The technical analysis of week 5 dives into the crypto market from a technical point of view without forgetting other aspects. We’ll go through bitcoin’s golden cross and the transition of the leading cryptocurrency towards a new market cycle, looking at next year’s halving. In addition, we examine how short-term investors (STH-SOPR) have clearly been profitable so far in 2023.

The leading cryptocurrency continues its sideways movement for the second week already after bitcoin reached its year’s high ($24K) in early February. Bitcoin’s consolidation gives higher beta tokens more room to maneuver, an example of which is the FXS governance token of the FRAX protocol, which strengthened by almost 30 percent in a week.

NB. The FXS token is not currently listed on Coinmotion’s platform, but it can be purchased via our OTC service.

At the end of the year 2022, bitcoin passed the descending and ascending trend lines (turquoise), which form a technical turning point. With the macro market remaining favorable, bitcoin will likely head toward its fair price of $41 955 (purple) during 2023.

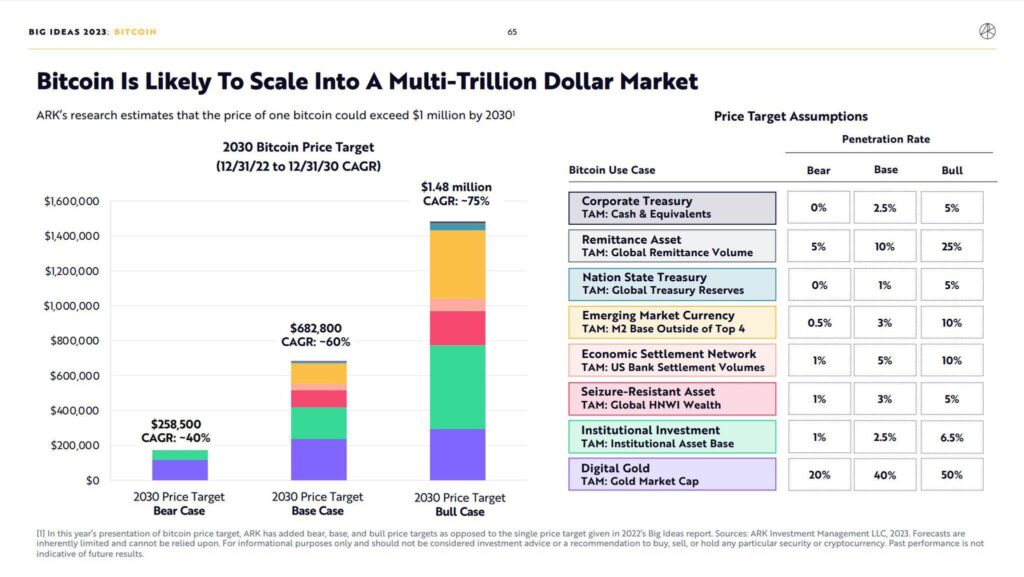

The early momentum of 2023 has also caused experts to update their price estimates. According to ARK Invest, bitcoin may cross the million-dollar mark by 2030. In ARK Invest’s bear scenario (CAGR -40%), bitcoin would rise to $258 500 by 2030 and to $682 800 in the base scenario (CAGR -60%). In a favorable model (CAGR -75%), bitcoin would reach 1,48 million dollars by 2030. ARK Invest’s portfolio company Coinbase (COIN) has already recovered 103,66 percent at the beginning of the year.

