The technical analysis of week 6 assesses the impact of recent uncertainties on the market. In addition, we analyze the sustainability of the early 2023 upward momentum from technical and on-chain data perspectives. The exchange stablecoin ratio ESR signals a continuing recovery.

The crypto market has continued its moderate decline since last week, with the leading cryptocurrency, bitcoin falling -4 percent in a seven-day time window. Despite the upward momentum in January, the sector of digital assets has seen growing regulatory uncertainty, which escalated on Sunday when the US Securities and Exchange Commission (SEC) sued the Paxos company. The US-based Paxos is known for its Stablecoins, which it has also launched in cooperation with the Binance exchange.

Despite the weakness of the market, many experts predict that the positive movement will continue, at least in the medium term. Pantera Capital’s Dan Morehead believes that the market bottom is behind and bitcoin is headed for a new cycle. Analyst and trader Tone Vays is sticking to his 40 percent allocation for now but is ready to move to 80 percent when bitcoin touches the $20K level.

On a technical level, bitcoin just reached the golden cross pattern when the 50 (yellow) and 200 (red) day moving averages met in early February. A golden cross is a clearly positive technical signal. After rising above the realized price (turquoise) in early 2023, bitcoin is at a multi-year confluence zone (purple) of several different indicators as the market awaits a decisive move. Bitcoin’s reasonable price (blue) can be argued to be above $40 000.

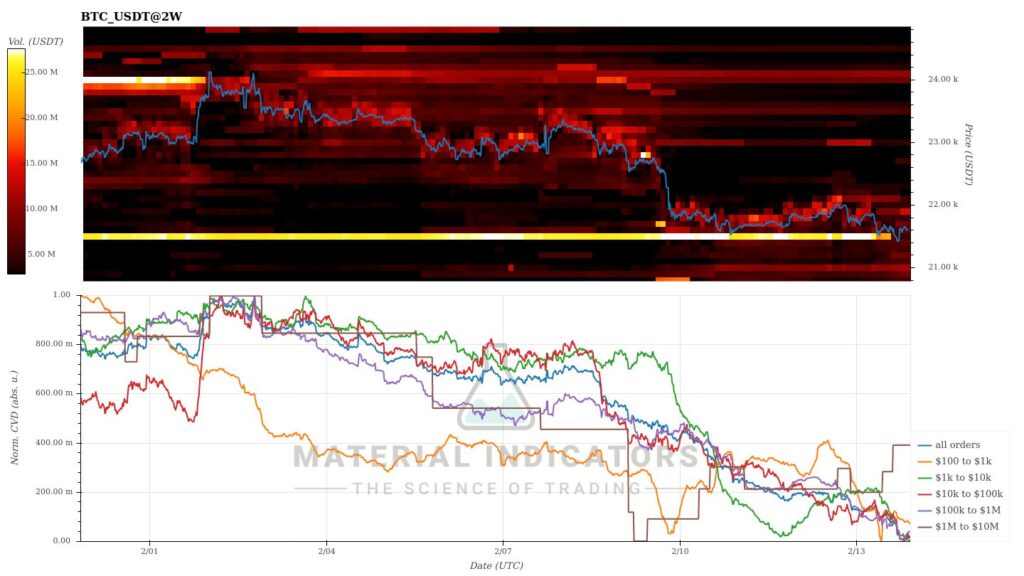

According to the Material Indicators heatmap, the main support area for the spot price of bitcoin is $21 500, but its strength is weakening. The strength of the support area fell from $25-27 million to $19M. If the current support area fragments, bitcoin’s next big confluence area will be at $20 000.

A closer look reveals that cryptocurrencies weakened surprisingly moderately in seven days. The leading cryptocurrency, bitcoin, fell by -4,3 percent and ethereum by -6,1%. Other cryptocurrencies listed on Coinmotion also weakened between three and seven percent, showing a growing mutual correlation. The stock index S&P 500 ended up 0,6 percent, and gold fell -1,5%.

Seven-Day Price Performance

Bitcoin (BTC): 0,2%

Ethereum (ETH): 5,4%

Litecoin (LTC): 7%

Aave (AAVE): 6,5%

Chainlink (LINK): 3,4%

Uniswap (UNI): 5,2%

Stellar (XLM): 0,8%

XRP: -1,6%

Get started with Bitcoin Litecoin Ethereum AAVE USDC Stellar Ripple

Join Coinmotion and buy your first cryptocurrencies within minutes!

