The technical analysis of week 45 explores the crypto market’s recent correction and the current price discovery cycle, which has propelled all Coinmotion-listed tokens into a positive YTD territory. Additionally, we delve into why 85 percent of the bitcoin supply is in profit and contemplate the possibility of a supply shock. We also analyze the bespoke .USTLIQ index, personally developed by Arthur Hayes.

On Tuesday, the cryptocurrency market experienced a sharp correction as the epilogue to a multi-week uptrend, causing bitcoin to decline about five percent. However, the price of the largest cryptocurrency by market capitalization has since recovered, with a weekly drop of only -1,9 percent.

Despite the correction, market sentiment has remained positive. In his recent newsletter, Charles Edwards estimated that bitcoin has broken significant weekly and monthly resistance levels while predicting the next resistance level to be at $58 000. According to Edwards, the current market sentiment is clearly positive.

“Together the most important technicals and fundamentals are telling us that we have just achieved a major milestone and risk-reward remains heavily skewed to the upside. In the near-term, the picture is more mixed; with all derivatives markets currently overheated and low timeframe technicals suggesting a small retrace is possible.” – Charles Edwards

From a purely technical standpoint, the current price discovery cycle concludes a series of multi-month descending trendlines (2 and 3), which impeded the upward attempts of BTCUSD from spring to fall. Simultaneously, the spot price encountered its technical turning point in October at the intersection of trendlines 2 and 3.

Sources: Timo Oinonen, CryptoQuant

An earlier and even more crucial technical turning point occurred in late 2022, representing both investor capitulation and a price bottom. In addition to the price discovery period, the spot price is now supported by the violet realized price wave and the 200-day (turquoise) and 200-week (orange) moving averages. The Chop Zone indicator also points towards the pre-halving bull market.

