The technical analysis of week 44 presents the thesis of a “selective altseason,” where a chosen set of altcoins rises above bitcoin’s price development. Additionally, we delve into James Butterfill’s thoughts on the market and the possible bitcoin address of BlackRock. We also explore why MicroStrategy’s MSTR stock has surged 227 percent since the beginning of the year.

The upward momentum of the cryptocurrency market has continued in the early weeks of November, with bitcoin strengthening by about four percent on a weekly basis. In the one-month timeframe, the leading cryptocurrency has risen by 30 percent, reaching an impressive 133 percent Year-to-Date (YTD) figure. Furthermore, the market signals the possibility of an emerging altseason, with Chainlink surging by 82 percent within a month.

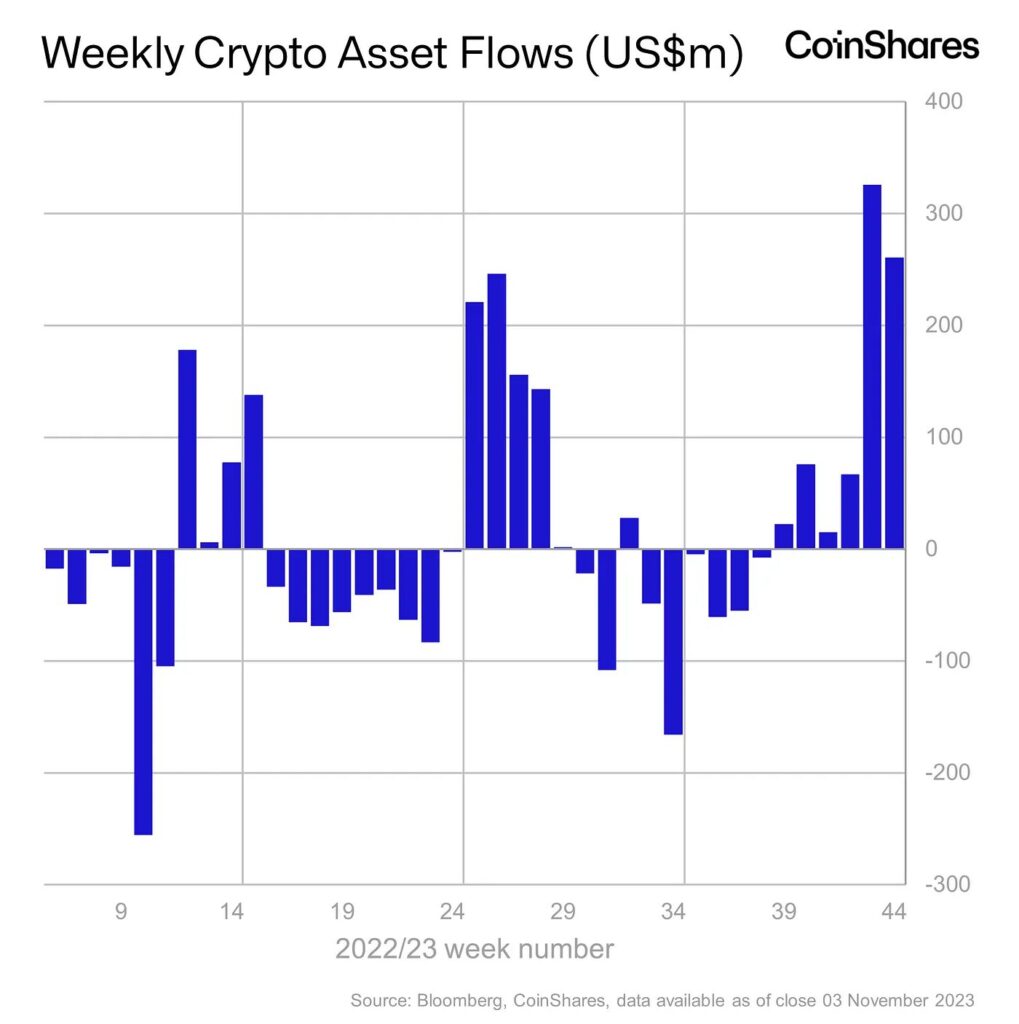

Q4’s bullish trend has not gone unnoticed by experts: James Butterfill of CoinShares estimates in his latest weekly review that the company’s inflows are as significant as during the July price rally, reaching the levels last seen in December 2021. According to Butterfill, new money flowed into CoinShares’ investment products to the tune of $229 million USD.

