The technical analysis of week 7 goes over the latest technical indicators and blockchain analysis. Additionally, we explore a model based on the 2019 cycle that suggests Bitcoin may rise to $46 092 by July.

The spot prices of the crypto market have climbed to moderate growth since last week, with the market leader, bitcoin strengthening by nine percent. Trader and analyst Tone Vays is sticking to his 40 percent bitcoin allocation, but is open to buying more after a correction. In the current market structure, you can clearly see similarities to the relief rally of 2019, during which the spot price of bitcoin rose by 178 percent between January and July.

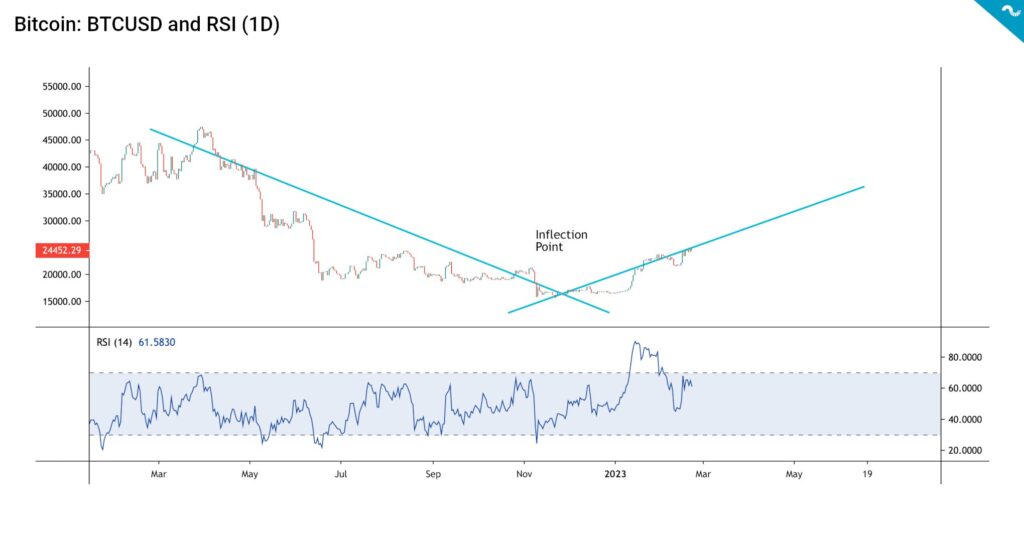

Bitcoin’s spot price moved into a new technical setup at the turn of the year while meeting the inflection point of the rising and falling trend lines (turquoise). Bitcoin’s relative strength index RSI (blue) was in the overbought area in January-February, but has since returned to the normal reading of 62.

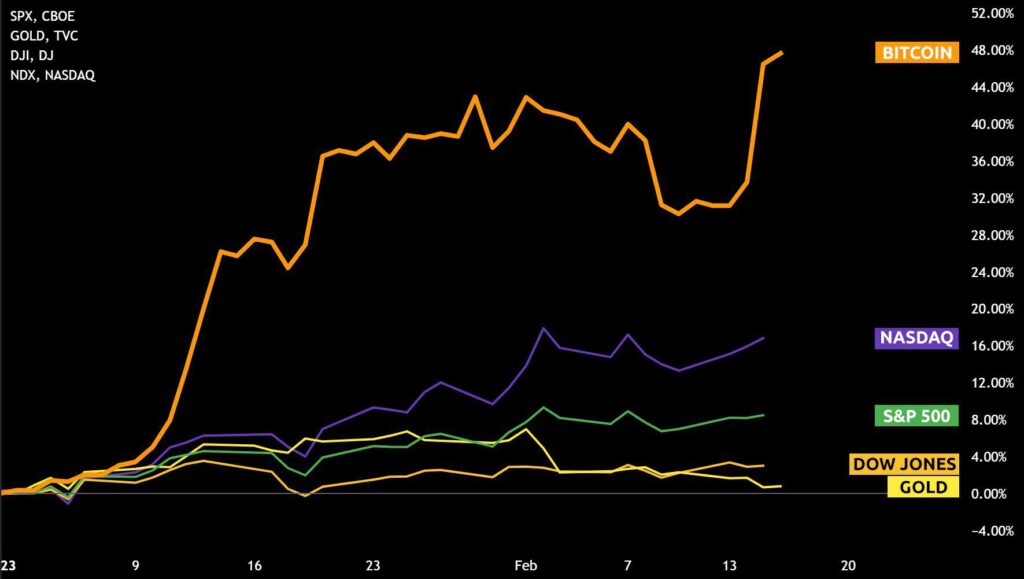

Bitcoin has fared excellently in the beginning of the year compared to other asset classes. While the leading cryptocurrency is up nearly 50 percent, the Nasdaq 100 is up just 11% year to date. The S&P 500 index has strengthened by 4.5 percent this year, and gold by a remarkably modest one percent.