Source: Maartunn

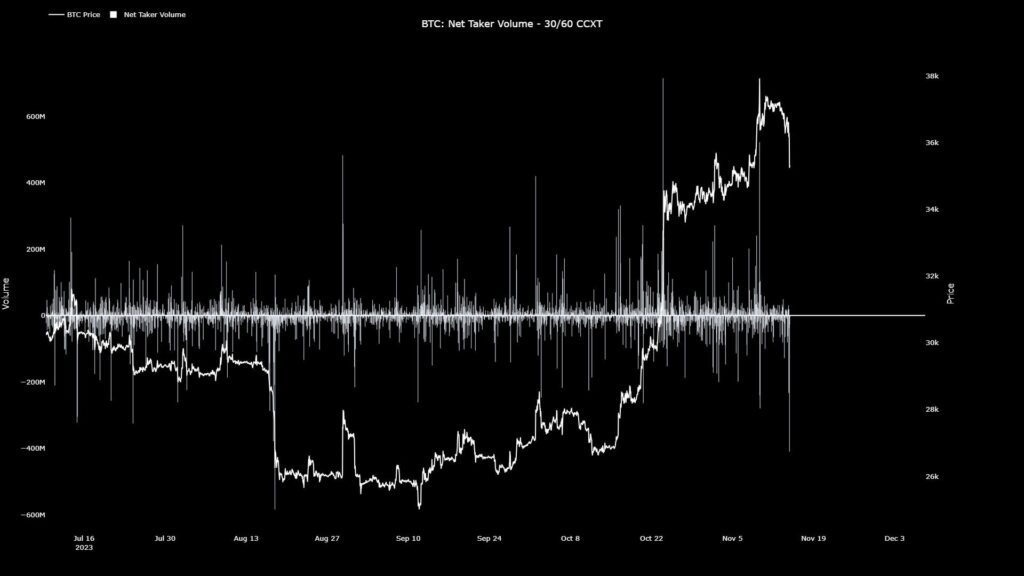

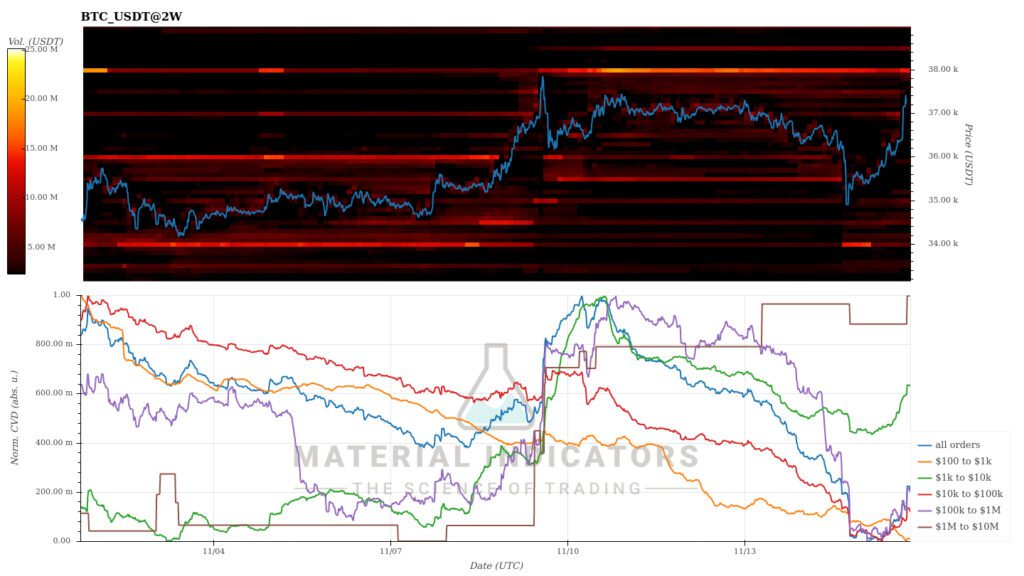

The depth of the technical correction is evident in the increase of selling pressure (net taker volume) to three-month highs. The Material Indicators’ heat map indicates the development of a support level at $34 000 and spot price’s upward pivot. At the same time, the cumulative volume delta reflects an increasing appetite for both mid-sized and large investors.

Source: Material Indicators

The weekly price movement appears mostly sideways, with bitcoin and Ethereum both weakening by approximately two percent in close correlation. As usual, higher-beta tokens took more significant hits, with Aave and XRP dropping nearly ten percent. Polygon, recently listed on Coinmotion, countered the market trend by strengthening 6,2 percent.

The S&P 500 stock index rose a robust 3,4 percent, continuing the trend from the previous week. The upward trajectory of the stock market also signifies a liquidity environment inflection point, indicating the new flow of stimulus into most asset classes.

7-Day Price Performance

Bitcoin (BTC): -1,9%

Ethereum (ETH): -1,6%

Litecoin (LTC): -4,3%

Aave (AAVE): -8,5%

Chainlink (LINK): -7,8%

Uniswap (UNI): 0,7%

Stellar (XLM): -6,9%

XRP: -9,5%

Cardano (ADA): 0,5%

Polygon (MATIC): 6,2%

Get started with Bitcoin Litecoin Ethereum AAVE USDC Stellar Ripple

Join Coinmotion and buy your first cryptocurrencies within minutes!

S&P 500 Index: 3,4%

Gold: -0,5%

Year-to-Date Price Performance

The crypto rocket Chainlink (LINK) maintains its lead among Coinmotion listings, surging by 166 percent since the beginning of the year. Bitcoin, the largest cryptocurrency by market capitalization, defends its position as the second-strongest performer of the year with a 126 percent YTD gain. XRP, which saw a 140 percent YTD increase in July, secures the third spot, climbing 91 percent in 2023.

As an interesting detail, the rising tide of demand in November has lifted all Coinmotion-listed cryptocurrencies into positive territory. Polygon (MATIC), which dipped into negative territory during the fall, is now up nearly 20 percent in YTD gains. The market dynamics continue to reflect the summer stance of the U.S. Securities and Exchange Commission (SEC), where bitcoin, Ethereum, and XRP were classified as commodities. However, the divergence between bitcoin and Ethereum is growing, with the ETHBTC pair dropping by -25 percent since the beginning of the year.

