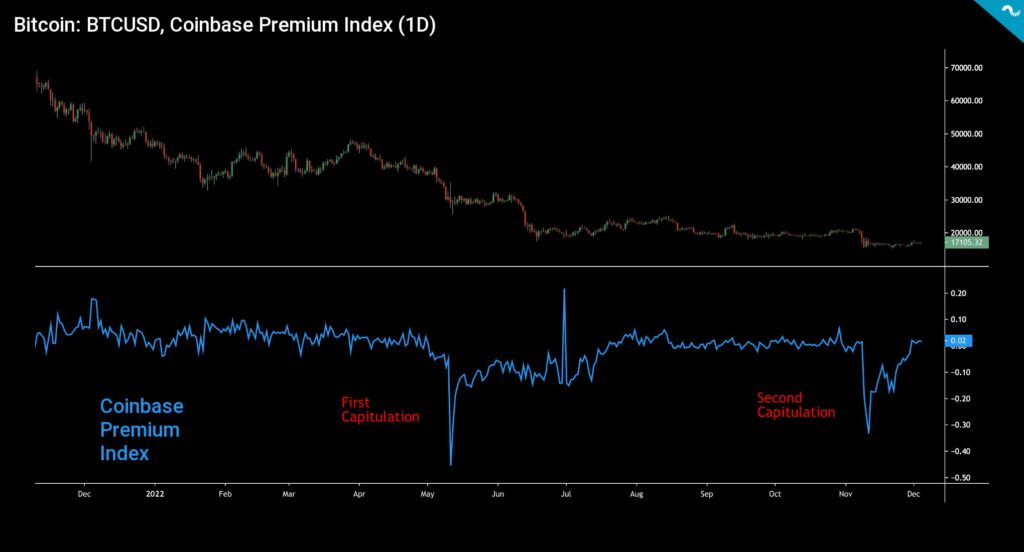

The Premium Index and Two Capitulations

Coinbase was one of the first publicly listed crypto exchanges in the world (symbol: COIN), and the company is also one of the most transparent operators in the industry. These features attract American institutions and high net worth (HNWI) individuals to the platform. The embedded chart uses Coinbase’s premium index, which measures the percentage difference between the bitcoin price of Coinbase (USD pair) and Binance (USDT pair).

The data for 2022 shows how the premium index moved to an upward angle after the institutional selling pressure in May, and the index has been inversely correlated with the spot price of bitcoin. Most institutional interest is currently coming from US investors, although the market remains uncertain. Meanwhile, Asian investors remain relatively negative due to China’s previously implemented cryptocurrency ban, zero-covid policy, and slowing local growth.

In the broader picture, two clear moments of capitulation can be seen in Coinbase’s premium index. The first of these took place in May (first capitulation) and the second in November (second capitulation). By December, we have thus seen two capitulation phases, which together indicate that the final market bottom is close.

What Are We Following Right Now?

The European Central Bank has published a blog article in which ECB experts are very suspicious of bitcoin as a means of payment and investment instrument. Bitcoin is a unique asset class, and as an antifragile system, it has survived a huge number of attacks. Does the ECB’s statement say more about the weakness of the central bank than about Bitcoin?

The apparent stabilisation of bitcoin’s value is likely to be an artificially induced last gasp before the crypto-asset embarks on a road to irrelevance. #TheECBblog looks at where bitcoin stands amid widespread volatility in the crypto markets.

— European Central Bank (@ecb) November 30, 2022

Read more https://t.co/Hk1LuYX2de pic.twitter.com/I3Uidks8Xo

Is Bitcoin an undervalued asset class? Sandi Bitenci’s and David Lin’s detailed conversation.

Bitcoin OG Erik Voorhees, known from the ShapeShift exchange, reviews the talk given by the founder of FTX at the DealBook event.

A classic rule of thumb for traders cash is king.

Stay in the loop of the latest crypto events

- Brazil legalizing cryptocurrencies & Telegram is planning its own cryptocurrency exchange

- Technical Analysis: Oversold Bitcoin

- Crypto lender Genesis in trouble & Bitcoin still more valuable than many large corporations

- Web3 in Slush & El Salvador continues BTC purchases

The views, thoughts, and opinions expressed in the text belong to the author and not necessarily to the author’s employer, organization, committee, or other group or individual.

Get started with Bitcoin Litecoin Ethereum AAVE USDC Stellar Ripple

Join Coinmotion and buy your first cryptocurrencies within minutes!