Bitcoin’s 90-day Pearson correlation with the S&P 500 is in a clear downward trend in the early part of the year, falling from 0.45 in early January to the current level of 0.37. Bitcoin has historically had a weak correlation with the stock market, and the cryptocurrency was long known as an “uncorrelated asset class.” However, after 2020, the correlation with the stock market has increased with mainstream adoption. The increasing correlation can also be considered a sign of a maturing market.

Cryptocurrencies have strengthened since last week in a clear mutual correlation. As the leading cryptocurrency gained 9,4 percent, DeFi platform ethereum gained 6%. Other cryptocurrencies listed on Coinmotion followed the market leaders in a close dependency relationship.

Seven Day Price Performance

Bitcoin (BTC): 9,4%

Ethereum (ETH): 6%

Litecoin (LTC): -1,7%

Aave (AAVE): 4,2%

Chainlink (LINK): 11,3%

Uniswap (UNI): 5,8%

Stellar (XLM): 8,6%

XRP: 1,3%

Get started with Bitcoin Litecoin Ethereum AAVE USDC Stellar Ripple

Join Coinmotion and buy your first cryptocurrencies within minutes!

S&P 500 Index: -3,4%

Gold: -0,7 %

If the 2019 Scenario Repeats Itself, Bitcoin Could Reach $46 000 in July

The market-leading digital asset bitcoin has gone through an amazing 2023 so far, rising by 50 percent year to date (YTD). According to CoinFairValue, bitcoin’s current fair price is at 40 673 USD, a 64 % increase from the current $24 786.

As Mark Twain famously said, “history never repeats itself, but it does often rhyme.” If we use the last bear cycle of 2018-2019 as a reference point, bitcoin could easily reach over $40K this year. Between 1st of January and 1st of July 2019, bitcoin’s spot price climbed from $3808 to $10 570, representing a 178 percent increase. In the 2023 context, a 178 percent increase between January 1st and July 1st would effectively mean bitcoin surging from $16 607 to $46 092. In summary, both bitcoin’s “fair price” and the previous cycle scenario would point towards bitcoin breaching 40 000 USD this year.

CryptoQuant’s UTXO Realized Price Age Distribution is a set of realized prices along with age bands. The indicators show how bitcoin’s price is currently above the 1W-1M (yellow), 1M-3M (purple), 3M-6M (green), and 2Y-3Y (red) bands. However, bitcoin is still below the major 6M-12M (blue) and 18M-2Y (light red) bands. The distribution indicates that particularly the shorter-term investors are already in profit, and this thesis is also supported by the STH-SOPR data. If bitcoin is able to breach $31K, it will attract a new cohort of long-term holders.

The realized price is an important indicator because it represents the average price of all bitcoin purchases. At the same time, the realized price illustrates that the average bitcoin buyers are now making a profit on their investments.

The UTXO Metric Reflects that 82 Percent of Investors Are in Profit

Despite the brutal bear market of 2022, bitcoin has historically been an excellent long-term investment. This claim can be substantiated with UTXO metrics that reveal up to 82 percent of investors still being in profit. The percentage of UTXOs in profit indicator compares the price between the creation of UTXO and the current time.

Last time when such a large amount of UTXOs were in profit, the spot price was between $43-45K. At the same time, the UTXO data reveals that many UTXOs were born at the levels of $19-20K, which act as clear accumulation zones.

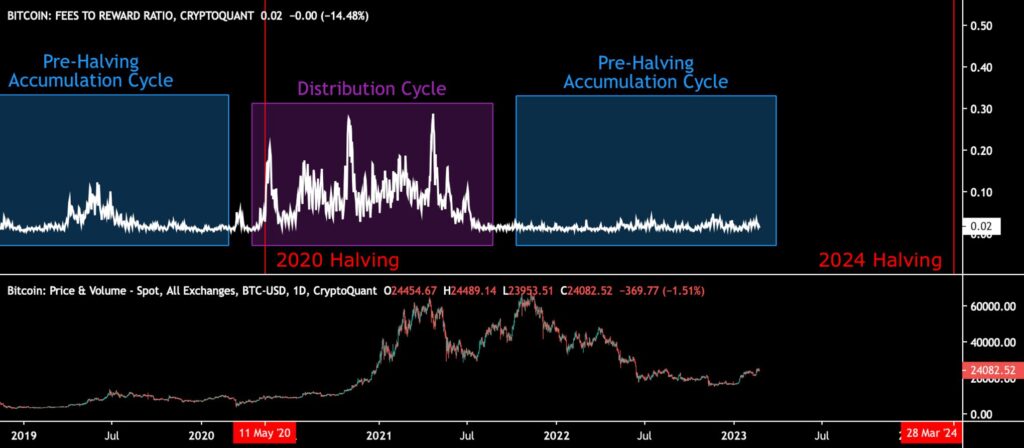

Bitcoin’s Next Halving Only 400 Days Away

Halving (or halvening) is one of the most important events in the Bitcoin ecosystem, as it increases the cryptocurrency’s scarcity by dropping the block reward from 6,25 to 3,125. The estimated date for the next halving event is March 28 2024, only 400 days away at the time of the writing.