Source: TradingView

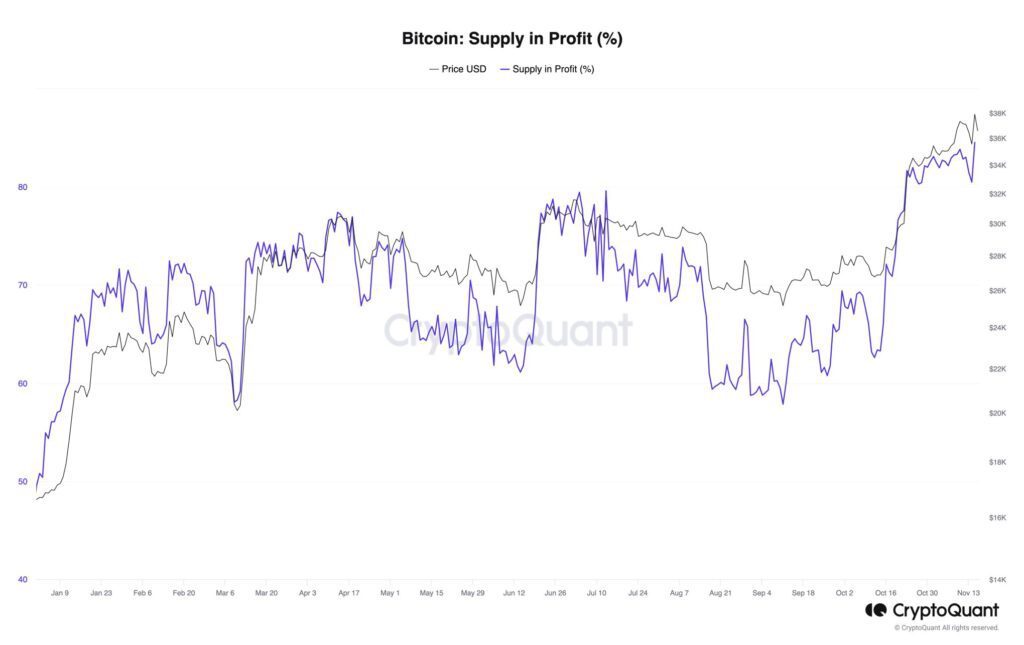

85 Percent of Bitcoin’s Supply in Profit

According to recent data from CryptoQuant, 85 percent of the bitcoin supply is currently in profit. The indicator has surged sharply throughout the year, as in January, only about 50 percent of the supply was in profit. This represents a 70 percent increase from January to mid-November.

According to Glassnode, over 80 percent of the bitcoin supply is held by long-term holders (LTH). The growing number of long-term holders could potentially lead to a supply shock as the number of liquid units decreases.

What percentage of your crypto portfolio does Bitcoin represent? 💰#BTC

— Coinmotion (@Coinmotion) November 17, 2023

The upcoming halving event, 158 days away, further reduces bitcoin’s supply by halving the current block reward from 6,25 to 3,125. The market capitulation already occurred at the technical inflection point of late 2022, and there are few sellers left. Instead, buying pressure continues to grow. As Matt Hougan of Bitwise commented in October: “The problem is: There is basically no one left to sell bitcoin, but there are new people who want to buy.”

Source: CryptoQuant

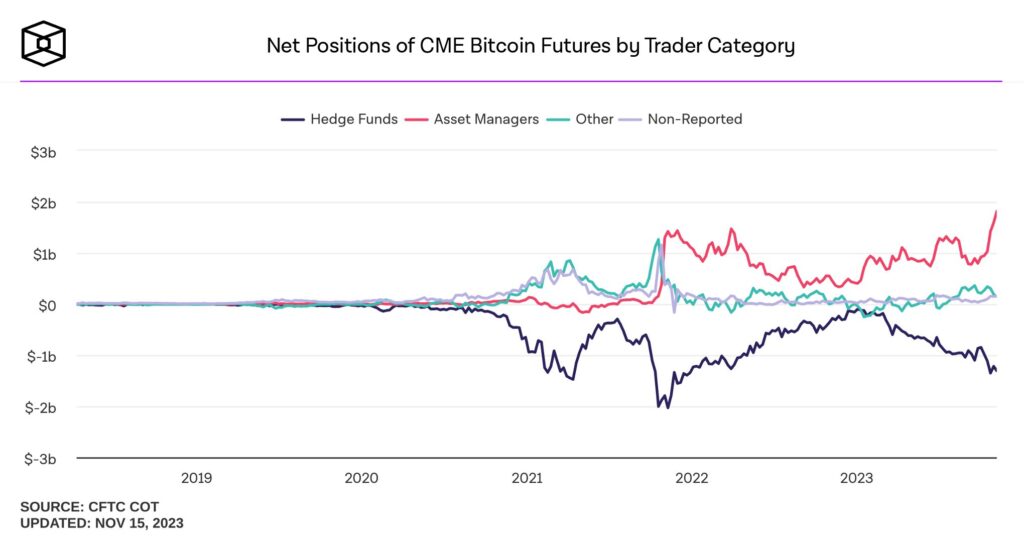

Asset Managers Building Long Positions, Hedge Funds Shorting

The United States financial market regulator, CFTC, collects data related to derivatives, including CME Group’s Bitcoin futures. This data is released under the name Commitment of Traders (COT) and is a valuable signal for interpreting market trends.

The latest COT data indicates that asset managers are optimistic about the prospects of bitcoin, with net positions of asset managers rising to $1,82 billion. In late 2022, the net positions of asset managers dropped to a minimum of $330 million, increasing from there by 451 percent in just over a year. Traditionally, hedge funds shorting bitcoin have net positions at their lowest level since 2021, standing at -$1,31 billion.