S&P 500 Index: 2,1%

Gold: -2,8%

Is The Liquidity Returning?

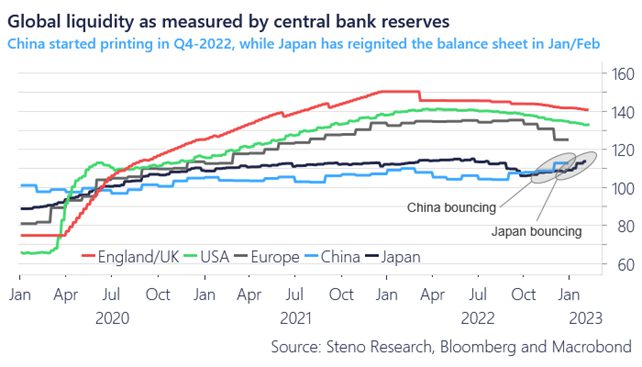

With the upward momentum of the beginning of the year, bitcoin has strengthened by more than 30 percent year-to-date, while the Nasdaq 100 index has risen by 15%. Analyst Andreas Steno Larsen sees the market possibly having reached its liquidity base, although sentiments are still mixed. Larsen notes the growing divergence between Western and Eastern central banks, as the central banks of China (PBoC) and Japan (BoJ) increase their balance sheets while the Western ones trim them. Asian central banks on the recovery line represent the second and third largest economic regions globally.

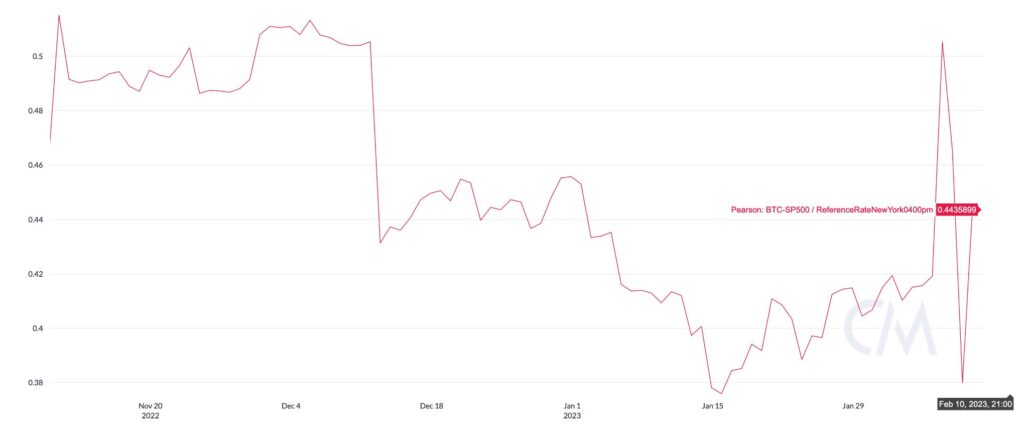

Bitcoin’s 90-day Pearson correlation with the stock market remains in a downtrend, falling to 0,43 in mid-February. The correlation rose to three-month highs in early December, touching a level of 0,51. On January 15, the correlation fell to 0,38. Historically, bitcoin’s correlation with the stock market was low for a long time, but their dependence began to converge in the “Saylor cycle” of 2020.

Several big-name analysts, such as Luke Gromen, are now waiting for the Fed’s pivot move, which would undoubtedly bring new momentum to the market. As the stock market possibly continues to strengthen, the correlation to bitcoin will remain strong, although a sovereign breakout of high-beta asset classes is always a possible scenario. Stock market correlation can be seen as protecting bitcoin yet providing an option to exit in bullish cycles.

