Have you ever dreamed about earning with your assets instead of passive holding? The crypto project Aave is a decentralized protocol that offers an active alternative to passive token holding. Aave is definitely a name to know for those who want to learn how to invest in decentralized finance and how to earn passive income with crypto.

The name Aave is rooted in the Finnish word “ghost.” The name ghost illustrates the protocol’s goal to be transparent and open infrastructure in the DeFi space. Aave is an Ethereum-based DeFi platform that started its journey as ETHLend (LEND). Aave’s core value proposition is to enable users to lend, borrow, and profit from stable or variable interest rates in a decentralized space. The AAVE crypto token launched in October 2020, and investors had the option to migrate their older LEND tokens to AAVE 1:100.

Aave in a nutshell

Aave’s history dates back to November 2017, when Stani Kulechov launched ETHLend with his Helsinki-based team. Since then, ETHLend has evolved into Aave, incrementally upgraded with more and more features.

- Aave is the most well-known Finnish crypto project.

- Aave is the world’s largest decentralized crypto lending platform.

- Users can apply for loans using cryptocurrencies as collateral.

- Aave operates fully automated through smart contracts.

- Aave’s own cryptocurrency is the AAVE token, which can be used to vote or earn interest.

A Decentralized Money Market Protocol

How does Aave work, then? Users deposit funds they intend to lend, thus providing liquidity to the market. The funds are gathered into a pool. The users who want to borrow draw from the pools. Thus, those users can now buy, sell, or transfer the tokens they drew.

Aave issues two types of tokens for these ecosystem operations. The first type is aTokens, issued to lenders so they can collect interest on deposits. The other type is AAVE tokens, the native tokens of Aave.

The AAVE cryptocurrency offers holders several advantages. AAVE token holders have the right to vote on upcoming protocol changes. Holders also act as “governors” for decentralized governance. Furthermore, AAVE borrowers don’t have to pay a fee if they take out token-denominated loans.

AAVE users, if they pay a fee in AAVE, can examine loans before the public has access to them. Borrowers who post AAVE as collateral can also borrow slightly more. Hence, the Aave ecosystem uses sophisticated game theory-inspired structures to incentivize different parties.

Get started with Bitcoin Litecoin Ethereum AAVE USDC Stellar Ripple

Join Coinmotion and buy your first cryptocurrencies within minutes!

Decentralized Governance & Flash Loans

AAVE Crypto: Governance

AAVE is the native token of the Aave protocol. Additionally, AAVE acts as a governance token that allows the community to decide collectively what the direction of the protocol is going to be.

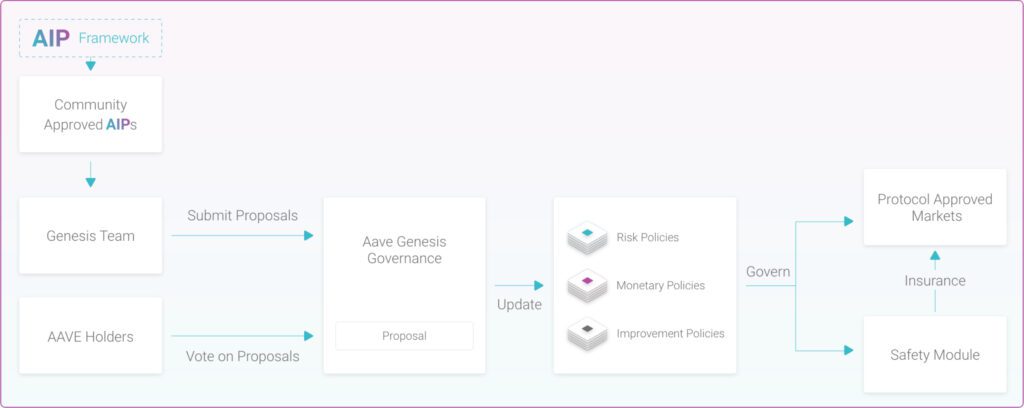

The Aave protocol aligns with the decentralized governance model. This model allows the protocol users to vote on future changes and the upcoming direction of the protocol.

“The goal of the Aave Tokenomics, through its incentives and policies, is to create a Shelling Point where the protocol’s growth, sustainability, and safety take priority over individual stakeholder objectives.”

Aave protocol governance features a decision-making process for the different risk parameter changes, such as improvements and incentives that constitute the policies. Future decisions governing the protocol will be enacted through protocol governance. The purpose of the AAVE token is, above all, to grant token holders the capability to vote on proposals. The token allows its holders to act as protocol governors.

In addition, AAVE holders can stake their tokens and earn passive income. Staking essentially means participating in transaction validation on a proof-of-stake (PoS) blockchain. Any user who has a minimum required balance of, in this case, AAVE can join a staking pool. Then, the users validate transactions and earn staking rewards.