“This run of inflows now matches the July 2023 run of inflows and is the largest since the end of the bull market in December 2021. Bitcoin saw the lion’s share of inflows, totalling US$229m, bringing year-to-date inflows to US$842m, likely buoyed by the increasing likeliness of a spot-based ETF in the US and weaker than expected macro data, bringing in to question the efficacy of US monetary policy. Short-bitcoin also saw inflows of US$4.5m, highlighting some investors see the recent rally as unsustainable.” – James Butterfill

Source: CoinShares

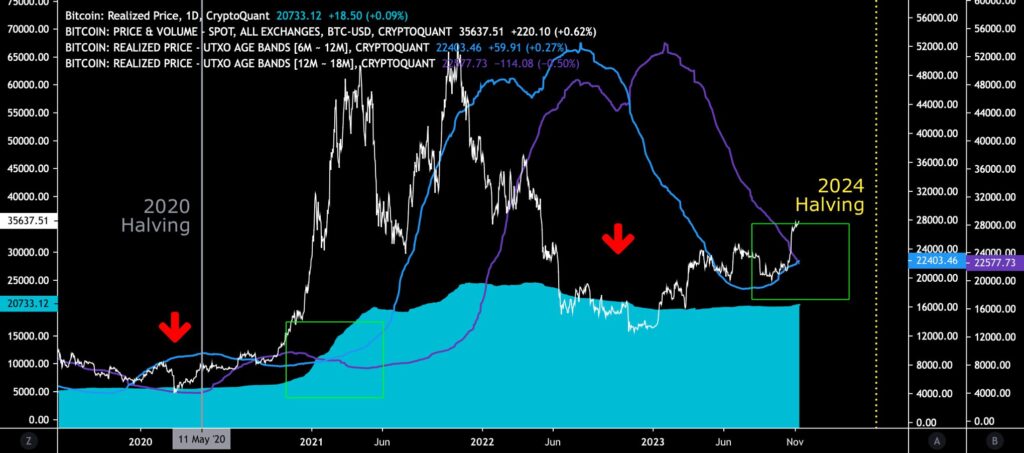

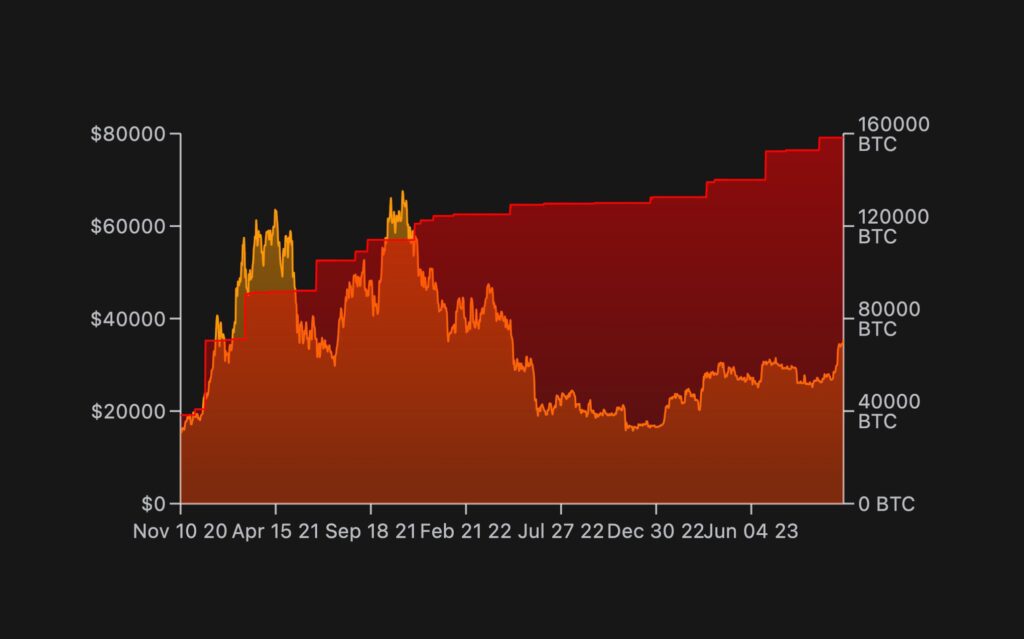

In addition to the ETF-related expectations, the spot market is being fueled by the upcoming halving scheduled for spring 2024, which is now only 167 days away. The halving, set for the end of April, increases the scarcity of the bitcoin network by reducing its supply, with the block reward decreasing from 6,25 to 3,125.