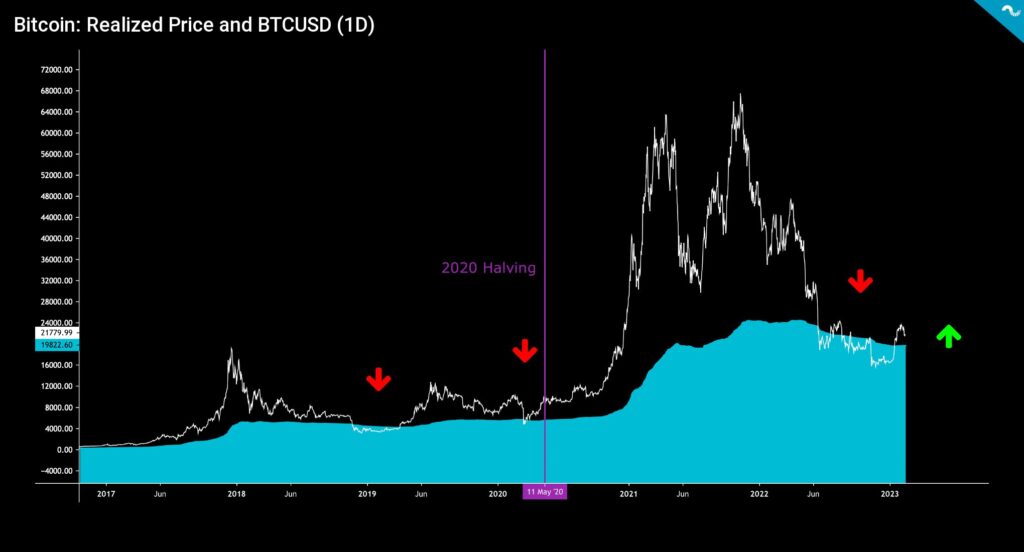

Bitcoin Still Above The Realized Price

Despite the market uncertainty, bitcoin has still remained above the realized price (turquoise). The realized price is an important indicator because it represents the average price of all bitcoin purchases. At the same time, the realized price illustrates that the average bitcoin buyers are now making a profit on their investments. The spot price of bitcoin fell below the realized price from mid-June 2022 to the end of the year. If we do not consider local increases above the realized price, the spot was oversold for six months.

From the realized price point of view, the 2022 bear cycle exceeded the 2018-2019 bear market in length, where the spot price fell below the realized price for 133 days. The realized price served as a resistance level for the spot price for a long time, but now it is becoming a support level again.

Binance USD Entering Uncertain Waters Amid the Regulatory Crackdown

On Monday, February 13th, the US Securities and Exchange Commission SEC attacked the fintech company Paxos with exceptionally harsh words. Paxos is known for, e.g., dollar-linked Paxos Standard (PAX) and gold-linked Paxos Gold (PAXG) stablecoins. In addition, the company acts as an intermediary for large institutions. New York-based Paxos has also been known for its licenses, and in 2021 the company completed a funding round of a total of 540 million dollars.

Paxos has also created a stablecoin called Binance Coin (BUSD) together with the Binance exchange, which also tracks the value of the dollar 1:1. According to Paxos, BUSD is 100% covered by cash reserves or government bonds (T-bill). Experts estimate that cooperation with the unregulated Binance was a suitable attack vector for the US Securities and Exchange Commission, which commented that Binance USD is an illegal security.