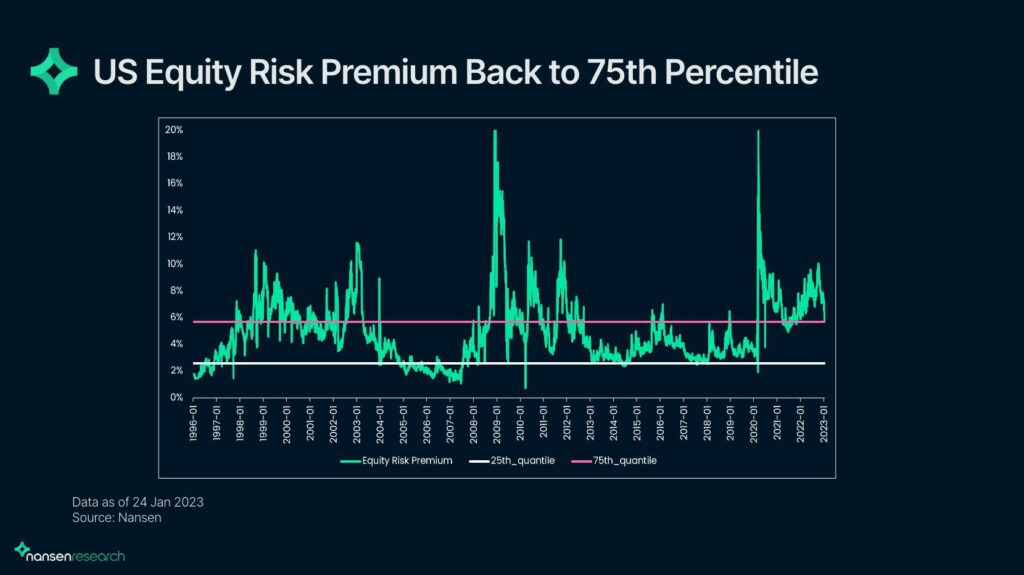

The blockchain analytics company Nansen estimates that the positive momentum of the crypto and stock markets will continue for now. Nansen justifies its thesis with the US equity risk premium, which has fallen to 5,7 percent from almost 10% at the end of the year. At the same time, the stablecoin indicator of smart money is returning to the normal territory.

The leading cryptocurrency, bitcoin, has moved almost sideways within seven days, ending up 0,2 percent. Ethereum has strengthened by 5,4% in a week, with other altcoins in Coinmotion’s repertoire rising moderately. Litecoin’s halving event scheduled for July is already uplifting it, with LTC ending up with a seven percent gain. At the same time, the stock index S&P 500 has strengthened by 2,1 percent, and gold has weakened by 2,8%.

Seven Day Performance

Bitcoin (BTC): -0,4%

Ethereum (ETH): -3,5%

Litecoin (LTC): 4,7%

Aave (AAVE): -6,1%

Chainlink (LINK): -0,6%

Uniswap (UNI): -2,7%

Stellar (XLM): -4,3%

XRP: -7,8%

Get started with Bitcoin Litecoin Ethereum AAVE USDC Stellar Ripple

Join Coinmotion and buy your first cryptocurrencies within minutes!

S&P 500 Index: -0,05%

Gold: 0,16%

Bitcoin Enters Technical Golden Cross and a New Paradigm

The leading cryptocurrency, bitcoin, has now strengthened by almost 43 percent during the early weeks of 2023, mirroring exceptional momentum. With an MVRV value of 1,19, bitcoin could easily reach its fair price of $40K this year.