Aave Crypto: Flash Loans

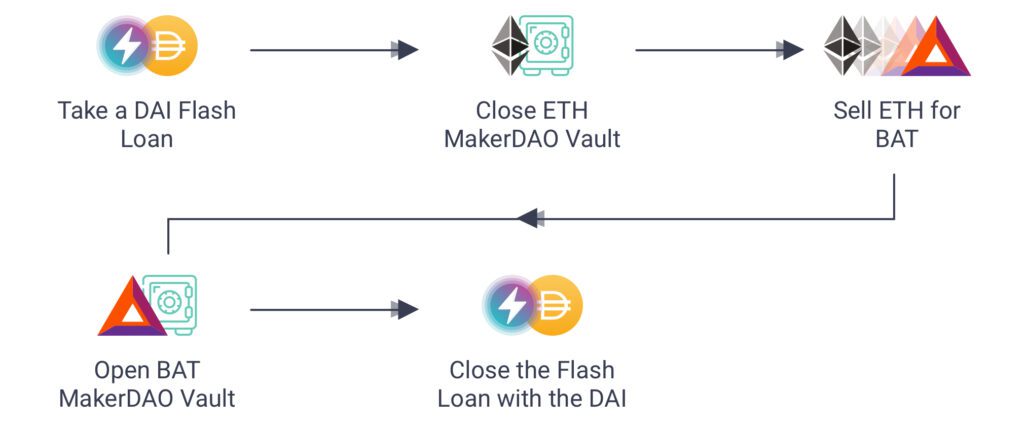

One of the Aave protocol’s core features is flash loans. This feature allows certain smart contracts to be instantly issued and settled. Flash loans don’t require any upfront collateral, and the system implements them immediately.

Flash loans finalize only when the network accepts a new bundle of transactions or blocks. This feature is inherent to all blockchain applications. On the Bitcoin network, adding a new block takes approximately 10 minutes. Using Bitcoin as a benchmark, the Aave network and flash loans are fast, settling within 13 seconds by Ethereum’s structure limits.

Flash loans work by a borrower requesting funds from Aave. The borrower must pay back the funds by flash loan contracts, combined with a 0,09 percent fee, within the same block. Should the borrower fail to meet his obligations, the entire transaction is canceled. This structure allows a zero-risk environment for borrowers and Aave itself.

What Makes Aave Important?

To understand why Aave is crucial for the crypto market, one must first understand crypto lending.

Just as traditional bank customers earn interest on their savings (albeit a very small amount), crypto investors can also deposit their digital assets into lending services and earn additional cryptocurrencies against them.

Banks offer negligible interest on savings accounts, but crypto lenders might pay up to a 20% annual return. However, the interest rate varies depending on the cryptocurrency and the service.

Thanks to attractive returns and the DeFi boom, crypto lending has gained immense popularity in recent years. DeFi and crypto lending represent a vision of the financial sector where lenders and borrowers can make agreements without intermediaries – banks.

The value of the DeFi market reached a record $180 billion in December 2021. Just two years earlier, the value was well below a billion. The market thus exploded in growth over two years. At the same time, Aave emerged as one of the largest DeFi services.

AAVE tokens are now available for buying, selling, and storing on Coinmotion.com.

CeFi vs DeFi

Both centralized lending services, such as Celsius and BlockFi, and decentralized services, like Aave and Compound, rapidly gained popularity.

Centralized services offered better returns, so investors quickly forgot why DeFi was originally invented and rushed to seek a 20% annual return on stablecoins. Now, doesn’t 20% interest per year sound too good to be true? You’re absolutely right.

Centralized services were temporarily able to offer attractive returns due to massive leverage. These services invested customer funds in high-risk assets during the bull market, believing the rise would continue.

Then reality struck in 2022. First, Terra Luna collapsed, dragging a large lending protocol, Anchor, with it. Anchor had offered a 19.5% return on Terra’s stablecoin. The crash spooked the markets completely, causing massive panic.

Dominoes began to fall one by one, and many crypto lenders, including Celsius and BlockFi, went bankrupt in the turmoil. They had invested customer funds with massive leverage, and Luna’s collapse dragged the entire market downhill.

Centralized services failed — DeFi didn’t

The collapse of centralized services also affected the DeFi market, but the services continued to operate as usual. That’s why DeFi and Aave are essential: decentralized services can’t misuse customer funds recklessly. They only fail if the smart contract code is flawed or the service is hacked.

Meanwhile, as Celsius and partners filed for bankruptcy, Aave took the market’s top spot as the largest DeFi lending service. Aave has operated flawlessly and securely because it’s decentralized. Users don’t have to trust the goodwill of the management; they only trust the code.

At its core, the Aave protocol is about freeing up liquidity for DeFi use. Aave allows anyone to earn interest or borrow against their digital assets, turning passive assets into active ones.

Aave crypto — FAQ

Aave is the most well-known Finnish crypto project. It is one of the world’s largest DeFi services and the largest crypto lending service. With Aave, users can borrow against crypto collateral and earn passive income by depositing cryptocurrencies on the platform.

Aave is a decentralized lending protocol that allows users to borrow or lend cryptocurrency without intermediaries. It operates entirely through smart contracts, which determine the loan terms and approve transactions.

Stani Kulechov founded the Aave protocol in Finland in 2017. Until 2018, the service was known as ETHLend until it was rebranded as Aave.

A user connects their digital wallet to the Aave platform and deposits cryptocurrency into it. Once the funds are deposited, the user can choose whether to borrow against crypto collateral or lock their assets on the platform to earn interest.

Aave is a secure crypto protocol, protected by both the decentralized Ethereum network and the AAVE tokens staked for the security of the blockchain network. Aave relies on smart contracts that handle all transactions on the platform. The biggest risk is if a hacker gains access to the platform’s funds.

The return paid to lenders is collected from borrowers. When loan interests are paid, lenders who have deposited crypto into Aave’s liquidity pool earn a portion of the interest in the form of cryptocurrencies.

Get started with Bitcoin Litecoin Ethereum AAVE USDC Stellar Ripple

Join Coinmotion and buy your first cryptocurrencies within minutes!

The views, thoughts, and opinions expressed in the text belong to the author and not necessarily to the author’s employer, organization, committee, or other group or individual.