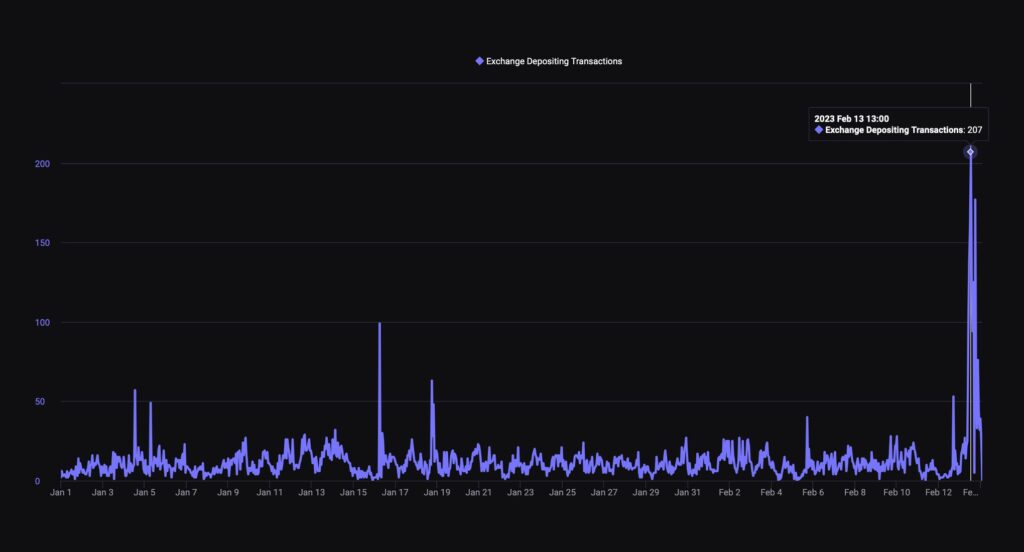

The actions of the SEC caused a clear panic momentum in the market, and blockchain data reveals how huge amounts of BUSD currency were transferred to the Binance platform for conversion on Monday. Binance tried to calm the market by promising to replace the use of BUSD directly with other stablecoins. The beginning of the week also saw USD Coin (USDC) short positions grow and Tether (USDT) increase its market share to more than 50 percent.

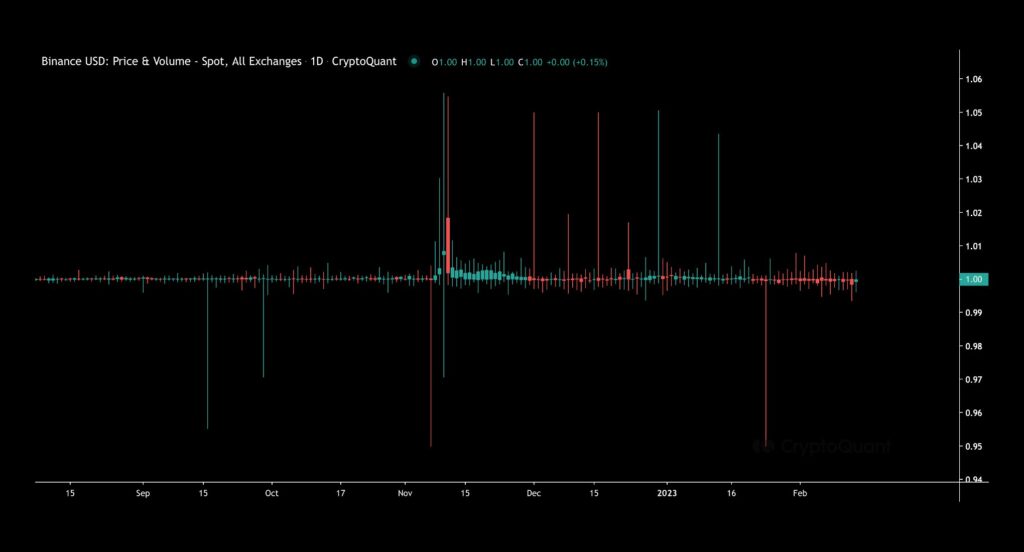

Amidst the market turmoil, Binance USD appeared to momentarily break away from its dollar peg, falling to $0,995 on Monday. However, according to these prospects, BUSD is not weakening radically and is supported by its position as the third largest stable currency, with a market value of $16 billion. Binance USD’s breakaway from its dollar peg also weakened the price of Binance’s native token, BNB (Binance Coin), sending it down 7,5 percent.

The Divergence Between Spot and ESR Supports Bitcoin’s Recovery

Despite the -6 percent correction within the last seven days, the leading cryptocurrency, bitcoin, has still strengthened by 32 % year-to-date (YTD). In my opinion, bitcoin has a significant chance to reach its fair price of $42K this year. One essential on-chain indicator supporting bitcoin’s further price increase is the exchange stablecoins ratio (ESR) (yellow) which is used to correlate with bitcoin’s spot price in 2022. Throughout 2022, the ESR formed a convergence (pink, left) with the spot price, as they declined vis-à-vis. The falling ESR in 2022 mirrored the escalating selling pressure.

Now the ESR has surpassed the technical inflection point (purple) and started to diverge (pink, right) away from the spot price. After the previous distribution cycle (grey), bitcoin moves towards a new pre-halving accumulation cycle (turquoise), heading toward the 2024 halving event. These factors together propel bitcoin towards a new paradigm. Additionally, exchange bitcoin reserves (red) have been in a secular downtrend for years, dropping significantly during the FTX crisis of November 2022. Unlike the ESR, reserves don’t act as a leading indicator of the spot price. Instead, the reserves mirror a long-term horizon trend of entities holding their assets off-exchange, which is a healthy development.