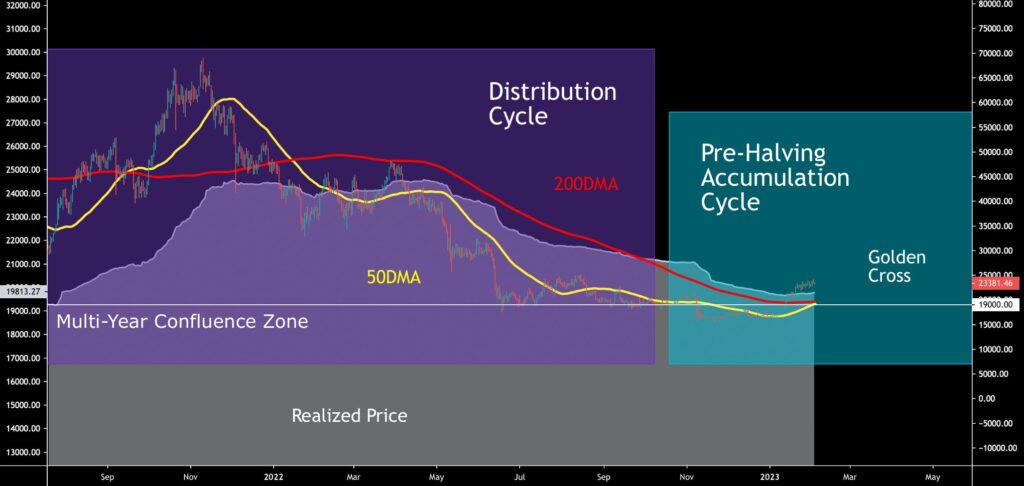

Bitcoin is extremely close to a technical “golden cross” setup as its 50 (yellow) and 200 (red) day moving averages are merging. The spot price has risen above both moving averages during January, which itself is a positive signal. In addition, the 50-day moving average is crossing the 200-day moving average to the upside, forming a golden cross setup.

Additionally, bitcoin has been able to rise above the realized price (grey) indicator. The realized price is important because it represents the average price of all bitcoin purchases. At the same time, the realized price illustrates that the average bitcoin buyers are making a profit on their investments. In 2022, the spot price was pulled below the realized price from June to December. If we do not consider local increases above the realized price, the spot was oversold for six months.

In summary, bitcoin currently sits at an intersection of multiple crucial indicators, heading into a new paradigm. The technical golden cross will support bitcoin’s spot price, and the realized price has evolved into a support zone. In addition, bitcoin trades above the multi-year confluence zone (white) and moves deeper into the pre-halving accumulation cycle (turquoise).

What Are The Whales Buying Right Now?