Source: 21metrics

From a purely technical standpoint, bitcoin has clearly diverged from the realized price wave (turquoise), which served as a support level for the spot price back in the spring. The realized price itself has also started a moderate upward trend, trading at $20 733. At the same time, the realized price represents the average cost of all bitcoin purchases, indicating that the majority of bitcoin investors are significantly in profit.

Sources: Timo Oinonen, CryptoQuant

The 6M-12M (blue) and 12M-18M (purple) realized price UTXO waves of bitcoin mirror the setup of 2021, where the 6M-12M transitioned above the 12M-18M (green). The intersection point of these UTXO waves in 2021 led to the spot price increasing past $69 000.

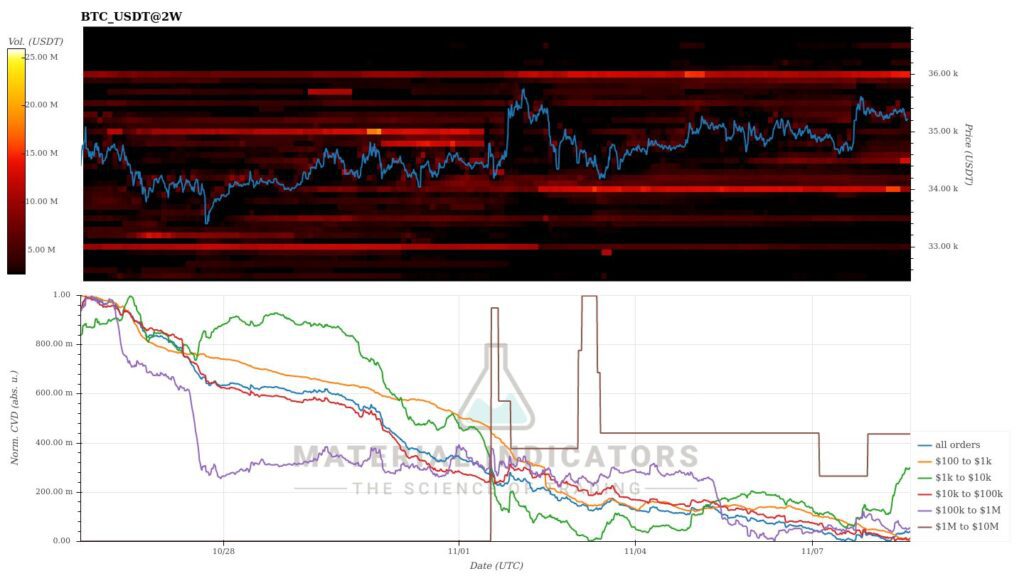

The Material Indicators’ heat map indicates a strengthening support level at $34 000, enabling bitcoin’s upward efforts towards $40 000. Short-term cumulative volume delta reflects demand coming from larger market participants.

Source: Material Indicators

The cryptocurrency market has surged impressively over the past seven days, with bitcoin strengthening by 3,8 percent and Ethereum by 4,3% in close correlation. There is a clear sense of an impending altseason, although parabolic rises have so far been limited to selective currencies such as Chainlink and Solana. Meanwhile, the divergence between bitcoin and gold, which mimics its scarcity characteristics, is becoming significant, with gold weakening by -2,6% on a weekly basis.

7-Day Price Performance

Bitcoin (BTC): 3,8%

Ethereum (ETH): 4,2%

Litecoin (LTC): 6%

Aave (AAVE): 10,6%

Chainlink (LINK): 29,5%

Uniswap (UNI): 11,4%

Stellar (XLM): 5,5%

XRP: 12,7%

Cardano (ADA): 20,5%

Polygon (MATIC): 21,4%

Get started with Bitcoin Litecoin Ethereum AAVE USDC Stellar Ripple

Join Coinmotion and buy your first cryptocurrencies within minutes!

S&P 500 Index: 3,4%

Gold: -2,6%

Has BlackRock Quietly Amassed a Balance Sheet of 120 000 Bitcoins?

Bitcoin’s current YTD surge of over a hundred percent is largely fueled by ETF expectations. On Thursday, November 9th, the U.S. Securities and Exchange Commission (SEC) will open an “approval window” for all 12 ETF candidates, so the situation is being closely monitored.