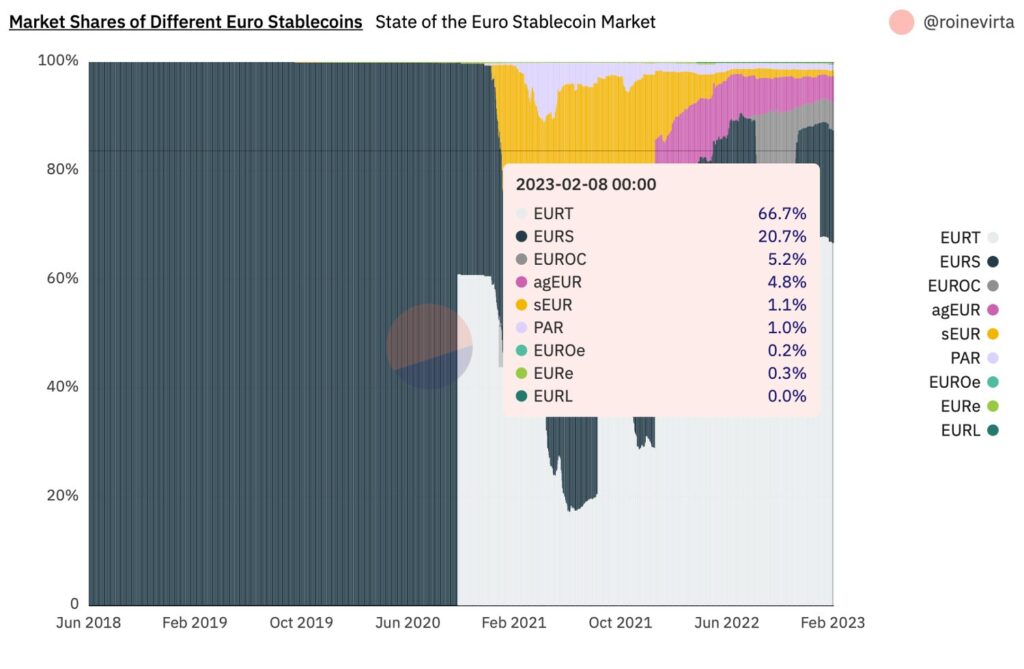

The Finnish EUROe Stablecoin is Now on Dune Analytics

At the beginning of the year, the Finnish Membrane Finance released the first and only fully EU-regulated EUROe stablecoin on the Ethereum blockchain. The price of one EUROe is supposed to correspond in a 1:1 ratio to the price of a real euro, and for every EUROe issued, there is at least one euro in a European financial institution or bank, which is separate from Membrane Finance. This ensures that the company’s own funds are not mixed with EUROe’s funds.

Read more about the EUROe stablecoin project:

Membrane Finance’s Juuso Roinevirta has created a EUROe dashboard for the Dune Analytics platform. On the platform you can compare, e.g., The development of EUROe’s market share compared to other stable currencies, the number of units in circulation, and user profiles.

What Are We Following Right Now?

Preston Pysh, Luke Gromen, and Natalie Brunell discuss the outlook for bitcoin and digital asset classes in early 2023.

Cross Border Capital’s Michael Howell argues that liquidity is on the rise, especially because the Chinese central bank (PBoC) is stimulating.

Trader and analyst Gareth Soloway’s latest thoughts on the crypto market.

Stay in the loop of the latest crypto events

- EUROe stablecoin — First EU-regulated stablecoin launched in Finland | Interview with Juha Viitala

- Technical Analysis: Bitcoin in a New Market Cycle

- How did Norway become the largest Bitcoin mining hub in Europe?

- The Calm Before The Storm

- Top 10 cryptocurrencies by market cap

- Ripple v. SEC update & crypto lender Genesis goes bankrupt

- Inflation is slowing & the crypto market is rising

- NFT market value increased by 11,000 percent in 2020-2022

- Bitcoin’s Price Predictions for 2023

Get started with Bitcoin Litecoin Ethereum AAVE USDC Stellar Ripple

Join Coinmotion and buy your first cryptocurrencies within minutes!

The views, thoughts, and opinions expressed in the text belong to the author and not necessarily to the author’s employer, organization, committee, or other group or individual.