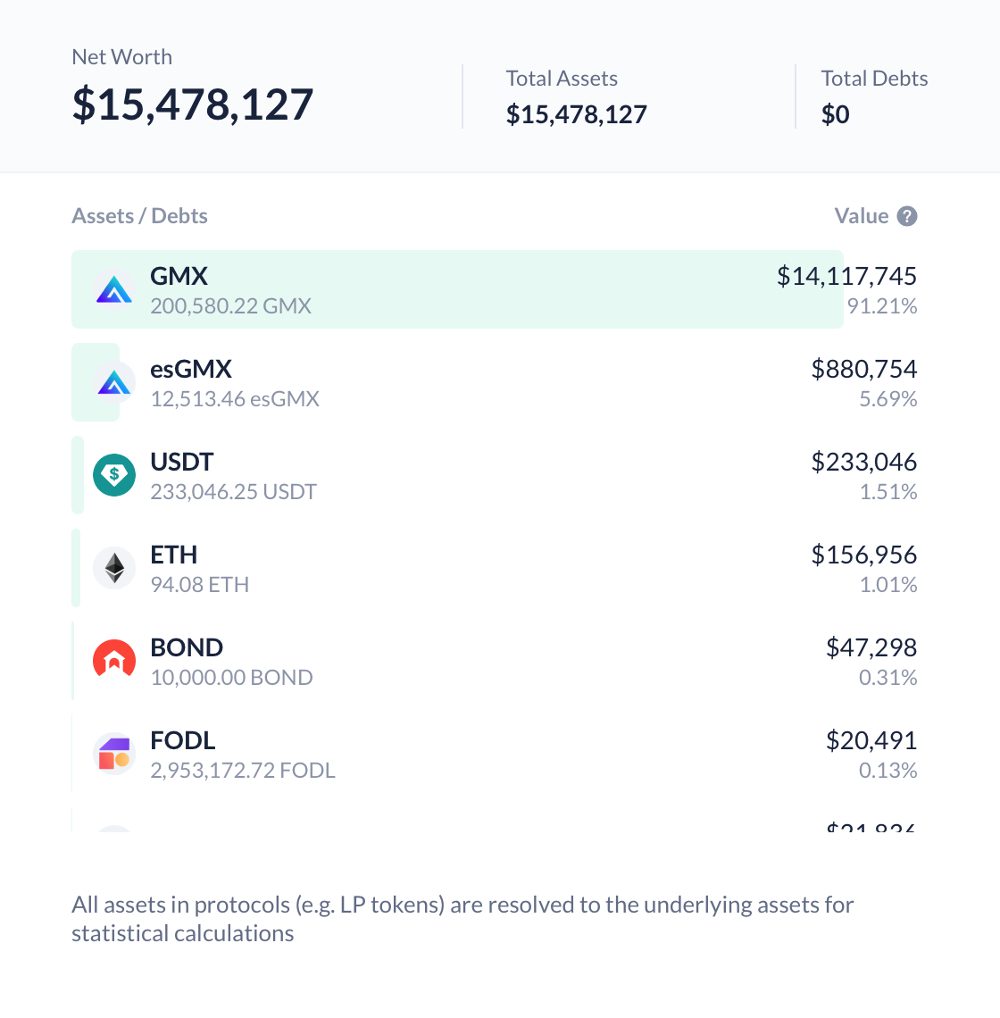

Whales usually refer to investors or entities owning more than 1000 bitcoin units, and these actors have considerable power in the market. The public blockchains of cryptocurrencies enable the tracking of whales, e.g., on sites like DeBank. Arthur Hayes, the well-known whale of the BitMEX exchange, operates on wallet 0x534a0076fb7c2b1f83fa21497429ad7ad3bd7587, which shows that he owns a significant portfolio of GMX tokens.

GMX is a decentralized exchange (DEX) governance token, which Hayes has accumulated a total of 200 580,22 native units. That portfolio makes Arthur Hayes the largest single holder of GMX while also giving him great power in the protocol’s decision-making processes. Hayes has also previously shown interest in the FXS token of the FRAX protocol, of which he had more than 55 000 in the fall.

NB. The GMX token is not currently listed on Coinmotion’s platform, but it can be purchased through our OTC service.

SOPR: Short-Term Investors Made Profit During Early 2023

The SOPR indicator was originally developed by Renato Shirakashi, and it’s calculated by dividing the realized value of bitcoin (USD) by the value of the original bitcoin transaction. Or, in simplified terms, the selling price divided by the purchase price. The SOPR indicator can be interpreted with the following logic:

SOPR > 1 = Seller in profit

SOPR < 1 = Seller at a loss

The SOPR indicator is usually divided into two parts: Short-term holders (STH-SOPR) and long-term holders (LTH-SOPR).

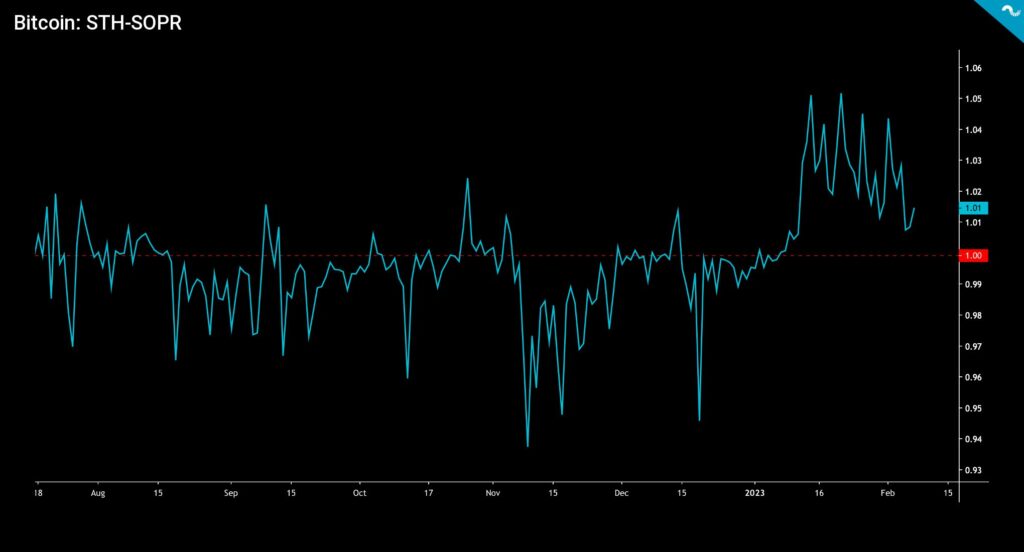

Despite the positive price development, the SOPR data offers somewhat surprising readings for the beginning of the year. The STH-SOPR, which describes short-term holders, rose from year-end lows to January-February highs of 1,05, higher than ever in 2022. The last time short-term holders made this much profit was at the peak of the November 2021 cycle.