Source: The Block

The Shifting Liquidity Environment

Arthur Hayes, known as the founder of the BitMEX exchange, predicts that an improving liquidity environment will support the upward trend of cryptocurrencies. Hayes utilizes his personally developed .USTLIQ index in his analyses can be tracked through the Bloomberg Terminal. His bespoke index indicates a liquidity injection of over $200 billion since the beginning of November.

In addition to Arthur Hayes, figures like Raoul Pal have long been forecasting a shift in central bank monetary policy, moving from a hawkish stance (QT) towards a dovish monetary policy (QE). With inflation currently decreasing, the return of quantitative easing (QE) seems likely, signifying the flow of a “cheap dollar” into high-beta asset classes such as cryptocurrencies.

Sources: Arthur Hayes, Bloomberg

Investors in Accumulation Mode

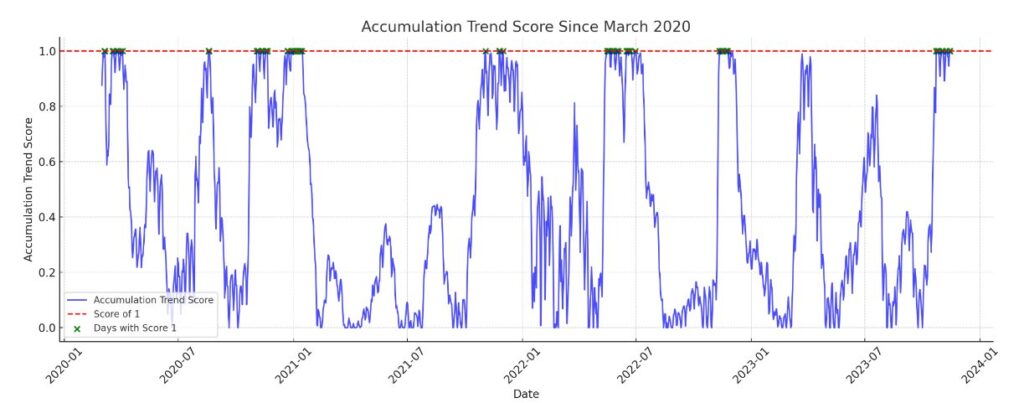

The technical strength of bitcoin is supported by Glassnode’s Accumulation Trend Score indicator, which has reached its highest reading in 12 months. Furthermore, the indicator’s sustained level above one (1) makes the current accumulation trend exceptionally strong after the year 2020.

In last week’s technical analysis, we discussed the increasing institutional interest in bitcoin. MicroStrategy has accelerated its cyclical buying program this year, expanding its balance sheet by a total of 25 900 bitcoin units. This year’s purchases represent a significant 16,4 percent of MicroStrategy’s total balance sheet.

Source: Glassnode

What Are We Following Right Now?

Chainlink (LINK) has surged by 175 percent since the beginning of the year. In this interview, its founder, Sergey Nazarov, discusses various topics with Real Vision. Nazarov shares insights into new cross-chain applications within the Chainlink ecosystem and the outlook for Web3.

South Korea’s National Pension Fund has acquired 282 673 shares of Coinbase (COIN), totaling $19,9 million in value. While the quantity of acquired shares is relatively small, the initiative signifies the traditional financial sector’s interest in gaining exposure in the field of digital assets.

South Korea’s pension fund snapped up 282,673 @coinbase shares at an average price of $70.5 in the third quarter, achieving a 40% profit from the investment, according to a report. By @godbole17.https://t.co/fCmtaqJb0q

— CoinDesk (@CoinDesk) November 16, 2023

The Bitcoin bulls are back! Mark Yusko, known for his hedge fund(s), is providing price projections for bitcoin.

Stay in the loop of the latest crypto events

- Interest in Bitcoin ETFs persists in rising — Bitcoin value climbs 28% in October

- Are We Approaching a Selective Altseason?

- Polygon (MATIC) – Infrastructure for billion users

- A 100 000 Dollar Target Price: The Bold Prediction and its Basis

- Bitcoin’s October Storm and the New Price Discovery Cycle

- Report your crypto investments to Verohallinto: Lesson #11

- A Prologue to the Upcoming ETF Market Reaction

- Dive into Cardano (ADA): A newcomer’s comprehensive guide

- Security measures to safeguard your cryptocurrencies: Lesson #10

- 200 Days Until the Halving: Bitcoin’s Next Chapter

Get started with Bitcoin Litecoin Ethereum AAVE USDC Stellar Ripple

Join Coinmotion and buy your first cryptocurrencies within minutes!

The views, thoughts, and opinions expressed in the text belong to the author and not necessarily to the author’s employer, organization, committee, or other group or individual.