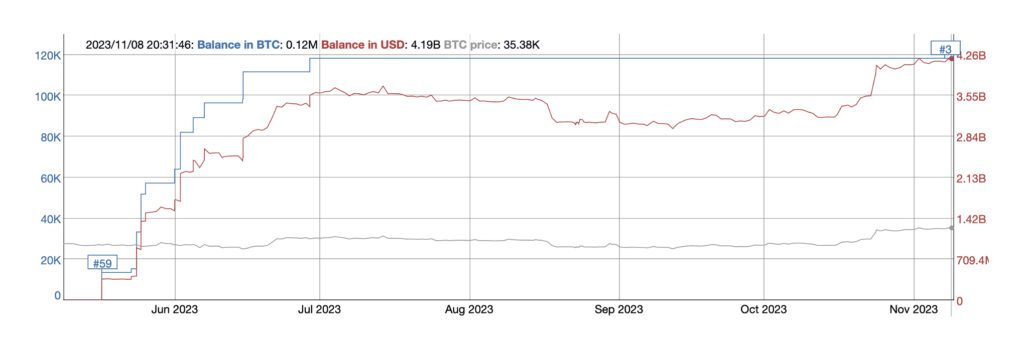

Since May, attention has been drawn to the bitcoin address “bc1ql49ydapnjafl5t2cp9zqpjwe6pdgmxy98859v2,” possibly indicating an institutional player’s purchasing program. Over the past few months, this address has increased its bitcoin holdings to 120 000 units.

Source: BitInfoCharts

At the current spot price, the 120 000 bitcoins held by the address amount to $4,19 billion USD, approaching the balance of 158 400 units held by the Bitcoin pioneer MicroStrategy. As the embedded chart indicates, MicroStrategy has recently increased its holdings, adding 155 bitcoins to its balance sheet at the beginning of November.

Led by the renowned Michael Saylor, MicroStrategy has become perhaps the most well-known institutional player in Bitcoin, often regarded as an unofficial ETF. However, some experts speculate that MicroStrategy’s position may change with the realization of an actual spot ETF approval.

Comme ci, comme ça, MicroStrategy’s MSTR stock has surged a parabolic 227 percent this year, outperforming the underlying asset class, bitcoin, by nearly double. Jeff Booth has suggested that some Bitcoin-related companies may offer returns even better than the cryptocurrency itself, and MSTR is a prime example of this. At the same time, the company serves as a leading indicator to the cryptocurrency market.

Source: 21metrics

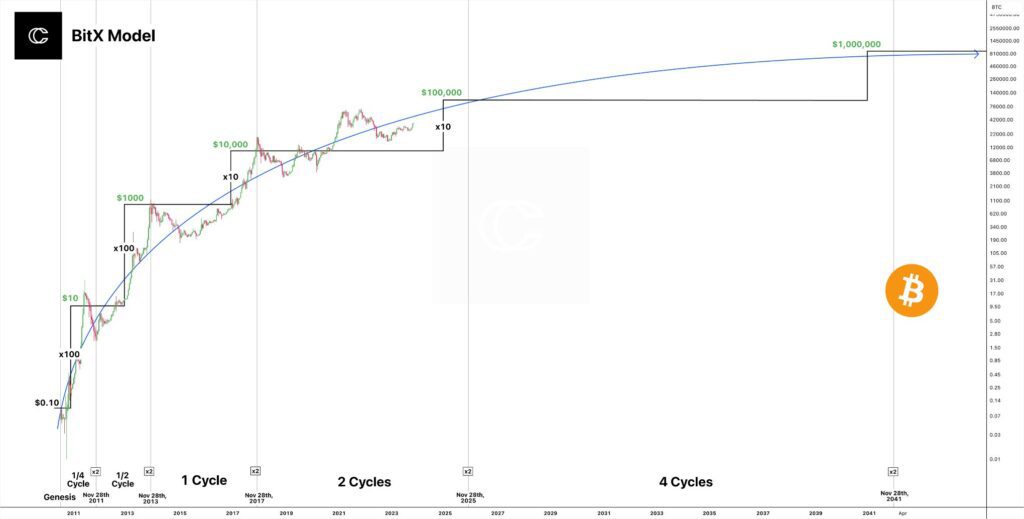

The BitX Model Anticipates Bitcoin’s Rise to Six Figures

Last week, we discussed the target price of $100 000, which is also supported by the BitX cyclical model. BitX, somewhat following the stock-to-flow model, segments the bitcoin market into four-year recurring halving events, during which the spot price of bitcoin has increased ten-fold. The model indicates a rise to $100 000 by 2025, with a new cycle peak set for November 28th, 2025.