The STH-SOPR clearly reflects how downbeat the year 2022 was, with the SOPR value falling to a low of 0,91 during the selling pressure in June. The current strength of STH-SOPR indicates the rebounding strength of the market reversal and the transition of bitcoin toward a new paradigm after 2022.

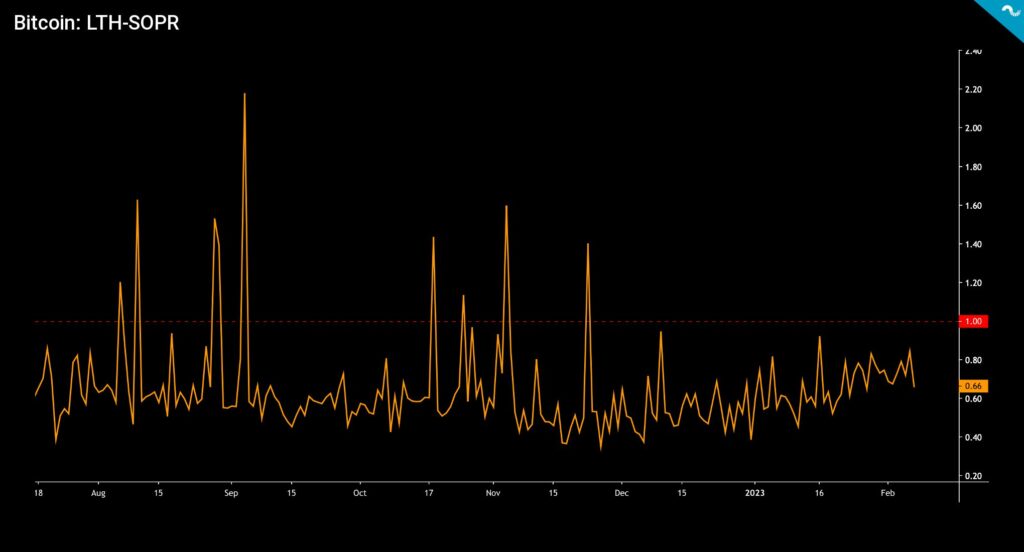

In contrast to the success of short-term investors, long-term holders are strongly below the break-even point, although the LTH-SOPR indicator rose to the level of 0,8 in February. The LTH-SOPR fell to its lowest reading of 0,32 in November, remaining clearly below the break-even in January.

In the bear cycle of 2018-2019, long-term investors continued their sales for a total of 291 days until the market reacted to the strong correction of the summer of 2019. The LTH-SOPR has remained in its current cycle for 265 days, approaching the final capitulation point. Although the message of the LTH-SOPR indicator is brutal, it also signals a gradual market recovery.

What Are We Following Right Now?

Human Rights Foundation’s Alex Gladstein and Natalie Brunell evaluate the speed of bitcoin adoption in developing countries and the role of cryptocurrencies in promoting freedom and individual rights.

Lyn Alden and Parker Lewis discuss inflation and how to protect yourself against fiat currency depreciation.

Capriole Investments’ Charles Edwards opens up his views on Bitcoin’s position in the current macro cycle. In addition, Edwards explains how bitcoin’s value is determined.

Stay in the loop of the latest crypto events

- How did Norway become the largest Bitcoin mining hub in Europe?

- The Calm Before The Storm

- Top 10 cryptocurrencies by market cap

- Technical Analysis: Will The FOMO Rally Continue?

- Ripple v. SEC update & crypto lender Genesis goes bankrupt

- Inflation is slowing & the crypto market is rising

- The Positive Momentum Continues

- NFT market value increased by 11,000 percent in 2020-2022

- Bitcoin’s Price Predictions for 2023

- Accepting crypto donations for your charity or non-profit organization

Get started with Bitcoin Litecoin Ethereum AAVE USDC Stellar Ripple

Join Coinmotion and buy your first cryptocurrencies within minutes!

The views, thoughts, and opinions expressed in the text belong to the author and not necessarily to the author’s employer, organization, committee, or other group or individual.