In addition to the halving, bitcoin’s price development is supported by long-term holders, who already represent 49 percent of the entire network. These long-term investors have held their bitcoin units for at least two years. A general increase in the number of long-term holders may lead to a possible supply shock as the number of liquid units decreases.

In addition to holders, the supply shock will be escalated by Bitcoin’s upcoming halving event next year. The selling pressure on bitcoin is clearly weakening, and at the same time there are still unprotected short positions in the market. The positive turn of the macro market has caused short squeeze situations.

In the previous halving cycle, the spot price of bitcoin increased by 1263 percent between 2016 and 2020. If the same trend continues, Bitcoin will reach the level of 100 000 euros in 2024. After the accumulation and distribution cycles, Bitcoin is again in a new pre-halving accumulation cycle (blue) after the accumulation and distribution cycles, which will continue until the 2024 halving.

Bitcoin’s halving will be preceded by the halving of its sister currency Litecoin, which is scheduled for early August. As with Bitcoin’s halving event, Litecoin’s halving will drop its block reward from 12,5 to 6,25, increasing supply scarcity.

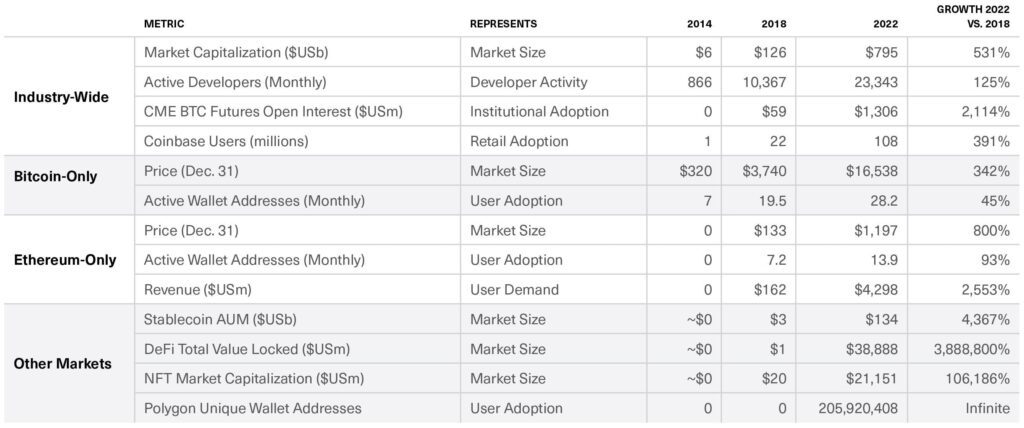

The Growth of the Industry Has Been Exponential since 2018

The beginning of 2023 has been exceptionally promising for the crypto market, especially after the sluggish last year. Despite the weak price development, the year 2022 also was successful compared to previous cycles. Bitwise’s data shows how digital asset market value increased by 531 percent between 2018 and 2022.

The number of developers vital to the ecosystems doubled between 2018 and 2022, rising from 10 367 to 23 343 active developers. The growth of the derivatives market was explosive, while the number of open derivatives contracts on CME BTC futures increased by more than 2000 percent. In the United States, Coinbase’s user base increased from 22 million in 2018 to over one hundred million last year.

Although the growth of Bitcoin itself has been remarkable, stablecoins and the decentralized finance sector have grown even more. As recently as 2018, stablecoins were a niche market, with their market capitalization reaching $3 billion. The stablecoin market grew to 134 billion, or 4367 percent, between 2018 and 2022.

The value locked in decentralized finance (total value locked, TVL) increased from 1 million dollars in 2018 to almost 39 billion dollars last year. The NFT market also grew explosively: Its size was a modest $20 million in 2018, from which the market grew to over $21 billion last year.

As a whole, the industry has grown exponentially over the past few years, and the growth can reasonably be expected to continue. Bitcoin’s “fair price” is currently over $40 000, and the strengthening of the leading cryptocurrency correlates with the growth of the decentralized finance sector.

What Are We Following Right Now?

Glassnode’s weekly in-depth analysis of on-chain data.

Retired hedge fund manager Raoul Pal reviews his best trades and experiences with bitcoin.

Michael Saylor’s view of Bitcoin’s growth path over the next eight years.

Stay in the loop of the latest crypto events

- Bitcoin marketplace LocalBitcoins is closing — here’s how to transfer funds to Coinmotion

- Bitcoin Resilient Amid the FUD Week

- EUROe stablecoin — First EU-regulated stablecoin launched in Finland | Interview with Juha Viitala

- Technical Analysis: Bitcoin in a New Market Cycle

- How did Norway become the largest Bitcoin mining hub in Europe?

- The Calm Before The Storm

- Top 10 cryptocurrencies by market cap

- Ripple v. SEC update & crypto lender Genesis goes bankrupt

- Inflation is slowing & the crypto market is rising

Get started with Bitcoin Litecoin Ethereum AAVE USDC Stellar Ripple

Join Coinmotion and buy your first cryptocurrencies within minutes!

The views, thoughts, and opinions expressed in the text belong to the author and not necessarily to the author’s employer, organization, committee, or other group or individual.