Source: CryptoCon

A Selective Altseason?

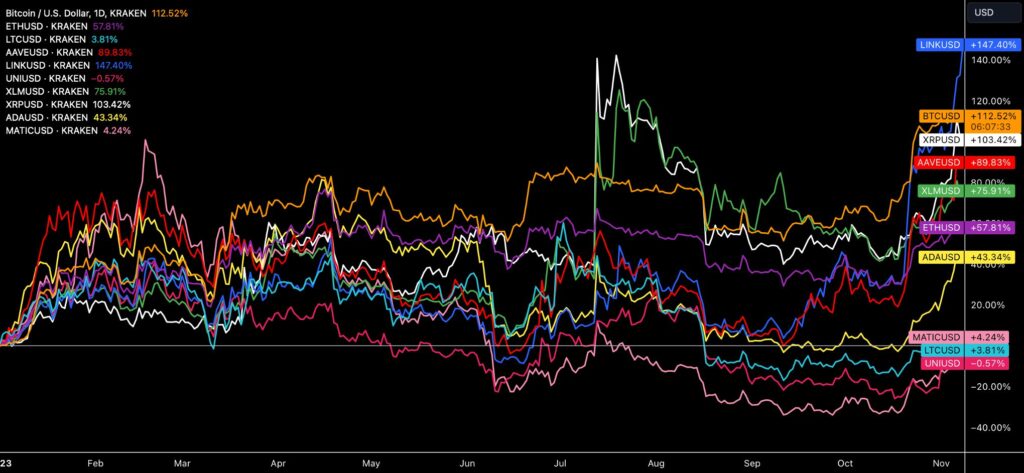

While bitcoin has solidified its position this year, with its dominance growing by 53 percent since the beginning of the year, the altcoin field is also gaining fresh momentum. Among the Coinmotion listings, particularly Chainlink (LINK), has surged in the year’s final quarter, countering its weak early 2023. In June, LINK even briefly dipped into negative YTD territory.

Which altcoin will overtake #bitcoin's returns in the next bull market? 🚀📈

— Coinmotion (@Coinmotion) November 9, 2023

🔎 “Selective #altseason” where a chosen set of tokens clearly outperforms bitcoin’s price development.

In addition to the LINK token, Solana has been a clear surprise of the year, strengthening by a parabolic 342 percent since the beginning of the year. Solana, a decentralized finance platform, is seen as a challenger to Ethereum, which has modestly recorded a 58 percent YTD climb. At the same time, the ETHBTC pair has weakened significantly by -27 percent since the beginning of the year.

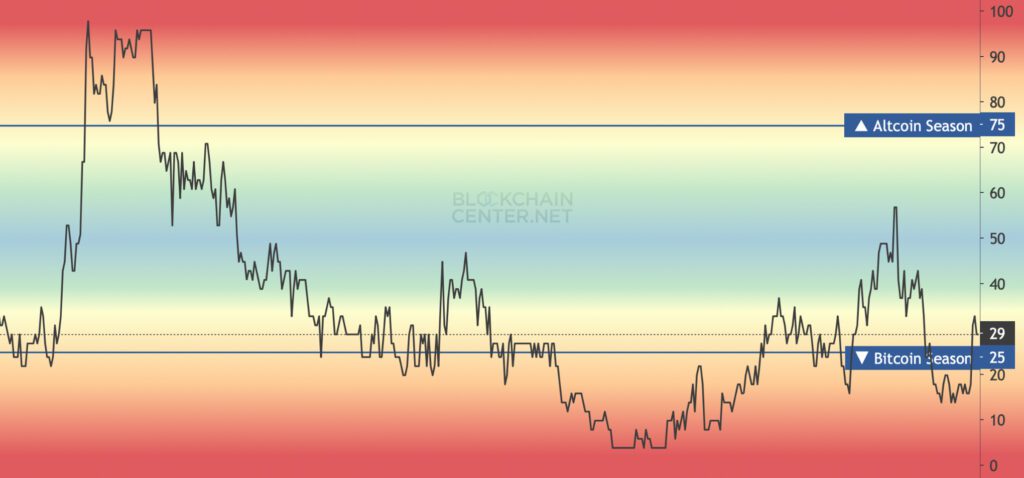

Source: Blockchaincenter

In the cases of Chainlink and Solana, we can talk about a “selective altseason” where a chosen set of tokens clearly outperforms bitcoin’s price development. Despite the indicator’s spike, Blockchaincenter’s model does not indicate an actual altseason, with the indicator value at 29, signaling a bitcoin-weighted price development.

A review of Coinmotion listings tells a similar story: While Chainlink has clearly outperformed bitcoin, the price development of all other tokens lags behind the largest cryptocurrency (in terms of market capitalization). After LINK and BTC tokens, the third-strongest price development is represented by XRP, rising by 103% since the beginning of the year. XRP is supported, among other factors, by the SEC’s commodity classification, a status shared only by bitcoin and Ethereum. The Securities and Exchange Commission’s classifications can still be seen as a market watershed, with the possibility of a security classification weighing on many altcoins.

Source: TradingView

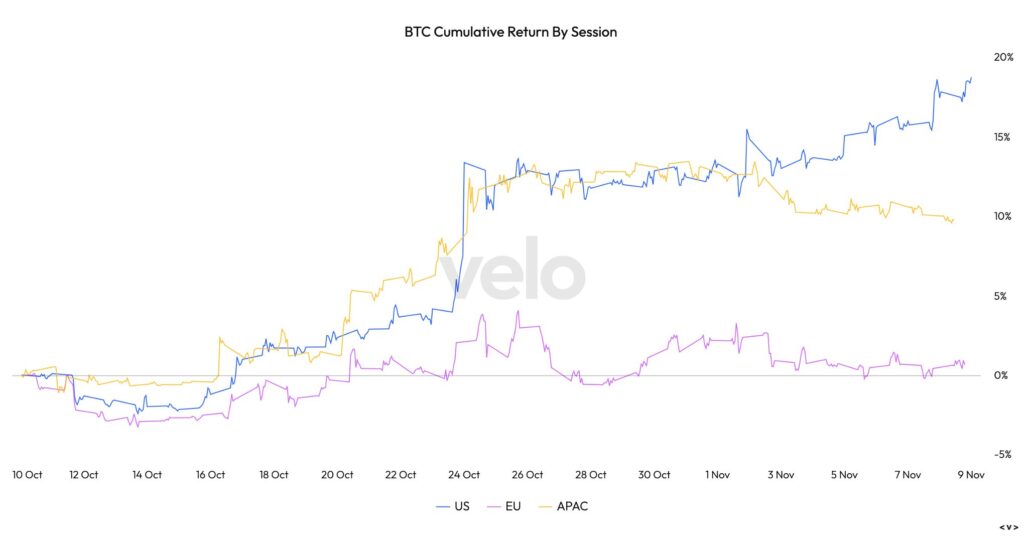

An interesting market detail is the US-based demand surge in October-November (blue). It appears that particularly North American investors are now building their expectations around the spot ETF fund and the halving of spring 2024. In the Asia-Pacific region (yellow), there was a demand peak in October, which has since slightly subsided. The EU area (purple) forms a clear divergence to the other two regions, reacting modestly to the cryptocurrency market movements so far.

Source: Velo Data

What Are We Following Right Now?

Raoul Pal and Jordi Visser discuss the position of cryptocurrencies in the “exponential age” and the impact of disruptive technology on society. Pal argues that humans perceive the world linearly, even though technological development progresses in exponential leaps. Therefore, it is challenging for humans to grasp the speed of the technological change.

According to Adam Back, the CEO of Blockstream, Bitcoin is clearly undervalued below $100 000.

The analyst Luke Gromen explains why the value of bitcoin, with its limited supply, will perpetually rise against fiat currencies with unlimited supply.

Stay in the loop of the latest crypto events

- Interest in Bitcoin ETFs persists in rising — Bitcoin value climbs 28% in October

- Polygon (MATIC) – Infrastructure for billion users

- A 100 000 Dollar Target Price: The Bold Prediction and its Basis

- Bitcoin’s October Storm and the New Price Discovery Cycle

- Report your crypto investments to Verohallinto: Lesson #11

- A Prologue to the Upcoming ETF Market Reaction

- Dive into Cardano (ADA): A newcomer’s comprehensive guide

- Security measures to safeguard your cryptocurrencies: Lesson #10

- 200 Days Until the Halving: Bitcoin’s Next Chapter

Get started with Bitcoin Litecoin Ethereum AAVE USDC Stellar Ripple

Join Coinmotion and buy your first cryptocurrencies within minutes!

The views, thoughts, and opinions expressed in the text belong to the author and not necessarily to the author’s employer, organization, committee, or other group or individual.